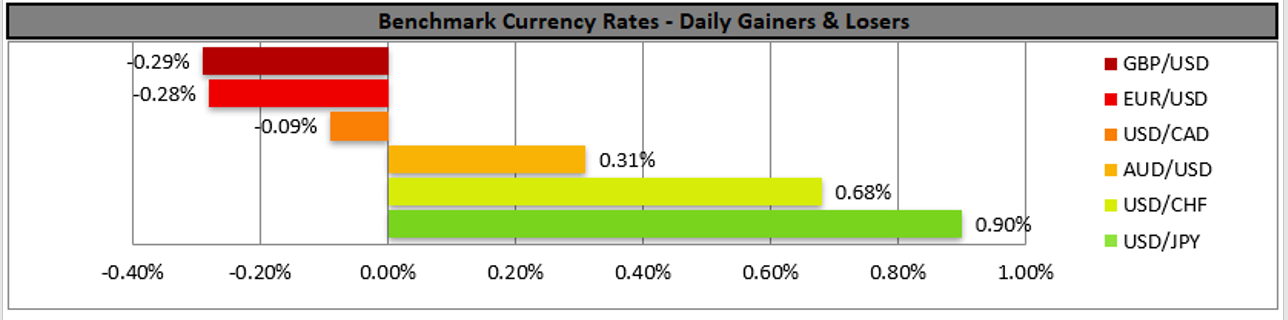

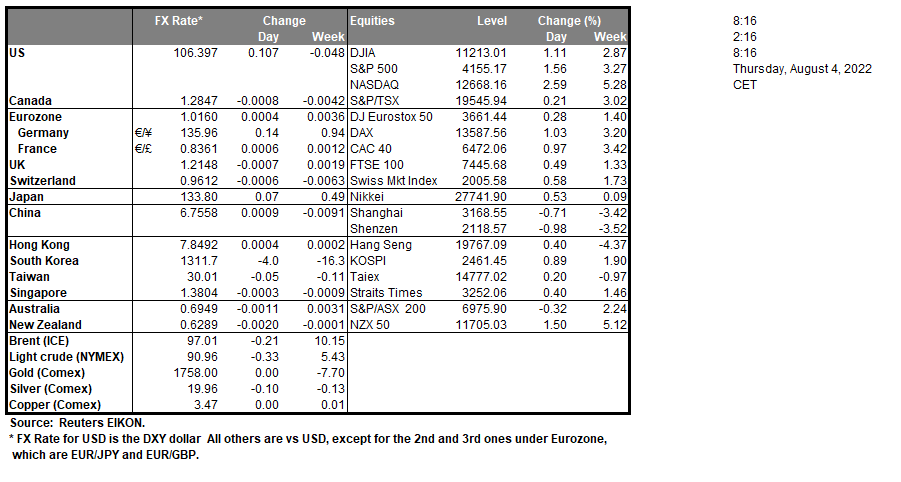

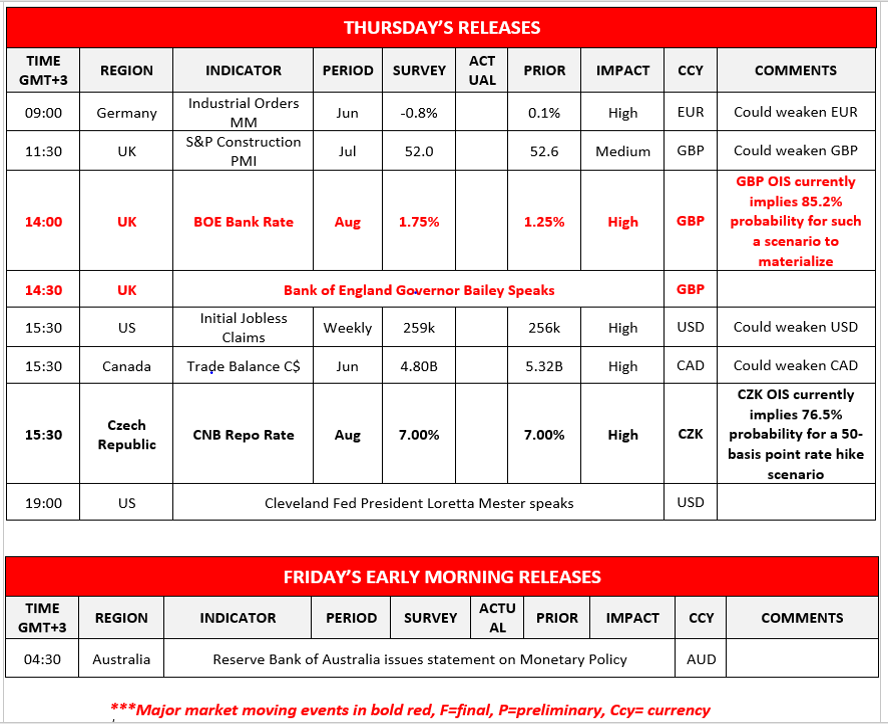

The US dollar stabilized yesterday, after a week of underperformance following the FOMC meeting, where the market interpreted a dovish pivot in Fed’s plans mainly because of slowing growth data. This week however, FOMC speakers namely, Minneapolis Fed President Kashkari and San Francisco Fed President Daly pushed back against this idea, coming across with a similar underlying message, that the Fed is not done with interest rate hikes and curbing inflation remains a top priority. Its characteristic that Minneapolis Fed President Kashkari, a well known dove, particularly stated “The more likely scenario is we would continue raising (interest rates) and then we would sit there until we have a lot of confidence that inflation is well on its way back down to 2%.“ Its understandable that when even a dovish policy maker makes such comments that the Fed’s intentions are clearly leaning on the hawkish side, which could provide some support for the greenback as monetary policy differentials could favor it. On the equities front however, we have to note that all three main indexes of the stock market, Dow Jones, Nasdaq and S&P500, were in the greens as the recent earnings reports, reportedly boosted traders’ confidence. Today, we would like to single out the earnings releases of BABA, GPRO, LYFT, and Dropbox, among many other companies, while traders may also keep an eye out for today’s weekly initial jobless claims figure. The pound was trading in the reds yesterday against the US dollar, as well as against the euro but not the yen, without any major moves in anticipation of today’s rate hike decision. The main event for today is BoE’s interest rate decision and the bank is expected to hike rates by 50 basis points, raising the rate from the 1.25% to 1.75%. Also note, that GBP OIS currently imply an 85.2% probability for such a scenario to materialize. Please note that the percentage implied yesterday by GBP OIS for the same scenario accounted to 93.6% and the drop may imply an easing of the market’s hawkish expectations. Should the bank deliver the 50 basis points rate hike and provide a rather hawkish forward guidance for the following meetings, then a case for the pound getting a boost can be reasonably expected. Should the bank fail to deliver 50 basis points rate hike or should the banks forward guidance lie on the dovish side, or even show uncertainty about future rate hikes we may see sterling weakening, given the market’s hawkish expectations about the current and future interest rate decisions.

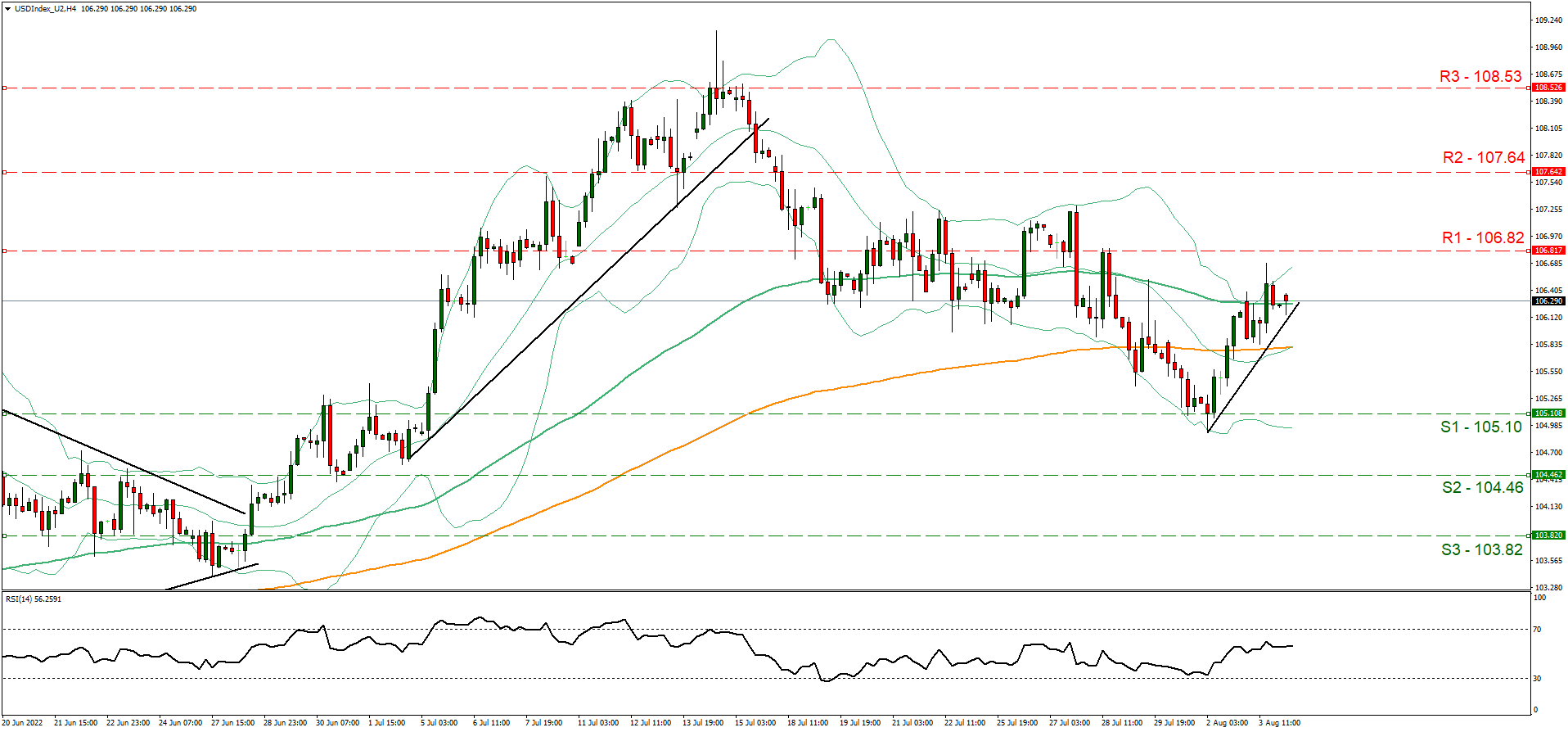

USDIndex stabilized during yesterday’s session at the $106.25 range. We hold a bullish outlook bias for the future continuation of greenback as the RSI indicator rests in above the 50 level showcasing positive momentum. Should the bulls reign over, we may see the break of the 106.82 (R1) resistance line and move towards the 107.64 (R2) level. Should the bears take over, and for us to change our view, we might need see the break below the ascending trendline and the 105.10 (S1) support level, heading definitively towards the 104.46 (S2) barrier.

GBP/USD was trading in the reds yesterday closing in the ascending trendline. We hold a bullish bias for the future price action of the pair as long as it remains above the aforementioned trendline. Should the bulls find extensive buying orders we may see the break above the 1.2276 (R1) and a decisive move towards the 1.2378 (R2) barrier. Should the selling interest overwhelm however, and for us to change our assessment from bullish to bearish we would require seeing the definitive break below the ascending trendline, followed by the break of the 1.2081 (S1) hurdle and move close to the 1.1937 (S2) level.

その他の注目材料

Today, we note Germany’s Industrial Orders for June, Canada’s Trade Balance figure for June, CNB’s interest rate decision and the monetary front we note Cleveland Fed President Mester and RBA’s monetary policy statement in the Asian session tomorrow.

USDIndex 4時間チャート

Support: 105.10 (S1), 104.48 (S2), 103.82 (S3)

Resistance: 106.82 (R1), 107.64 (R2), 108.53 (R3)

GBP/USD 4時間チャート

Support: 1.2081 (S1), 1.1937 (S2), 1.1778 (S3)

Resistance: 1.2276 (R1), 1.2378 (R2), 1.2483 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。