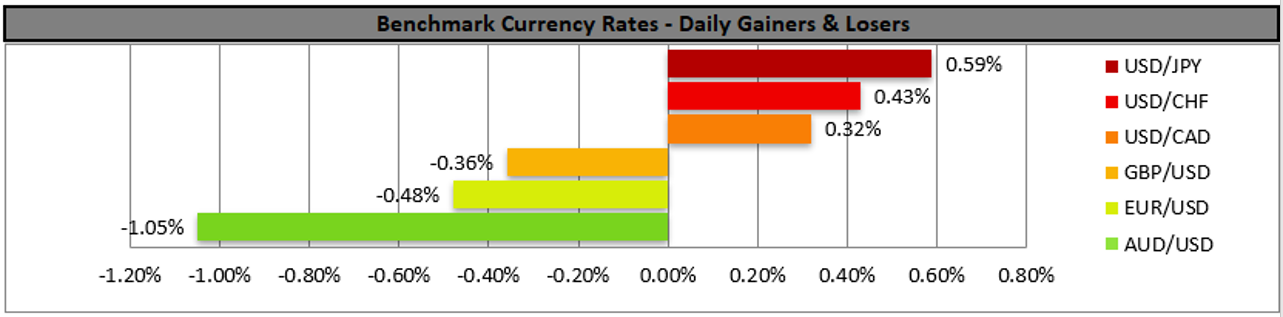

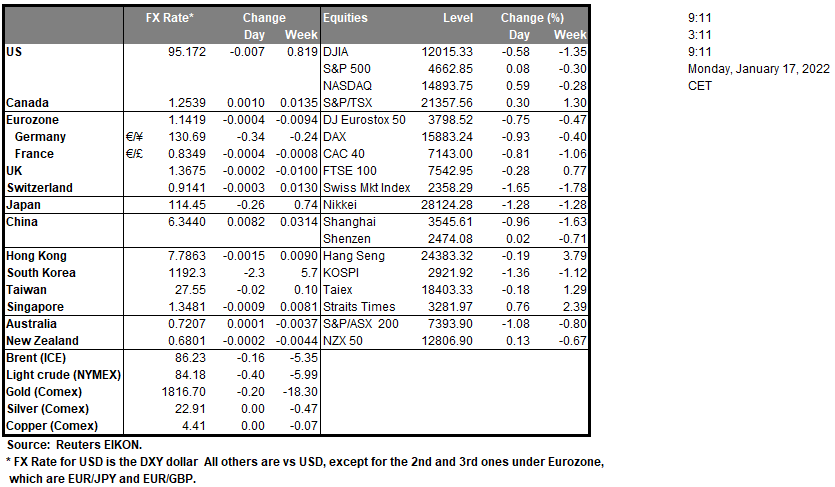

The USD was on the rise on Friday against a number of its counterparts, yet the bull’s dominance seems to have lost steam given that December’s US retail sales growth rate along with other US data tended to disappoint USD traders as the readings were worse than expected. On the other hand, US Stockmarkets seemed to be disappointed by earnings results reported for Q1 and in the coming week we expect interest in the stockmarkets to intensify given that the earnings season is on. It should also be mentioned that the markets seem to brace for a more hawkish Fed while USD yields were on the rise on Friday again which may have provided additional support for the USD. JPY retreated and traders wait for BoJ’s interest rate decision early tomorrow, as the bank is widely expected to remain on hold at -0.10 and economists and analysts mention that the bank could be adjusting its view on inflation risks, for the first time since 2014.

Nevertheless, despite some nudging up of the inflation and GDP projections being expected by BoJ, it is rather unlikely that the bank is to move away from its usual dovish stance and ultra-loose monetary policy. Aussie traders may have been disappointed by China’s GDP rates for Q4 2021, yet it should be noted that the rate decelerated less than expected while on the contrary Chinese industrial output growth rate accelerated for December which was good news for Australian exporters of raw materials. The Loonie retreated against the USD on Friday as well as during today’s Asian session, despite oil prices being on the rise as expectations for oil supply to remain tight seemed to be on the rise.

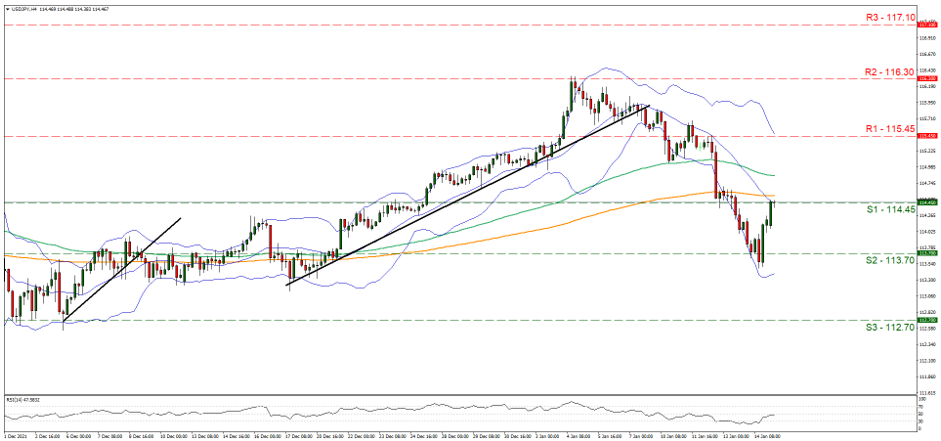

USD/JPY was on the rise on Friday and during today’s Asian session and is currently teasing the 114.45(S1) level. We tend to maintain expectations for the pair to rise further given its bullish tendencies, yet we must note that the RSI indicator below our 4-hour chart is at the reading of 50 implying a rather indecisive market, yet with an upward slope. Should the bulls actually have the upper hand, we may see the pair taking aim for the 115.45 (R1) resistance line. Should the bears take over, we may see the pair breaking the 114.45 (S1) support line and aim for the 113.70 (S2) support level.

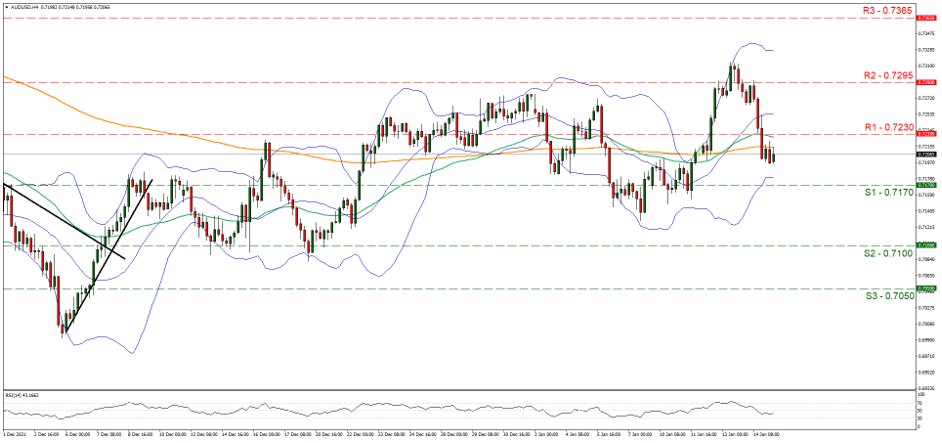

AUD/USD dropped yesterday breaking the 0.7230 (R1) support line now turned to resistance. We tend to maintain a bearish outlook for the pair given also that the RSI reading is between 50 and 30 implying that the bears have the advantage Should the selling interest be extended we may see the pair breaking the 0.7170 (S1) and take aim for the 0.7100 (S2) level. Should on the other hand the buyers take charge of the pair’s direction, we may see AUD/USD breaking the 0.7230 (R1) line and take aim of the 0.7295 (R2) level.

カナダの小売売上高がカナダドルを動かす

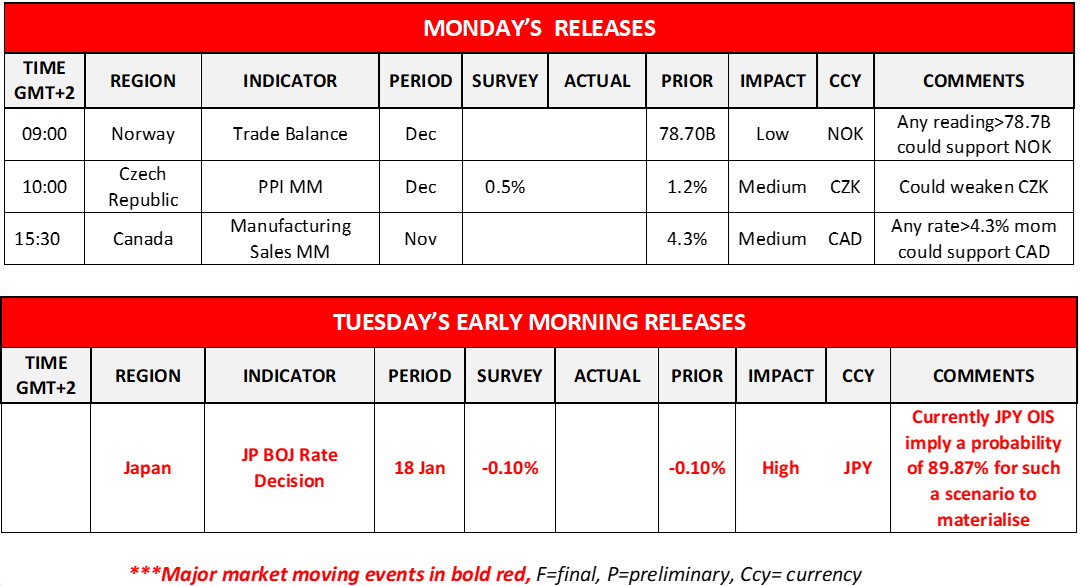

Besides BoJ’s interest rate decision during tomorrow’s Asian session we note today the release of Norway’s Trade Balance for December, the Czech Republic’s PPI rates for December and Canada’s Manufacturing sales for November.

今週の指数発表

On Monday the 17th of January we get from China Q4s’ GDP rate as well as Decembers’ industrial output, retail sales and urban investment growth rates, while from Japan we get the machinery orders growth rate for November. On Tuesday the 18th , besides BoJ’s interest rate decision we also note the release of UK’s employment data, Germany’s ZEW indicators for January, and Canada’s CPI inflation measures for December. On Wednesday the 19th we get from Germany the final HICP rate for December as well as UK’s inflation metrics for the same month. On Thursday the 20th of January we get from Japan the trade data, from Australia Employment data and Eurozone’s final HICP rate, al aforementioned data being for December.

We also get from the US the weekly initial jobless claims figure, and January’s Philly Fed Business index, while on the monetary front we note the release of Norway’s Norgesbank interest rate decision and from Turkey CBT’s interest rate decision. On Friday the 21st of January we get from Japan the CPI rates for December, UK’s retail sales for also for December, Canada’s retail sales for November and Eurozone’s preliminary consumer Sentiment for January.

AUD/USD 4時間チャート

Support: 0.7170 (S1), 0.7100 (S2), 0.7050 (S3)

Resistance: 0.7230 (R1), 0.7295 (R2), 0.7365 (R3)

USD/JPY 4時間チャート

Support: 114.45 (S1), 113.70 (S2), 112.70 (S3)

Resistance: 115.45 (R1), 116.30 (R2), 117.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。