The losing streak of the past two weeks for oil seems about to come to an end as the bullish sentiment in the market for black gold is building up. Worries for a global economic downturn and low demand prospects for the commodity are still present yet the overall supply side for oil seems to be tightening and is pushing oil prices higher. In this report, we aim to shed light on the factors driving WTI’s price, assess its future outlook and conclude with a technical analysis.

US oil market tightens

We make a start with the latest data concerning the US oil market. At the end of the past week Baker Hughes reported that the number of active oil rigs dropped by eight, reaching 512, a continuance of the declining course of the indicator. The drop is not to be considered a positive signal for oil prices as it would imply lesser demand in the US oil market. Yet the overall picture was overturned as the American Petroleum Institute (API) reported a wide drawdown of -11.486 million barrels, which showed that demand was able to surpass production levels. Similarly, the Energy Information Administration’s (EIA) Crude Oil Inventories also indicated a substantial drawdown of -10.584 million barrels. The data tended to highlight that the tightness of the US oil market as reported by the previous week’s figures and overall could continue to provide support for oil prices, should they continue to paint the picture of a tight oil market.

Saudi’s production cuts the supply side

Yet the tightening of the supply side of the international oil market seems also to be maintained as analysts tend to expect Saudi Arabia to extend its voluntary oil production cut of one million barrels per day, well into October, as reported by Bloomberg. In the survey, it seems that only a minority of participants expect the Saudi Kingdom to taper the oil production cuts and none to widen it. The Saudis are expected to announce such an extension in the next few days and given the fragile nature of the oil market currently, could have a substantial impact on oil prices. Such a move in combination with the oil production level cuts decided by OPEC along with Russia, may intensify the bullish sentiment in the market for oil. At this point, it would be useful to point out that analysts have mentioned that US sanctions on Venezuela seem about to start easing and such a scenario may have a negative effect on oil prices, while Iranian oil seems to be flowing towards China which in turn also could weaken oil prices.

Market worries for China’s rebound remain

Yet gains for oil’s price seem to have been clipped by market worries for the demand side of the commodity and especially from China. China, which is a key oil consumer, seems to be facing headwinds regarding the recovery of its economy. It’s characteristic that the National Bureau of Statistics (NBS) released the manufacturing PMI figure for August today. The indicator’s reading improved yet remained below the reading of 50, implying another contraction of economic activity in the Chinese manufacturing sector. The key takeaway here remains that Chinese factories continue to struggle since early spring, despite the lift of the Chinese Government’s strict restrictions at the beginning of the year. Hence the issue may turn into a structural problem for the Chinese economy. Also, the Caixin manufacturing PMI figure is to be released tomorrow yet we do not expect the overall picture to change dramatically. Given that manufacturing production is facing difficulties, as may also be the construction sector in China, we would expect it to have an adverse effect on oil prices, as demand for oil, seems to remain lower than initially expected in the coming months.

テクニカル分析

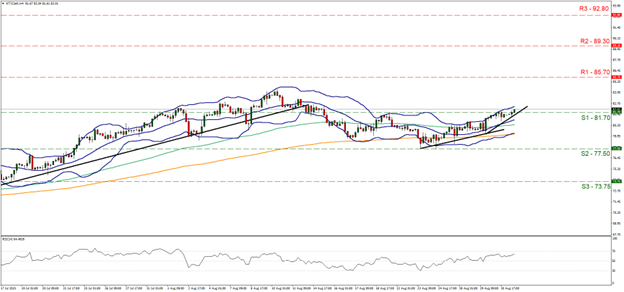

WTI Cash 4H Chart

- Support: 81.70 (S1), 77.50 (S2), 73.75 (S3)

- Resistance: 85.70 (R1), 89.30 (R2), 92.80 (R3)

WTI’s price has been moving in an upward fashion in the past week, covering the distance from the 77.50 (S2) support line and breaking the 81.70 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for the commodity’s price given its upward movement which formed an upward trendline that has steepened its slope in the past 48 hours. Yet also the fact that the RSI indicator has risen and is currently aiming for the reading of 70, is implying a bullish sentiment among market participants for oil’s price. Should the upward movement of WTI’s price be maintained in the coming week, we set as the next target for the bulls the 85.70 (R1) resistance line. Should the bears take over, we may see WTI’s price dropping, breaking the prementioned upward trendline, signaling the interruption of the upward movement, breaking the 81.70 (S1) support line and aim if not breach the 77.50 (S2) support level.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.