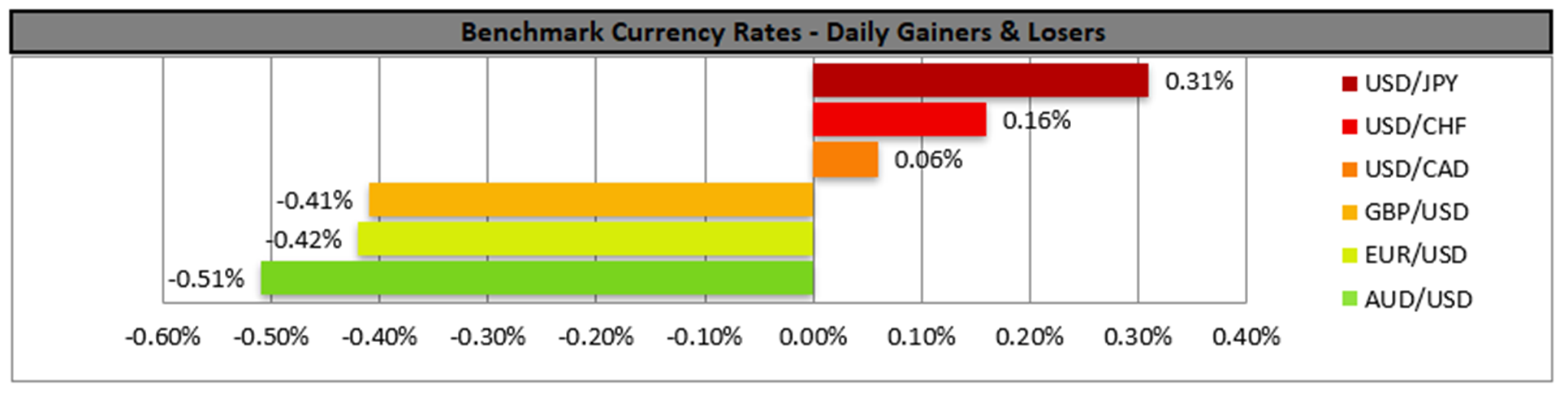

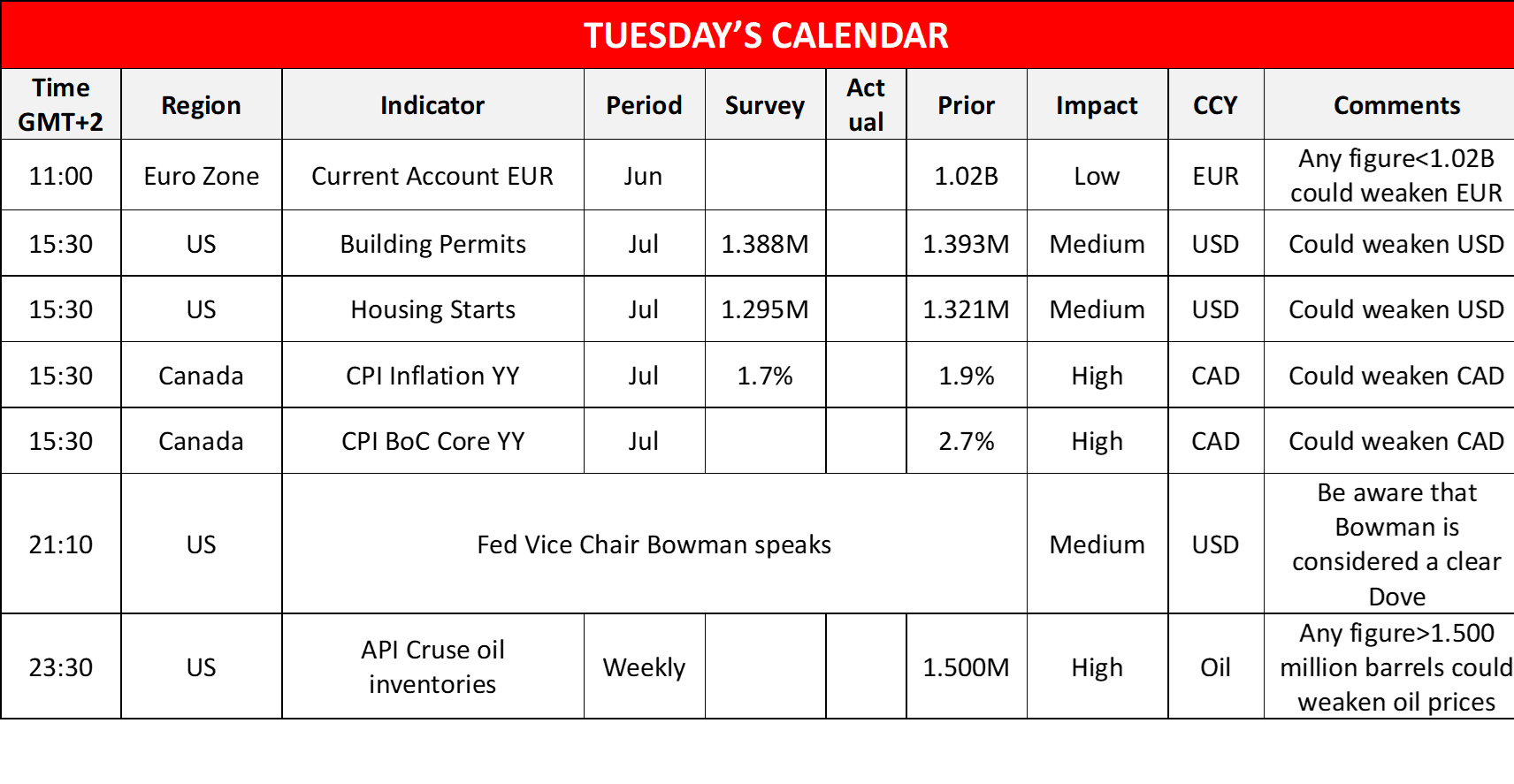

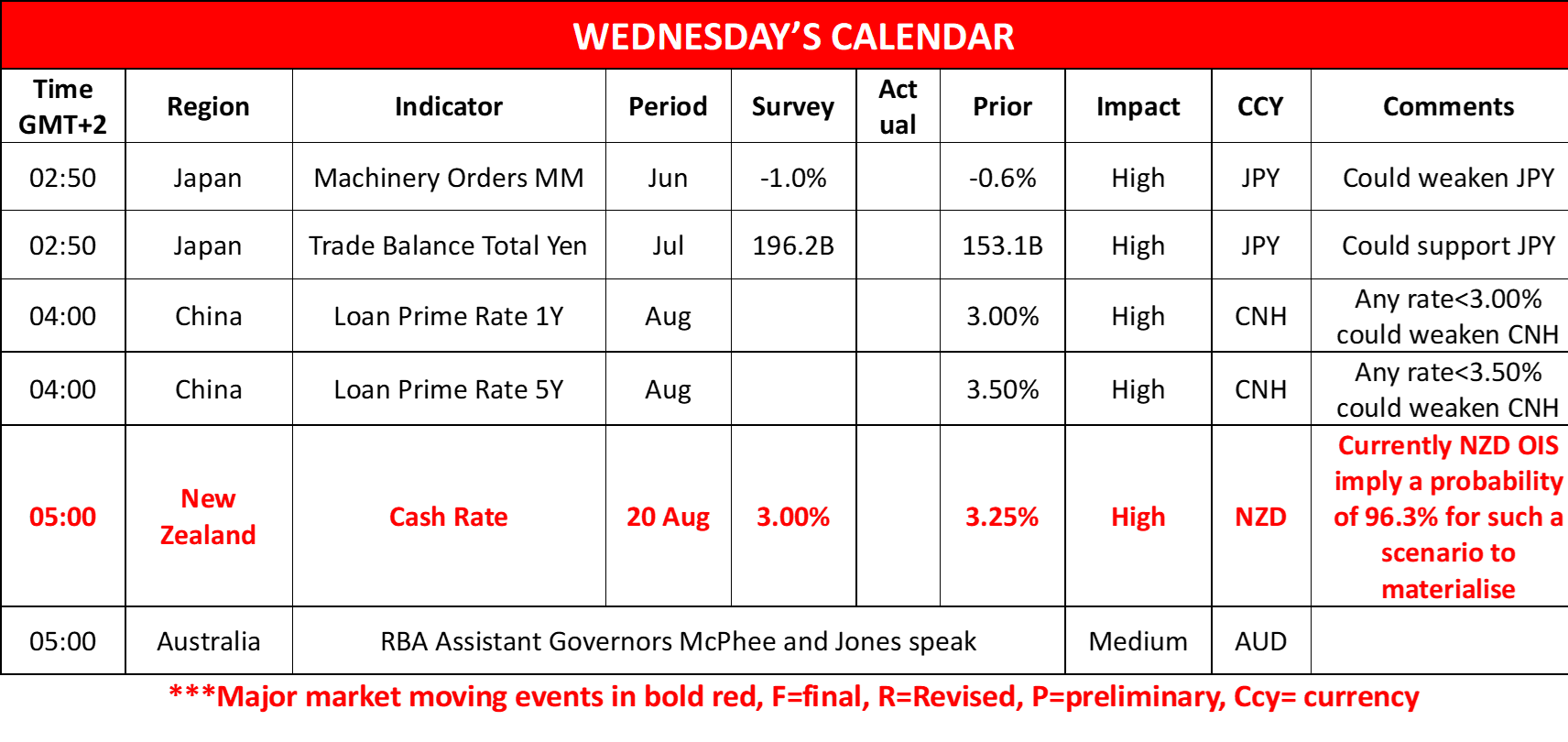

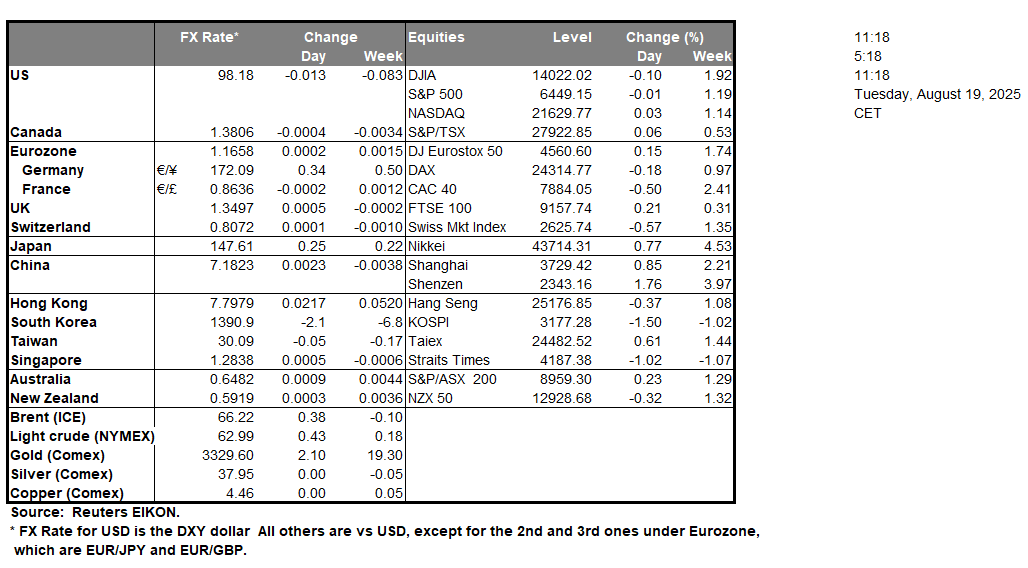

Canada’s CPI rates for July are set to be released during today’s American session. Economists are currently anticipating the headline rate to showcase easing inflationary pressures in the economy with the anticipated rate standing at 1.7% which is lower than the prior rate of 1.9%. In turn, should such a scenario materialize and imply easing inflationary pressures in the economy, increased pressure may be exerted on the bank of Canada to cut interest rates in the near future. Therefore, this could potentially weigh on the Loonie. However, should the inflation print showcase an acceleration of inflationary pressures, it may have the opposite effect and could thus aid the CAD. In tomorrow’s Asian session the RBNZ is set to take it’s interest rate decision. The majority of market participants are currently anticipating the bank to cut rates by 25 basis points from 3.25% to 3.00% with NZD OIS currently implying a 96.3% probability for such a scenario to materialize. Thus, attention may turn to the bank’s accompanying statement where should it be implied that further rates cuts are to come, it may weigh on the Kiwi and vice versa. However, we should that in the unlikely scenario that the bank opts for another decision, such as remaining on hold, it may provide support for the NZD. In the US Equities markets, Intel (#INTC) appears to be gaining some traction with the FT reporting that Japan’s SoftBank has agreed to invest $2bn in the struggling chipmaker. Moreover, reports have emerged that the US government has considered acquiring a 10% stake in the company. Overall, the aforementioned events may provide support for the company’s stock price. On a political level, negotiations to end the war in Ukraine are ongoing and could influence the precious metal’s price.

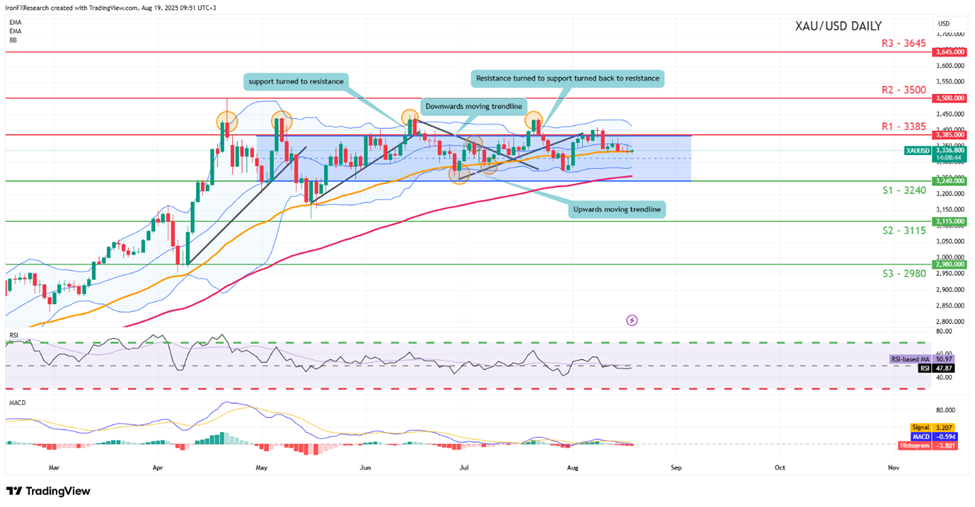

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

USD/CAD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 60, implying a bullish market sentiment. For our bullish outlook to continue we would require a clear break above our 1.3855 (R1) resistance line with the next possible target for the bulls being the 1.4085 (R2) resistance level. On the other hand for a sideways bias we would require the pair to remain confined between our 1.3545 (S1) support level and our 1.3855 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.3545 (S1) support line with the next possible target for the bears being the 1.3325 (S2) support level.

その他の注目材料

Today we get the Euro Zone’s current account balance for June, the US building approvals and house starts, as well as Canada’s CPI rates all being for July. On a monetary level, we note that Fed Vice Chair Bowman is scheduled to speak, while oil traders may be more interested in the release of the weekly US API crude oil inventories figure. On Wednesday’s Asian session, we get Japan’s machinery orders for June and trade data for July, and on a monetary level, we note the release of China’s PBOC and New Zealand’s RBNZ interest rate decisions, while RBA’s Assistant Governors McPhee and Jones are scheduled to speak.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

USD/CAD Daily Chart

- Support: 1.3545 (S1), 1.3325 (S2), 1.3115 (S3)

- Resistance: 1.3855 (R1), 1.4085 (R2), 1.4300 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。