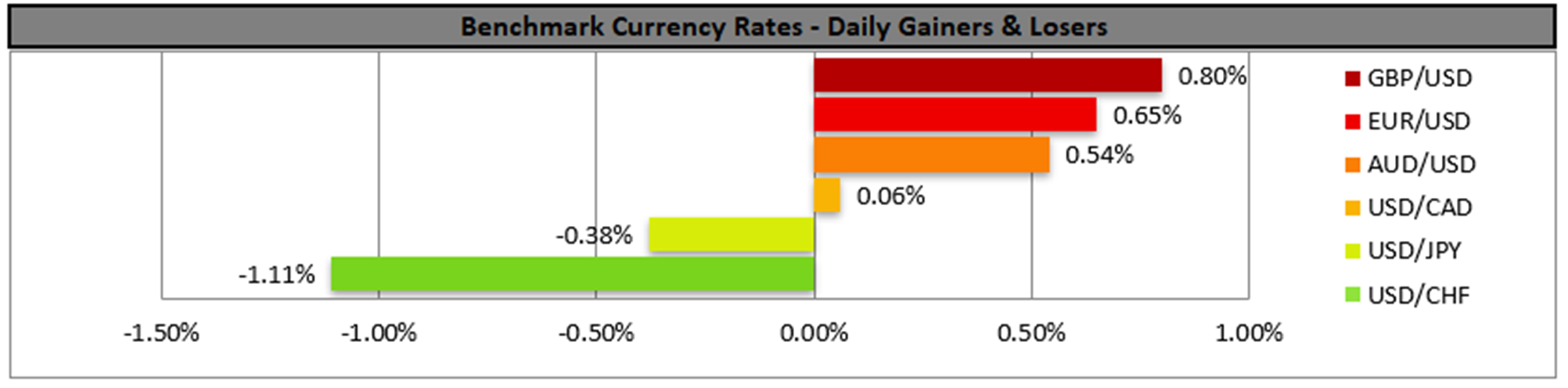

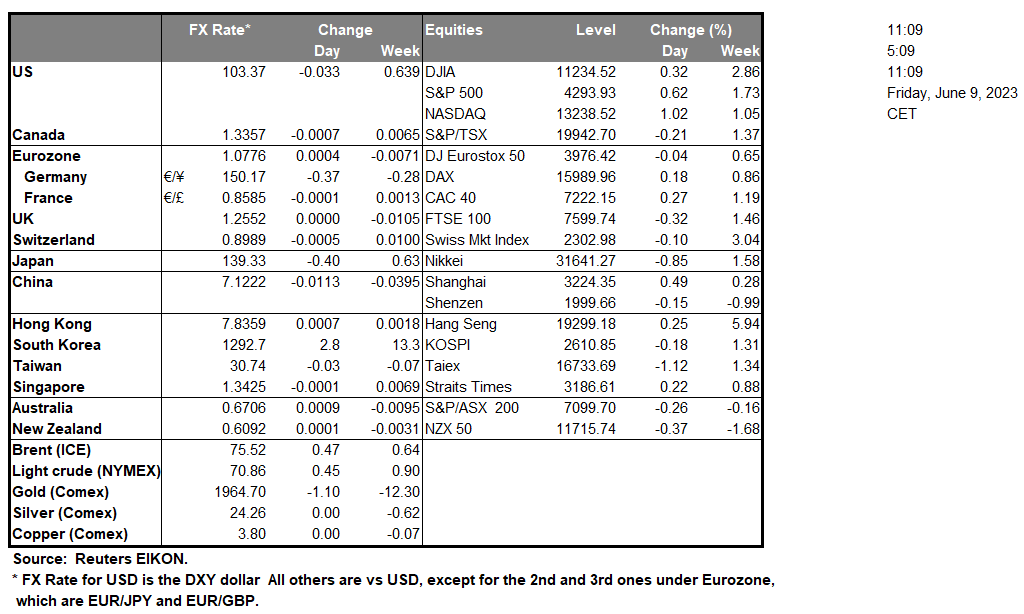

The USD edged lower against its counterparts yesterday possibly set under selling pressure due to the lower US Treasury yields but also as the weekly US initial jobless claims figure rose beyond market expectations, implying that the crack in the tightness of the US employment market is deepening. It’s characteristic that the number of Americans filling for unemployment benefits for the first time last week, has risen to levels not seen since August last year.

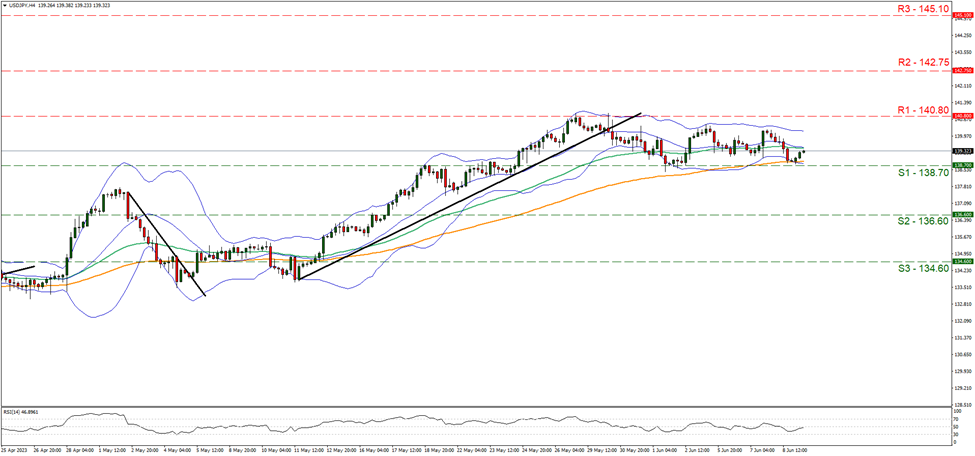

USD/JPY edged lower yet the 136.70 (S1) support line held its ground. We tend to maintain our bias for the sideways motion between the 140.80 (R1) resistance line and the 138.70 (S1) support line to be maintained, given also that the RSI indicator has reached the reading of 50, implying a rather indecisive market. Should the bears take over, we may see the pair finally breaking the 138.70 (S1) support line and aim for the 136.60 (S2) support level. Should the bulls take over, we may see USD/JPY breaking the 140.80 (R1) resistance line and aim for the 142.75 (R2) resistance level.

Given the lack of high-impact financial releases stemming from the US today we expect fundamentals to be the key driver for the USD while the market has started to focus on the Fed’s interest rate decision next Wednesday and is increasingly expecting the bank to skip hiking rates in its June meeting. On a more fundamental level, we note that former US President Trump has been indicted on US criminal charges for mishandling documents and obstruction of justice. It should be noted that the charges could be viewed as another obstacle for Mr. Trump on his way to the elections of 2024 and the issue may alter the balance among Republican voters.

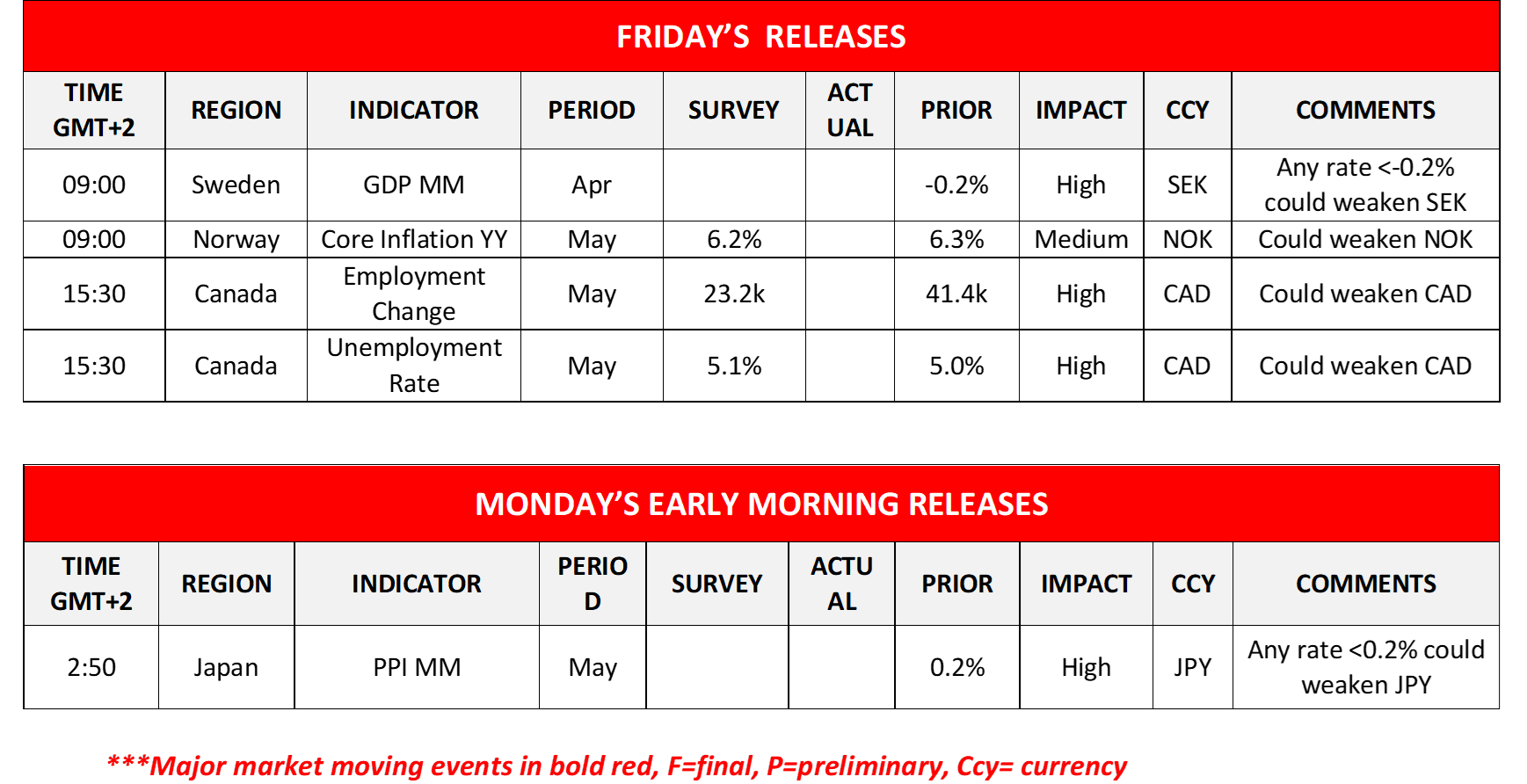

North of the US border, we highlight the release of Canada’s employment data for May. The unemployment rate is expected to tick up and reach 5.1% while the employment change figure is expected to drop from 41.4k in April to 23.2k for May. Overall, the forecasts seem to align towards pointing to an easing of the Canadian employment market’s tightening which in turn could weaken the CAD. Yet on the other hand we must note that Canada’s unemployment rate is expected to remain at relatively low levels for Canadian standards and the employment change figure is expected to correct lower after April’s 41.4k, yet is also expected to remain in the positives, which in turn could mitigate any possible weakening of the Loonie.

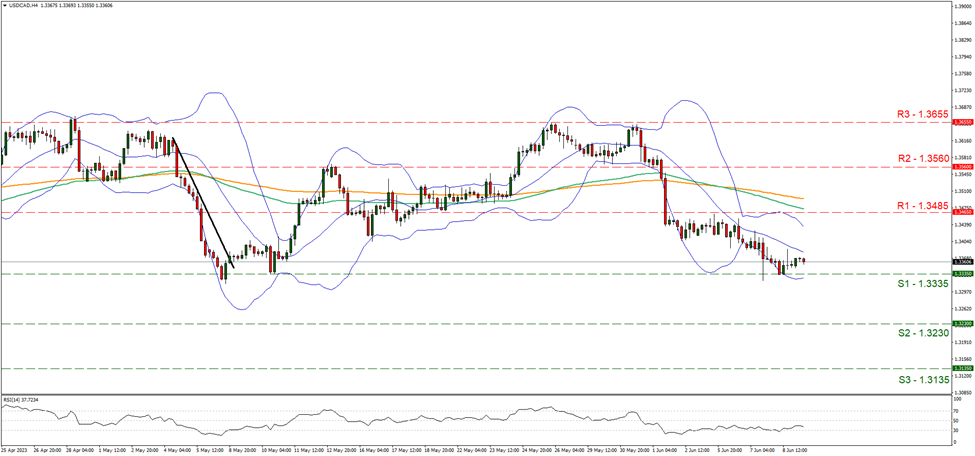

On a technical level, USD/CAD edged lower yesterday yet hit a floor on the 1.3335 (S1) support line and seems to have stabilised just above it. Given the incompetence of the pair to actually break through the S1 we note the interruption of the pair’s downward movement and hence tend to maintain a bias for the pair to maintain a sideways motion. Yet we highlight that the release of Canada’s employment data for May, may alter the pair’s direction to either way. Should the pair come under the market’s selling interest, we may see USD/CAD breaking the 1.3335 (S1) support line and aim for the 1.3230 (S2) support level. Should the bulls take over, we may see USD/CAD aiming if not breaking the 1.3485 (R1) line, aiming for higher grounds.

On the side-line, please note that the Turkish Lira seems to be stabilising after a heavy sell-off in the past few days. It should be noted that the Turkish Government is trying to paint a rosy picture by setting in key positions persons which are to follow a more orthodox economic policy, yet the bearish tendencies for the Lira are still present and the country’s Net FX reserves remained in the negatives.

その他の注目材料

In today’s European session, we note the release of Sweden’s GDP rates for April and Norway’s CPI rates for May, while in the American session, there are no major financial releases besides Canada’s employment data. During Monday’s Asian session. we note the release of Japan’s Corporate Goods Prices growth rate for May.

USD/CAD 4時間チャート

Support: 1.3335 (S1), 1.3230 (S2), 1.3135 (S3)

Resistance: 1.3485 (R1), 1.3560 (R2), 1.3655 (R3)

USD/JPY 4時間チャート

Support: 138.70 (S1), 136.60 (S2), 134.60 (S3)

Resistance: 140.80 (R1), 142.75 (R2), 145.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。