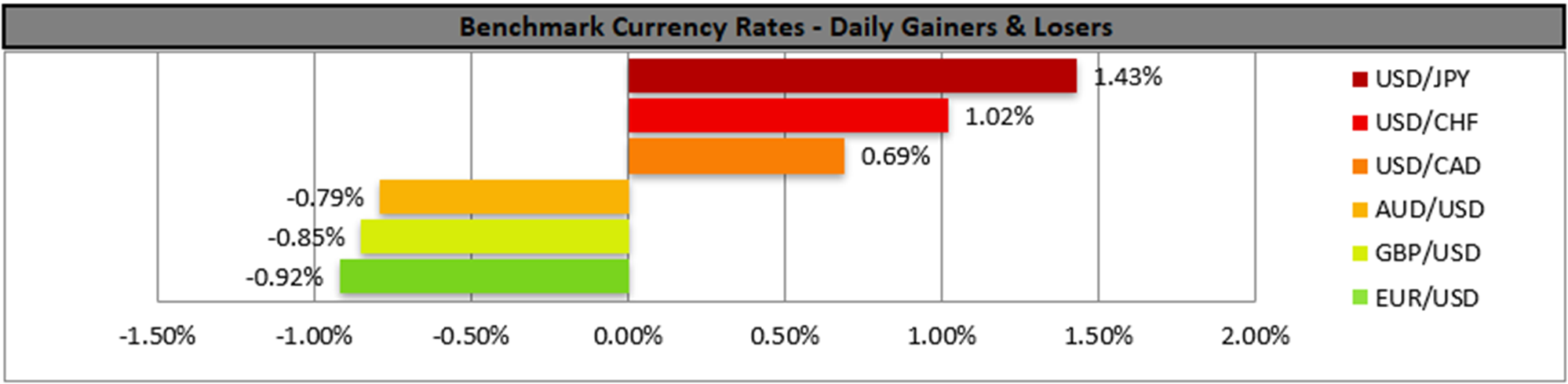

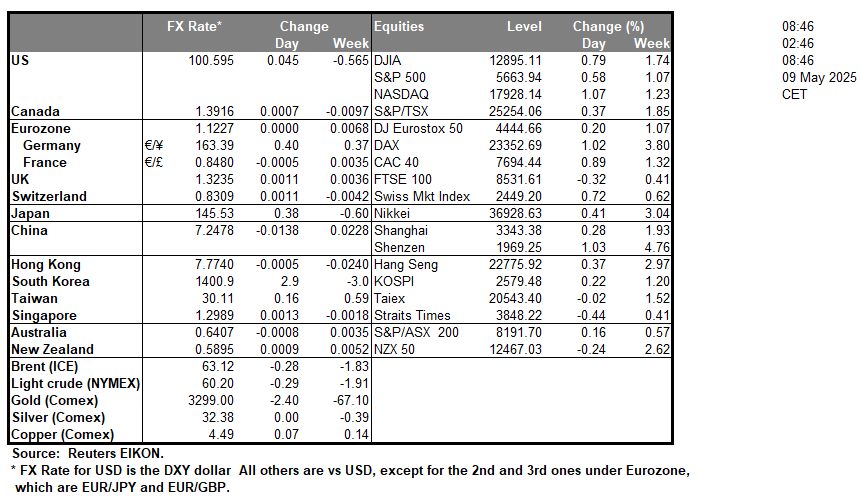

The USD got some support yesterday, against its counterparts as the market’s hopes for a possible US-Sino trade deal intensified. US and Chinese negotiation teams at a high level are to meet in Switzerland over the weekend in an effort to explore the possibility of a trade deal The news more or less tended to provide support for riskier assets while on the flip side weighed on safe havens such as gold and JPY. We also note that the Fed’s hesitation towards cutting extensively its rates as expressed at its latest interest rate decision, past Wednesday, may have also provided some support as it pressures the market to adjust its dovish expectations.

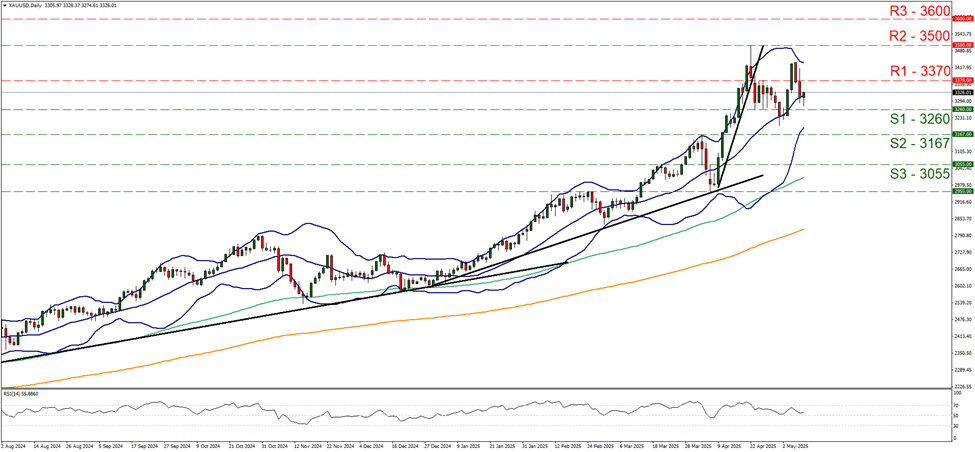

Gold’s price continued to fall yesterday breaking the 3370 (R1) support line, now turned to resistance. For the time being we tend to maintain a bias for a sideways motion off the precious metal’s price as despite the drop of its price action, the RSI indicator edged lower nearing the reading of 50, implying an easing of the bullish sentiment of the market but has not proceeded to signal the existence of a bearish predisposition among market participants yet. For a bearish outlook we would require gold’s price to drop below the 3260 (S1) support line and aim if not reach the 3167 (S2) support level. Should the bulls regain control over the precious metal’s price action, we may see it reversing yesterday’s losses breaking the 3370 (R1) resistance level, with the next possible target for the bulls being set at the record high level marked by the 3500 (R2) resistance line.

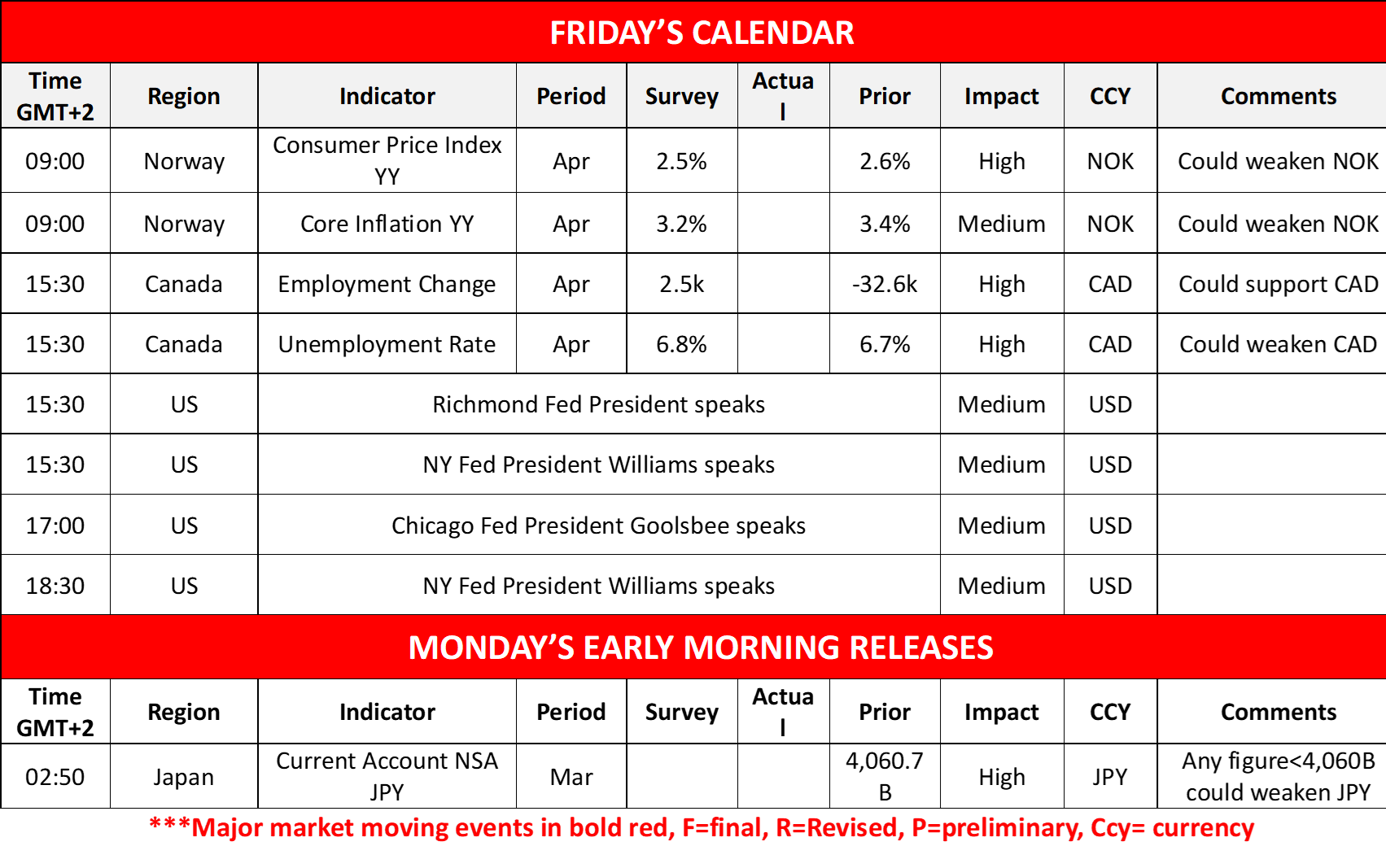

Loonie traders are expected to keep a close eye on the release of the Canadian employment data for April. Current forecasts tend to provide mixed signals to the market as on the one hand the employment change figure is expected to rise in a positive sign that the Canadian economy was able to create new jobs, yet on the other hand the unemployment rate is expected to tick up, continuing its upward trajectory in a sign of widening unemployment. Should the actual rates and figures be able to show a relative tightening of the Canadian employment market we may see the Loonie getting some support and vice versa.

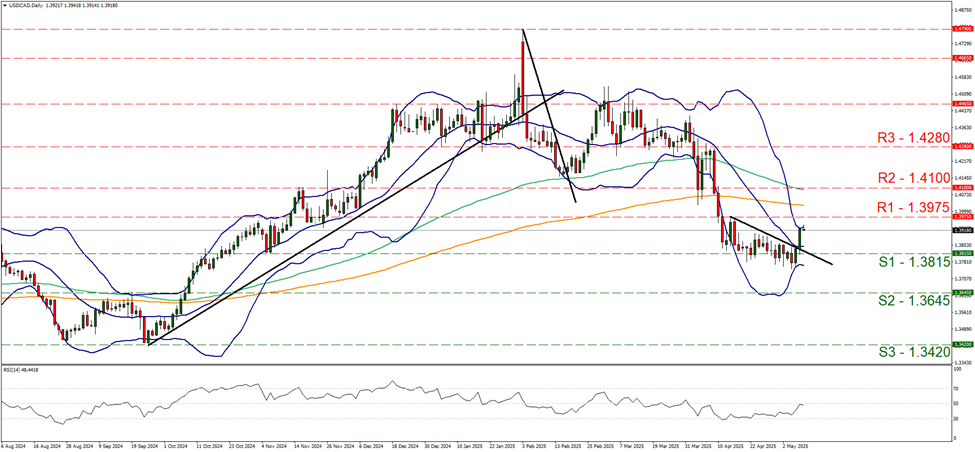

USD/CAD rose yesterday aiming for the 1.3975 (R1) resistance line but tended to stabilise as it hit on the upper Bollinger band. The pair in its upward motion broke the downward trendline capping the pair’s price action since the 15th of April, thus signalling an interruption of the downward motion and forcing us to switch our bearish outlook in favour of a sideways motion bias for the time being. Should the bulls take over, we may see the pair breaking the 1.3975 (R1) resistance line and the pair to start aiming for the 1.4100 (R2) resistance level. Should the bears take over, we may see the pair reversing yesterday’s gains and breaking the 1.3815 (S1) support line aiming for the 1.3645 (S2) support level.

Across the pond, the pound got some support from the release of BoE’s interest rate decision yesterday, despite the bank proceeding to the expected 25 basis points rate cut and signaling its readiness for more. The vote count though was telling a different story as two members voted for the bank to remain on hold in a signal of the worries for the possible effects of US President Trump’s tariff policy on the UK economy. It should be noted that yesterday, US President Trump and UK PM Starmer announced a trade deal, on aluminium and steel, automotive and aerospace exports, and pharmaceuticals yet the 10% overall tariff remains, which may have been a bit disappointing for pound traders.

その他の注目材料

Today we get Norway’s CPI rates for April and later on Canada’s employment data for the same month. On a monetary level, we note that Richmond Fed President Barkin, NY Fed President Williams and Chicago Fed President Goolsbee are scheduled to speak. In Monday’s Asian session we note the release of Japan’s current account balance for March.

XAU/USD Daily Chart

- Support: 3260 (S1), 3167 (S2), 3055 (S3)

- Resistance: 3370 (R1), 3500 (R2), 3600 (R3)

USD/CAD Daily Chart

- Support: 1.3815 (S1), 1.3645 (S2), 1.3420 (S3)

- Resistance: 1.3975 (R1), 1.4100 (R2), 1.4280 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。