Since our last report, the bears appear to be taking control over the coin’s direction. In this report, we aim to shed light on the possible factors aiding to the recent developments such as President Trump’s trade wars and the recent announcement by the SEC in combination with a technical analysis of Bitcoin’s daily chart.

Global trade war concerns mount, with Crypto taking a hit.

President Trump’s tariff agenda was announced last week, leading to heightened concern over the resiliency of the global economy. Specifically, Trump announced a 10% base tariff on all imports into the US, with a 20% tariff being imposed on the EU and a 34% tariff being imposed on China.

In response, the EU Commission President announced that the EU was prepared to retaliate, and the Chinese Government announcing that they would be implementing a 34% retaliatory tariff. The ongoing trade war has sparked widespread concern with stock markets plunging over the past week, as investors may be seeking ‘safer’ assets.

Furthermore, the comments by the US President earlier on today in his TruthSocial account that “The only way this problem can be cured is with TARIFFS, which are now bringing Tens of Billions of Dollars into the U.S.A. They are already in effect, and a beautiful thing to behold” may be exacerbating the situation and could intensify the ongoing rhetoric.

In turn given Bitcoin’s nature as a riskier asset, the ongoing uncertainty and heightened volatility in the market may be weighing on the coin’s price and in general the wider crypto industry.

Therefore, in our view, should investors continue on their risk-averse path, it could further weigh on Bitcoin’s price. Yet should the situation appear to be nearing an end, such as trade negotiations to alleviate some of the tariffs, then the coin’s price could find some support.

SEC announces covered stablecoins are not securities

The SEC released guidance last week on certain stablecoins. The stated that “this statement addresses stablecoins that are designed to maintain a stable value relative to the United States Dollar, or “USD,” on a one-for-one basis. Can be redeemed for USD on a one-for-one basis (i.e., one stablecoin to one USD), and are backed by assets held. In a reserve that are considered low-risk and readily liquid with a USD-value that meets or exceeds the redemption value of the stablecoins in circulation” and that “that the offer and sale of Covered Stablecoins. In the manner and under the circumstances described in this statement, do not involve the offer and sale of securities”.

Essentially, the SEC is providing guidance that the offer and sale of covered stablecoins do not constitute as securities, thus providing some legal guidance for crypto industry.

It appears that the SEC is progressing forward with it’s “pro-crypto” mandate from President Trump, a vocal advocate for crypto participants during his pre-election campaign. Therefore, the SEC providing some clarity for the crypto industry may be beneficial for the wider industry, yet that may be overshadowed by the recent events we discussed in the previous paragraph.

Crypto Technical Analysis

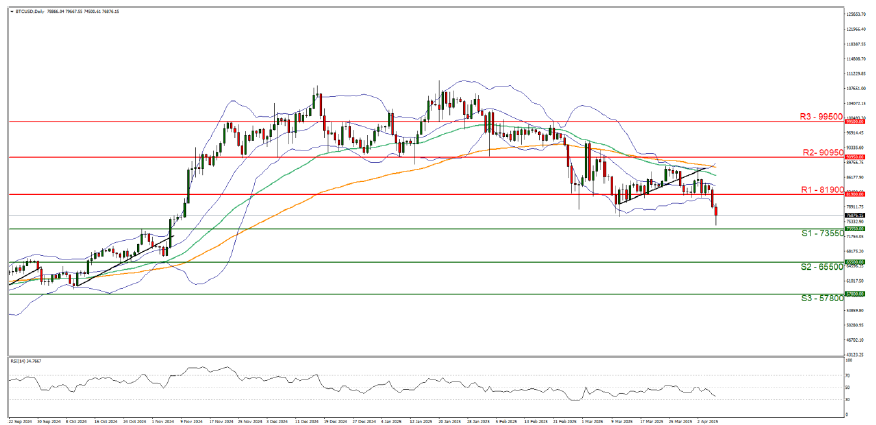

BTC/USD Daily Chart

- Support: 73550 (S1), 65500 (S2), 57800 (S3)

- Resistance: 81900 (R1), 90950 (R2), 99500 (R3)

BTC/USD appears to be moving in a downwards fashion, with the pair having cleared our support turned to resistance at the 81900 (R1) level.

We opt for a bearish outlook for the coin’s price and supporting our case is the RSI indicator below our chart which currently registers a figure close to 30 implying a bearish market sentiment. For our bearish outlook to continue we would require a clear break below the 73550 (S1) support level, with the next possible target for the bears being the 65500 (S2) support line.

On the flip side, for a sideways bias we would require the coin’s price to remain confined between the 73550 (S1) support level and the 81900 (R1) resistance line.

Lastly, for a bullish outlook we would require a clear break above the 81900 (R1) with the next possible target for the bulls being the 90950 (R2) resistance level.

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。

リスク警告:

Crypto CFDs are an extremely high-risk, speculative investment and you may lose all your invested capital. Before trading, you need to ensure you fully understand the risks involved taking into consideration your level of experience and investment objectives. Seek independent advice, if necessary.