US stock markets moved higher since last week, with the S&P 500 and NASDAQ 100 reaching levels last seen in January. It seems that tech shares continue to dominate the markets with the AI frenzy still leading market sentiment. In this report, we aim to present the recent fundamental and economic news releases that impacted the US stock markets, look ahead at the upcoming events that could affect their performance and conclude with a technical analysis.

Google charged by the EU for its Advertising dominance.

Google (#GOOG) Today has been charged by the EU Competition 手数料 for allegedly abusing its advertising dominance. The EU Competition Commission claims that Alphabet the parent company of Google, has favored its own advertisement programs over their rivals. his allegedly has provided Google with the ability to charge 高い fees for their services, which has provided google with a “dominant position” by favoring its own AdX ad exchange. According to the commission, Google has allegedly abused this position by “Favouring its own ad exchange AdX in the ad selection auction run by its dominant publisher ad server DFP by, for example, informing AdX in advance of the value of the best bid from competitors which it had to beat to win the auction”. In the event, that the conducts by Google are found to be true, then they could infringe on Article 102 “of the Treaty on the Functioning of the European Union (‘TFEU’) that prohibits the abuse of a dominant market position.” In conclusion, should Google be found in violation of Article 102, it may lead to a “divestment” of Google’s services in order to address competition concerns, potentially weakening the stock’s price as it may lose a lucrative ad division in Europe.

Intel linked to British Chip Designer Arm.

Intel (#INTC) has been linked as a potential anchor investor in Arm before their widely anticipated IPO this year. Should Intel be formally revealed as an anchor investor, it may signal a shift from Intel’s decade long policy of only developing its own in-house microchips, by allowing Arm access to its factories. In theory, by opening up their doors, Intel could potentially be in a better position to compete with chip behemoth TSMC and as such could provide long term support for the stock in the future in terms of increased revenue through higher sales, by expanding Intel’s capabilities そして reach in the global chip markets.

General Motors joins Ford in using Tesla’s superchargers.

前の Thursday, 一般 Motors (#GM) joined Ford (#F) in announcing that they would be using Tesla’s EV charging network for their electric vehicles. According to CNBC the deal would provide access to 12,000 fast chargers for GM vehicles, thus greatly bolstering Tesla’s lead as the EV’s industry’s leader. The deal according to CNBC would also benefit GM by saving up to $400 million that would have been incurred should they have continued their investment to build their own EV charging ports. Overall, this appears to have aided to Tesla’s rise as demand for their services continues to increase with more automotive manufacturers adapting to their technology, may have solidified Tesla as the dominant marker leader for the EV market.

テクニカル分析

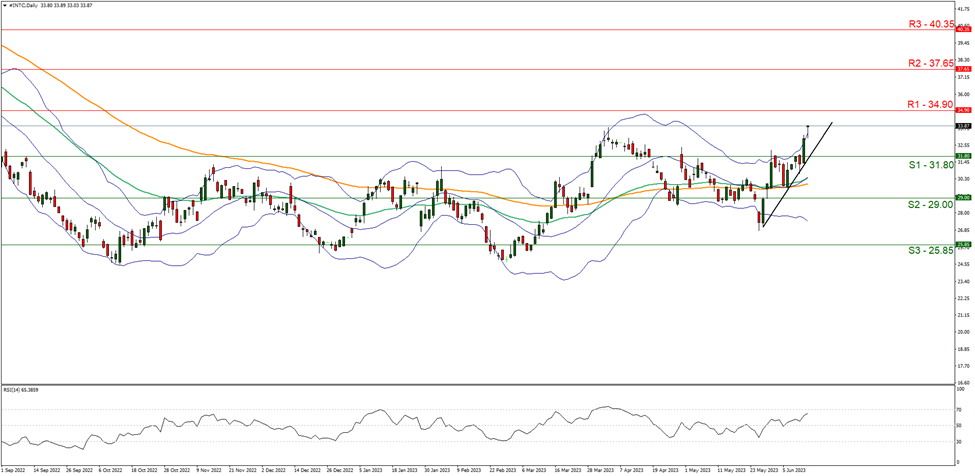

#INTC Daily Chart

Support: 31.80 (S1), 29.00 (S2), 25.85 (S3)

Resistance: 34.90 (R1), 37.65 (R2), 40.35 (R3)

#INTC’s share price seems to be moving in an upwards fashion, having formed an upwards trendline that was incepted on the 26 of May. For the time being, we maintain a bullish bias for the stock and supporting our case is the RSI indicator below our Daily Chart which currently registers a reading near the figure of 70, implying a strong bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 34.90 (R1) resistance level, with the next possible target for the bulls being the 37.65 (R2) resistance ceiling. On the other hand, for a bearish outlook, we would like to see a clear break below the 31.80 (S1) support level, with the next potential target for the bears being the 29.00 (S2) support base. Furthermore, we note that the widening of the Bollinger bands, implying high market volatility and the stock which is near the upper band of the Bollinger bands, may be due for a market correction lower.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。