The bearish tendencies for US stock markets of the past week seem to have been halted as per the movement of the three major US stock market indexes. Yet fundamentals affecting them are present including the Fed’s interest rate decision later today and the release of July’s US employment report on Friday. Both events could prove to be extensively market moving hence we tend to advise increased caution should you be trading during the particular releases. Today we are to discuss some tech companies and for a rounder view finish the report with a technical analysis of Nasdaq’s Daily chart.

Microsoft’s earnings disappoint traders

We make a start with Microsoft which suffered a drop of its share price yesterday. The share’s price was affected by the release of the company’s earnings report. Despite the Earnings per Share (EPS) figure and the revenue figure being both slightly above expectations the market participants chose to sell its share as the mega cap tech company stated that it intents to invest more money on artificial intelligence infrastructure, despite slowing growth in its cloud business, which was considered the backbone for the company’s revenue. The news hit the markets creating an expectation that any payouts of the investments is to be delayed. Also yesterday another outage of Microsoft’s services and served as a painful reminder for the major outage of services almost two weeks ago. We expect the share’s price to recover, yet on a fundamental basis, should we see further worries for the operations of Microsoft, we may see them weighing on MSFT’s share price.

Meta’s earnings report today

On the other hand, Meta’s share price seems to show some stabilisation despite the drop in the past two days. We highlight for Meta traders the release of its earnings report after the close today. The company’s revenue is expected to rise to $38.26 billion if compared to last quarter’s respective figure of $36.46 billion, yet a stagnation of the EPS figure at the level of at around 4.7. Should the figures meet their respective forecasts, we may see the market being somewhat disappointed as it would imply an issue in the cost structure of the company. Besides the figures mentioned we highlight also the company’s spending on AI and the revenue from ad sales. At this point, we also note that Meta agreed to a $1.4 billion settlement in Texas to settle a facial recognition data lawsuit by the state. We also remind our readers that the company is expected to be hit with first EU antitrust fine for linking Marketplace and Facebook. The fine is expected to be hefty and some mention even a figure of $13.4 billion being possible, which would equal 10% of its global income for 2023. On a fundamental level, the climate for Meta seems to be sour and could weigh on its share price.

NVIDIA’s fall seems to continue

The fall of NVIDIA’s share price seems to have continued if not intensified yesterday. NVIDIA’s share price was adversely affected as the Biden administration announced its intentions to set limitations in the trading of chips with China. Yet news that the US Government is set to announce next month new rules, expanding its power to halt exports of some semiconductor manufacturing equipment from some foreign countries to Chinese chipmakers, could rattle the markets once again. Shipments from allied countries like Japan, Netherlands and South Korea are to be excluded. Despite NVIDIA not being directly affected by the news it could get a boost should the market perceive the news as positive.

Incoming earnings reports and Apple

As for incoming earnings reports we note Amazon on Thursday, Exxon Mobin and Chevron on Friday, Caterpillar and Airbnb next Tuesday and Walt Disney next Wednesday. Yet we would like to focus on Apple tomorrow. The company is expected to report a drop in both the EPS and revenue figure which may not bode well with investors. On a more fundamental level, we note that the company released Apple has just released the developer betas for iOS 18.1, iPadOS 18.1, and macOS Sequoia 15.1, giving users access to the company’s first set of AI features, as per The Verge. Should we see positive comments regarding the software emerging in the media, we may see them providing a boost to the share’s price.

テクニカル分析

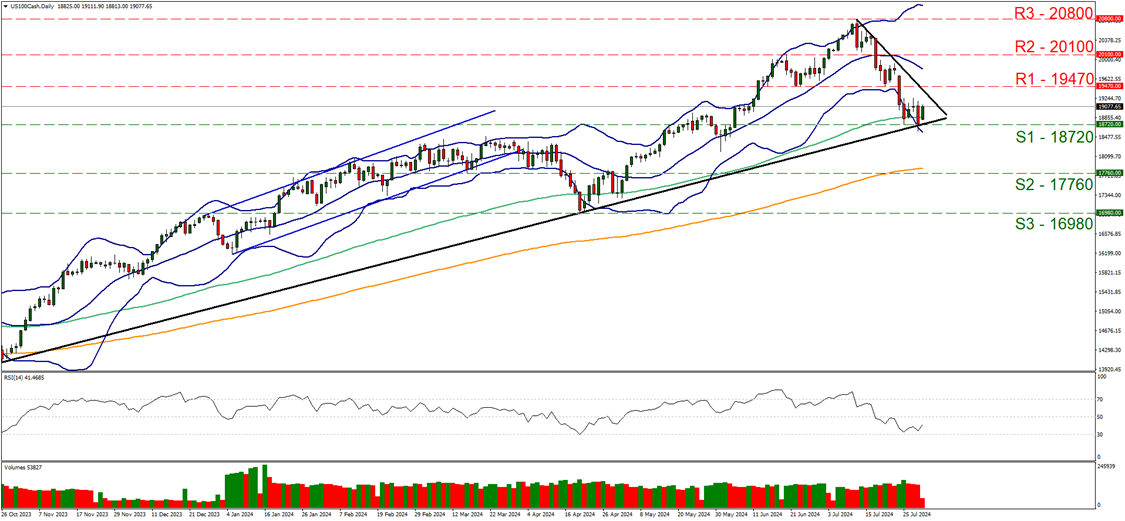

US100 Cash デイリーチャート

- Support: 18720 (S1), 17760 (S2), 16980 (S3)

- Resistance: 19470 (R1), 20100 (R2), 20800 (R3)

Nasdaq’s downward motion seems to have been halted after it’s price action hit a floor at the 18720 (S1) support line since last Friday. The price action seems to be reaching the peak of a symmetrical triangle as two opposing trendlines meet. We note that a sideways motion seems to be prevailing since the start of the week, yet at the same time, we also note that the downward motion of the index’s price action was halted after hitting the lower Bollinger band, which is understandable yet may imply that the correction is temporary and the downward motion may resume as there is some distance now between the two allowing for some room for the bears to play. Also the RSI indicator despite correcting lower remains between the readings of 30 and 50, implying that he bearish tendencies may be easing yet have not been totally erased yet. For the bearish outlook to be renewed we would require the index’s price action to break the prementioned upward trendline guiding the index since the 26 of October last year, break the 18720 (S1) support line and aim for the 17760 (S2) support level. On the flip side for a bullish outlook the bar is pretty high as the index would have to break initially the downward trendline guiding the index since the 11 of July, break the 19470 (R1) resistance base and continue higher aiming if not testing the 20100 (R2) resistance level.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。