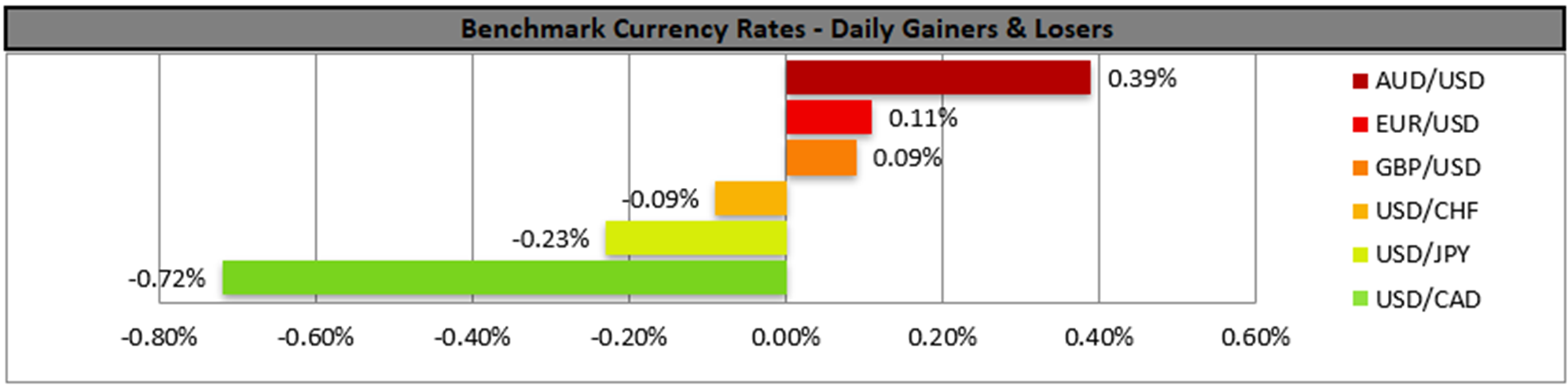

The USD tended to edge lower against its counterparts during today’s Asian session, as US President Trump announced late Friday evening that he intends to double aluminium and steel tariffs to 50% from Wednesday onwards. He also claimed that China backtracked from what was agreed in recent negotiations in Switzerland. China opposed accusations that the agreement about rare earth elements has been violated. The issue threatens to cancel any agreement. Overall tensions seem to be escalating and if actually intensify we may see the USD losing more ground as fundamentals seem to be leading the greenback. Today we get the US ISM manufacturing PMI figure and should the indicator’s reading rise we may see the USD limiting its losses.

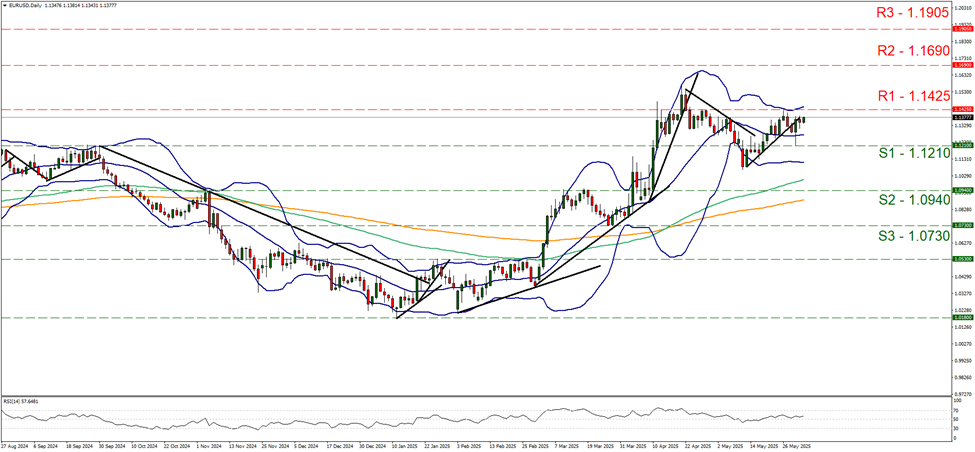

Since Friday’s report, EUR/USD has been on the rise, especially during today’s Asian session given the weakening of the USD, aiming for the 1.1425 (R1) resistance line. The RSI indicator seems to be edging slowly higher, implying some bullish predisposition of the market for the pair, yet for the time being we tend to maintain our bias for a sideways motion between the R1 and the S1 levels. For a bullish outlook to emerge we would require the pair to clearly break the 1.14250 (R1) resistance line and start aiming for the 1.1690 (R2) resistance level. For a bearish outlook to emerge, we would require the pair to break the 1.1210 (S1) support line and start aiming for the 1.0940 (S2) support level .

その他の注目材料

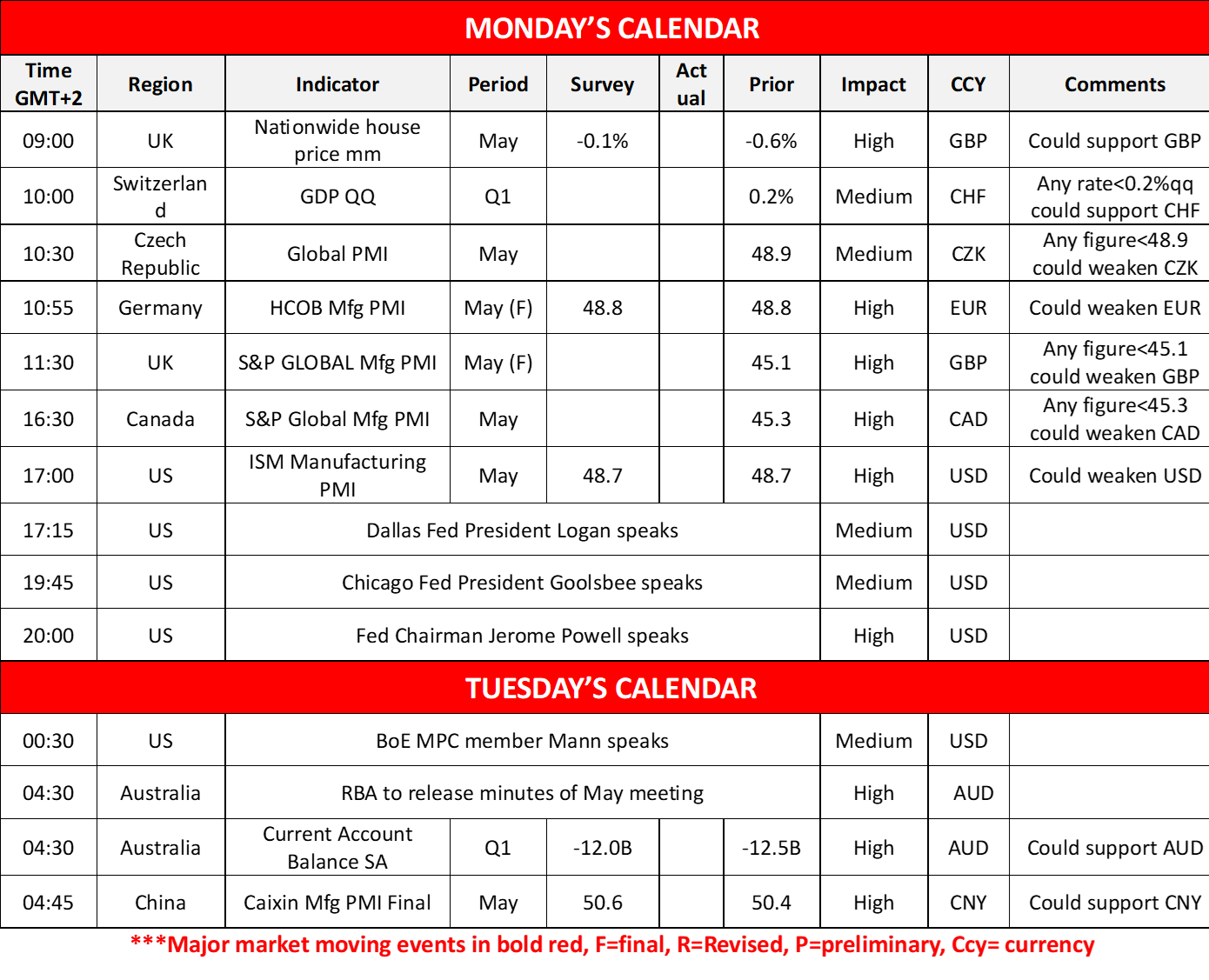

Today we get UK’s nationwide house prices for May, Switzerland’s GDP rate for Q1, the Czech Republic’s PMI figure for May, Germany’s, the UK’s and Canada’s final manufacturing PMI figures for May On the monetary front, we note that Dallas Fed President Logan, Chicago Fed President Goolsbee and Fed Chairman Jerome Powell are scheduled to speak. In tomorrow’s Asian session, we get Australia’s current account balance for Q1 and China’s Caixin manufacturing PMI figure for May, while BoE MPC member Mann speaks and RBA is to release the minutes of the May meeting.

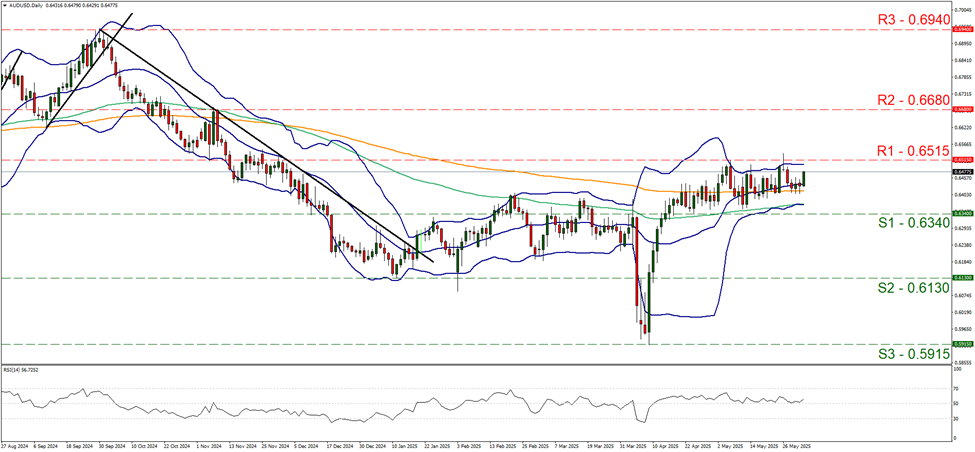

On a technical level, we note that the Aussie was on the rise against the USD during today’s Asian session, yet for the time being remains well within the boundaries set by the 0.6515 (R1) resistance line and the 0.6340 (S1) support level. Despite the RSI indicator edging higher today for the time being we tend to maintain a bias for the sideways motion to continue given also that the Bolinger bands remain flat. Should the bulls take over we may see AUD/USD breaking the 0.6515 (R1) resistance line and start aiming for the 0.6680 (R2) resistance barrier. Should the bears be in charge we may see the pair breaking the 0.6340 (S1) support line, thus paving the way for the 0.6130 (S2) support level.

今週の指数発表:

On Tuesday, we get Switzerland’s, Turkey’s and the Euro Zone’s inflation metrics for May and from the US the factory orders and JOLTS job openings all being for April. On Wednesday we get Australia’s GDP rate for Q1, the Czech Republic’s preliminary CPI rate for May, the US ADP national employment figure for May and in Canada, BoC is to release its interest rate decision while from the US we get the ISM non-manufacturing PMI figure for May. On Thursday we expect the highlight to be the release of ECB’s interest rate decision while we also get Australia’s trade balance for April, China’s Caixin Services PMI figure, Germany’s industrial orders for April, Sweden’s preliminary CPI rates for May, the Euro Zone’s and the UK’s construction PMI figures for May, the weekly US initial jobless claims figure and Canada’s trade data for April. On Friday, we get Japan’s all household spending, Australia’s building approvals and Germany’s industrial output, all being for April, UK’s Halifax House prices for May, the Eurozone’s revised GDP rate for Q1, Canada’s employment data for May and May’s US employment report.

EUR/USD デイリーチャート

- Support: 1.1210 (S1), 1.0940 (S2), 1.0730 (S3)

- Resistance: 1.1425 (R1), 1.1690 (R2), 1.1905 (R3)

AUD/USD Daily Chart

- Support: 0.6340 (S1), 0.6130 (S2), 0.5915 (S3)

- Resistance: 0.6515 (R1), 0.6680 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。