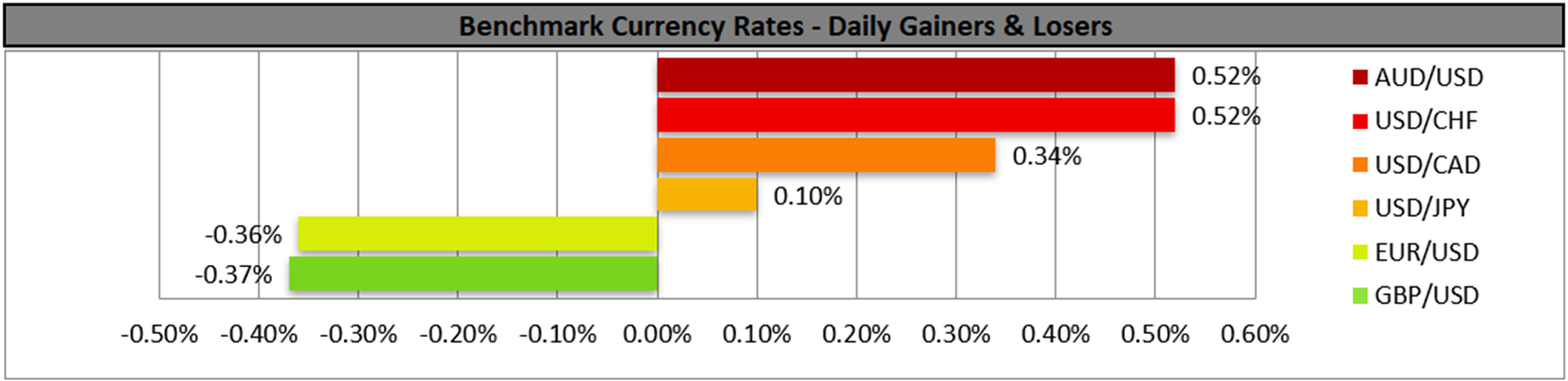

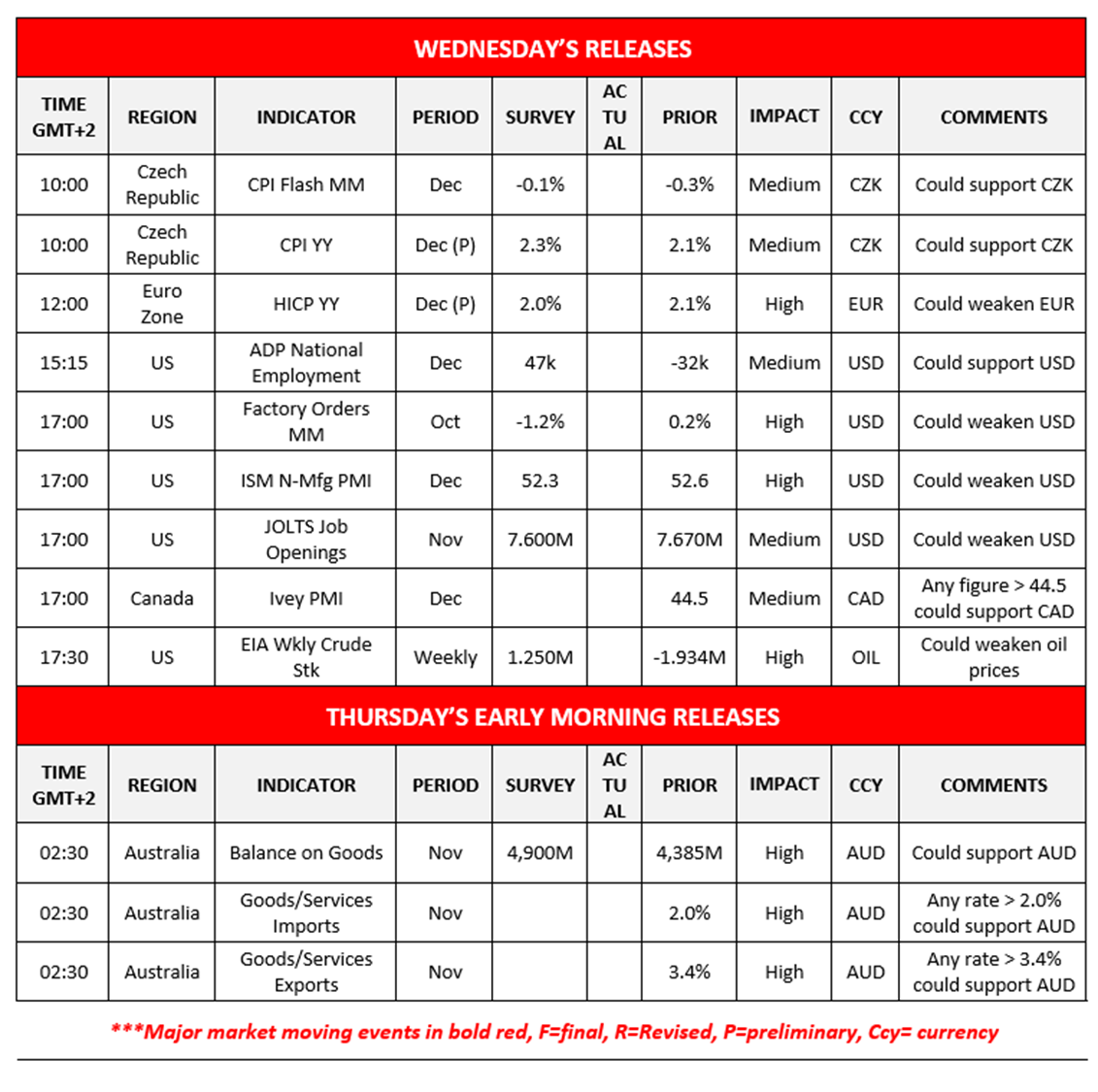

The USD rose against its counterparts yesterday as financial releases could alter the market’s expectations for the Fed’s intentions. Today, we note the release of the ADP national employment figure for December, as market focus may be more on the US employment market, given the release of the US employment report for December on Friday. Yet regarding the level of economic activity in the US economy, we highlight the release of US factory orders for October and the ISM Manufacturing PMI figure for December. On a deeper fundamental level, we note that the markets have, to a large extent, priced in the recent developments on a geopolitical level, including the US intervention in Venezuela and the capturing of Venezuelan President Maduro. Across the world, we note the banning by China of exports of dual-use items to Japan that can be used for military purposes, which may have been a response to the Japanese Prime Minister Takaichi’s remarks about Taiwan. The tensions seem to be escalating further, which could create safe-haven demand.

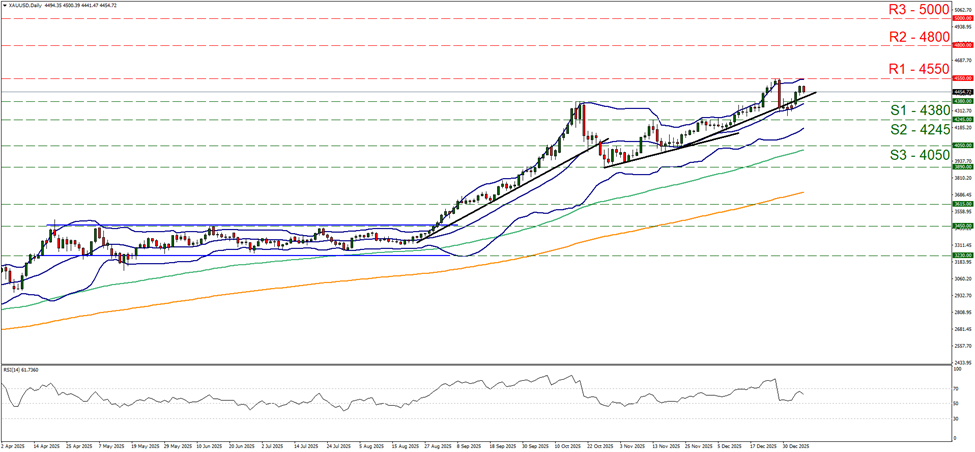

Despite the rise of the USD on a technical level, we note that gold’s price also rose yesterday, yet any gains made were relented in today’s Asian session. The RSI indicator remains between the reading of 50 and 70, implying a bullish predisposition of the market for the precious metal’s price. We also note how the 20 moving average, which is also the median of the Bollinger bands acted as a support line for the bullion’s price. Yet for the adoption of a clearcut bullish outlook we would require gold’s price to break the 4550 (R1) resistance line, reaching new record high levels, and we set as the next possible target for gold’s bulls the 4800 (R2) resistance level. For a bearish outlook to emerge for gold’s price we would require gold’s price to break the 4380 (S1) support line and start aiming if not reaching the 4245 (S2) support barrier.

Talking about Japan, we also note the release of the Overall Lab Cash earnings growth rate for November and a possible acceleration of the rate, along with the Overtime pay growth rate, may provide support for the JPY as it could enhance the hawkish intentions of BoJ. Also, Japan’s super-long-dated government bonds fell on Wednesday, steepening the yield curve across maturities. It’s characteristic that the 20 and 30-year Japanese bond yields have reached record high levels.

Today we also highlight the release of the Eurozone’s preliminary HICP rate for December after the slowdown of the respective rates of France and Germany for the same month. A possible easing of inflationary pressures in the Euro Zone may turn the ECB more dovish, at least in theory, yet we still see inflation in the Euro Zone around the bank’s 2.00% year-over-year inflation target. Thus, it could allow the ECB to keep rates unchanged for longer and weigh on the common currency.

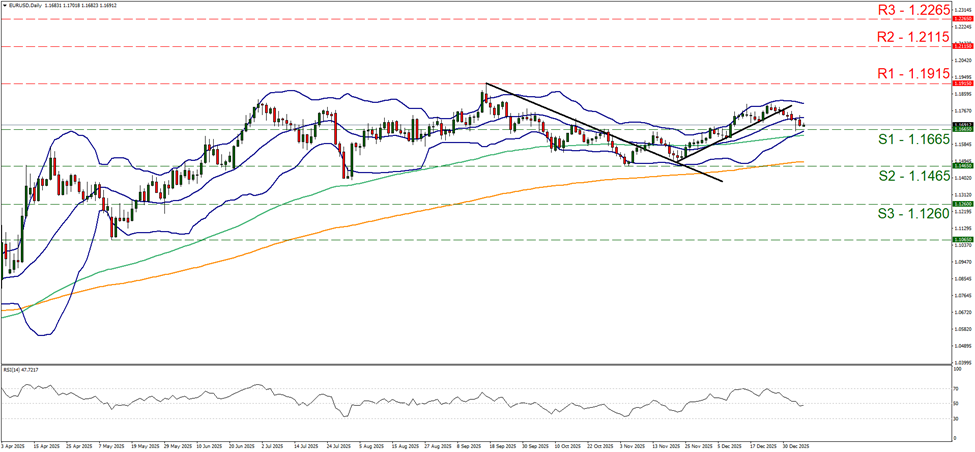

EUR/USD dropped yesterday aiming for the 1.1665 (S1) support line. The RSI indicator has dropped below yet remained close to the reading of 50, implying a relative indecisiveness on behalf of market participants for the pair’s direction. We also note the narrowing of the Bollinger bands that may imply an easing of volatility for the pair which in turn may allow the sideways motion of EUR/USD’s to be maintained. For the time being, we maintain our bias for a sideways motion of the pair. Should the bears take over, we may see the pair breaking the 1.1665 (S1) support line clearly and continue to aim if not breach the 1.1465 (S2) support level. Should the bulls take over, we may see EUR/USD reversing course and breaching the 1.1915 (R1) resistance line and continue to aim for the 1.2115 (R2) resistance level.

その他の注目材料

Today we get the Czech Republic’s preliminary CPI rates for December, the Eurozone’s preliminary HICP rate for December, Canada’s Ivey PMI figure for December and the EIA weekly crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s trade balance data for November.

EUR/USD デイリーチャート

- Support: 1.1665 (S1), 1.1465 (S2), 1.1260 (S3)

- Resistance: 1.1915 (R1), 1.2115 (R2), 1.2265 (R3)

XAU/USD Daily Chart

- Support: 4380 (S1), 4245 (S2), 4050 (S3)

- Resistance: 4550 (R1), 4800 (R2), 5000 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。