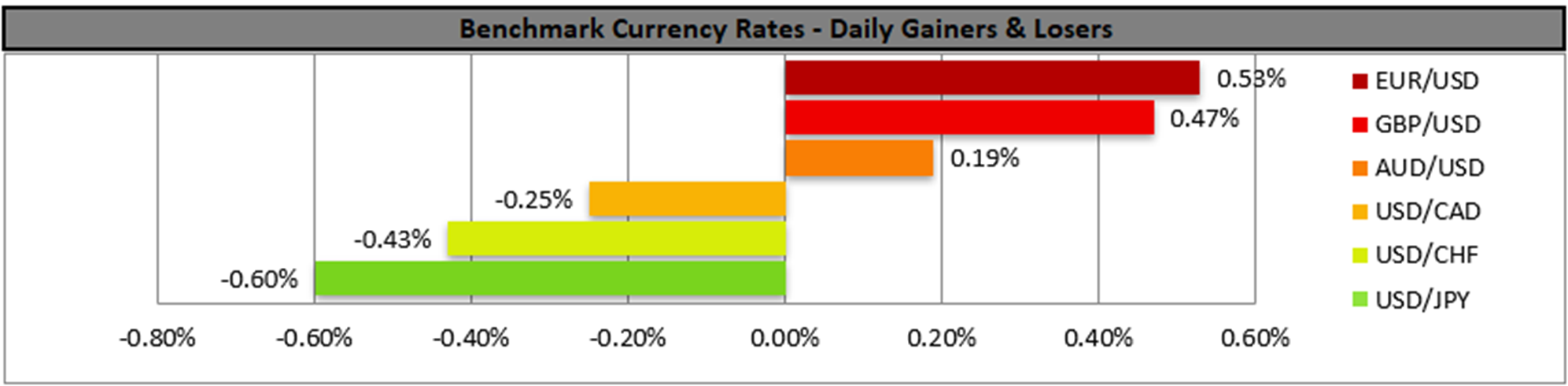

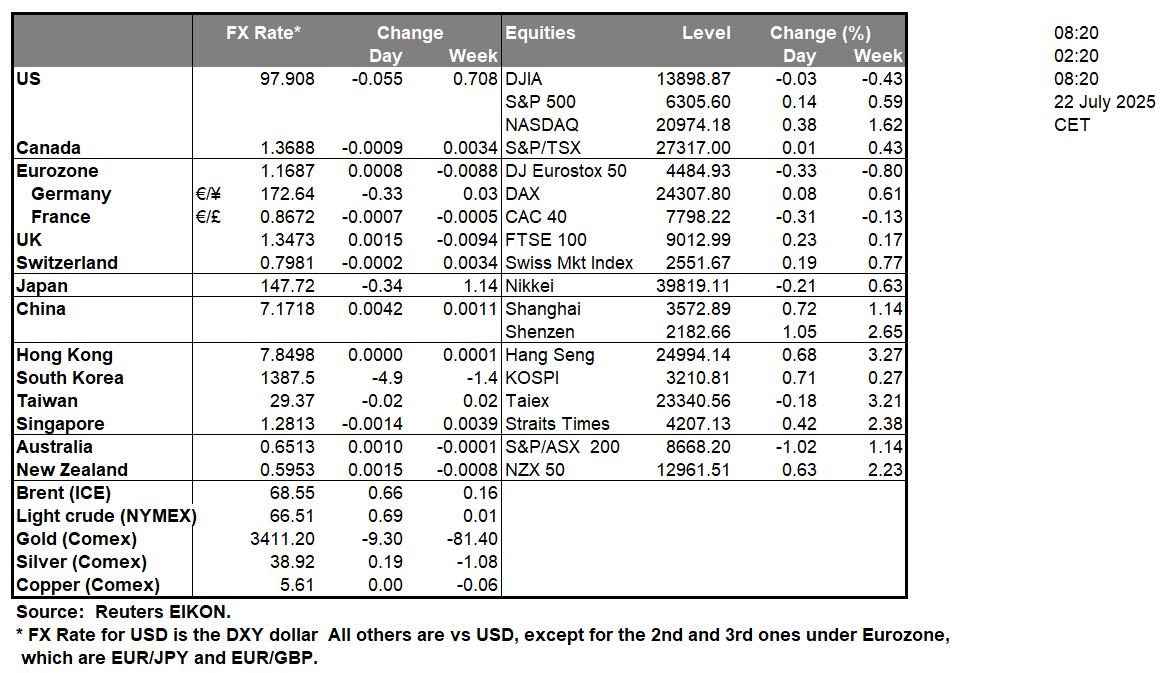

The USD edged lower against its counterparts yesterday, which may have allowed gold’s price to edge higher. On a fundamental level, the US trade wars continue to tantalize the markets as US President Trump’s tariff deadline on the 1st of August is nearing and the stakes are high not only for the US economy but the issue could slow down economic growth on a global level. For the time being, we note that US Trade Secretary Lutnick, stated that he is confident that a US-EU trade deal will be secured, yet uncertainty runs high. Overall, any escalation of the tensions in the US trade relationships, such as a possible announcement of countermeasures by the EU, especially if countermeasures include the services sector, could heighten uncertainty as it would be signaling an overspilling of the tensions beyond the manufacturing sector. On a monetary level, we highlight US President Trump’s criticism for the Fed’s monetary policy, which he considers to be too tight. U.S. Treasury Secretary Bessent added another twist yesterday, by claiming he wanted to review the entire Fed institution and its performance. As per CNBS, US Treasury Secretary Bessent stated “What we need to do is examine the entire Federal Reserve institution and whether they have been successful,”. The statement tends to highlight conflict between the US Government and the US central bank, which in turn may weigh on the USD. In today’s early American session, we highlight the speech of Fed Chairman Powell. Should the Fed Chairman signal that he intends to remain in his position until the end of his term, it could provide some support for the USD, while any signs of a possible resignation could weigh on the greenback. Also, should the Fed Chairman signal that the bank is prepared to keep rates high for longer, we may see the USD gaining, as it could contradict the market’s current dovish expectations, while a possible dovish tone could weigh on the USD.

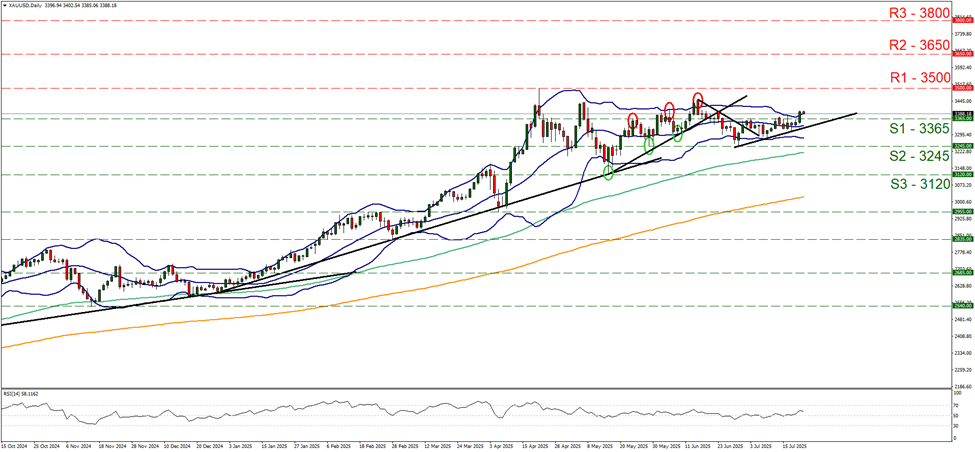

XAU/USD rose yesterday breaking the 3365 (S1) resistance line, now turned to support. The breaking of the R1, allowed for the precious metal’s price to form new higher peak and an upward trendline has been formed, hence we adopt a bullish outlook for gold’s price. The RSI indicator has risen, a bit timidly, above the reading of 50, implying some slight bullish tendencies in the market for gold’s price. The price action has reached the upper Bollinger band, which may slow down the bulls somewhat. Should the bulls maintain control as expected, we may see gold’s price aiming if not breaching the 3500 (R1) resistance level, which marks a record high level for the precious metal. Should the bears take over we may see gold’s price breaking the 3365 (S1) support line, continuing to break the prementioned upward trendline in a signal that the upward motion has been interrupted and continue to break the 3245 (S2) support level.

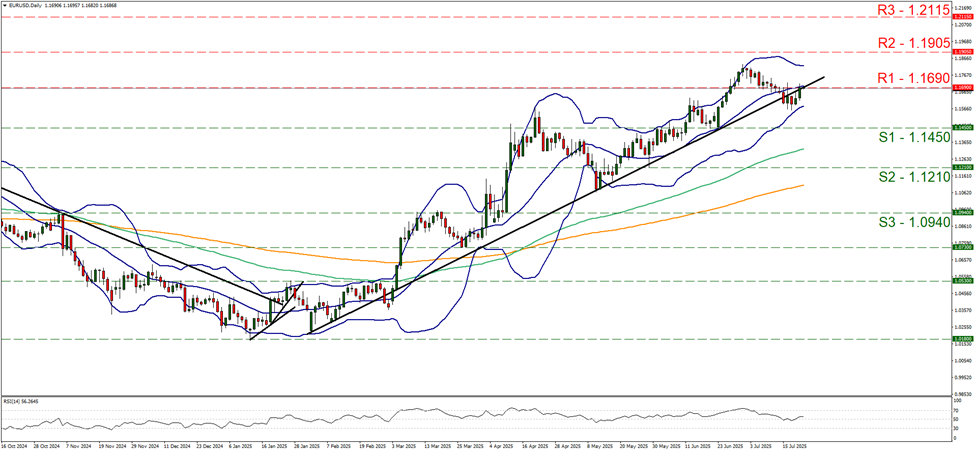

In the FX market EUR/USD rose yesterday and is currently testing the 1.1690 (R1) resistance line. We maintain our bias for the sideways motion of the pair after EUR/USD broke the upward trendline guiding it. The RSI indicator is slightly above the reading of 50, yet nothing as convincing for a bullish predisposition of the market for the pair. Furthermore, the Bollinger bands are narrowing, implying less volatility for the pair, which in turn could allow the pair’s sideways motion to continue. For a bullish outlook we would require the pair to break the 1.1690 (R1) resistance line and continue higher to breach the 1.1905 (R2) resistance level. For a bearish outlook to emerge, we would require the pair to break the 1.1450 (S1) support line clearly.

その他の注目材料

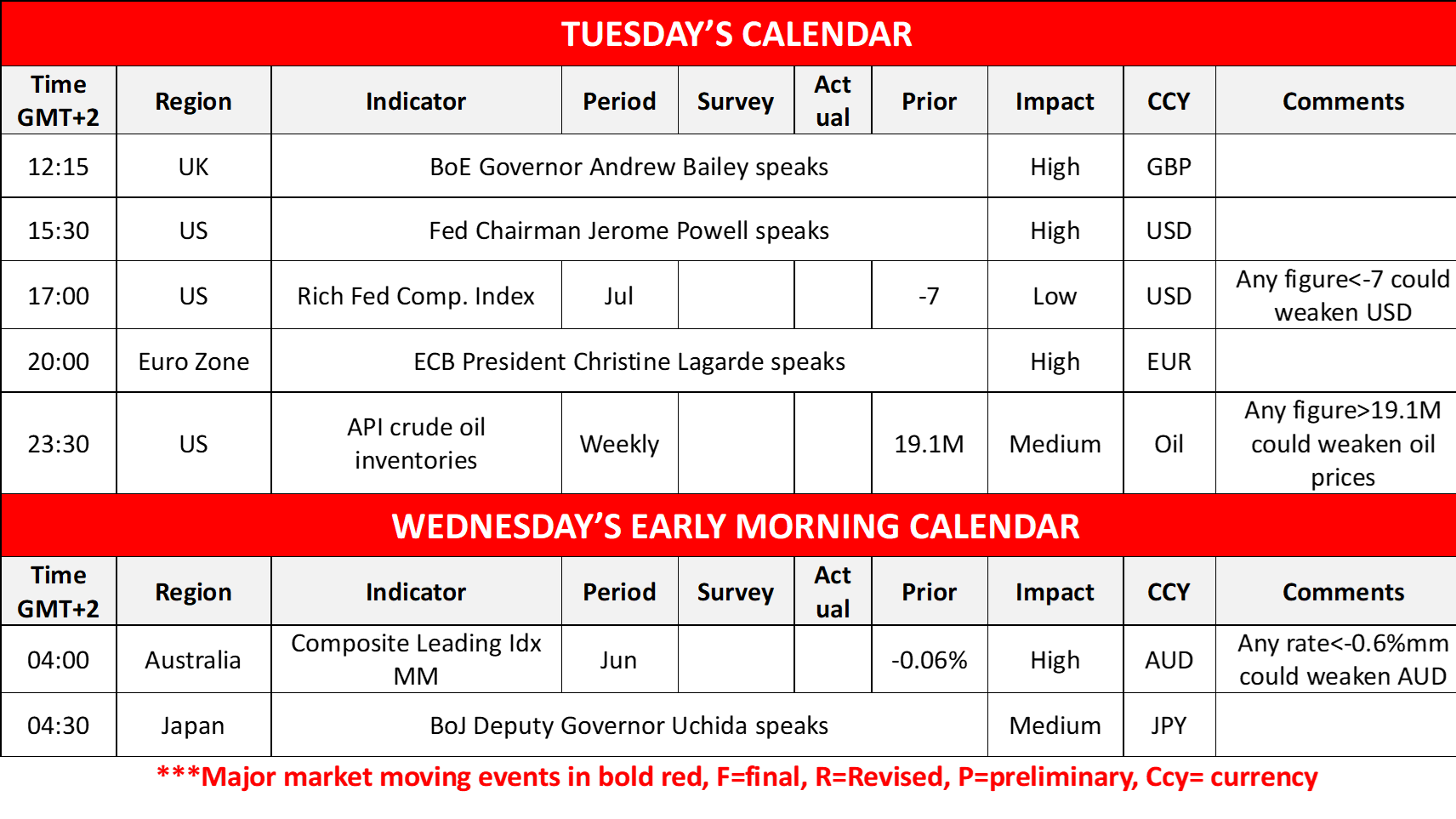

Today we note BoE Governor Andrew Bailey’s speech while from the US we get the Richmond Fed Composite Index for July, while oil traders may be more interested in the release of the weekly US API crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s composite leading index for June and from Japan, BoJ’s Deputy Governor Uchida is scheduled to speak.

XAU/USD Daily Chart

- Support: 3365 (S1), 3245 (S2), 3120 (S3)

- Resistance: 3500 (R1), 3650 (R2), 3800 (R3)

EUR/USD デイリーチャート

- Support: 1.1450 (S1), 1.1210 (S2), 1.0940 (S3)

- Resistance: 1.1690 (R1), 1.1905 (R2), 1.2115 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。