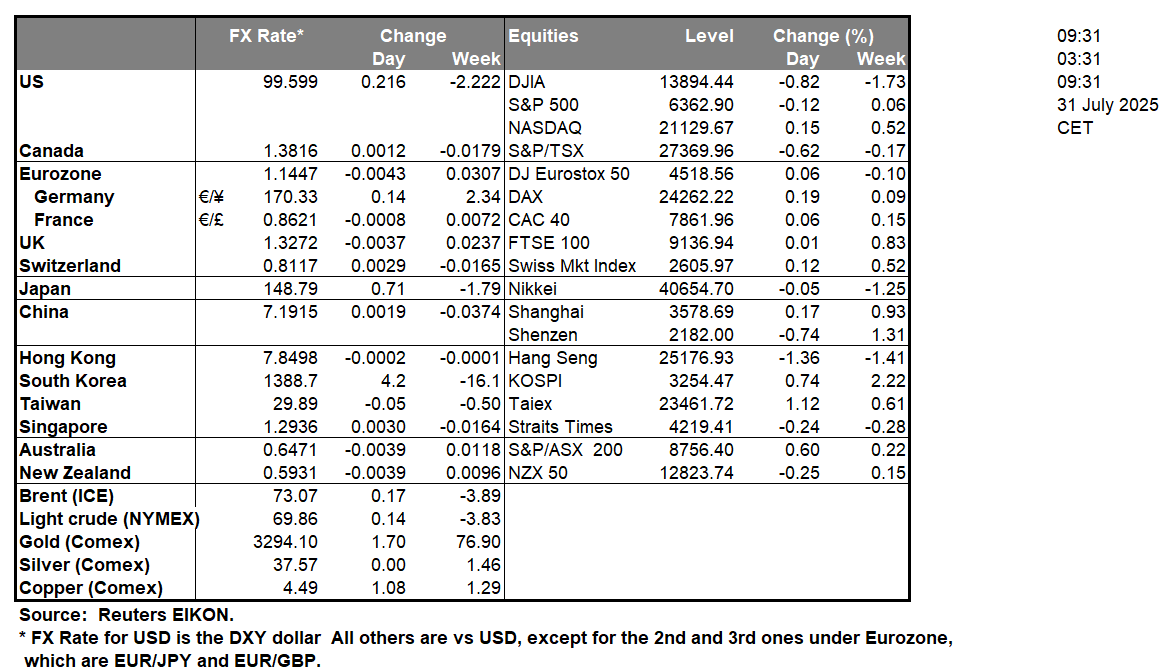

The Fed’s interest rate decision occurred yesterday with the bank remaining on hold as it was widely expected. As expected, we saw some dissent from policymakers with Michelle W. Bowman and Christopher J. Waller voting against the Fed’s decision to remain on hold and who preferred to lower the target range for the federal funds rate by 1/4 percentage point at this meeting. Moreover, Fed Chair Powell during his press conference stated that “We see our current policy stance as appropriate to guard against inflation risks”, showcasing a desire to remain on hold for a prolonged period of time as their “obligation is to keep longer-term inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem. In turn this may have aided the dollar against it’s counterparts, however in our view the dissenting members mark a possible shift in the Fed’s inner dynamics as this is the first time in more than 30 years that two Fed governors have dissented. The Bank of Canada’s interest rate decision took place yesterday with the bank remaining on hold as it was widely expected.In the bank’s accompanying statement it was said that “With still high uncertainty, the Canadian economy showing some resilience, and ongoing pressures on underlying inflation, Governing Council decided to hold the policy interest rate unchanged.” Yet the bank also stated that if required they may cut rates in order to aid the economy. In turn this may have weighed on the Loonie.The BOJ’s interest rate decision occurred earlier on today with the bank remaining on hold as well. BOJ Governor Ueda stated “If the economy and prices move in line with our forecast, we expect to continue raising interest rates” which may aid the JPY.

XAU/USD appears to be moving in a predominantly sideways fashion. We opt for a sideways bias for the precious metal’s price and supporting our case is the sideways moving channel which was incepted on the 1st of May and gold’s recent price action which places the precious metal’s price between our 3240 (S1) support level and our 3385 (R1) resistance line. Yet the RSI indicator below our chart currently registers a figure close to 40 which tends to imply a bearish market sentiment. Nonetheless, for our sideways bias to be maintained we would require gold’s price to remain confined between our 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 3240 (S1) support line with the next possible target for the bears being the 3115 (S2) support level. Lastly , for a bullish outlook we would require a clear break above our 3385 (R1) resistance level with the next possible target for the bulls being the 3500 (R2) resistance line.

AUD/USD appears to be moving in a downwards fashion after clearing our support now turned to resistance line at the 0.6525 (R1) level. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure close to 40, implying a bearish market sentiment in addition to the MACD indicator. For our bearish outlook to continue we would require a clear break below the 0.6360 (S1) support level with the next possible target for the bears being the 0.6225 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between our 0.6360 (S1) support level and our 0.6525 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 0.6525 (R1) resistance line with the next possible target for the bulls being the 0.6675 (R2) resistance level.

その他の注目材料

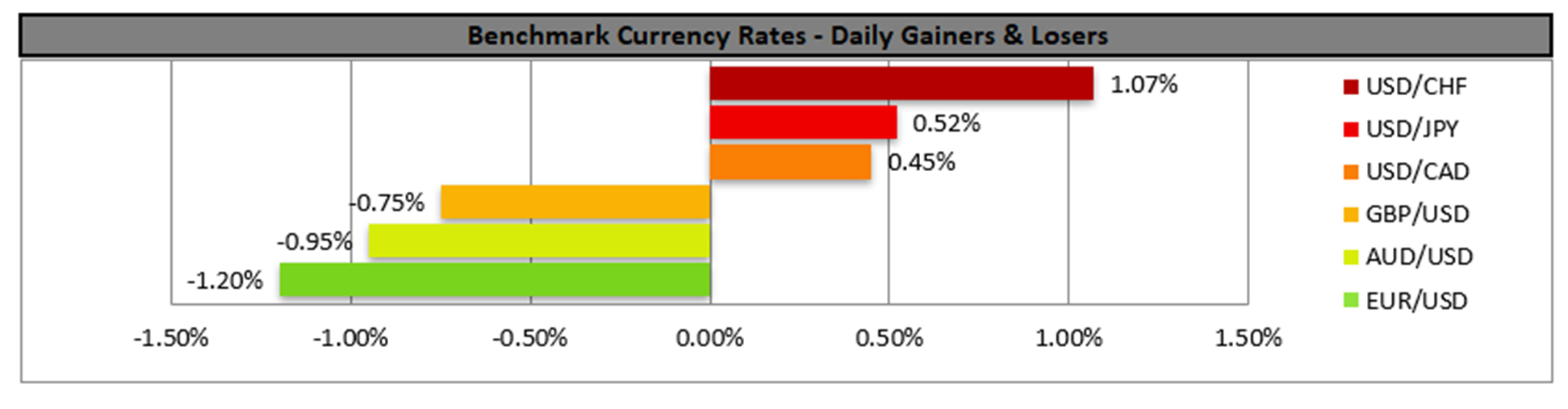

Today we get France’s and Germany’s preliminary HICP rates for July, and from the US we get the consumption rate for June, the PCE rates for the same month and the weekly initial jobless claims figure, while from Canada the note the release of the GDP rate for May. In tomorrow’s Asian session, we get Australia’s PPI rates for Q2 and China’s Caixin manufacturing PMI figure for July.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

AUD/USD デイリーチャート

- Support: 0.6360 (S1), 0.6225 (S2), 0.6090 (S3)

- Resistance: 0.6525 (R1), 0.6675 (R2), 0.6825 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。