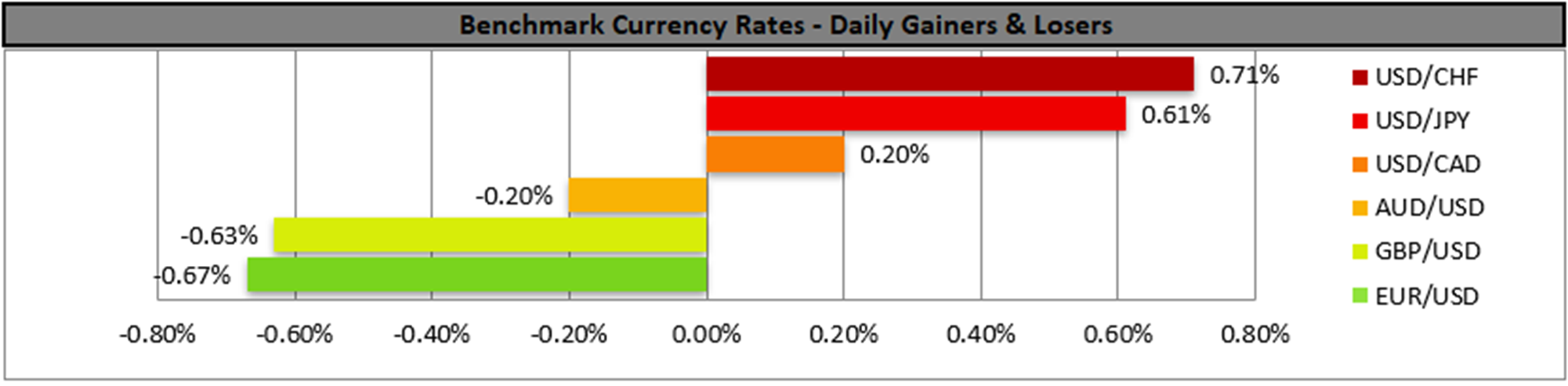

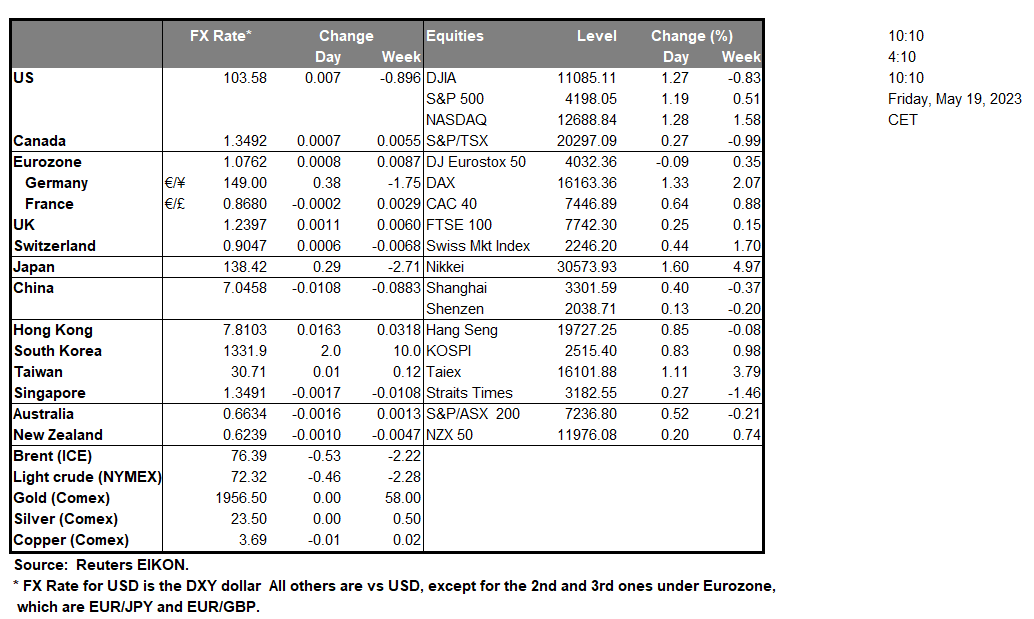

The USD tended to gain against its counterparts yesterday, getting a boost from the hawkish comments expressed by various Fed policymakers. It’s characteristic that yesterday Dallas Fed President Logan and St. Louis Fed President Bullard argued for another rate hike, given that inflation does not seem to be cooling off fast enough. We would like to note that the prementioned Fed policymakers are well-known hawks, yet other policymakers do not seem to feel uncomfortable with the idea of more rate hikes and definitely seem to be supportive of rates remaining at high levels for a longer period, contradicting market expectations for a possible rate cut by September. Overall, we expect that given the tight US employment market and the slow easing of inflationary pressures, Fed policymakers may continue to lean on the hawkish side which could provide further support for the USD and weigh on Gold’s price.

North of the US border, the Loonie lost some ground also due to BoC Governor Macklem who practically refused to lock in another rate hike by the bank despite the CPI rate ticking up on a core level last month. Also, CAD traders seem to keep an eye out for oil prices, which tended to edge lower yesterday yet the market sentiment for oil seems to be mixed and currently demand prospects for oil seem to be the main driver behind the direction of its prices. Should there be more optimism about the outlook of the global economy and a possible deal for a rise of the US debt ceiling we may see oil prices rising further and thus providing some support for the Loonie as well, yet we expect CAD traders to also focus on the release of Canada’s March retail sales growth rates later today.

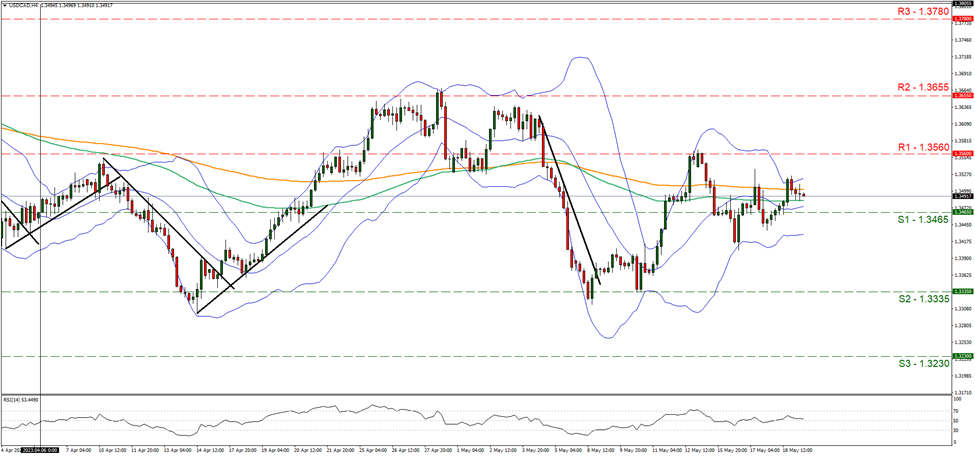

USD/CAD maintained largely its sideways motion yesterday above the 1.3465 (S1) support line. We tend to maintain our bias for the sideways motion to continue given also that the RSI indicator continues to remain near the reading of 50, implying a rather indecisive market. Should the pair find fresh buying orders along its path we set as the next possible target for the bulls the 1.3560 (R1) resistance line. Should a selling interest be expressed by the market we may see USD/CAD breaking the 1.3465 (S1) support line and aim for the 1.3335 (S2) support barrier.

Across the Pacific and on a macroeconomic level we note that inflationary pressures in Japan, were on the rise for April as the CPI rates accelerated both on a core and a headline level. Definitely, the acceleration of Japan’s CPI rates casts doubts on BoJ’s viewing that inflationary pressures are expected to ease, and the release may add more pressure on the Bank to alter its ultra-loose monetary policy settings, in turn providing some support for JPY.

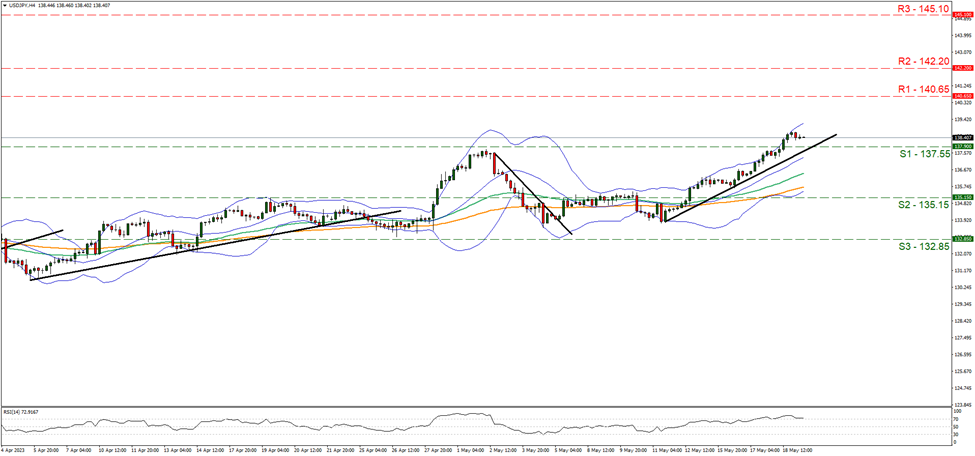

USD/JPY continued to be on the rise breaking the 137.55 (S1) resistance line, now turned to support. We tend to maintain our bullish outlook as long as the pair’s price action remains above the upward trendline incepted since the 11 of March, yet note some hesitation on behalf of the bulls to advance further. Should the bulls maintain control over the pair, we may see USD/JPY aiming if not breaching the 140.65 (R1) resistance line. Should the bears take over, we may see USD/JPY breaking the 137.55 (S1) support line and aim if not reach the 135.15 (S2) support level.

その他の注目材料

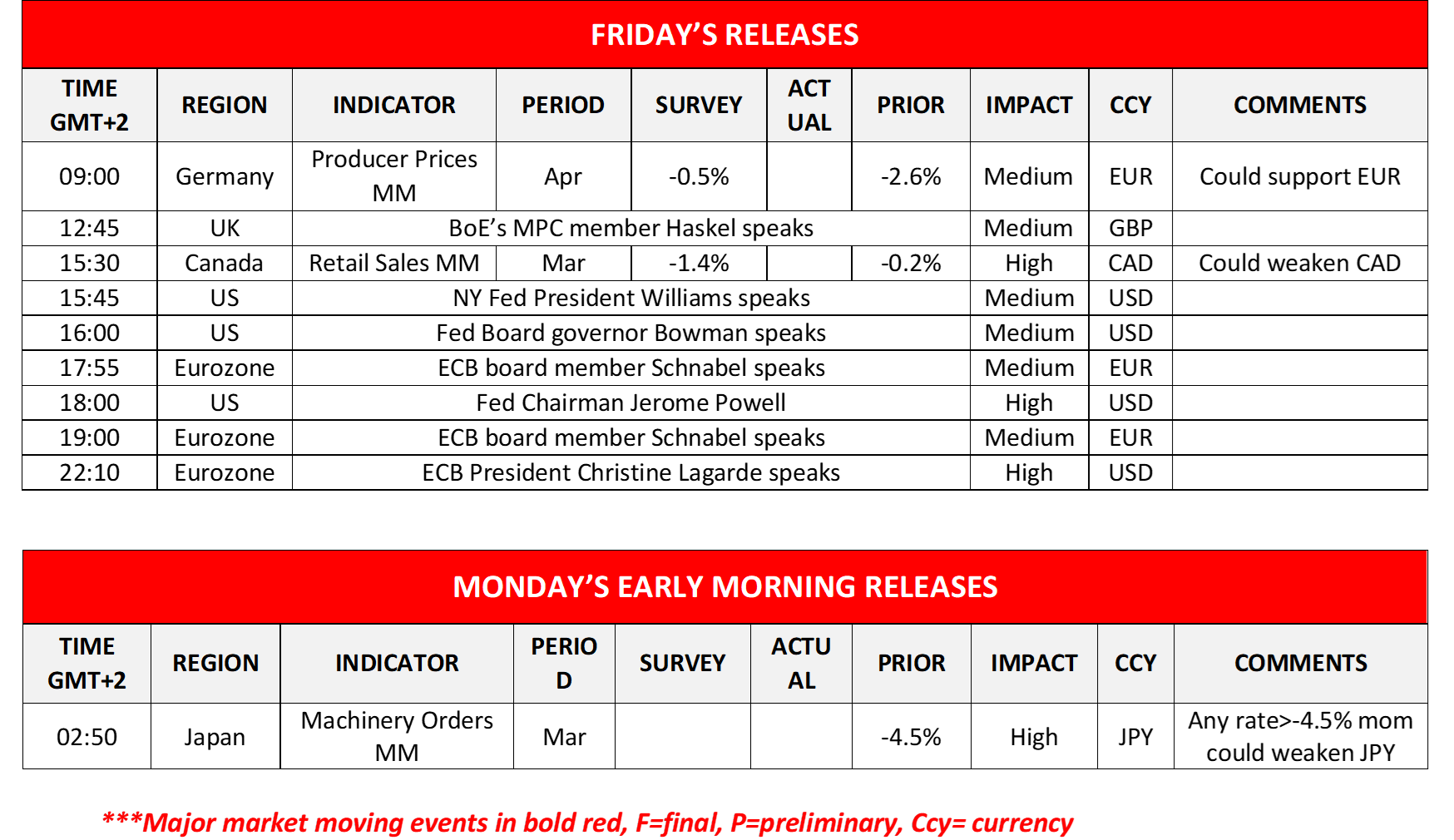

It’s expected to be an easy-going Friday and today we note the release of Germany’s producer prices for April and Canada’s retail sales growth rate for March, while during Monday’s Asian session, we note the release of Japan’s machinery orders growth rate for March. On the monetary front, we note that today BoE’s MPC member Haskel, NY Fed President Williams, NY Fed President Williams, ECB board member Schnabel, Fed Chairman Jerome Powell and ECB President Christine Lagarde are scheduled to speak.

USD/JPY 4時間チャート

Support: 137.55 (S1), 135.15 (S2), 132.85 (S3)

Resistance: 140.65 (R1), 142.20 (R2), 145.10 (R3)

USD/CAD 4時間チャート

Support: 1.3465 (S1), 1.3335 (S2), 1.3230 (S3)

Resistance: 1.3560 (R1), 1.3655 (R2), 1.3780 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。