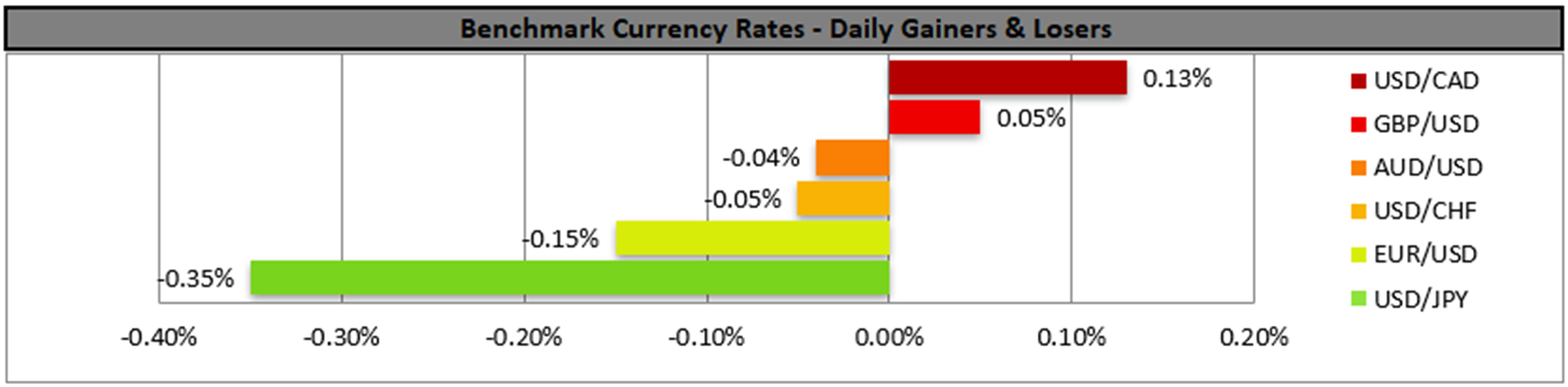

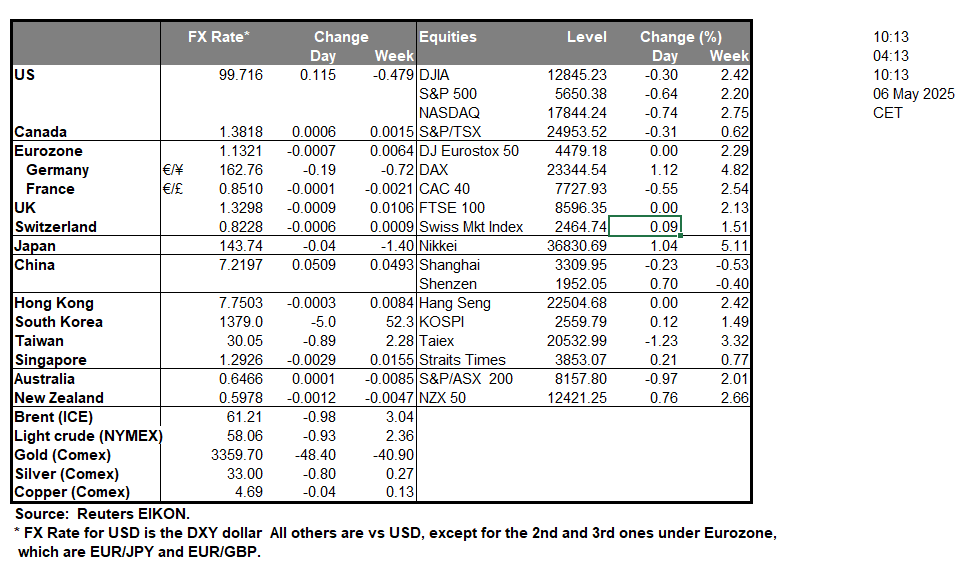

The USD continued to edge lower against its counterparts yesterday, yet nothing convincing for a bearish trend. We note the difficulty the USD has especially against Asian currencies after the Taiwanese Dollar (TWD) rallied against the greenback. The rally was caused by rumors for a possible deal which would cancel US tariffs on Taiwanese products in exchange for an appreciation of the TWD. The issue may overspill to other currencies thus leading to a wider weakness of the USD. Market focus is increasingly being set on the release of the Fed’s interest rate decision tomorrow in the late American session. Market expectations are for the bank to remain on hold keeping a wait-and-see position. It’s characteristic that the Fed Fund Futures imply a probability of 98.1% for such a scenario to materialise, while also imply that the market prices in three rate cuts until the end of the year, implying a dovish predisposition. Overall, should the bank remain on hold as expected yet at the same time highlight its doubts for rate cuts further down the road, we may see the USD gaining as the market may be forced to reposition its expectations, while a more dovish outlook could weigh on the USD. Fundamental issues like how the tariffs on US imports will be affecting the economy, especially inflationary pressures, a tighter than expected US employment market despite its cooling and a relative resilience of inflationary pressures tend to ease the pressure on the Fed to cut rates. On the flip side, US President Trump is leaning in adding pressure on the bank to lower rates. Also market worries about a possible recession in the US economy tend to add pressure on the bank to start considering cutting rates. The release is expected to have ripple effects beyond the FX market on US equities and gold’s price, with a more hawkish-oriented position possibly weighing on the prementioned trading instruments.

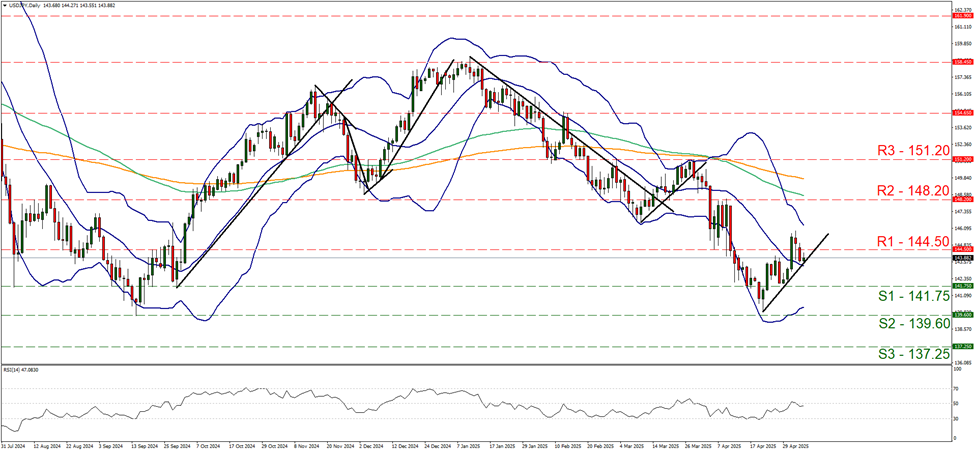

USD/JPY continued to weaken yesterday breaking the 144.50 (R1) support line, now turned to resistance. Yet in today’s Asian session, the price action bounced on the upward trendline guiding the pair since the 22nd of April. Should a new higher trough be formed, thus respecting the prementioned upward trendline the bullish outlook would remain, thus expecting a new higher peak. Thus for the bullish outlook to remain the pair’s price action has to break the 144.50 (R1) line clearly and start aiming for the 148.20 (R2) level. Yet the RSI indicator has dropped below the reading of 50, implying that the bullish sentiment has been erased and a possible bearish predisposition is emerging. Should the bears take over, we expect the pair’s price action to break the prementioned upward trendline clearly in a first signal of an interruption of the bullish movement and continue to break the 141.75 (S1) line, with the next possible target for the bears being set at the 139.60 (S2) barrier, a level that reversed the pair’s downward motion in the midst of September last year.

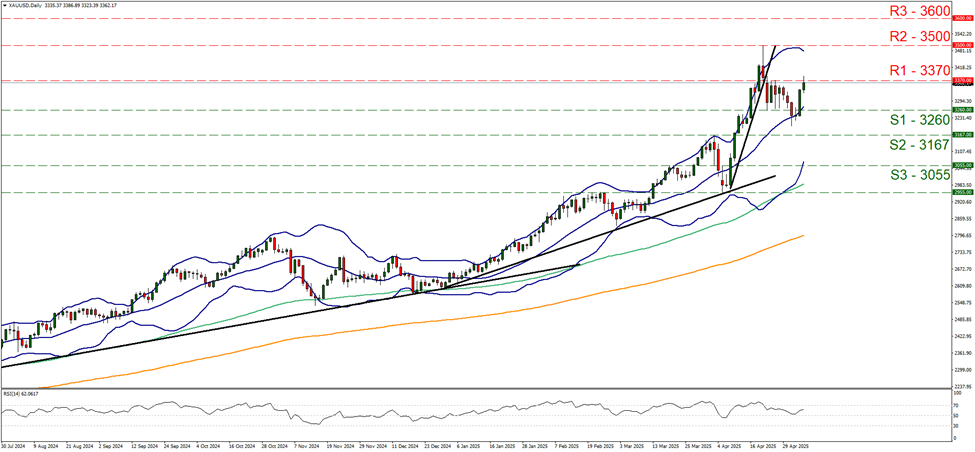

Gold’s price rose yesterday and during today’s Asian session, testing the 3370 (R1) resistance line, a level a level that provided resistance to gold’s price action on the 24th of April. The RSI indicator is on the rise implying an intensification of the bullish sentiment of the market for the precious metal. Yet for us to abandon our sideways movement bias and adopt a bullish outlook, we would require gold’s price to break clearly the 3370 (R1) resistance line and start aiming for the record high level of 3500 (R2). Should the bears take over we may see gold’s price dropping, breaking the 3260 (S1) support line clearly and start actively aiming if not breaching the 3167 (S2) support level.

その他の注目材料

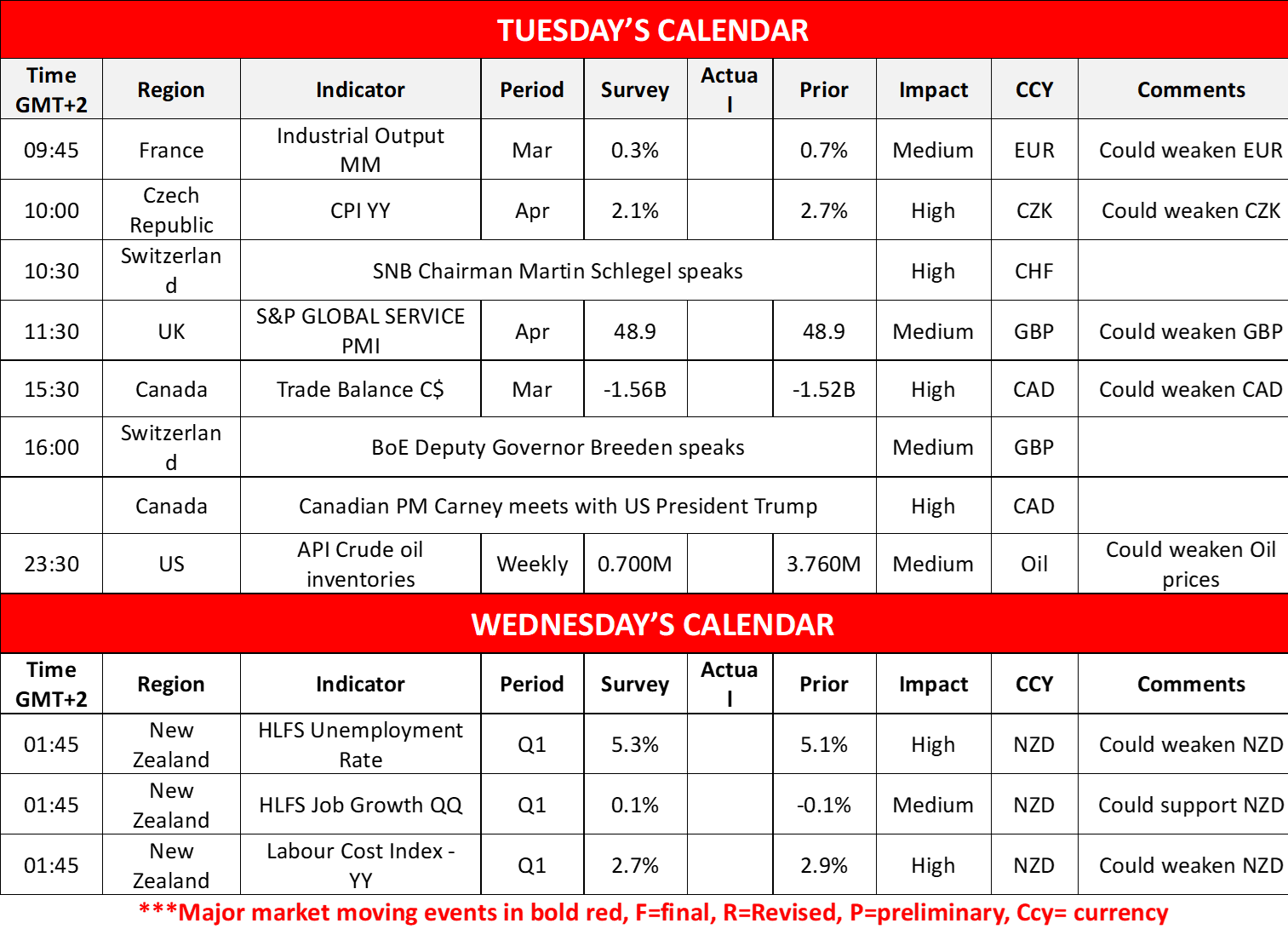

Today we get France’s industrial output for March, the Czech Republic’s CPI rates for April, Canada’s trade data for March, and later on from the US, the API weekly crude oil inventories figure. On a monetary level, we note the planned speeches of SNB Chairman Schlegel and BoE’s deputy Governor Breeden, while on a political level, we note the meeting between US President Trump and Canadian Prime Minister Carney. In tomorrow’s Asian session we get New Zealand’s employment data for Q1.

USD/JPY Daily Chart

- Support: 141.75 (S1), 139.60 (S2), 137.25 (S3)

- Resistance: 144.50 (R1), 148.20 (R2), 151.20 (R3)

XAU/USD Daily Chart

- Support: 3260 (S1), 3167 (S2), 3055 (S3)

- Resistance: 3370 (R1), 3500 (R2), 3600 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。