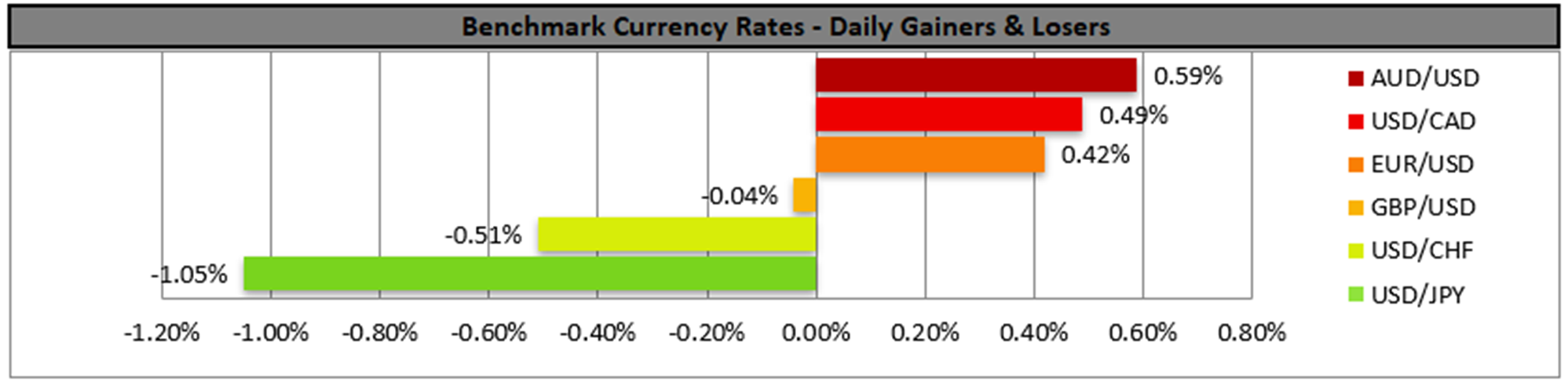

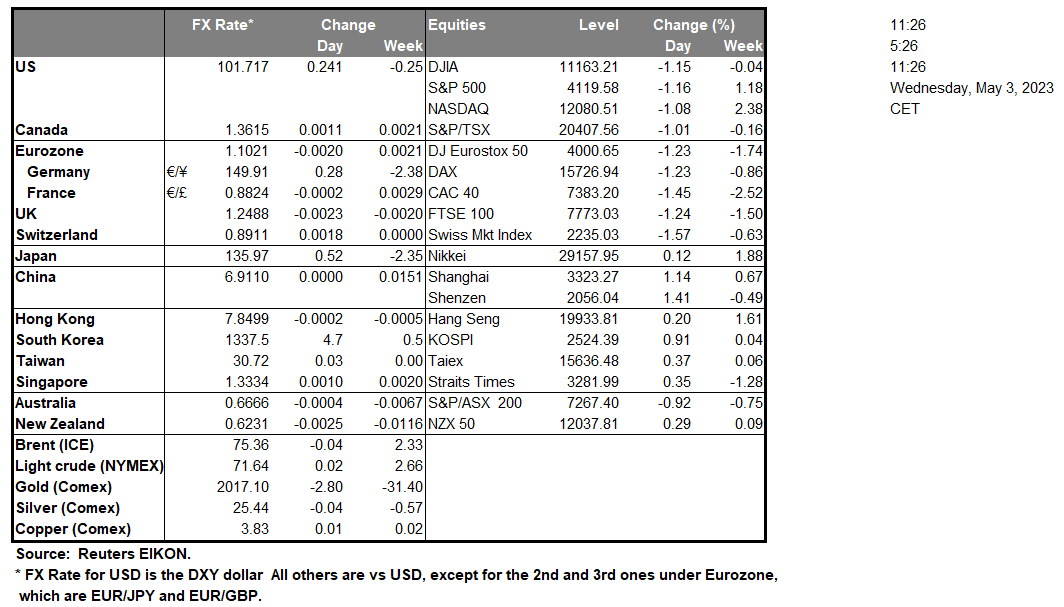

The USD tended to weaken against its counterparts yesterday, as the Fed’s meeting kicked off. The bank is to release its interest rate decision today and is expected to hike rates by 25 basis points raising them to the 5.00%-5.25% range. Characteristically Fed Fund Futures (FFF) tend to imply that currently, an 86.9% probability exists for such a scenario to materialize with the rest implying that the bank could remain on hold. Also please note that FFF tends to imply that the bank is to pause its rate hiking path after today’s meeting and may proceed with rate cuts from September onwards. For the time being, we expect the bank to hike rates as mentioned and if actually so, we may see market attention turning towards the accompanying statement. Should the bank maintain a hawkish tone implying that more hikes are possible and that it’s to maintain its tight monetary policy settings in place for a prolonged period of time, we may see the USD getting some support as market expectations for possible rate cuts within the year may be contradicted. On the other hand, should the accompanying statement actually be characterised by cautiousness and hesitation we may see the USD slipping as the market’s expectations for a pause in the Fed’s rate hiking path may solidify. Overall, we also note that gold’s price tended to maintain its negative correlation with the USD, yet its rise yesterday may have gotten a bit out of proportion as it broke the $2000 per ounce psychological threshold while on the flip side, US stock markets tended to drop expressing market expectations for a possible hawkish tone in the Fed’s decision. It should be noted that earnings reports of high-profile companies are also out, yet attention is expected to be mostly on the Fed’s intentions. Please note that oil prices dropped yesterday, with WTI dropping below $72 per barrel, despite API reporting another substantial drop of US oil reserves. Market worries for the possible adverse effects of another rate hike by the Fed on economic activity and consequently on oil demand levels, tended to spur oil bears. Overall we may see increased volatility erupting upon the release of the Fed’s interest rate decision, hence caution is advisable whilst trading at that time. Please note that volatility may be extended beyond the time of the release as Fed Chairman Powell is to deliver a press conference about half an hour later.

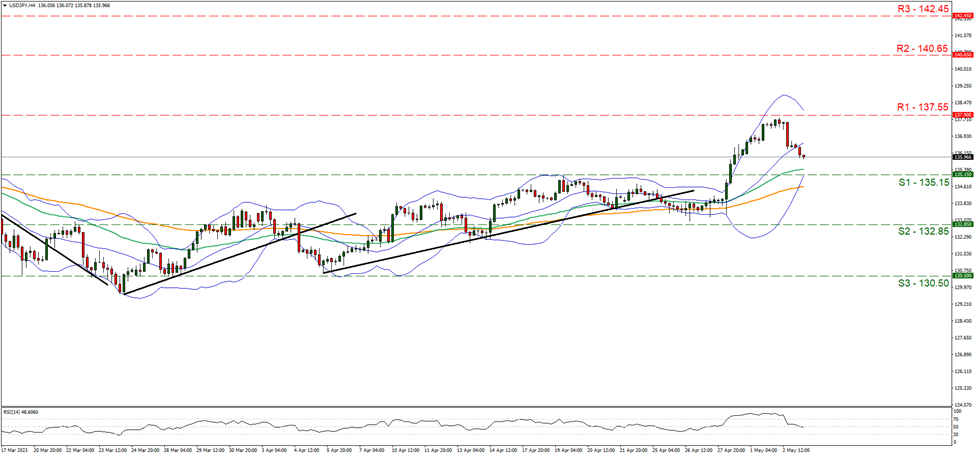

USD/JPY seems to have hit a ceiling on the 137.55 (R1) resistance line consolidating lower. Also, we note how the RSI indicator dropped to the reading of 50 reflecting the easing of the bullish sentiment in the market. Overall we expect the Fed’s interest rate decision is to define the direction of the pair. Should the bulls maintain control over the pair, we may see USD/JPY breaking the 137.55 (R1) resistance line, which would open the gates for the 140.65 (R2) resistance level. Should a selling interest be expressed by the market, we may see USD/JPY reversing course, breaching the 135.15 (S1) support line and taking aim for the 132.85 (S2) support level.

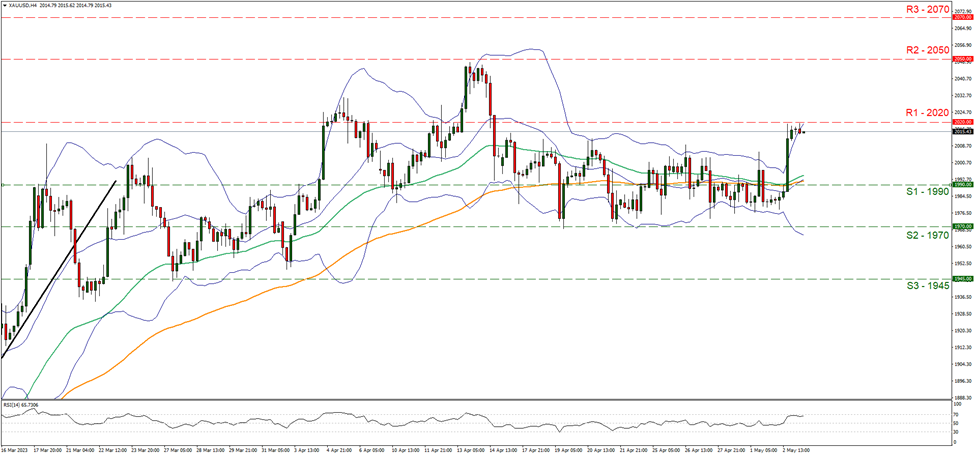

XAU/USD jumped yesterday breaking clearly the 1990 (S1) resistance line, now turned to support and reached the 2020 (R1) resistance level. We tend to maintain a bullish outlook for the precious metal’s price, given that the RSI indicator remains just below the reading of 70 implying a rather bullish sentiment on behalf of the market, yet we also expect the Fed ‘s interest rate decision to a key if not the main catalyst behind the course of gold’s price. Should the bulls be in charge of gold’s price direction, we may see it breaking the 2020 (R1) resistance line and aim for the 2050 (R2) resistance level. Should the bears take over, we may see the bullion reversing course, breaking the 1990 (S1) support line and aim for the 1970 (S2) support level.

その他の注目材料

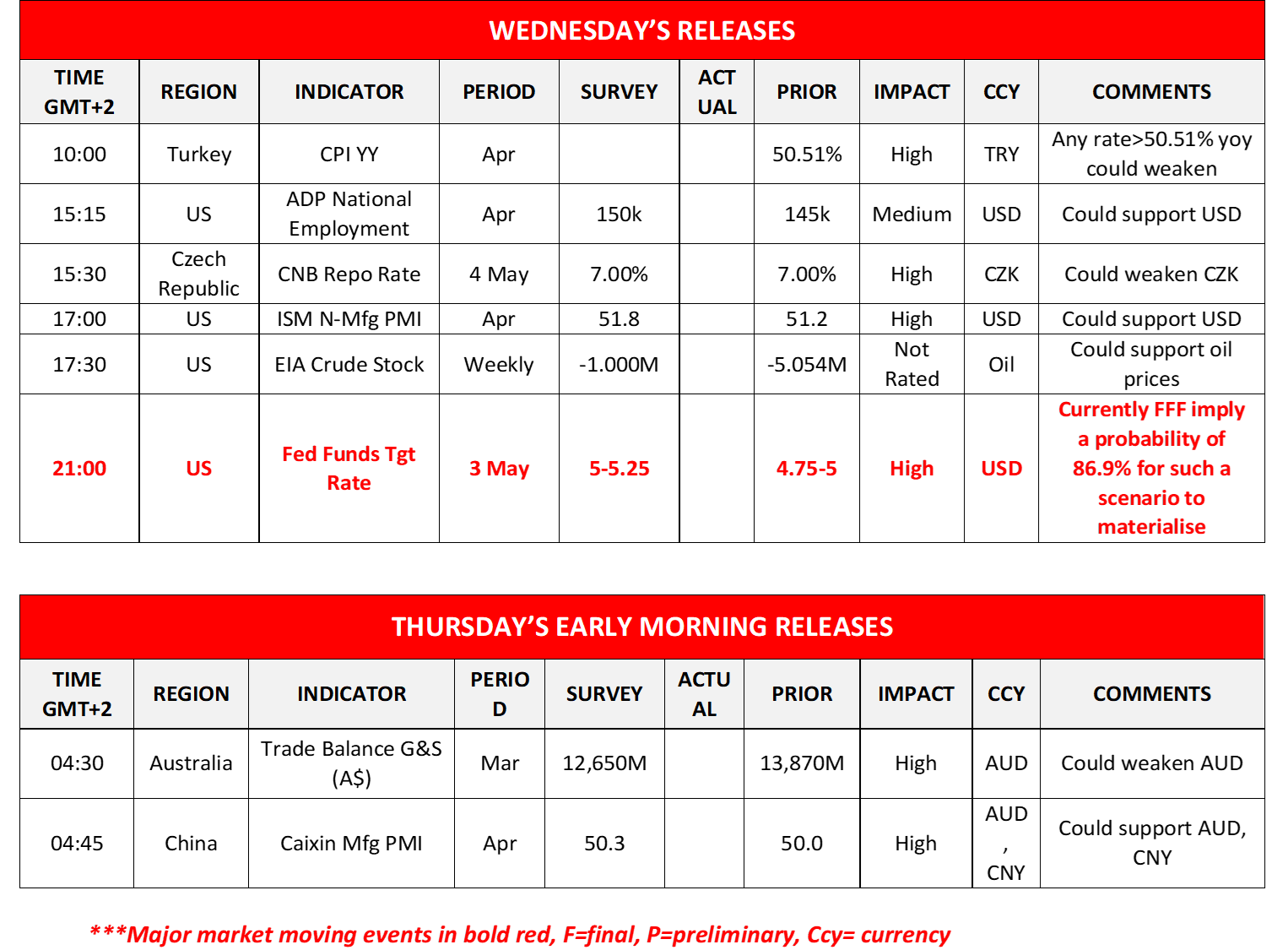

During today’s European session, we note the release of Turkey’s CPI rates for April and on the monetary front, we note the release from the Czech Republic of CNB’s interest rate decision. In the American session besides the Fed’s interest rate decision, we note the release of the US ADP national employment figure for April and the ISM non-manufacturing PMI figure for April, while oil traders may be more interested in the release of the weekly EIA crude oil inventories figure. During tomorrow’s Asian session, we note the release of Australia’s trade data for March and China’s Caixin manufacturing PMI figure for April.

USD/JPY 4時間チャート

Support: 135.15 (S1), 132.85 (S2), 130.50 (S3)

Resistance: 137.55 (R1), 140.65 (R2), 142.45 (R3)

XAU/USD 4時間チャート

Support: 1990 (S1), 1970 (S2), 1945 (S3)

Resistance: 2020 (R1), 2050 (R2), 2070 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。