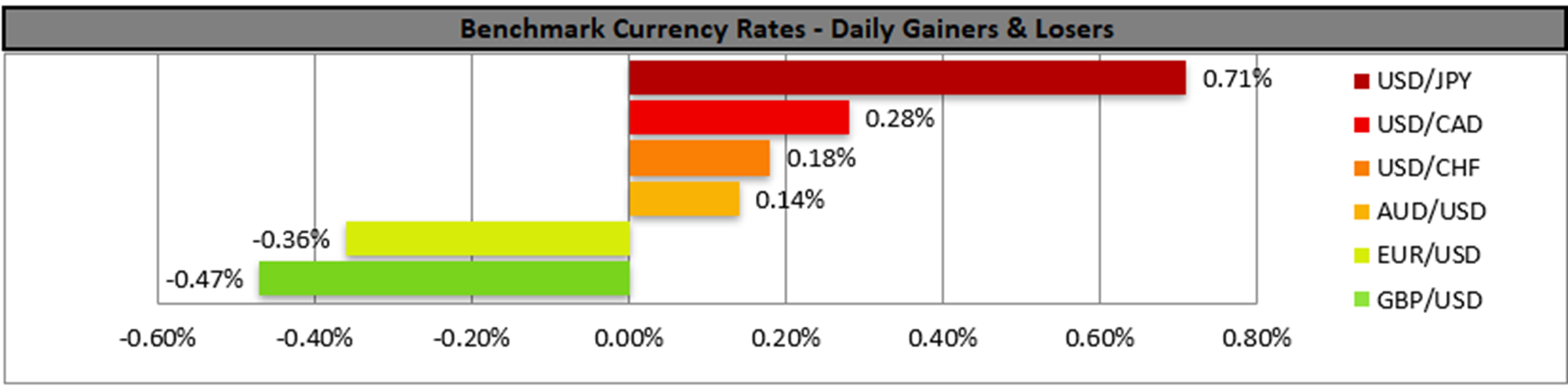

The USD continued to gain against its counterparts yesterday as the trade turmoil continues. Letters are being sent out to various countries officially announcing the tariffs that are to be imposed on their products entering the US. It’s characteristic that US President Trump announced that there would no extensions to the new August 1st deadline set on Monday, for new trade deals to be negotiated. On other news in addition to the 25% tariffs on Japan and mentioned in yesterday’s report, the US President also stated that he would impose a 50% tariff on copper. It seems that the Europeans are nearing a possible deal with Reuters sources citing even the possibility of exemptions from the US blanket tariff of 10%, which in turn may provide some support for the EUR.

On the flip side, Japan’s trade relationships with the US seem to be problematic as the land of the rising sun seems to be still a way off from securing a trade deal with the US. The issue tends to create turmoil also on the Japanese political scene, with key upper house elections coming up on the 20th of July and threatening the stability of the incumbent Japanese Government as the popularity of PM Ishiba’s government seems to be slipping in polls. Should we see further tensions in the US-Japanese trade relationships, we may see the issue weighing on JPY and vice versa.

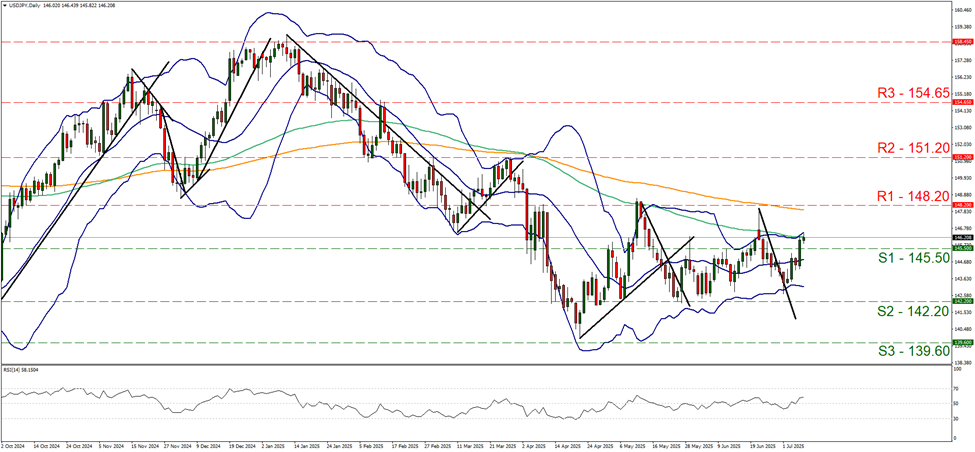

USD/JPY continued to be on the rise, aiming for the 148.20 (R1) resistance line. Given that the pair’s price action on Monday broke the 145.50 (S1) resistance line, now turned to support and that the RSI indicator is above the reading of 50 and rising we tend to maintain a bullish outlook for the pair. At the same time though we also note that the pair’s -price action has reached the upper Bollinger band and which may slow down the bulls or even cause a correction lower. Should the bulls maintain control we may see USD/JPY breaking the 148.20 (R1) resistance line and open the gates for the 151.20 (R2) resistance base. Should the bears take over, we may see USD/JPY reversing course, breaking the 145.50 (S1) support line and start actively aiming for the 142.20 (S2) support level.

On a monetary level, we highlight the release of the Fed’s last meeting minutes in today’s late American session. The market has since the release of the June employment data eased on its dovishness and the number of expected rate cuts until the end of the year has been reduced to two, as per Fed Fund Futures. The document is to be scrutinized by market participants and should it highlight Fed policymakers’ doubts for extensive easing of the bank’s monetary policy, we may see the USD getting some support and weighing on gold prices and equities, as it may force the market to ease further its dovish expectations.

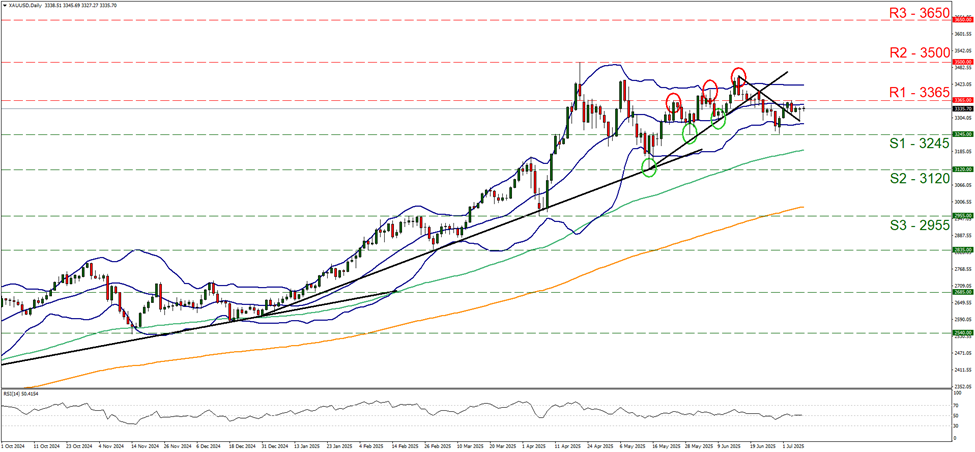

Gold’s price edged lower yesterday yet remained well within the boundaries set by the 3365 (R1) resistance lien and the 3245 (S1) support level. We maintain a bias for a sideways motion of the pair between the prementioned levels, yet at he same time we also note that the RSI indicator has been dropping which may imply the build up of a bearish sentiment among market participants for the precious metal. Yet for the bearish outlook to emerge, we would require the gold’s price to break clearly the 3245 (S1) support line and start aiming for the 3120 (S2) support level. For a bullish outlook to be adopted gold’s price would have to break the 3365 (R1) resistance line and continue higher aiming for the 3500 (R2) resistance level.

その他の注目材料

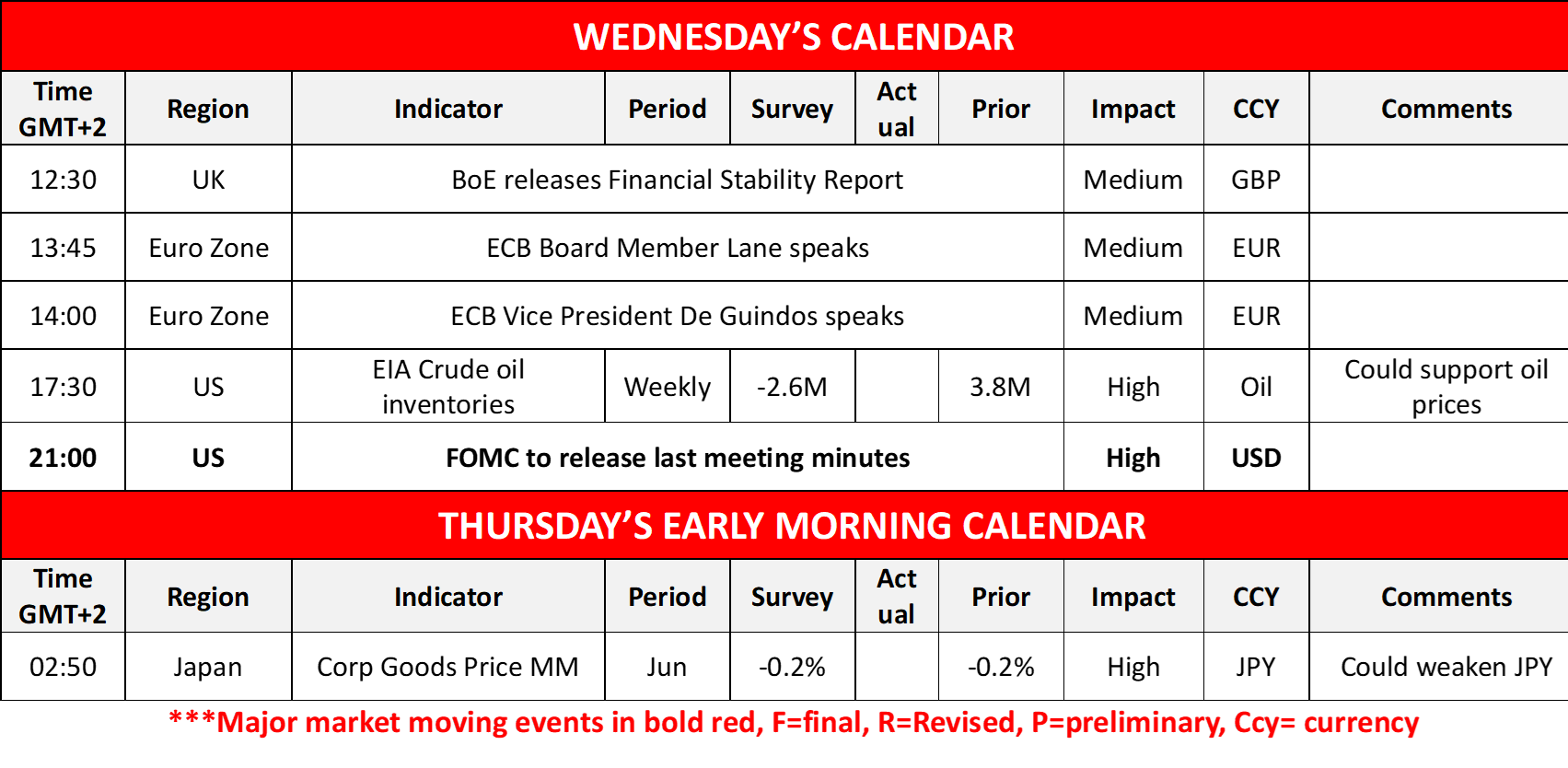

Today besides the release of the Fed’s last meeting minutes, we also note that BoE is to release its Financial Stability Report, while ECB’s Lane and De Guindos are scheduled to speak. Oil traders may be more interested in the release of the weekly EIA crude oil inventories figure. In tomorrow’s Asian session, we get Japan’s Corporate Goods Prices for June.

USD/JPY Daily Chart

- Support: 145.50 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 148.20 (R1), 151.20 (R2), 154.65 (R3)

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。