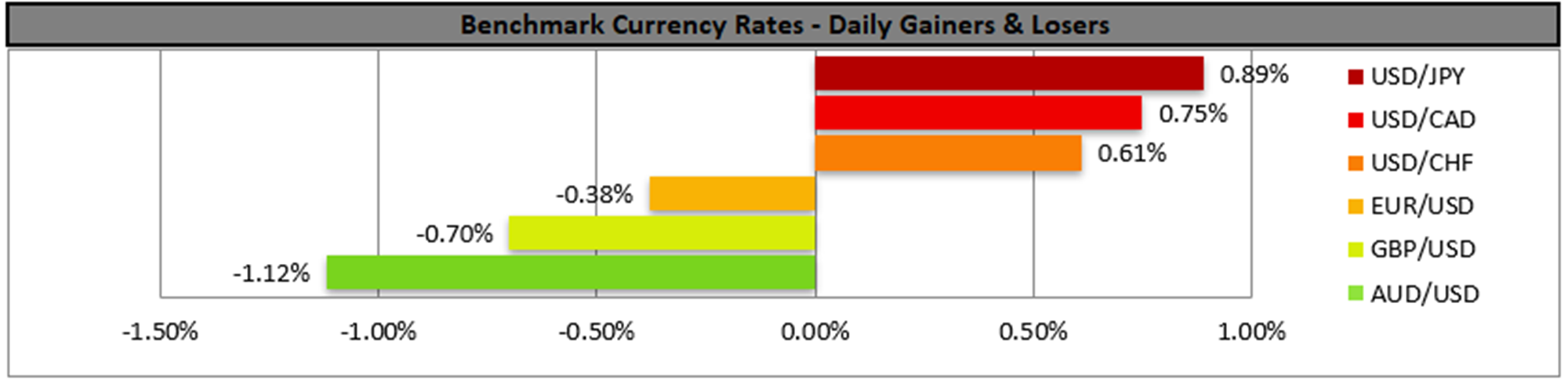

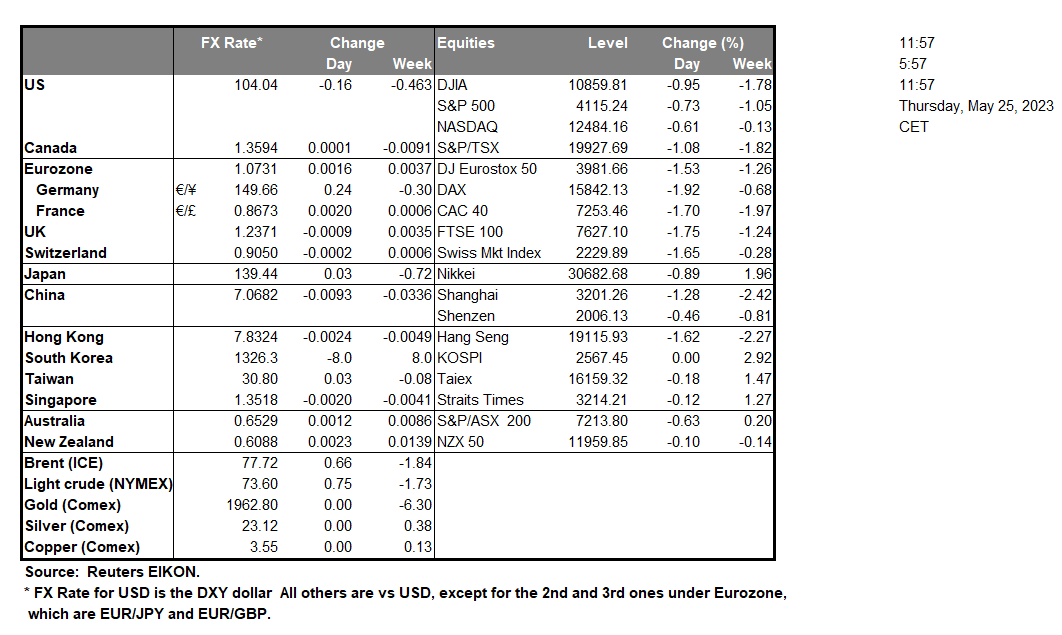

The USD tended to gain probably on safe haven inflows as the market worries for a possible default of the US government on its debt seemed to intensify. It should be noted that Republican lawmakers are to leave for a long weekend today, which lowers the chances for an agreement between the White House and House of Representatives in the next few days. Nevertheless, House Speaker McCarthy stated that he could get a deal on raising the Debt ceiling “in principle” by this weekend. The issue continues to tantalise the markets and should market worries intensify further, we may see the USD enjoying more safe haven inflows, while riskier assets such as US equities may extend their losses and vice versa. Please note that the ongoing negotiations and the lack of common ground, caused Fitch to place the “AAA” rating watch negative.

On the monetary front we note that the Fed’s meeting minutes revealed that Fed policymakers tended to lean less towards the hawkish side as they seemed to align in that future rate hikes are becoming less likely intensifying market sentiment for a possible pause of the rate hiking path. The release tended to weaken the USD, yet the market’s insecurities about a possible default quickly reversed any losses.

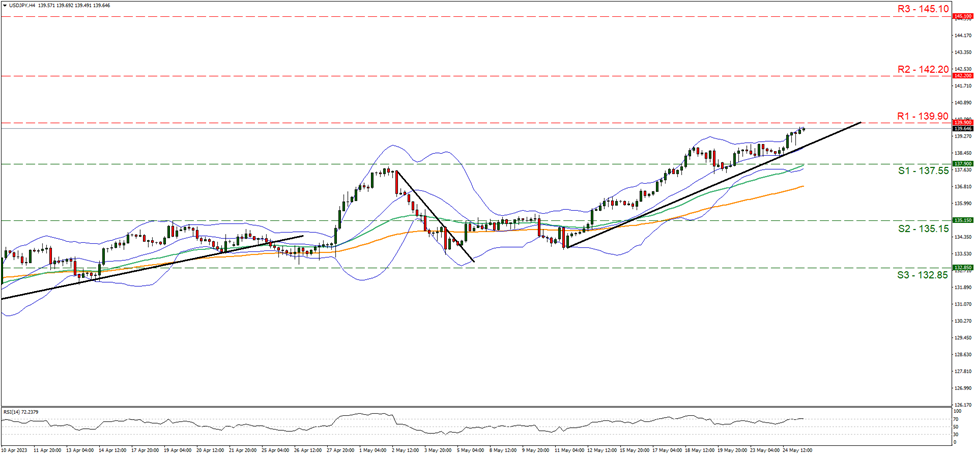

USD/JPY continued to rise yesterday approaching the 139.90 (R1) resistance line. We maintain a bullish outlook for the pair as long as the price action remains above the upwards trendline incepted since the 11 of May. Please note that the RSI indicator has reached the reading of 70, highlighting the bullish sentiment of the market currently for the pair, yet may also imply that the pair is nearing overbought levels and may be ripe for a correction lower. Should the bulls maintain control over USD/JPY we may see the pair breaking the 139.90 (R1) resistance line clearly with the next possible stop for the bulls being placed on the 142.20 (R2) resistance level. Should the bears take over, we may see the pair, reversing course, breaking the prementioned upward trendline in a first sign of a trend reversal and aim if not break the 137.55 (S1) line.

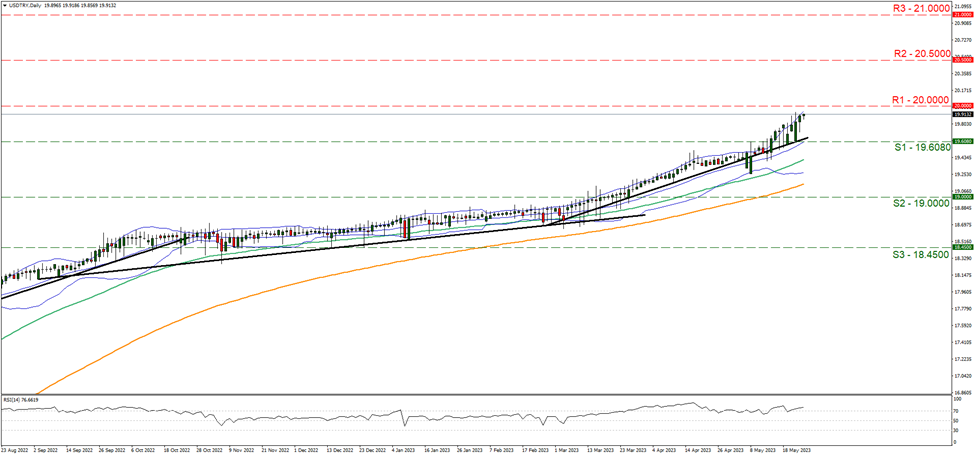

Last but not least we would like to note the release of Turkey’s CBT interest rate decision and the bank is expected to remain on hold with the weekly repo rate at 8.5%. It should be noted that inflation in Turkey continues to run at high levels, currently at 43% yoy and the unorthodox practice of Turkish President Erdogan who has a firm grip over the central bank, to keep interest rates low, tends to weigh on the TRY which has reached a new all-time low against the USD in recent days.

USD/TRY continued its upward movement nearing the 20.0000 (R1) line. We maintain our bullish outlook for the pair given the upward trendline characterising the pair’s price action. The RSI indicator has surpassed the reading of 70 and underscores the bullish prospects of the pair, yet also highlights the risk that the pair is at overbought levels and may be correcting lower anytime soon. Should buyers retain control the pair comes into uncharted waters and we may see its price action breaking the 20.0000 (R1) resistance line and start aiming for the 20.5000 (R2) level. Should a selling interest be expressed by the market, we may see the pair reversing course breaking the prementioned upward trendline and aim for the 19.6080 (S1) support line.

その他の注目材料

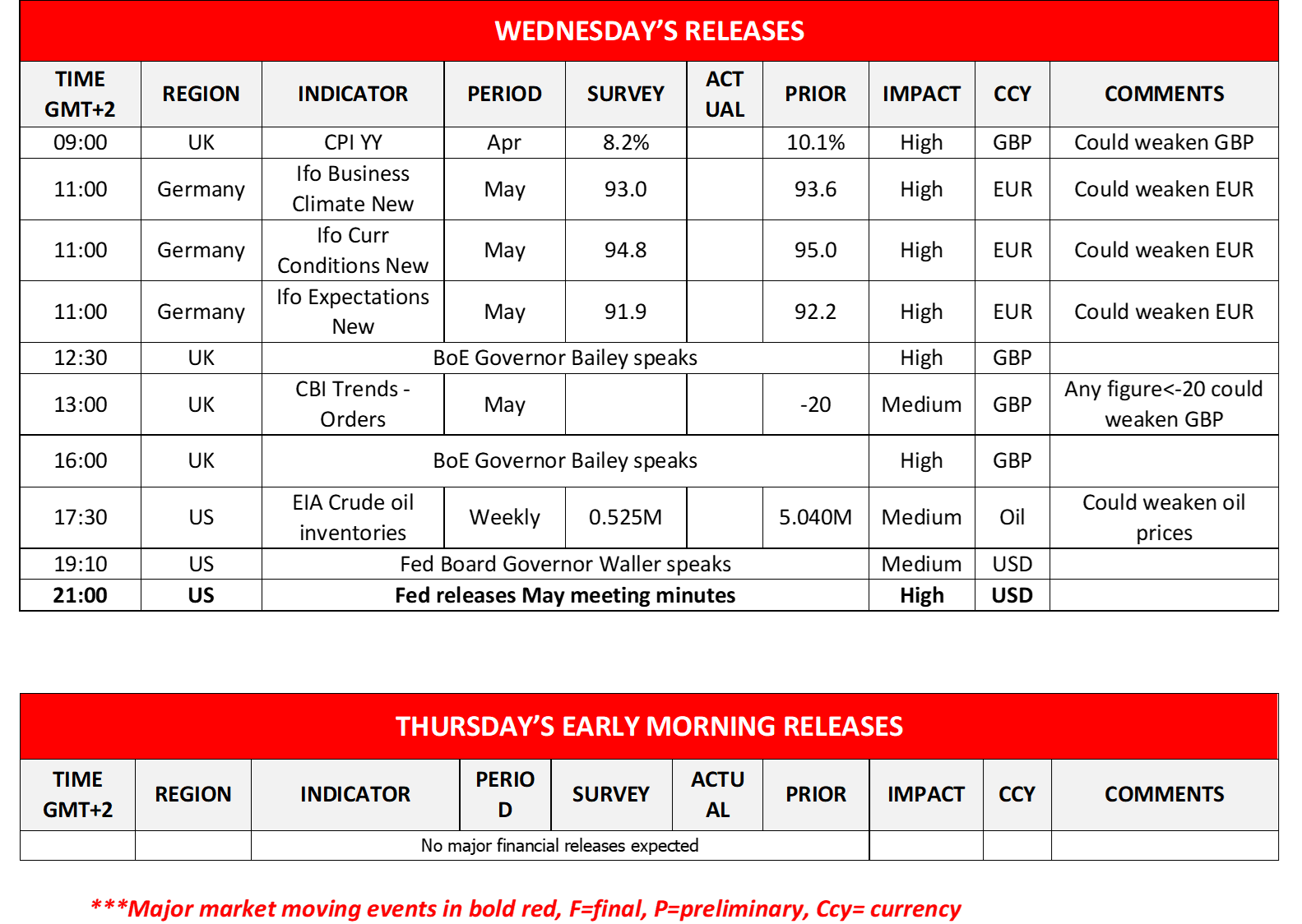

Today in the European session, we note the release of Sweden’s Unemployment rate for April, Germany’s GFK Consumer sentiment and France’s Business Climate figures for June and May respectively. During the American session, we note the release of Canada’s Business barometer figure for May, the US Weekly Jobless claims figure and the US 2nd GDP Estimate rate for Q1. During tomorrow’s Asian session, we highlight Japan’s Tokyo CPI rate for May and Australia’s Final Retail sales for April. On the monetary front, we note ECB Vice President De Guindo is due to speak, followed by Bundesbank Chief Nagel and later on in the day we note Richmond Fed President Barkin and Boston Fed President Collins who are due to speak.

USD/JPY 4時間チャート

Support: 137.55 (S1), 135.15 (S2), 132.85 (S3)

Resistance: 139.90 (R1), 142.20 (R2), 145.10 (R3)

USD/TRY Daily Chart

Support: 19.6080 (S1),19.0000 (S2), 19.4500 (S3)

Resistance: 20.0000 (R1), 19.0000 (R2), 18.4500 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。