Gold moved lower since last week, as media outlets reported that there was a productive meeting amongst legislative leaders in regards to raising the debt ceiling. Furthermore, fading banking fears have slightly reduced market volatility, and at the time of this report, it appears that the shiny metal is moving in a downwards fashion. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

Will the US default on it’s debt?

Talks of the US potentially defaulting on its debt have spooked investors, as the very real ‘X-Date’ is nearing its maturity. Such a scenario, which was previously unheard of, has now slowly gained traction as market traders who had previously anticipated that a deal would be struck on the 11th hour, now fear that the two sides have reached a stalemate, hence increasing market worries of a US default. The ‘X-Date’ was first announced by US Treasury Secretary Yellen, who stated that the “Treasury will likely no longer be able to satisfy all of the government’s obligations, if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1st”. In addition, should the US fail to uphold its financial obligations, it would have immediate and near catastrophic implications for the economy, as this failure would most likely lead to the US being downgraded by credit rating agencies, leading to a mass sell-off of US debt, followed by a potential crash of US stock markets, as the pre-existing market volatility could trigger further bank runs, undermining the stability of the entire financial industry. Furthermore, the US defaulting on its debt would most likely result to an instant increase in the unemployment rate, possibly followed by a reignition of inflationary pressures, should in the aftermath the Federal Reserve chooses to step in and rectify the situation by kickstarting another QE campaign. Overall, the longer it takes legislative leaders to reach a consensus, the volatility level in the markets will be exacerbated, which may lead to the bullion gaining safe haven inflows, as it is considered to be a store of value in times of financial uncertainty, as the US nears the ‘X-Date’.

Newmont and Newcrest Merger, nearing the finish line

Newcrest announced on Monday that it would back Newmont’s $17.8 billion takeover offer, a revision from a Reuters report that surfaced back in April, which stated that the offer was rumored to be valued at $19.5 billion. As was previously stated in our 11 of April report, should the merger be approved by shareholders and pass the necessary regulatory hurdles, Newmont would be in control of approximately, 8.9% of the world’s global gold supply. As a result, Newmont’s gold output would be nearly double of that of its closest rival, namely Barrick Gold Corp, thus potentially supporting the precious metal’s price as the global gold supply becomes more centralized, which may reduce supply volatility in the market.

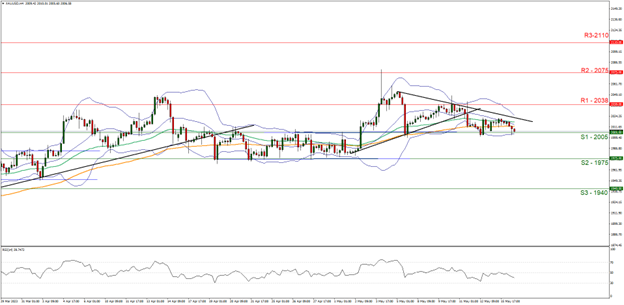

テクニカル分析

XAUUSD 4時間チャート

- Support: 2005 (S1), 1975 (S2), 1940 (S3)

- Resistance: 2038 (R1), 2075 (R2), 2110 (R3)

Gold’s price seems to continue in an downwards fashion, and is currently testing support at 2005 (S1). We tend to maintain a bearish outlook for the bullion, and supporting our case is the RSI indicator below our 4hour-chart failing to break above the reading of 50 and at the time of this report appears to be edging to the 30 figure, indicative of a bearish sentiment in the market. For our bearish outlook to continue we would like to see a clear break below the 1975 (S2) support level and a move towards the 1940 (S3) support line. On the other hand, should the bulls take over, we may see a break above resistance at the 2038 (R1) line, with the next potential target for the bulls being the 2075 (R2) resistance barrier. Please note that should fears for a US default persist and should US lawmakers fail to make progress, we may see gold printing new all-time highs.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.