ゴールド price extended its advance to higher ground this week, hitting fresh 9-month highs as the dollar remains downbeat. Less hawkish comments from FOMC policymakers signalling that the central bank will most likely downshift to a 25-basis point rate hike in the February meeting, put a floor under the gold’s price and contributed to its ascent to higher ground. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

Incoming data crucial for the bullion’s outlook

Later this week, a wide array of key US economic data is anticipated by investors which could determine whether the greenback rebounds from its 8-month lows または continue its journey south. Today, traders will be paying attention to the release of the preliminary US manufacturing PMI figure for January and according to estimates the figure is expected to contract further from the 46.2 level, recorded in the prior month, to the 46.0 level. Should that be the case we may see the USD relenting more ground and gold to find extra support. On Thursday, the market’s attention is expected to shift towards the crucial preliminary quarter-on-quarter GDP estimate for Q4, and according to forecasts, the rate is expected to ease to 2.6%, when compared to the previous quarter’s 3.2% rate. Should the actual rate meet the expectations, that would imply that the domestic growth of the US is decelerating, showcasing that the cumulative effect of the Fed’s tightening efforts has started to impact adversely the US economy. That as a result, may put extra pressure on the dollar, while on the flip side, gold could experience more inflows. On the contrary, durable goods orders for December are expected to record a rebound from their recent slump, rising from -2.1% to 2.5% according to forecasts, and may dampen the negative effect of the GDP results. The uptick in US consumer spending could be attributed to the seasonality effect observed during the festivities season. Lastly, on Friday the Fed’s favourite metric for keeping track of the inflationary problem, the core PCE index, is according to estimates expected to ease to 4.4%, down from 4.7% and should that be the case, we may see the USD face headwinds, as the result would practically reaffirm that inflationary pressures within the US economy are abating, mirroring the CPI results reported earlier in January. Should the actual figure meet the expectation that would incentivize the Fed to opt for a smaller, 25 basis points rate hike, in its February meeting next week? Hence, due to the negative correlation between the greenback and the precious, we would therefore expect to see the bullion being positively predisposed for further upside, since the prospect of smaller rate hikes, polishes the shiny metal’s appeal.

FOMC policymakers signal downshift

Recently, speakers from the Federal Open Market Committee took the stand on multiple occasions and expressed their views and opinions at how they see the central bank going forward. The committee will convene on the 1 of February and decide the magnitude of its interest rate hike, taking into consideration the most recent economic developments alongside the latest incoming data. Overall, comments from various speakers seem to favour a less hawkish, smaller than originally forecasted rate increase, while others stick to their guns and continue to reiterate the need for a more aggressive, head-on approach. On Friday, Fed Governor Waller stated that he favours a 25 basis points rate hike in the February meeting, as inflation data cooled further in December, but the policymaker underlined that there is more work to do to get rates at a sufficiently restrictive level. On the flip side, St Louis Fed President Bullard stated last week that, even though the central bank has made good progress, it must push forth with 50 basis points and then some, in order to bring rates above the 5.1% median target, obstructing inflationary pressures from becoming deeply entrenched within the economy. Currently, the market foresees that the Fed will indeed proceed with a less hawkish, 25 basis points hike in the upcoming meeting, and should that be the case we may see the odds for an extension of the bullion’s rally increase.

テクニカル分析

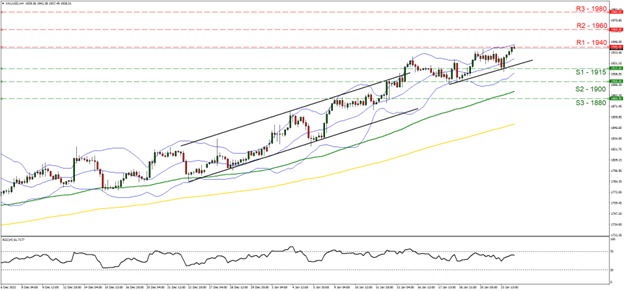

XAUUSD 4時間チャート

- Support: 1915 (S1), 1900 (S2), 1880 (S3)

- Resistance: 1920 (R1), 1940 (R2), 1960 (R3)

Looking at XAUUSD 4-hour chart we observe gold extending is upward move this week, hitting fresh highs and today is currently attempting to break above the $1940 (R1) resistance barrier. We maintain our bullish outlook bias for the precious and supporting our case is the RSI indicator below our 4-hour chart which currently registers a value of 61, showcasing that the sentiment is still in favor of the bulls. The price action trading near the midline of the Bollinger bands may imply that the precious consolidates and attempts to form a higher low, which could facilitate its next move north should the bulls maintain their superiority. Should the bulls continue to drive the price action higher, we may see the break above the 1940 (R1) resistance level and the possible challenge of the 1960 (R2) resistance barrier. Should on the other hand the bears take the initiative, we may see the break below the 1915 (S1) support level and the move closer to the 1900 (S2) support base.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.