ゴールド continues moving lower, as progress appears to have been made in prevented the US from defaulting on its debt, with traders awaiting the FOMC May meeting minutes tomorrow and the Core PCE rates on Friday. Furthermore, at the time of this report, it appears that the shiny metal is moving in a downwards fashion. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

US debt talks in the spotlight.

US Financial releases could swing the markets in either direction.

One may be excused for forgetting that during tomorrow’s American session, the FOMC’s last meeting minutes are due to be released. Therefore, given the recent dovish rhetoric from Fed Chair Powell stating that the Fed’s “policy rate may not need to rise as much as it would have otherwise to achieve our goals”, could imply that the Fed may be nearing its peak rate or may consider keeping interest rates at current levels. Hence, given the slightly dovish comments from Fed policymakers, whose comments may be attempting to prepare the markets ahead of release of the meeting minutes, may indicate that there is growing pressure towards the Fed, to pause rates sooner rather than later. Furthermore, in combination with the core PCE rates on Friday, which are expected to decrease, we may see the precious gaining on the back of a weaker dollar, potentially bringing the bullion back above the $2000 key psychological level. On the other hand, should the FOMC minutes take a more hawkish tone with the indication of prolonged rate hikes, in addition to the PCE rates coming in higher than expected, we may see the precious loosing further ground in its battle against a stronger dollar.

テクニカル分析

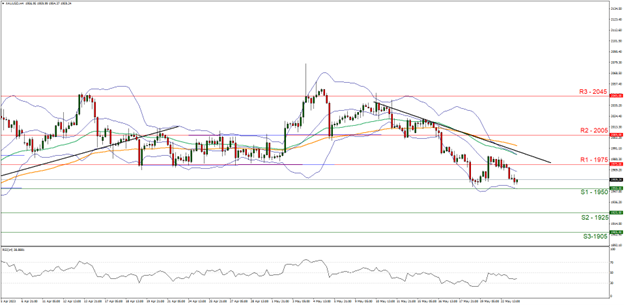

XAUUSD 4時間チャート

- Support: 1950 (S1), 1925 (S2), 1905 (S3)

- Resistance: 1975 (R1), 2005 (R2), 2045 (R3)

Gold’s price seems to move in a downwards fashion, having broken below its prior support which has now turned resistance at 1975 (R1). We maintain a bearish outlook for the bullion, with the RSI indicator below our 4 hour-chart failing to break above the reading of 50 on numerous occasions, indicative of a continued bearish sentiment surrounding the precious, as the US debt talks progress. For our bearish outlook to continue, we would like to see a clear break below the 1950 (S1) support level with the next target for the bears being the 1925 (S2) support base. On the other hand, for a bullish outlook, we would like to see a clear break above resistance at the 1975 (R1) line, with the next potential target for the bulls being the 2005 (R2) resistance barrier, which would also coincide with the break above the key $2000 psychological barrier. Please note that should the US debt talks break down or reach an agreement, we may see heightened market volatility within a short time period.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.