Gold’s price has moved higher since the start of trading on Monday. Today we are to have a look at it along with other fundamental issues affecting gold’s price and for a rounder view conclude the report with a technical analysis of gold’s daily chart.

US Sovereign credit rating gets downgraded

Moody’s on Friday downgraded the U.S. sovereign credit rating ,citing concerns over the nation’s growing $36 trillion debt pile. Moody’s stated on Friday that “Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs”. The announcement by Moody’s could have aided gold’s price initially, yet the announcement appears to have sent yields on Treasury bonds higher.

Thus, given that US bonds are interest-bearing whereas gold is not, investors may have re-allocated funds from gold to the bond market, which in turn may have weighed on gold’s price. However, should fears over the mounting US debt pile continue to increase, it may aid gold’s price in the future.

Ukraine-Russia peace deal in the works?

Overall, we note an easing of tensions on a geopolitical level tends to have a possible bearish effect on gold’s price. It’s characteristic that US President Trump announced yesterday that Russia and Ukraine will “immediately” begin negotiations on preparations for peace talks.

The announcement by Trump showcases that Russia and Ukraine appear to be willing to begin proceedings that could eventually bring an end to the war. In turn, the recent developments may ease geopolitical tensions in the continent and thus could weigh on gold’s price, which is considered to be a safe haven asset.

However, should the talks fail to proceed or break down with no meaningful progress being made, it could potentially aid the gold’s price. Nonetheless, in our view, the push by the US to bring both sides to the table may bear fruit in the future and thus could weigh on gold’s price.

Israel to take over the Gaza strip?

According to a report by Bloomberg, Israeli Prime Minister Netanyahu stated on Monday that Israel will take over the entire Gaza strip, following an announcement by the military that it would carry out an “unprecedented attack” on Hamas.

The announcement by the Israeli Prime Minister that Israel will take over the entire Gaza strip which could result in a significant displacement of the local population, may significantly escalate regional tensions between Israel and its neighbours. In turn, such a scenario could potentially aid the precious metal’s price.

Gold Technical Analysis

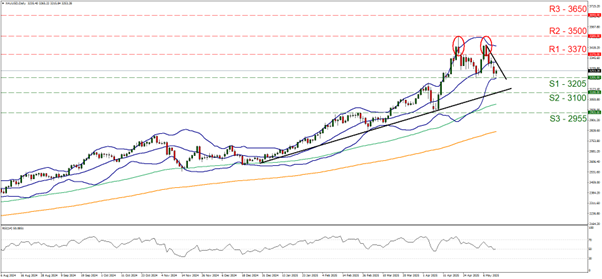

XAUUSD 4H Chart

- Support: 3115 (S1), 2980 (S2), 2830 (S3)

- Resistance: 3240 (R1), 3365 (R2), 3500 (R3)

Since our last report gold’s price appears to have moved lower, with the commodity’s price currently testing our 3240 (R1) resistance line once again. The precious metal’s price appears to be moving in a relatively sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. Y

et the MACD indicator below our chart tends to showcase bearish implications. Nonetheless, for our sideways bias to be maintained we would require gold’s price to remain between our 3115 (S1) support level and the 3240 (R1) resistance line.

On the other hand, for a bullish outlook we would require a clear break above our 3240 (R1) resistance line, with the next possible target for the bulls being the 3365 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 3115 (S1) support line with the next possible for the bears being the 2980 (S2) support level.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked in this communication.