Gold’s price moved in a downwards fashion over the past week. Today we are to discuss the fundamental challenges laid ahead for the precious metal as well as upcoming financial releases that may affect the direction of its price action. Finally, we will be concluding this report with a technical analysis of gold’s daily chart.

FOMC Interest rate decision

利 Fed’s interest rate decision is set to occur during tomorrow’s American session. The current expectations by market participants are for the bank to remain on hold, with Fed Fund Futures currently implying a 99% probability for such a scenario to occur. Therefore, our attention now turns to the bank’s , in addition to the post-decision press conference by Fed Chair Powell.

In the event that Fed policymakers appear to be predominantly hawkish in nature, i.e implying that interest rates may need to remain higher for longer, and thus pushing back against the market’s current expectations of a rate cut in the bank’s November meeting, it could provide support for the greenback whilst weighing on the precious metal’s price and vice versa.

On another note, the Fed’s revised dot plot is set to be released alongside the Fed’s interest rate decision. The dot plot is essentially the forecasts made by Fed policymakers for where they believe interest rates will be further down the line. Therefore, should the dot plot be revised higher i.e implying interest rates remaining higher for longer and thus fewer expected rate cuts in the near future, it could support the dollar whilst weighing on the precious metal’s price and vice versa.

US Financial releases

The release of the US Employment data for May tended to highlight the resilience of the US labour market. It was characteristic that the NFP figure vastly exceeded expectations by coming in at 272k versus the expected figure of 182k, implying a resilient labour market. Hence following the release, we saw the USD getting support, whilst gold’s price moved lower. As a reminder, the implication of a tight US employment market could allow the Fed to maintain rates high for longer, which in turn may weigh on gold’s price given their inverse relationship with one another.

Yet, we would also like to note that the unemployment rate for May, which ticked upwards by coming in at 4.0% versus the previous rate of 3.9%, insinuating that the US labour market may not be as resilient, as was inferred by the NFP figure. Nonetheless, market participants appear to have glossed over the 0.1% uptick in the unemployment rate and may have focused predominantly on the unexpected surge in the NFP figure.

The next hurdle for bullion traders may be the release of the US CPI rates for May, which are expected by economists to showcase persistent inflationary pressures in the US economy. In particular, the headline CPI rate on a yoy level is expected to come in at 3.4%, which would be identical to the prior rate. Yet the Core CPI rate on a yoy level is expected to showcase easing inflationary pressures, with economists anticipating the rate to come in at 3.5%, which would be lower than the prior rate of 3.6%.

Nonetheless, we would place a greater degree of emphasis on the headline CPI rate, as it may increase pressure on the Fed to maintain interest rates at their current levels for a prolonged period of time, in order to combat inflationary pressures in the US economy. Such a scenario could provide support for the dollar whilst weighing on the bullion’s price.

China eases on its gold buying spree

According to a report by Bloomberg, data which was released on Friday, showcased that China’s Central Bank did not buy any gold during the month of May, ending an 18th-month buying streak which began in November 2022. The announcement following its release tended to weigh on the bullion’s price, as China was considered to be one of the key driving factors behind the gold rally in the past year.

As such, should the PBOC ‘s demand for the bullion remain relatively muted, it could further weigh on the precious metal’s price down the line. Yet, in our view, we believe the PBOC may be waiting for a more optimal opportunity to resume its gold buying spree, although that remains to be seen.

テクニカル分析

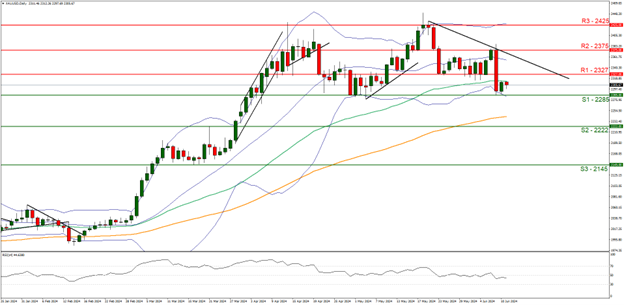

XAUUSD Daily Chart

- Support: 2285 (S1), 2222 (S2), 2145 (S3)

- Resistance: 2327 (R1), 2375 (R2), 2425 (R3)

On a technical level, gold’s price appears to have moved in a downwards fashion over the past week. We opt for a bearish outlook for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 40, implying a bearish market sentiment. Furthermore, we would like to note the downwards-moving trendline which was incepted on the 21 of May.

For our bearish outlook to continue, we would require the precious metal to make a clear break below the 2285 (S1) support level, with the next possible target for the bears being the 2222 (S2) support line.

On the flip side, for a bullish outlook, we would require a clear break above the 2327 (R1) resistance line, with the next possible target for the bulls being the 2375 (R2) resistance level. Lastly, for a sideways bias we would require the commodity to remain confined within the 2285 (S1) support line and the 2327 (R1) resistance level.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked in this communication.