Gold at the time of this report, seems to be moving in an upwards fashion ,compared to last week’s report on gold. The precious metals temporarily breaking above the $2000 key psychological level. We note the high volatility in the gold market, as tensions in the Middle East appear to persist and the Fed’s interest rate decision is due out this Wednesday. In this report, we aim to shed light on the catalysts driving gold’s price, assess its future outlook and conclude with a technical analysis.

Gold Analysis Report

Tensions in the Middle East continue to be at the epicenter.

Over the weekend, regional tensions in the Middle East appear to have eased slightly, as the potential risk of a wider regional conflict appears to have decreased. This appears to have been slightly reflected in the precious metal’s market, once trading commenced for the week, with the precious moving slightly lower. However, the potential risk of a wider escalation of hostilities in the region still remains high and as such, despite the apparent easing of pressures on the precious metal, it could change at any moment. The elevated volatility levels could maintain the precious metal’s ascent or may mitigate potential bearish tendencies in the market and considering the delicate nature of the conflict in Israel, we may see the precious maintaining some support until the conflict ends.

Furthermore, give the precious metal’s safe haven status, it may receive safe haven inflows in the event that the situation escalates and spreads into the region, with multiple actors getting involved in the conflict. Lastly, we would like to highlight that should the conflict be resolved, we may see the precious metal weakening, as the market volatility returns to normal. Yet, we maintain our view that the aforementioned scenario does not appear to be the case for now.

In conclusion, the elevated risks of a regional conflict may provide support to the precious metal, but for now it appears that the lack of a wider escalation seems to be the predominant scenario. In our opinion, the apparent easing of regional tensions, may lead to the precious metal weakening. However, in the event of an escalation in hostilities in the region, we a see a higher degree of market volatility for this week which may provide support for the precious metal, as the situation remains highly volatile.

Fed Interest rate decision due out on Wednesday.

The Fed’s interest rate decision is due out this Wednesday, with market participants widely anticipating that the bank will remain on hold. In the event that the Fed remains on hold, as it widely expected, we may see the greenback weakening, as it may imply that the Fed is done with raising interest rates for now. In such a scenario, we may see the precious capitalizing on a weaker dollar, given their inverse relationship. On the other hand, should the Fed take the markets by surprise and decide to hike in their next meeting, we may see the greenback strengthening against its counterparts and as such we may see the precious metal ceding back some control to the greenback. Therefore, potentially moving in a downwards trajectory.

Furthermore, the inflationary pressures on the US economy, appeared to have eased on a yoy level with the Core PCE rates coming in at 3.7% compared to 3.8%, yet the mom Core PCE rates point at a different picture. The increase from 0.1% to 0.3% could potentially justify a potential hike by the Fed, as inflationary pressures appear to have not entirely subsided. As such in our opinion, we maintain the belief that the Fed may hike in its next meeting, which in turn could strengthen the greenback and potentially weaken the precious metal.

Gold – Technical Analysis

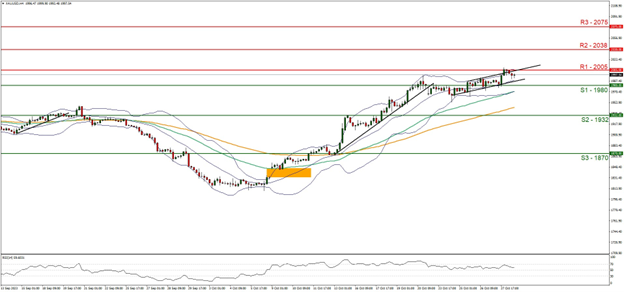

XAUUSD 4-Hour Chart

- Support: 1980 (S1), 1932 (S2), 1870 (S3)

- Resistance: 2005 (R1), 2038 (R2), 2075 (R3)

利 precious metal on a technical level appears to be moving in an upwards fashion, having broken above resistance turned support at the 1980 (S1) support level, in addition to the formation of an upwards moving channel which was incepted on the 24 of October. Despite this, we maintain a bearish outlook for the precious metal and supporting our case is the RSI indicator below our 4-Hour Chart which appears to be moving towards the figure of 50, implying that the bulls resilience may be weakening.

For our bearish outlook to continue, we would like to see a clear break below the 1980 (S1) support level, with the next possible target for the bears being the 1932 (S2) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 2005 (R1) resistance level, with the next possible target for the bulls being the 2038 (R2) resistance level. Lastly, for a neutral outlook, we would like to see the precious metal remaining confined between the 1980 (S1) and the 2005(R1) support and resistance levels respectively.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.