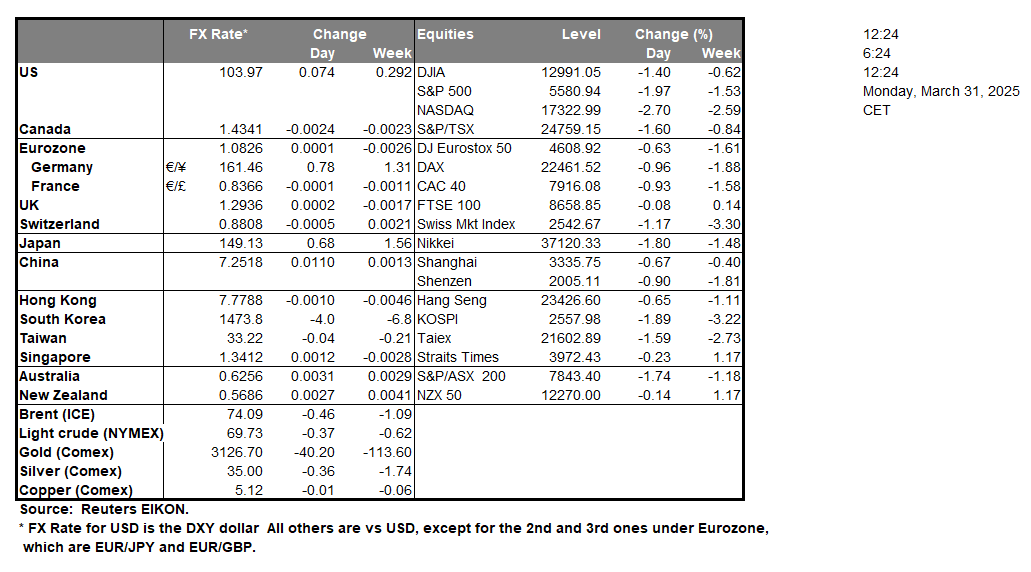

Gold’s price has continued on its meteoric rise with the precious metal’s price exceeding $3000 per troy ounce. The precious metal’s ascent could be in regards to the widely anticipated “Liberation Day” which is set to occur on the 2nd of April. The aforementioned date, is the day which President Trump has stated that tariffs will “start with all countries” according to various media outlets. In turn the possibility of an escalation of the ongoing trade wars and possibly the beginning of new ones, may be funneling inflows into gold, given its status as a safe haven asset and as a hedge during times of uncertainty. In turn, should President Trump proceed with the imposition of tariffs on all nation’s on the 2nd of April, it may further aid gold’s price.

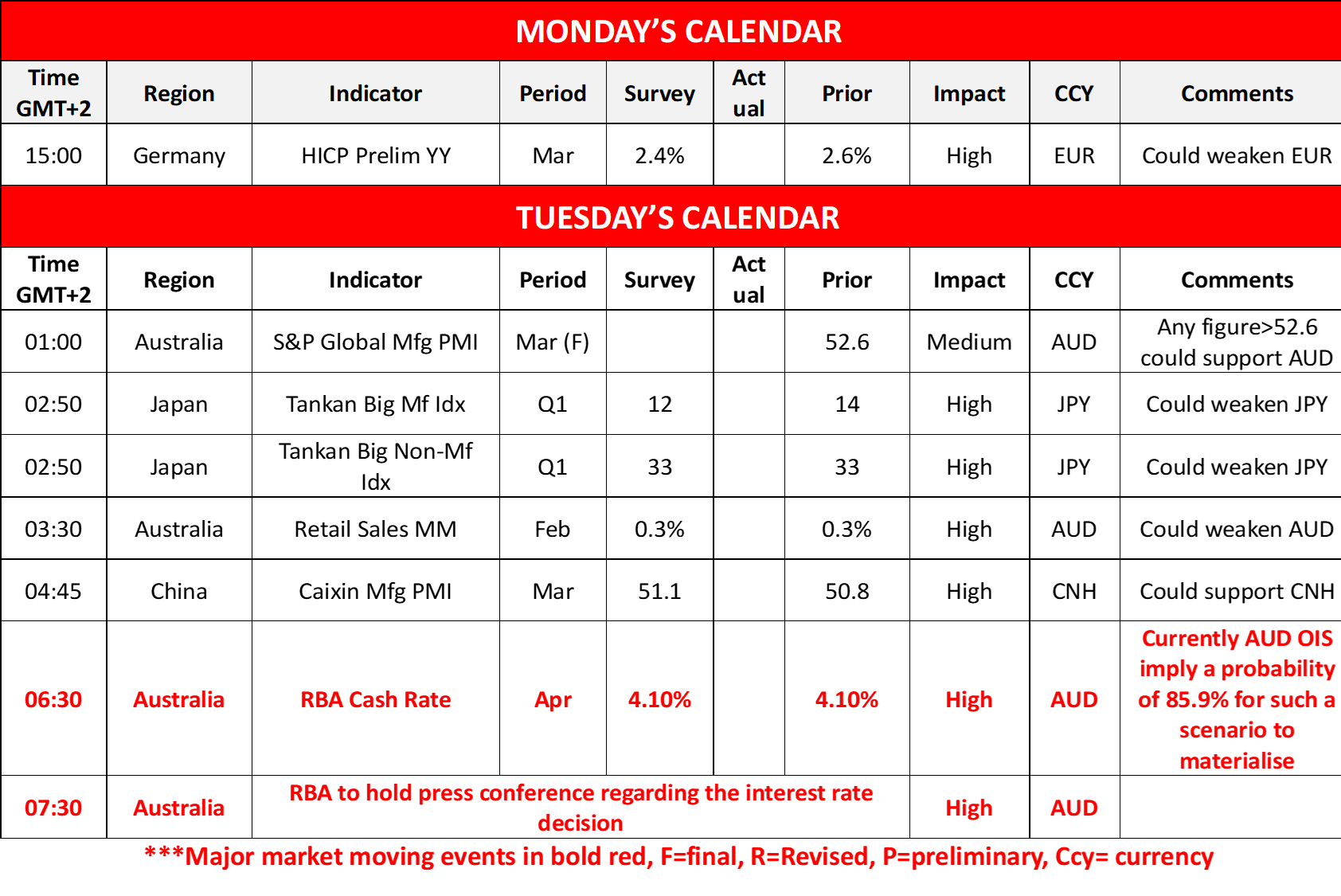

The RBA’s interest rate decision is set to occur during tomorrow’s Asian session. The majority of market participants are currently anticipating the bank to remain on hold with AUD OIS currently implying an 85.9% probability for such a scenario to materialize. Therefore, our attention turns to the bank’s accompanying statement, where should it be implied that the bank may cut rates in the future it may be perceived as dovish in nature which in turn could weigh on the Aussie. On the other hand should it be implied that the bank may remain on hold for a prolonged period of time it may be perceived as hawkish in nature which could aid the AUD.In the Eurozone, Germany’s preliminary HICP rates for March are set to be released later on today. The inflation print of Germany may influence the EUR given the significance of the German economy in the Zone. Economists are currently anticipating that the HICP rate may come in at 2.4% which would be lower than the prior rate of 2.6%

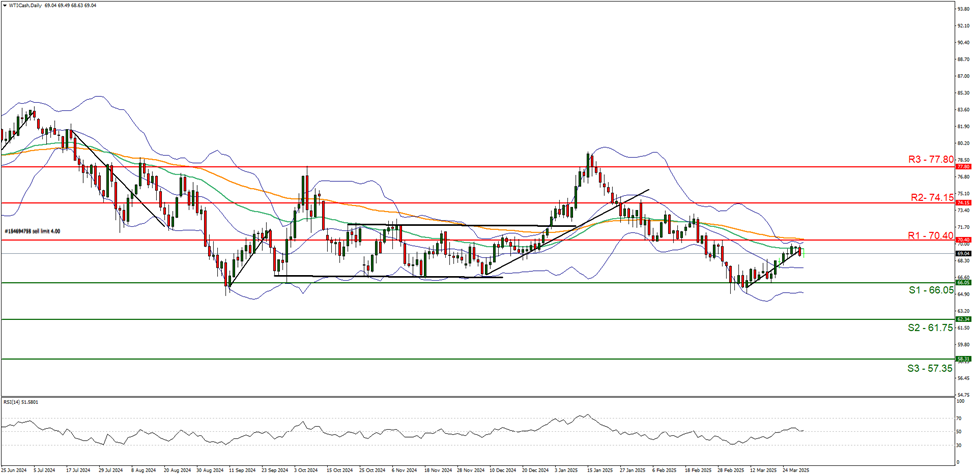

WTICash appears to be moving in a sideways fashion and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. For our sideways bias to continue we would require oil’s price to remain confined between the 66.05 (S1) support level and the 70.40 (R1) resistance line. On the flip side for a bullish outlook we would require a clear break above the 70.40 (R1) resistance line with the next possible target for the bulls being the 74.15 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break the 66.05 (S1) support level with the next possible target for the bears being the 61.75 (S2) support line.

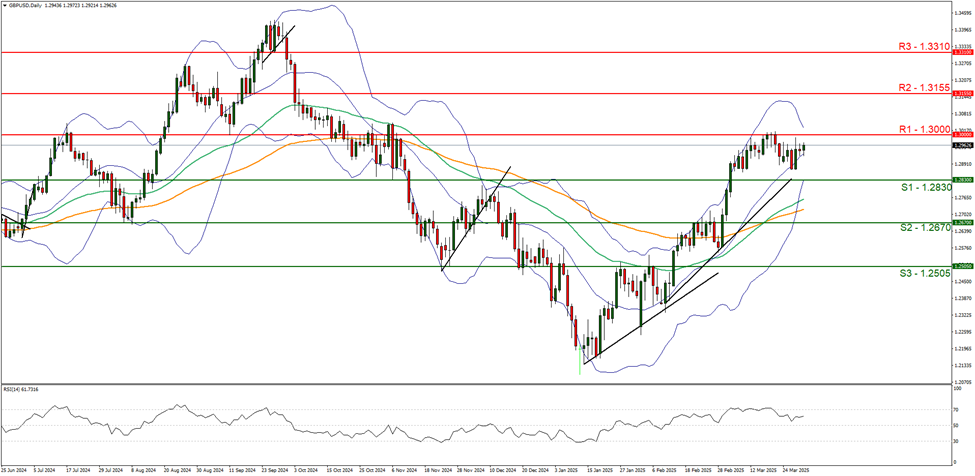

GBP/USD appears to be moving in a sideways fashion after failing to clear our 1.2830 (R1) resistance level. We opt for a sideways bias for the pair, yet we must note that the RSI indicator below our chart currently registers a figure near 60 implying a bullish market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between the 1.2830 (S1) support line and the 1.3000 (R1) resistance level. On the flip side for a bullish outlook we would require a clear break above the 1.3000 (R1) resistance level with the next possible target for the bulls being the 1.3155 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.2830 (S1) support line with the next possible target for the bears being the 1.2670 (S2) support level.

その他の注目材料

Today we get Germany’s preliminary HICP rate for March. In tomorrow’s Asian session, besides RBA’s interest rate decision we also note the release of Japan’s Tankan indicators for Q1 25, Australia’s retail sales for February and China’s Caixin manufacturing PMI figure for March.

今週の指数発表:

On Tuesday, we get the UK’s nationwide house prices for March, the Czech Republic’s GDP rate for Q4, Euro Zone’s preliminary HICP rate for March, Canada’s manufacturing PMI figure for March and the US ICM manufacturing PMI figure for March. On Wednesday we get from the US the ADP national employment figure for March and Februarys’ factory orders. On Thursday we get Australia’s trade data for February, Switzerland’s and Turkey’s CPI rates for March, the weekly US initial jobless claims figure, Canada’s trade data for February and the US ISM non-manufacturing PMI figure for March. On Friday we note the release of Germany’s industrial orders for February, Sweden’s and the Czech Republic’s preliminary CPI rates for March and in the American session, we highlight the release of the US and Canadian employment data for March.

WTICash Daily Chart

- Support: 66.05 (S1), 61.75 (S2), 57.35 (S3)

- Resistance: 70.40 (R1), 74.15 (R2), 77.80 (R3)

GBP/USD Daily Chart

- Support:1.2830 (S1), 1.2670 (S2), 1.2505 (S3)

- Resistance: 1.3000 (R1), 1.3155 (R2), 1.3310 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。