WTI/oil prices continued to fall over the past few days with WTI reaching prices below $70 per barrel yesterday, the lowest level in a month. There seemed to be some upward movement today, yet it still is unconvincing for now. As a key fundamental issue we note the market worries about a possible recession and thus a weakening of the commodity’s demand outlook, yet at the same time we note that the US oil market remains tight. In this report, we aim to shed light on the catalysts driving WTI’s price, assess its future outlook 、 conclude with a テクニカル分析.

Market Worries for oil demand

WTI’s prices started to drop once again on Monday and it’s no surprise that the drop in oil prices coincided with China reporting a contraction of economic activity in its huge manufacturing sector for the past month. Market worries for the demand side of oil tended to intensify as China is a major oil consumer and a contraction of economic activity in the manufacturing sector may have a negative effect also on the demand side of oil. But it’s not only China that’s worrying oil traders. We are in for another round of monetary policy tightening, with the Fed yesterday hiking rates once again by 25 basis points 、 Fed Chairman Powell in his press conference stating that it is “not appropriate to cut rates”. That would imply that even should the bank pause its rate hiking path, which the market already expects, it may keep rates at 高い levels for a prolonged period of time contradicting market expectations for rate cuts after the summer. Should monetary policy settings remain tight that may have a cumulative lagged adverse effect on economic activity and hence weaken oil demand. Mind you that it is not only the Fed that stepped on the brakes, also RBA surprised the markets by hiking rates after pausing, ECB also hiked rates by 25 basis points, while BoE is expected to follow on the same path next week. Hence, to put it mildly, the demand side of the economy seems to continue to be under threat, which may increase the downward pressure on the commodity’s prices.

OPEC’s response

On the flip side, OPEC and its allies, including Russia seem to be implementing their pledge to voluntarily cut production by an additional 1.16 million barrels per day (bpd). It’s characteristic that besides Saudi Arabia cutting production also Russia’s Deputy Prime Minister Alexander Novak stated today that Russia is keeping its voluntary production cuts of 500k barrels per day, from February until the end of the year. So OPEC’s production side seems to remain tight, yet that was already priced in by the market and with no additional production cuts from the oil-producing cartel on the horizon, it may play little role in oil price action.

The situation in the US oil market

利 USD oil production levels had risen steadily in the first two months of the year, yet that tendency seemed to have been halted. We note that the number of active oil rigs in the US remains relatively stable over the past two months, just below 600. On the other hand, we cannot miss out on commenting that US oil inventories have been dropping with API reporting a drawdown of -3.939 million barrels and EIA a drawdown of -1.280 million barrels practically highlighting the tightness of the US oil market as production levels were not able to reach demand. Yet both releases tended to leave oil traders unimpressed as oil prices continued to decline after the releases. Hence the US oil market tightness seems also to be largely priced in by the markets. Despite a halt in the drop of oil prices today, the rise may prove to be temporary and a mere correction should 基本的 worries for the demand side of oil not be lifted or should there be no additional tightening of oil production.

テクニカル分析

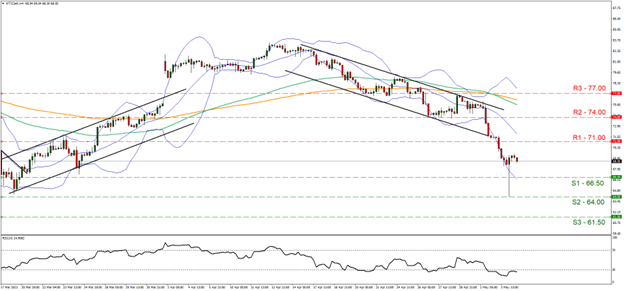

WTI Cash 4H Chart

- Support: 66.50 (S1), 64.00 (S2), 61.50 (S3)

- Resistance: 71.00 (R1), 74.00 (R2), 77.00 (R3)

Looking at WTI Cash 4-hour chart we see observe crude losing the floor under its feet, plunging to its lowest levels in almost two and a half years, but then quickly rebounding to the $68 per barrel level as traders indulged in some dip buying activity. We hold a bearish outlook bias for the commodity given the sharp drop and supporting our case is the RSI indicator below our 4-hour chart which currently registers a value of 25, highlighting the extreme bearish sentiment surrounding WTI. We must point out however, that the move appears overextended and a possible correction または consolidation near the $65.50 (S1) support base may be due. Should the bears continue to reign over and capitalize on the absence of bulls, we may see the definitive break below the $66.50 (S1) support level with the price action edging closer to the fresh $64.00 (S2) support level. Under extreme selling conditions, we may even see the crude prices falling towards the 61.50 (S3) base, reaching levels once seen before in August of 2021. Should, on the other hand, the bulls start piling in, we may see the rise and the break above the 71.00 (R1) resistance level and the move towards the 74.00 (R2) resistance barrier.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.