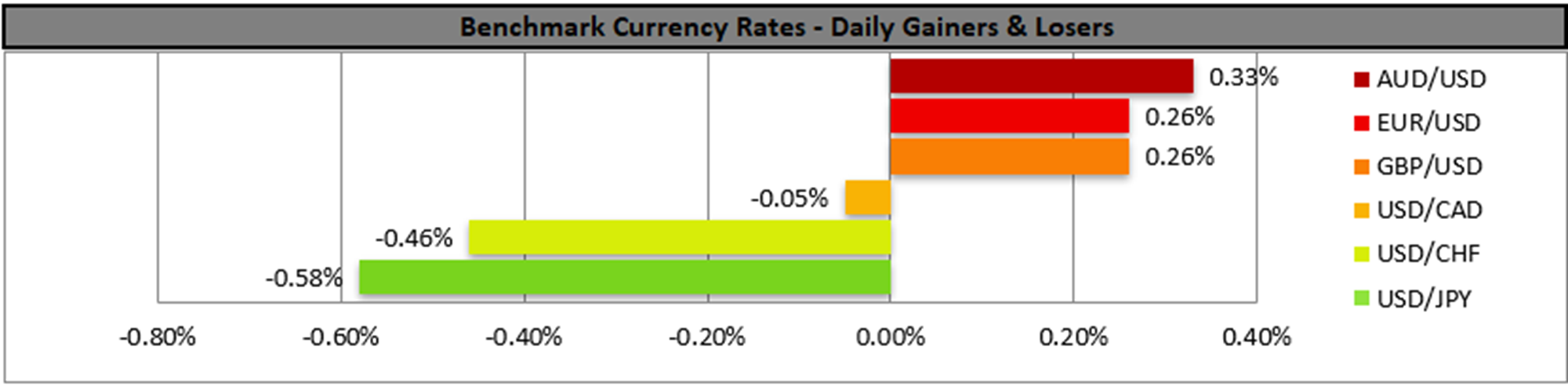

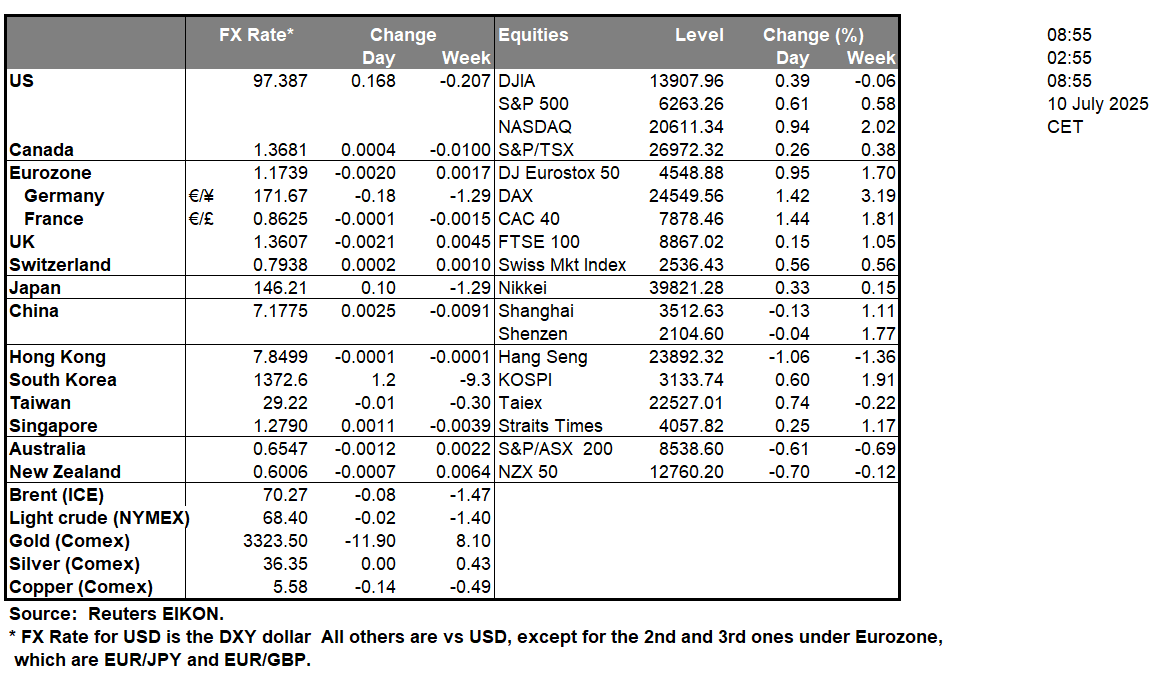

The USD seemed to lose momentum against its counterparts yesterday and it’s expected to be a rather quiet Thursday in regards of financial releases today. Maybe some interest could lie with the release of the weekly US initial jobless claims figure. Other than that, we expect fundamentals to lead the markets today. We make a start with the Fed’s monetary policy intentions and the release of the Fed’s June meeting minutes yesterday. The document showed that Fed policymakers see the case for more rate cuts to come, yet opinions tended to vary in regards to the timing and number of rate cuts. Today we have a number of Fed Policymakers which are scheduled to speak and should we see them underscoring the possibility of more easing to come, we may see the USD slipping and vice versa. On a deeper fundamental level, the markets seem to be less concerned with US President Trump’s tariff intentions than we may have been expecting, yet the issue may continue keeping traders on the edge of their seats. Our interest lies mostly not in the letters already sent out, which have been publicized, but on the tariff letters that are still to be released including Taiwan, India and the EU which have a heavy trading volume with the US. The improved market sentiment allowed for riskier assets to gain some support and its characteristic that Bitcoin neared All Time High levels yesterday. US stock markets gained little support despite the AI frenzy which pushed NVIDIA briefly to a record US$4 trillion market cap. Attention is starting to be placed on the earnings season which is to start next week. Gold’s price benefited only slightly by the weakening of the USD and overall, its movement continues to resemble a sideways motion. On the commodities front, oil prices remained relatively unchanged despite a considerable easing of the US oil market as reported by API and EIA. On the other hand, the rally of US copper prices reaching practically record high levels and fueled by Trump’s tariff intentions seems to continue.

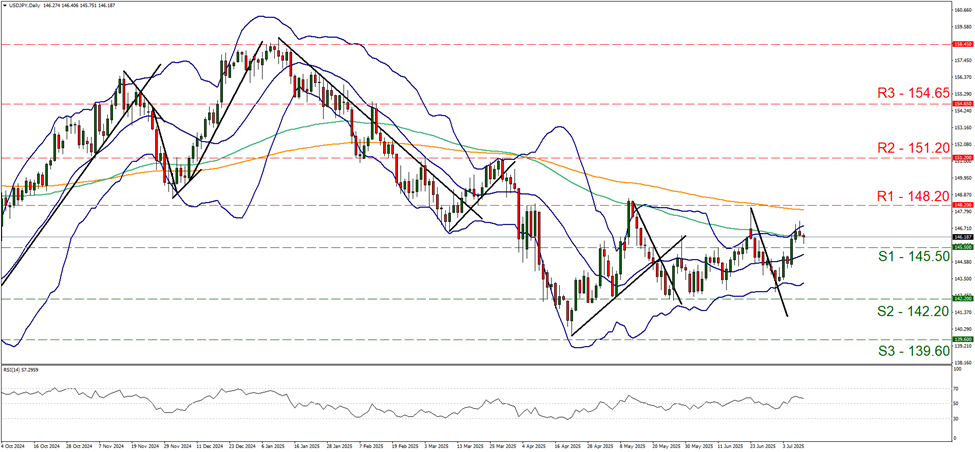

USD/JPY edged lower yesterday remaining well within the boundaries set by the 148.20 (R1) resistance line and the 145.50 (S1) support level. Given that the pair’s price action peaked and corrected lower after testing the upper Bollinger band as mentioned in yesterday’s report and the RSI indicator despite remaining above the reading of 50 has flattened, we tend to maintain a bias for a sideways motion of the pair. Should the bulls regain control we may see USD/JPY breaking the 148.20 (R1) resistance line and open the gates for the 151.20 (R2) resistance base. Should the bears take over, which we currently see as a remote scenario, we may see USD/JPY dropping, breaking the 145.50 (S1) support line and continuing lower to break also the 142.20 (S2) support level, with the next possible target for the bears being the 139.60 (S3) support base.

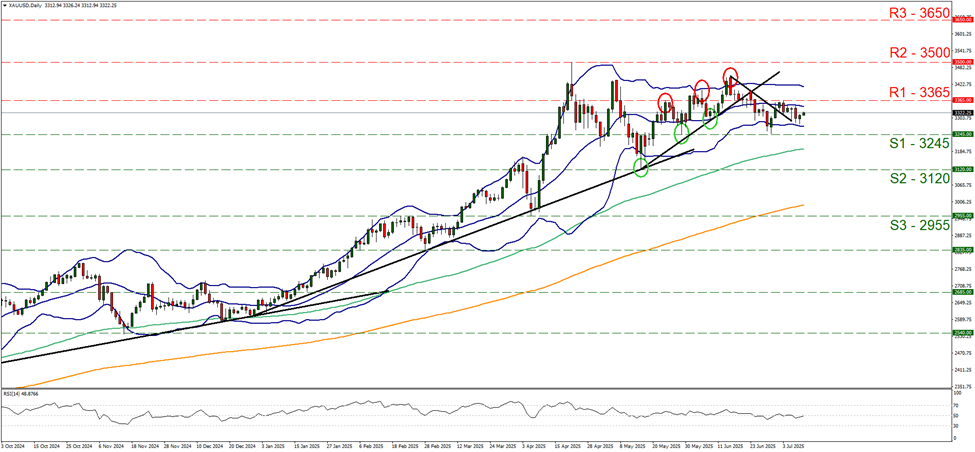

Gold’s price edged higher yesterday and during today’s Asian session, yet the movement resembles more a sideways motion within the boundaries set by the 3365 (R1) resistance line and the 3245 (S1) support level. We maintain a bias for a sideways motion of the shiny metal between the prementioned levels, yet at he same time we also note that the RSI indicator remains near the reading of 50 implying a relative indecisiveness on behalf of market participants. Yet for the bearish outlook to emerge, we would require the gold’s price to break clearly the 3245 (S1) support line and start aiming for the 3120 (S2) support level. For a bullish outlook to be adopted, gold’s price would have to break the 3365 (R1) resistance line and continue higher aiming for the 3500 (R2) resistance level.

その他の注目材料

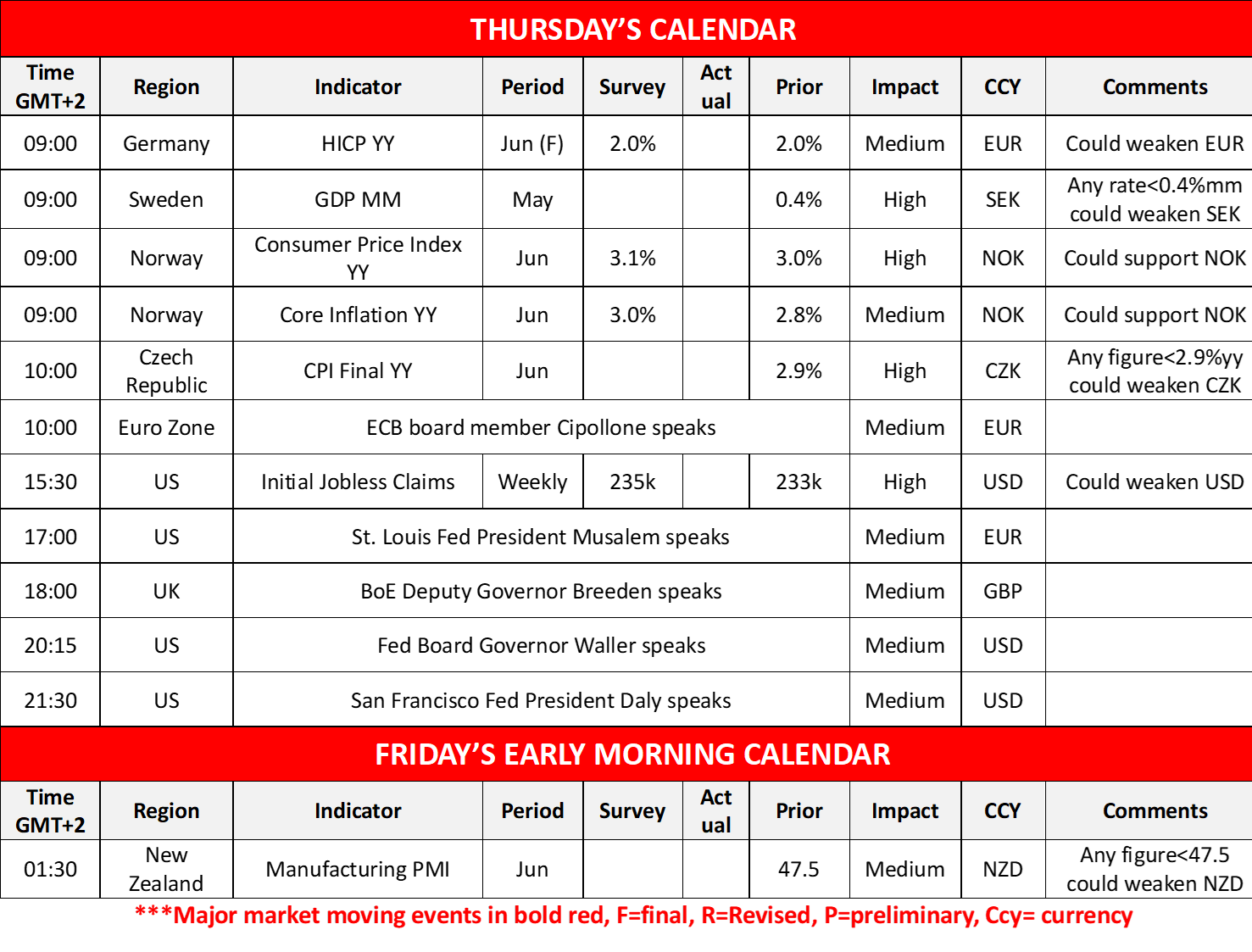

Today we get Germany’s, Norway’s and the Czech Republic’s inflation metrics for June and Sweden’s GDP rate for May while ECB’s Cipollone, St. Louis Fed President Musalem, BoE Deputy Governor Breeden, Fed Board Governor Waller and San Francisco Fed President Daly are scheduled to speak. In tomorrow’s Asian session, we get New Zealand’s June manufacturing PMI figure.

USD/JPY Daily Chart

- Support: 145.50 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 148.20 (R1), 151.20 (R2), 154.65 (R3)

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。