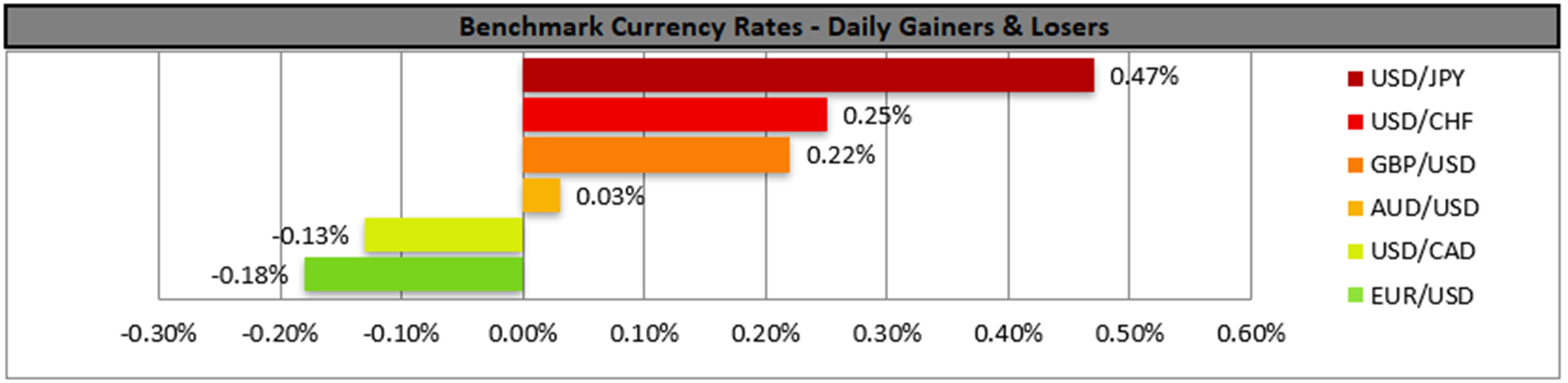

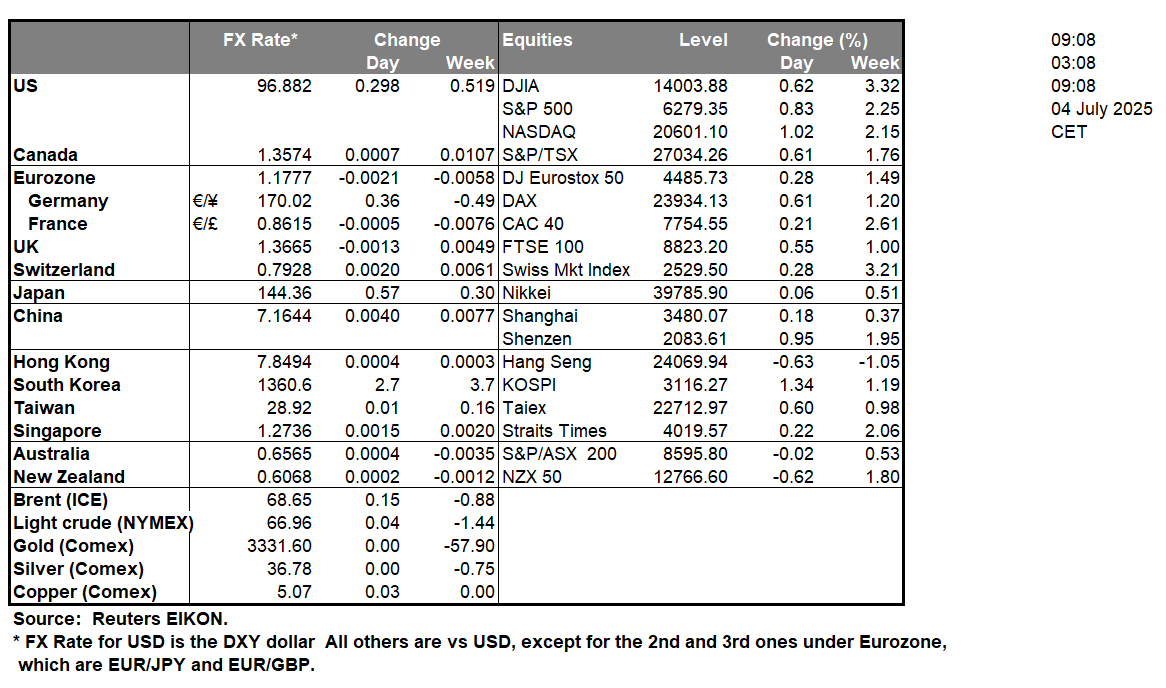

The USD gained against its counterparts yesterday, as the US employment report unexpectedly showed a tighter US employment market for the past month. The NFP figure instead of dropping as expected, rose while the unemployment rate instead of ticking up, ticked down while the average earnings slowed down. The release tends to highlight the resilience of the US employment market and may enhance the Fed’s doubts for the necessity of extensive rate cuts until the end of the year. It’s characteristic that after the release, Fed Fund Futures implied that the market was forced to ease its dovish expectations by reducing the expected three more rate cuts by the bank until the end of the year to two. On a fundamental level we note that our worries for the US fiscal outlook are enhanced as the US House of Representatives passed US President Trump’s big, beautiful spending bill and Trump is to sign it into law within the day. On the one hand, the spending bill is open the gates for Trump’s fiscal policy thus pushing the US President’s immigration policy and provide tax cuts, while at the same time is also expected to roll back social welfare policies such as health benefits and food assistance. The new bill is expected to also increase the US national debt, which tends to pose particular problems on a fiscal level, as its servicing costs are high. Overall we expect the issue to keep the USD under pressure. The US markets now turn their attention towards US President Trump’s tariff wars as his 9th of July is nearing. US President Trump stated that the US Government will start sending out letters to trading partners today setting unilateral tariff rates. Any development implying an easing of tensions in international trading relationships could provide some support for the USD, while further escalation could weigh on the greenback. Please note that today is a public holiday for the US, as it celebrates Independence Day, hence some thin trading conditions may apply.

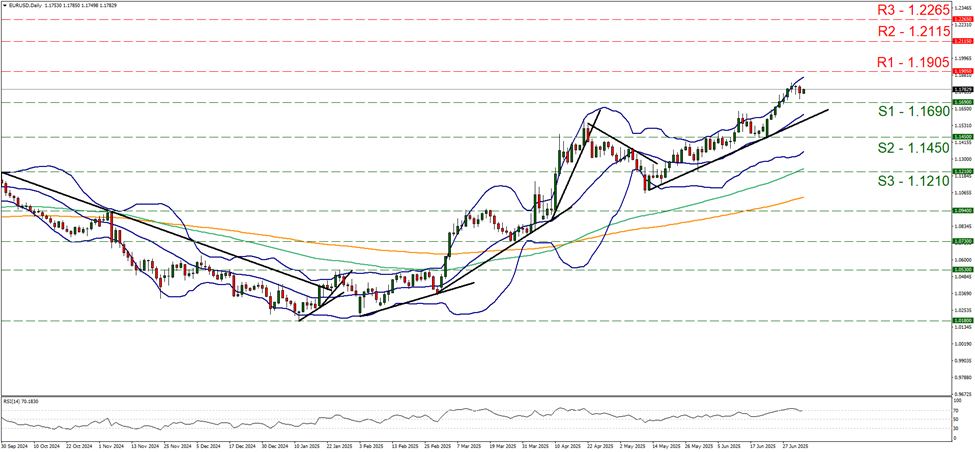

EUR/USD dropped yesterday yet corrected a bit higher in today’s Asian session, remaining well between the 1.1690 (S1) support line and the 1.1905 (R1) resistance level. Despite the pair’s price action peaking and showing some tendencies for stabilisation, we maintain a bullish outlook for the pair as the upward trendline guiding it remains intact and the RSI indicator despite edging lower remains near the reading of 70, implying a strong bullish sentiment among market participants for the pair. Should the bulls maintain control over the pair as expected, we may see it breaching the 1.1905 (R1) resistance level. Should the bears take over we may see the pair breaking the 1.1690 (S1) line , continue to break also the prementioned upward trendline, signalling the interruption of the upward movement and continue to break also the 1.1450 (S2) support level.

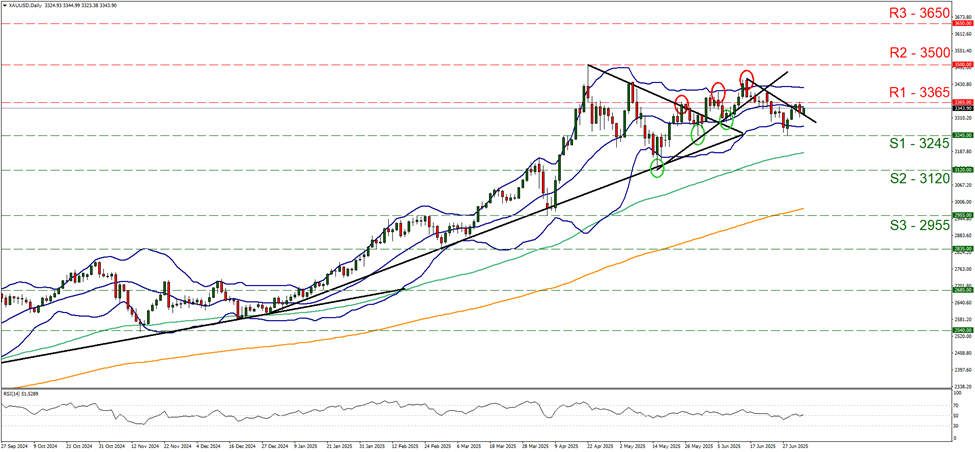

Gold’s price edged lower yesterday yet the bearish movement resembled more a correction than anything else as it remained close to the 3365 (R1) resistance line. Given also that the RSI indicator continues to run along the reading of 50, implying a rather indecisive market for the precious metal’s price. Hence we maintain our bias for a sideways motion as expressed in yesterday’s report. For a bullish outlook to emerge we would require gold’s price to break the 3365 (R1) resistance line and start aiming the All Time High level, of the 3500 (R2) resistance level. For a bearish outlook to be adopted gold’s price would have to break clearly the 3245 (S1) support line, opening the gates for the 3120 (S2) support level.

その他の注目材料

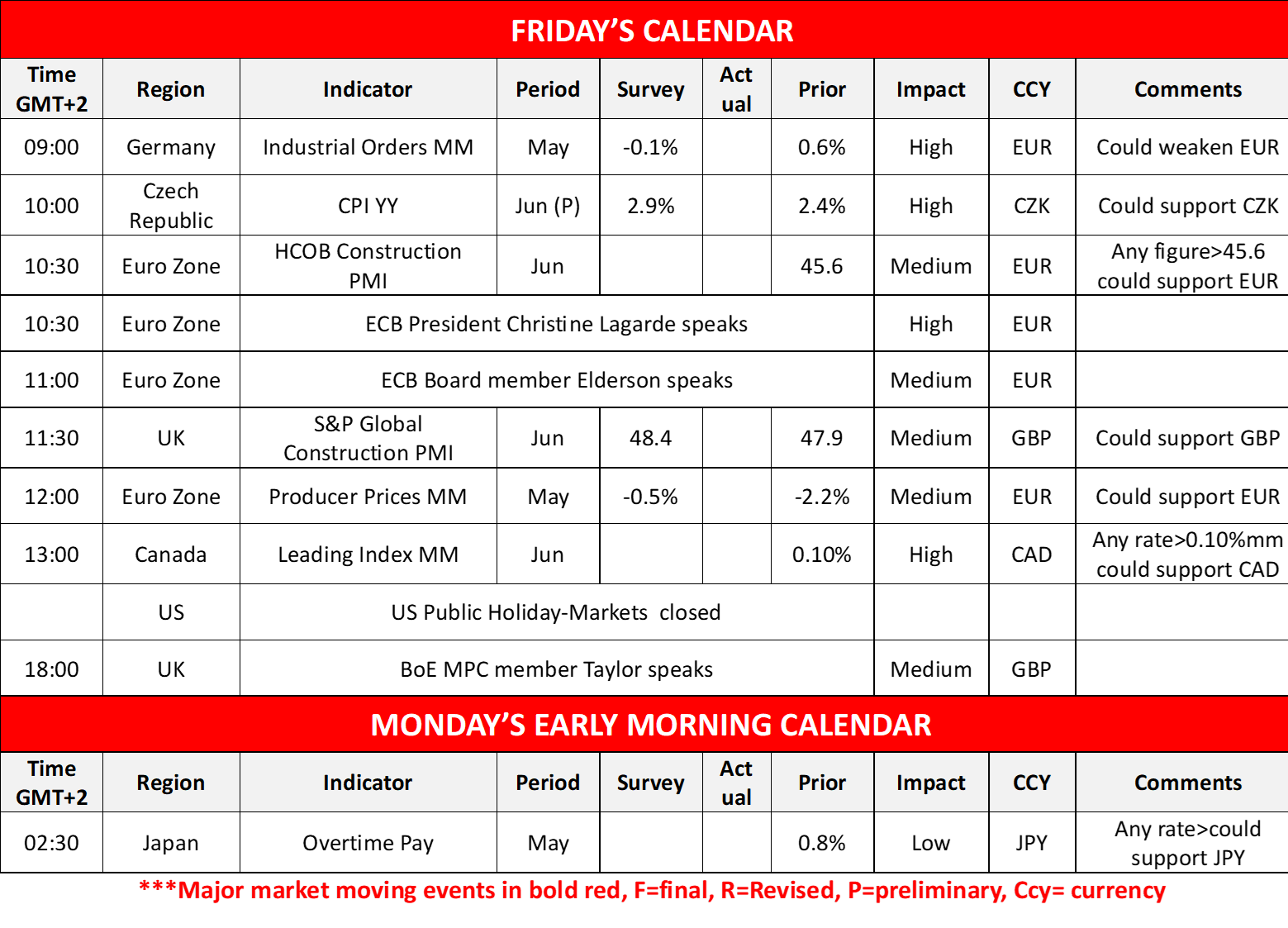

Today we note the release of Germany’s industrial output for May, the Czech Republic’s preliminary CPI rates for June, Euro Zone’s and the UK’s Construction PMI figures for June, Euro Zone’s PPI rates for May and Canada’s leading index for June. On a monetary level, we note that ECB President Christine Lagarde, ECB Board member Elderson and BoE MPC member Taylor are scheduled to speak. On Monday’s Asian session, we note the release of Japan’s overtime pay for May.

EUR/USD デイリーチャート

- Support: 1.1690 (S1), 1.1450 (S2), 1.1210 (S3)

- Resistance: 1.1905 (R1), 1.2115 (R2), 1.2265 (R3)

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。