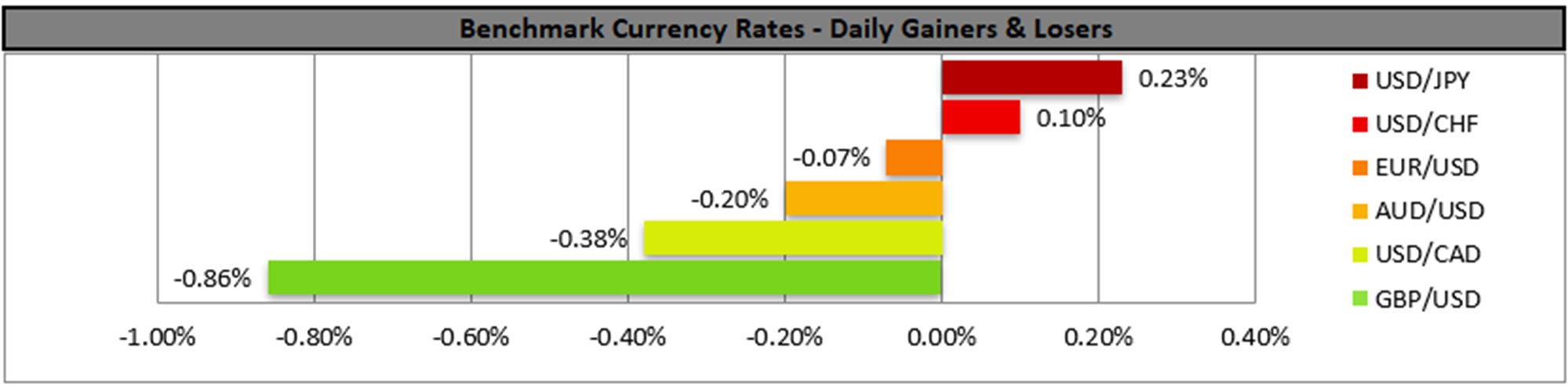

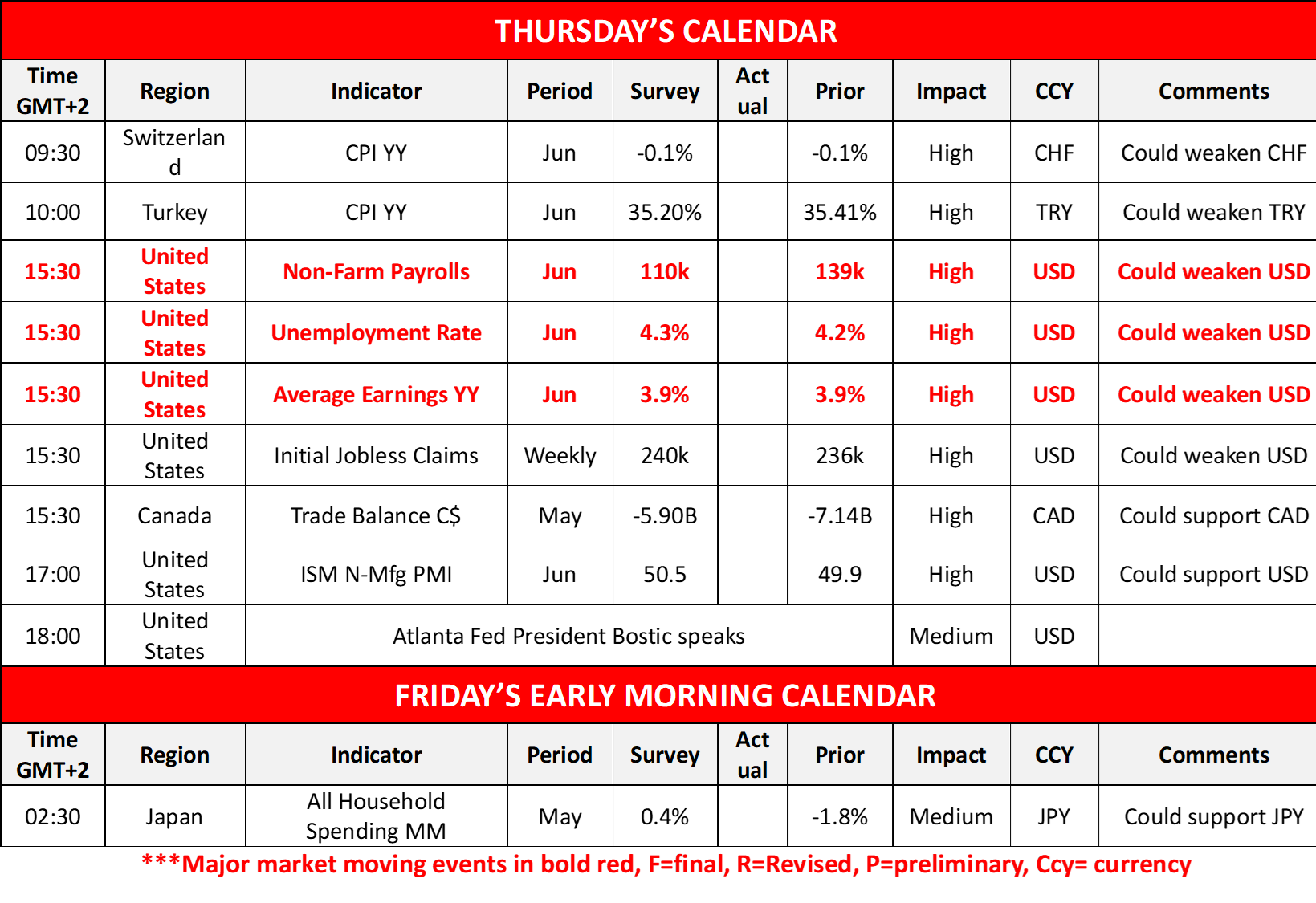

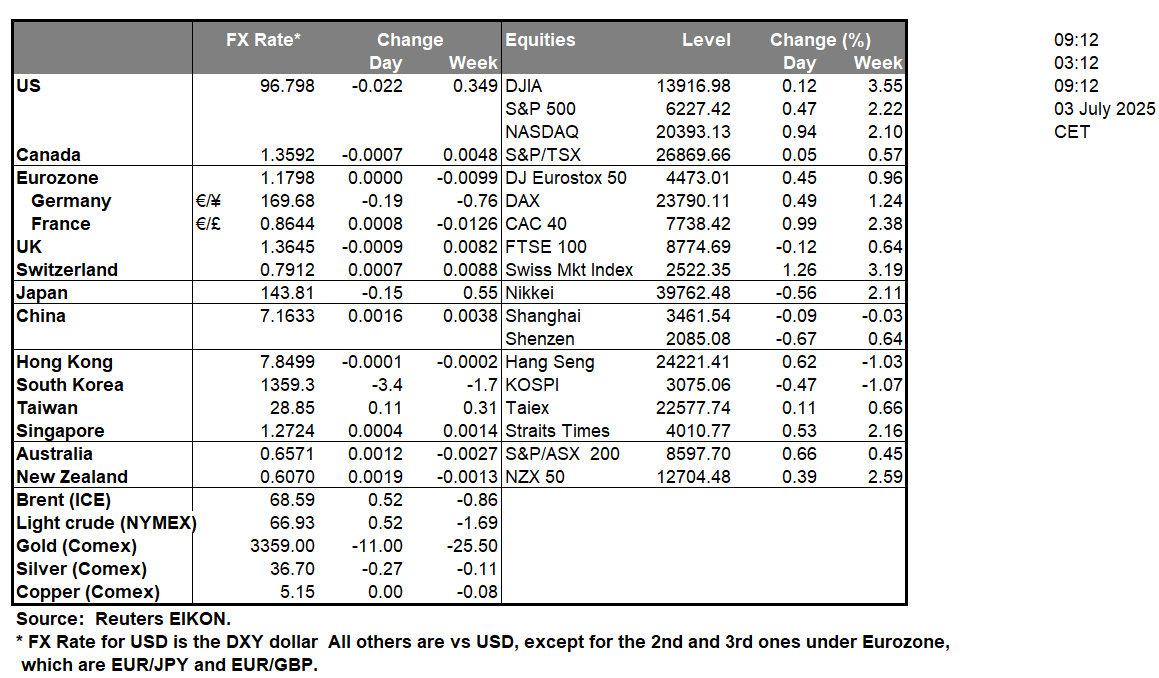

The USD edged higher against its counterparts, yesterday and during today’s Asian session, with the bullish tendencies for the time being unconvincing. On a fundamental level, the USD is set under pressure from the uncertainty created by US President Trump’s tariff wars, market worries for the level of the US national debt, given that Trump’s bill is before the House and finally the market’s dovish expectations for the Fed to cut rates three more times until the end of the year, starting on the September meeting. Today, we highlight US macroeconomics and specifically the release of the US employment report for June. Forecasts are for the Non-Farm Payrolls figure to drop to 110k if compared to May’s 139k, the unemployment rate to tick up reaching 4.3% and the average earnings growth rate to remain unchanged at 3.9%yy. Hence an easing of the US employment market is expected and three scenarios pop out for traders, as the actual rates and figures seldom actually meet the forecasts. The first is for the data to be close to the forecasts, in which case we may see a slight weakening of the USD while in case the data show less easing of the US employment market, could support the USD slightly. The market could be taken by surprise should the data show a beyond forecasts, easing of the US employment market, in which case we expect a substantial weakening of the USD as the market’s expectations for an easing of the Fed’s monetary policy could be enhanced. On the flip side, should the US employment data show a tightening of the US employment market, with the NFP figure rising and the unemployment rate ticking down could provide asymmetric support for the greenback. Yet the release is expected to have ripple effects beyond the FX market, with US equities, gold and to a lesser extent oil, being possible candidates for market movement. A possibly tighter US employment market could weigh on US equities and gold’s price, while a substantially looser US employment market suggesting an easing of the Fed’s monetary policy could support US stock markets and gold’s price.

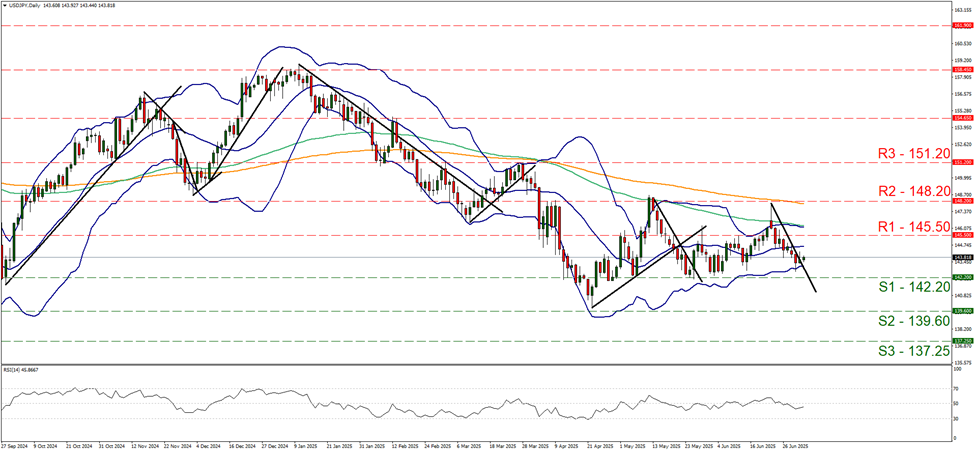

In the FX market, USD/JPY edged higher yesterday remaining well between the 145.50 (R1) resistance line and the 142.20 (S1) support line. Maybe the main characteristic of the pair’s movement yesterday and during today’s Asian session, was the interruption of the downward movement since the 23rd of the month, while the RSI indicator remained below yet close to the reading of 50 implying a relatively weak bearish market sentiment on behalf of the market for the pair. Hence we switch our bearish predisposition in favour of a sideways motion bias. Should the bears regain control over USD/JPY we may see it breaking the 142.20 (S1) support line, thus opening the gates for the 139.60 (S2) support base. Should the bulls take over we may see the pair breaking the 145.50 (R1) line and continues higher aiming for the 148.20 (R2) resistance level.

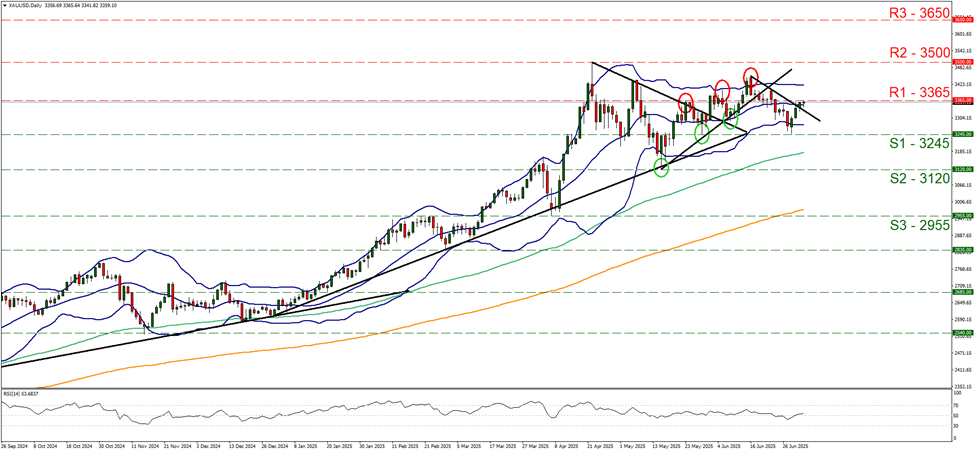

Gold’s price continued to edge higher yesterday and during today’s Asian session was testing the 3365 (R1) resistance line. The precious metal’s price in yesterday’s rise broke the downward trendline guiding it, signalling a possible stabilisation of the pair. For a bullish outlook to emerge we would require gold’s price to break the 3365 (R1) resistance line and start aiming if not reaching the All Time High level, marked by the 3500 (R2) resistance level. A bearish outlook remains remote currently and for its adoption we would require gold’s price to drop and break clearly the 3245 (S1) support line which was tested twice in the past two months, thus paving the way for the 3120 (S2) support level.

その他の注目材料

Today we get Switzerland’s and Turkey’s CPI rates for June, the US weekly initial jobless claims figure, the US ISM non-manufacturing PMI figure for June and Canada’s trade balance for May, while Atlanta Fed President Bostic speaks. In Monday’s Asian session, we note the release of Japan’s all household spending for May.

USD/JPY Daily Chart

- Support: 142.20 (S1), 139.60 (S2), 137.25 (S3)

- Resistance: 145.50 (R1), 148.20 (R2), 151.20 (R3)

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3365 (R1), 3500 (R2), 3650 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。