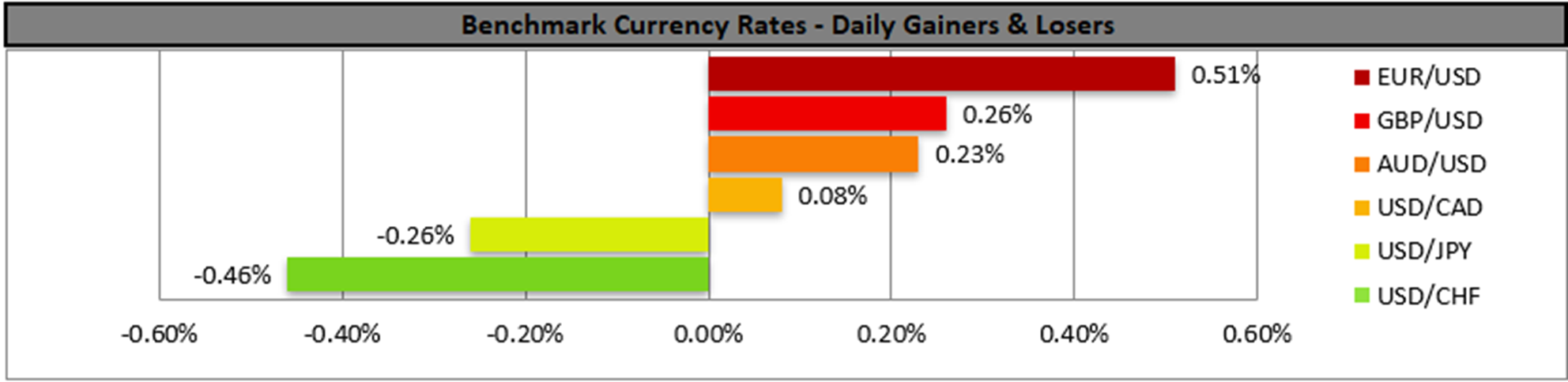

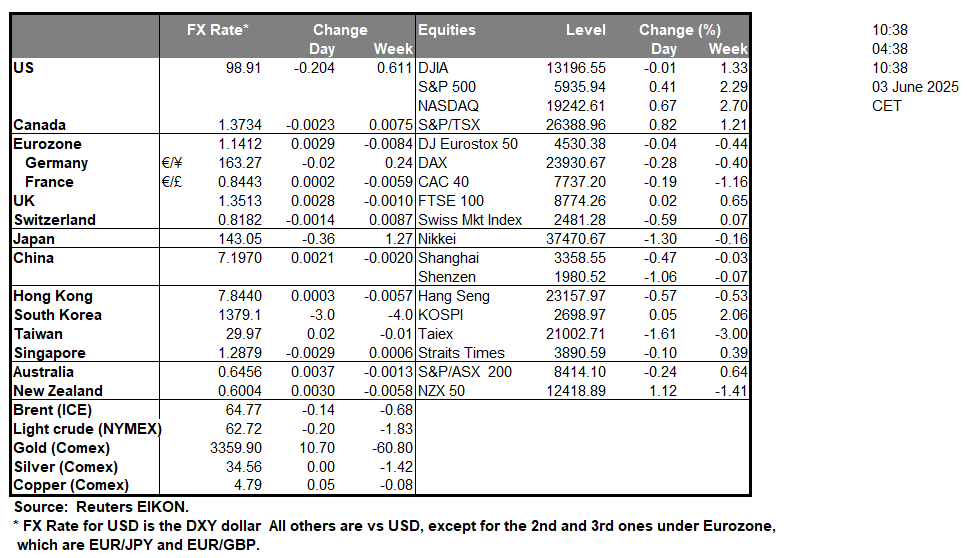

The USD weakened against its counterparts yesterday, remaining at relatively low levels if we consider the past three years. Market worries for the looming US tariffs and the escalation of the international trade war. US President Trump called upon countries to for the best offers as the tariff deadline of the 4th of July is nearing. The situation remains tense and despite US President Trump and Chinese President Xi Jinping being likely to have a call in order to clear any trade differences, hopes of the market for a positive outcome seem to remain low. Overall should we see trade tensions escalating further, we may see the USD losing some ground as the issue tends to weigh on the greenback at the current stage.

Aussie traders on the other hand may have been convinced for RBA’s dovish intentions as the minutes of the last meeting showed that the bank was ready to cut rates by 50 basis points, which highlighted the bank’s readiness to ease its monetary policy considerably. In tomorrow’s Asian session, we highlight the release of Australia’s GDP rate for Q1 and the rate is expected to slow down. A possible wider-than-expected slowdown could weigh on the Aussie.

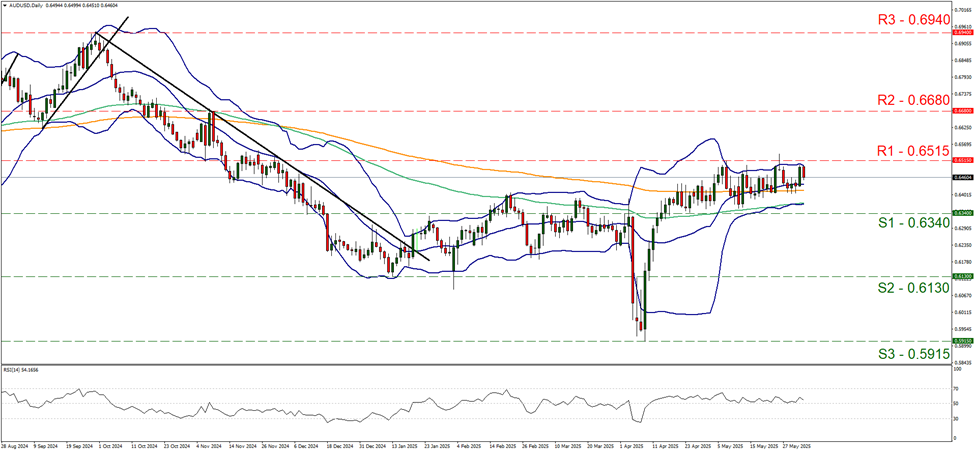

On a technical level AUD/USD edged lower in today’s Asian session, reversing part of yesterday’s gains as the pair failed to reach the 0.6515 (R1) resistance line. Given that since the midst of April, the pair remained well within the boundaries set by the 0.6515 (R1) resistance line and the 0.6340 (S1) support line, we maintain our bias for the sideways motion of the pair to be continued. Also the RSI indicator failed to materially diverge from the reading of 50, implying a relatively indecisive market, while the Bollinger Bands have narrowed since the 12of May and have flattened out, implying lower volatility for the pair, which in turn could allow the sideways motion to continue. Should the bulls take over, we may see the pair breaking the 0.6515 (R1) resistance line clearly and start aiming for the 0.6680 (R2) resistance level. Should the bears be in charge of the pair’s direction, we may see AUD/USD breaking the 0.6340 (S1) support line and start aiming for the 0.6130 (S2) support level.

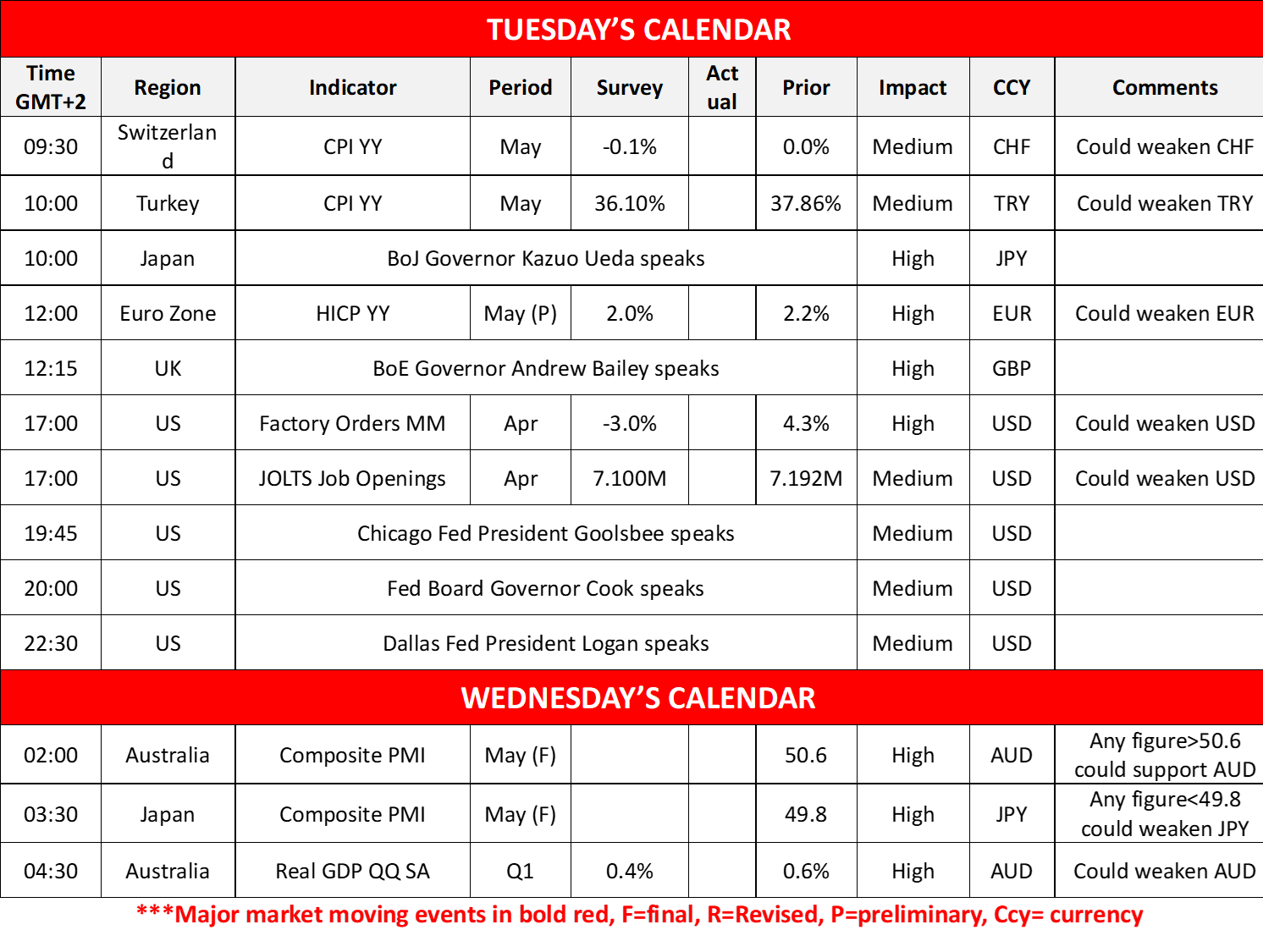

EUR traders are expected to focus on the release of Euro Zone’s Preliminary HICP rates for May and the rates are expected to slow down in a signal that inflationary pressures are easing in the Euro Zone. The release gains on attention as the ECB is to release its interest rate decision on Thursday.

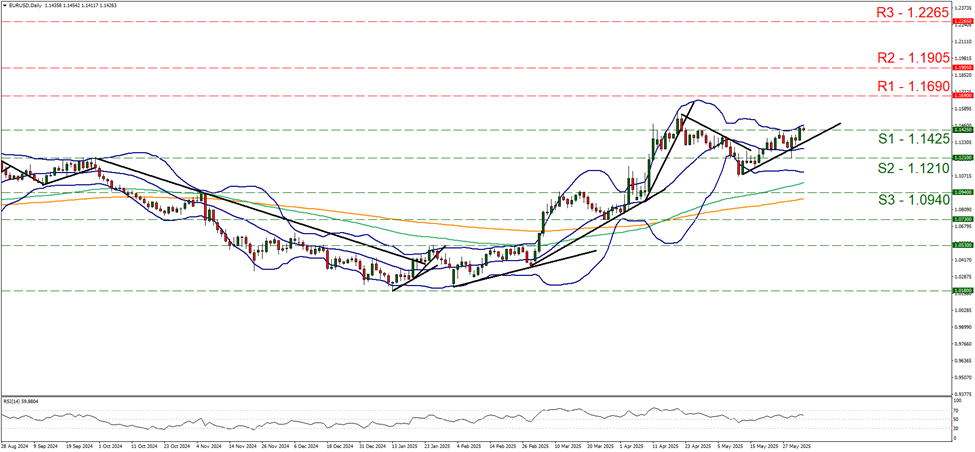

EUR/USD rose yesterday and surpassing albeit not clearly yet, the 1.1425 (S1) resistance line, now turned to support. In its upward motion the pair has formed a new higher peak, which allowed us to draw an upward trendline supporting the motion of the pair. Hence, we intend to maintain a bullish outlook for the pair as long as the upward trendline remains intact. Should the bulls actually remain in control we may see the pair start aiming for the 1.1690 (R1) resistance line. Should bears take the reins, we may see the pair breaking the 1.1425 (S1) support line and start actively aiming if not breaching the 1.1210 (S2) support level.

その他の注目材料

Today we get Turkey’s and Switzerland’s inflation metrics for May and the US April’s factory orders and JOLTS figure. On the monetary front, we note that BoE Governor Andrew Bailey, is scheduled to speak. In tomorrow’s Asian session, we get Japan’s and Australia’s Composite PMI figures.

AUD/USD Daily Chart

- Support: 0.6340 (S1), 0.6130 (S2), 0.5915 (S3)

- Resistance: 0.6515 (R1), 0.6680 (R2), 0.6940 (R3)

EUR/USD デイリーチャート

- Support: 1.1425 (S1), 1.1210 (S2), 1.0940 (S3)

- Resistance: 1.1690 (R1), 1.1905 (R2), 1.2265 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。