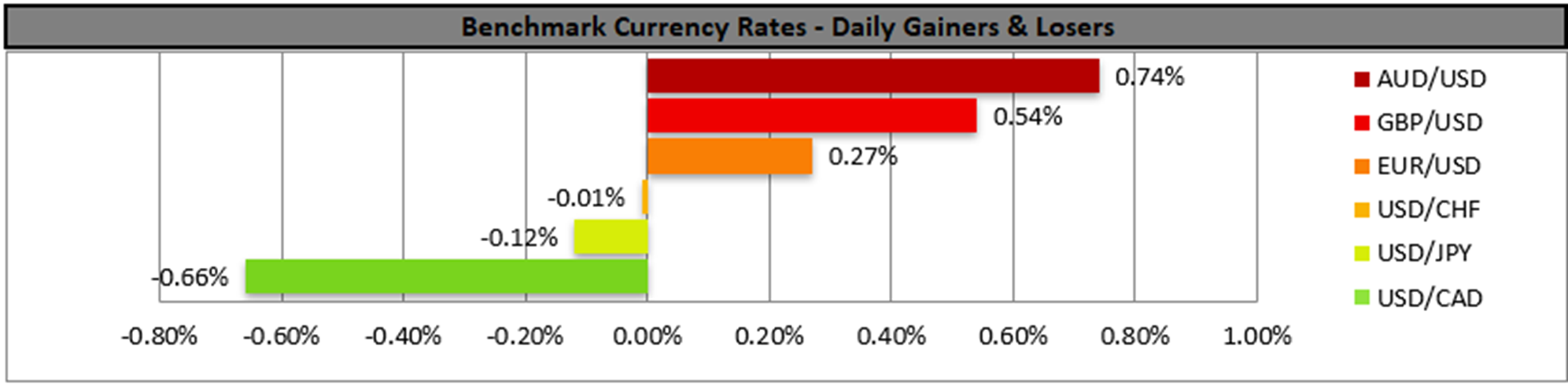

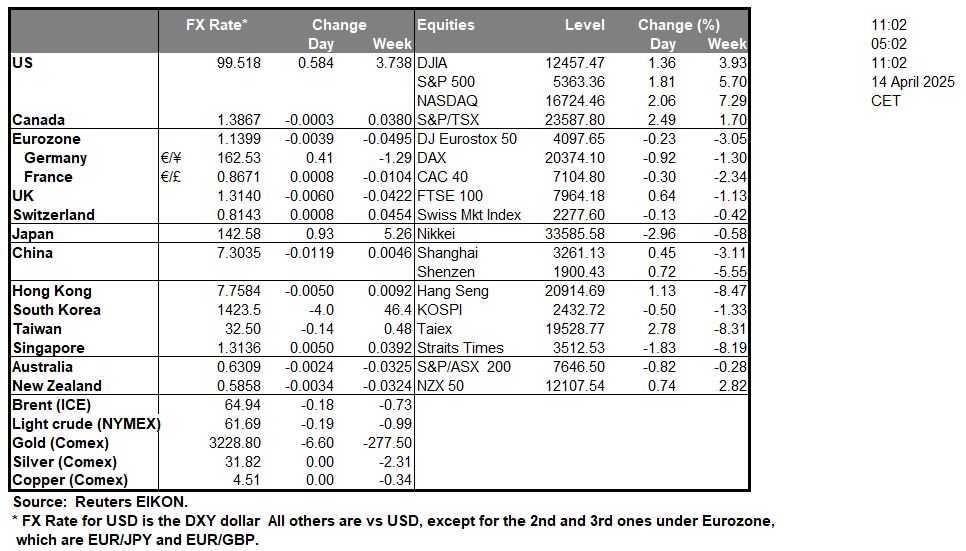

As the week begins the markets seem to have calmed down, yet uncertainty about the trade war seems to continue to simmer under the surface. The USD edged lower on Friday and in today’s Asian session, as the US PPI rates for March slowed down beyond expectations, underscoring the easing of inflationary pressures in the US economy and intensified market expectations for the Fed’s rate-cutting path. It should be noted though that the market expects the bank to remain on hold in its next meeting. We highlight the speeches of Fed policymakers scheduled for today as in the absence of any high impact financial releases from the US they could sway the market’s opinion. In the trade war front, in a latest development US President Trump stated that he will be announcing semiconductor tariffs next week. He also stated that there will be flexibility on some companies in the sector. Please note that the White House on Friday announced an exclusion from tariffs for smartphones, computers and certain other electronics imported largely from China yet the Trump stated that the move would be short-lived. Overall a reignition of the market worries for the possible consequences of the trade war could weigh on US stockmarkets, while intensification of market worries for a possible recession in the US economy could weigh on the USD.

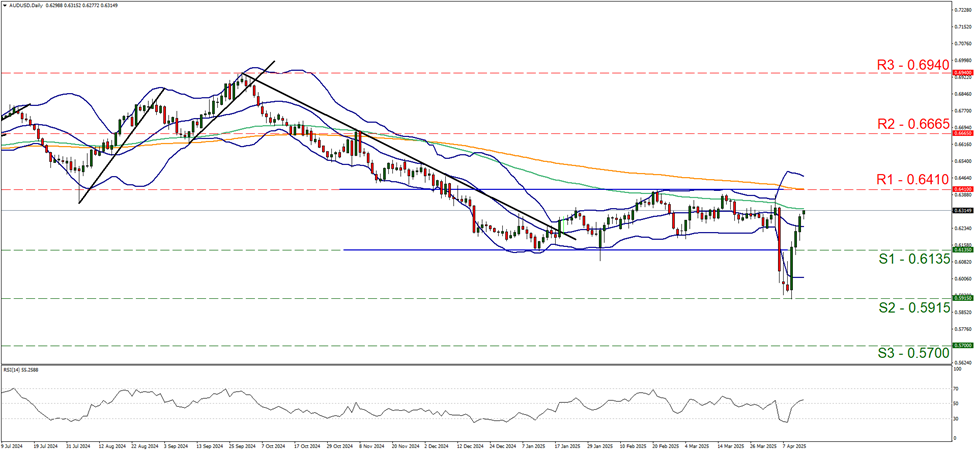

AUD/USD continued to rise yesterday and during today’s Asian session. We note the rise of the pair’s price action, yet at the same time, we also note that the RSI indicator has risen reaching the reading of 50, which on the one hand implies that the bearish sentiment has been erased, while a bullish sentiment has yet to be build up. For a bullish outlook to emerge, we would require the pair to break the 0.6410 (R1) resistance line and start aiming for the 0.6665 (R2) resistance level. Should the bears take over, which currently seems remote, we may see the pair reversing course, breaking the 0.6135 (S1) support line and start aiming for the 0.5915 (S2) support level.

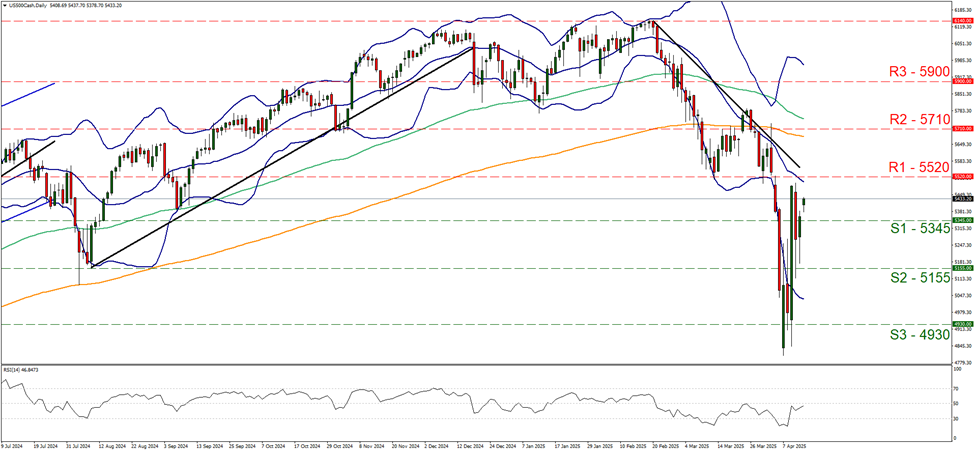

In the equities market, S&P 500 rose on Friday, breaking the 5345 (S1) resistance line now turned to support. The RSI indicator has risen nearing the reading of 50, yet remains for the time being just below that reading, which tends to underscore the lack of a bullish sentiment at the current stage. Should the bulls gain control over the index’s price action, we may see it breaking the 5520 (R1) resistance line and start aiming for the 5710 (R2) resistance level. Should the bears take over, we may see the pair breaking the 5345 (S1) support line and start aiming for the 5155 (S2) support level.

その他の注目材料

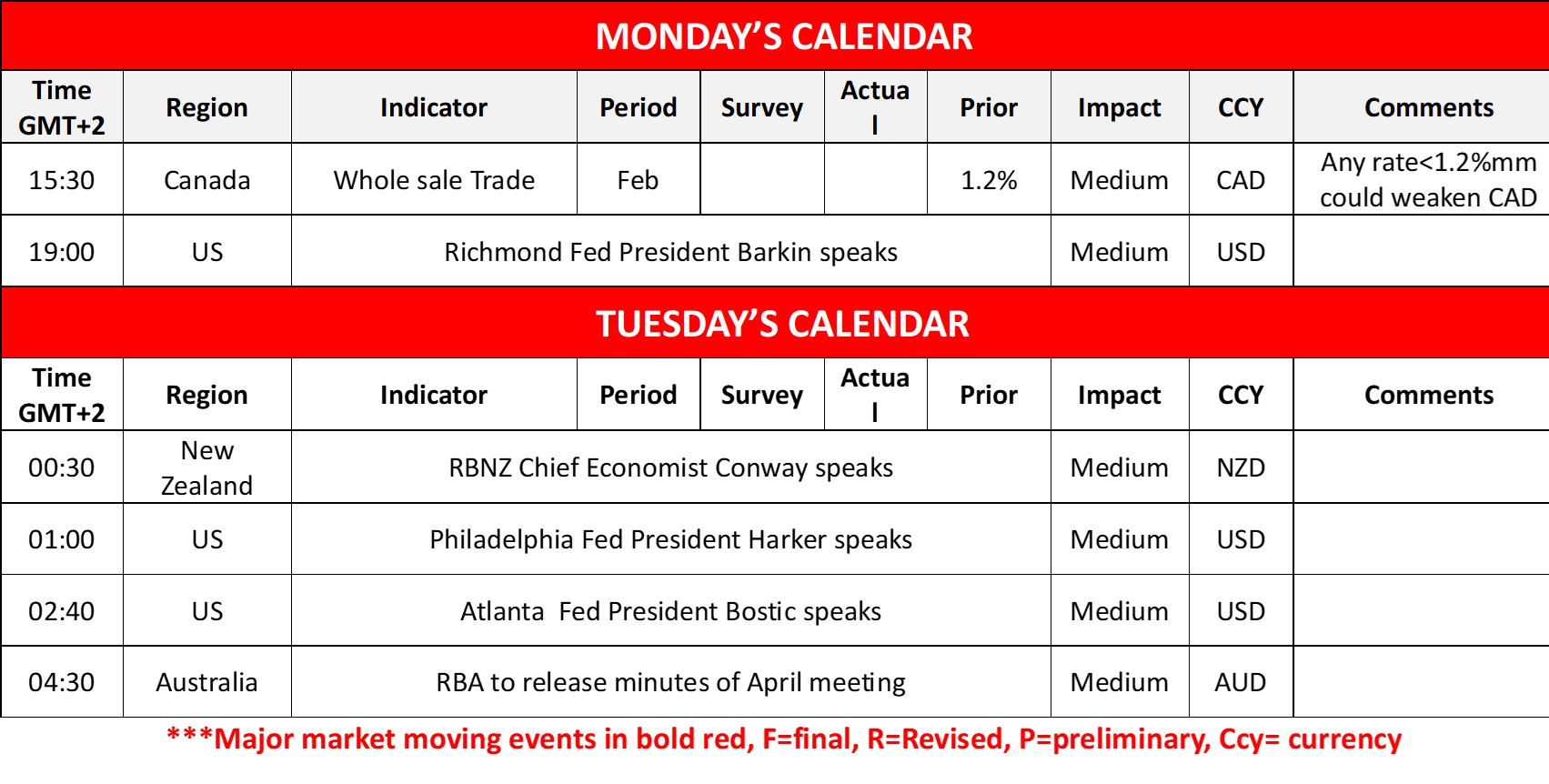

With a rather light calendar today we note the release of Canada’s wholesale trade for February, while Richmond Fed President Barkin speaks. In tomorrow’s Asian session, we note that RBNZ Chief Economist Conway, Philadelphia Fed President Harker and Atlanta Fed President Bostic are scheduled to speak, while RBA is to release the minutes of its April meeting.

今週の指数発表:

On Tuesday we get UK’s employment data for February, Germany’s ZEW economist sentiment figure for April and Canada’s CPI rates for March. On Wednesday we get Japan’s machinery orders rate for February, China’s GDP rate for Q1, the UK’s CPI rates for March, the Eurozone’s final HICP rate for March, the US’s retail sales and industrial production rates for March as well and ending the day is the BoC’s interest rate decision. On Thursday we get New Zealand’s CPI rate for Q1, Japan’s trade balance figure and Australia’s employment data for March, the CBT’s interest rate decision, the US weekly initial jobless claims figure, the US Philly Fed business index figure for April and the ECB’s interest rate decision. Lastly on Friday we note Japan’s nationwide CPI rates for March.

AUD/USD デイリーチャート

- Support: 0.6135 (S1), 0.5915 (S2), 0.5700 (S3)

- Resistance: 0.6410 (R1), 0.6665 (R2), 0.6940 (R3)

S&P 500 Daily Chart

- Support: 5345 (S1), 5155 (S2), 4930 (S3)

- Resistance: 5520 (R1), 5710 (R2), 5900 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。