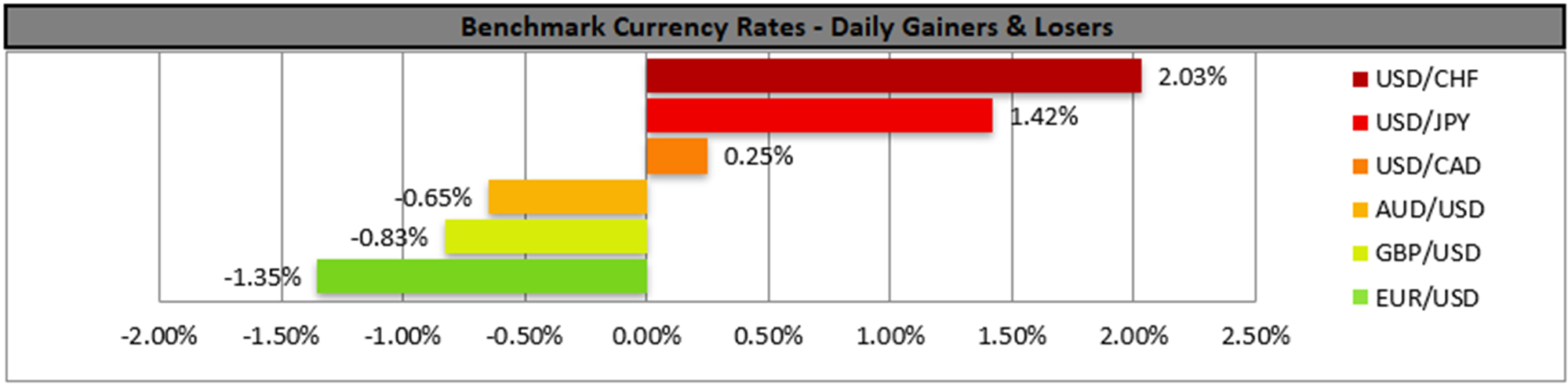

The greenback was on the rise against its counterparts yesterday as US President Trump, practically refrained from prior threats made on Fed Chairman Powell. Trump’s request for Powell’s termination and naming J. Powell a “looser” intensified market worries for the Fed’s independence in the past week. US President Trump yesterday stated “I have no intention of firing him,” also stating that “I would like to see him be a little more active in terms of his idea to lower interest rates“, easing market worries. The news allowed for the greenback to gain and despite some wobbling it seems to stabilise. The market sentiment was also improved by US Treasury Secretary Bessent’s comments that an easing of trade tensions with China is possible, also adding that should there be a trade deal with China, tariffs would be substantially reduced, something verified by Trump as well. The US Treasury Secretary also stated that the current situation is not sustainable which is obvious on both sides of the front, which could be highlighting the willingness of the US to strike a deal with China. At the same time White House officials stated that 18 countries have offered proposals up to this point and the US negotiating team is to start discussions this week. Overall, the comments from the US side tend to point that there is light at the end of the tunnel and further signals for a possible de-escalation could improve market sentiment further thus supporting riskier assets.

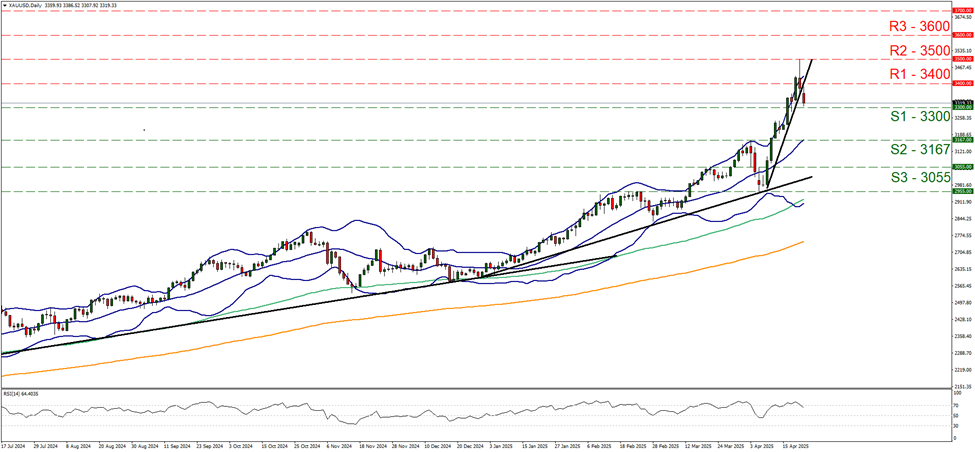

Gold’s price dropped yesterday and during today’s Asian session, breaking the 3400 (R1) support line ,now turned to resistance and continued lower to test the 3300 (S1) support level. In its drop, gold’s price also broke the upward trendline guiding the precious metal’s price since the 9th of April. As the upward trendline has been broken we switch temporarily yesterday’s bullish outlook for the precious metal in favour of a sideways motion bias. For a renewal of the bullish outlook for gold’s price we would require the gold’s price to break the 3400 (R1) resistance line and continue to also break 3500 (R2) resistance barrier, reaching new record high levels. Should the bears take over we may see gold’s price breaking the 3300 (S1) support line and start aiming for the 3167 (S2) support level.

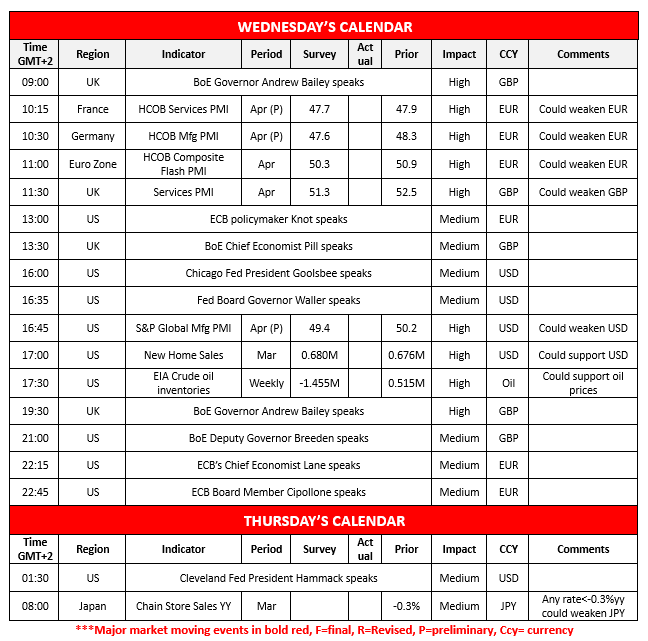

Today we highlight the release of April’s preliminary PMI figures of France, Germany, the Euro Zone as a whole, the UK and the US, with special focus being on the first three. Main indicator in the focus of EUR traders is expected to be Germany’s manufacturing sector which is considered as the “problem child” of the area. Should the indicators imply a deeper contraction of economic activity than expected we may see the common currency retreating and vice versa.

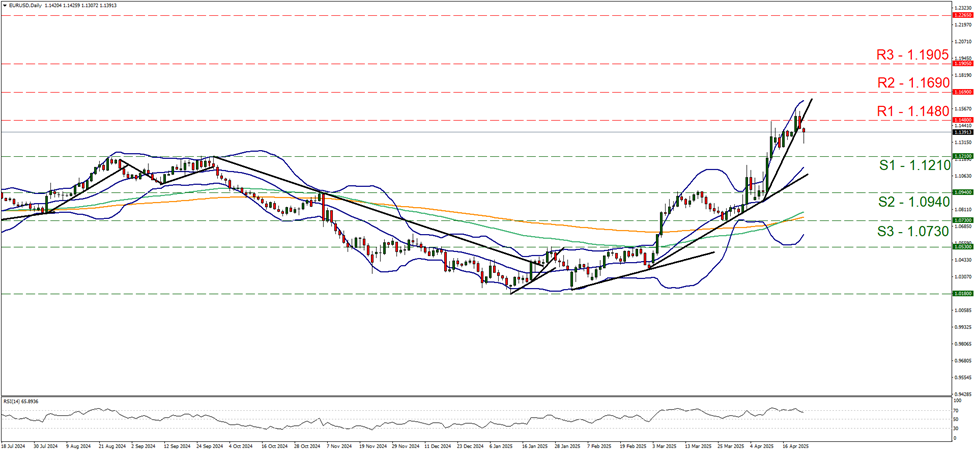

EUR/USD’s wondering over the 1.1480 (R1) level proved to be brief, as the pair dived below it once again turning it to a resistance level. As the upward trendline guiding it since the 9th of April has been broken we abandon for the time being the bullish outlook for the pair and expect a relative stabilisation of the pair’s price action. Yet the RSI indicator remains high and should the bulls regain the initiative, we may see EUR/USD breaking the 1.1480 (R1) resistance line and start aiming for the 1.1690 (R2) resistance level. Should the bears take over, we may see the pair breaking the 1.1210 (S1) support level and start aiming for the 1.0730 (S2) support level.

その他の注目材料

Today we note the release of the US New Home Sales figure for March and oil traders could be more interested in the release of the EIA weekly crude oil inventories figure. On a monetary level, we note the planned speeches of BoE Governor Andrew Bailey, ECB policymaker Knot, BoE Chief Economist Pill, Chicago Fed President Goolsbee, Fed Board Governor Waller, BoE Deputy Governor Breeden, ECB’s Chief Economist Lane and ECB Board Member Cipollone.

EUR/USD デイリーチャート

- Support: 1.1210 (S1), 1.0940 (S2), 1.0730 (S3)

- Resistance: 1.1480 (R1), 1.1690 (R2), 1.1905 (R3)

XAU/USD Daily Chart

- Support: 3300 (S1), 3167 (S2), 3055 (S3)

- Resistance: 3400 (R1), 3500 (R2), 3600 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。