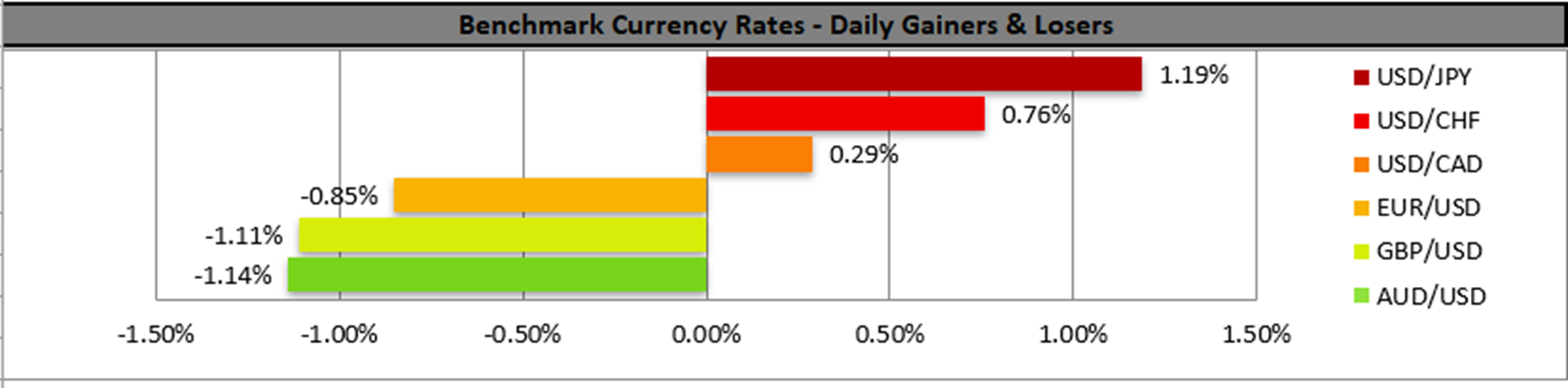

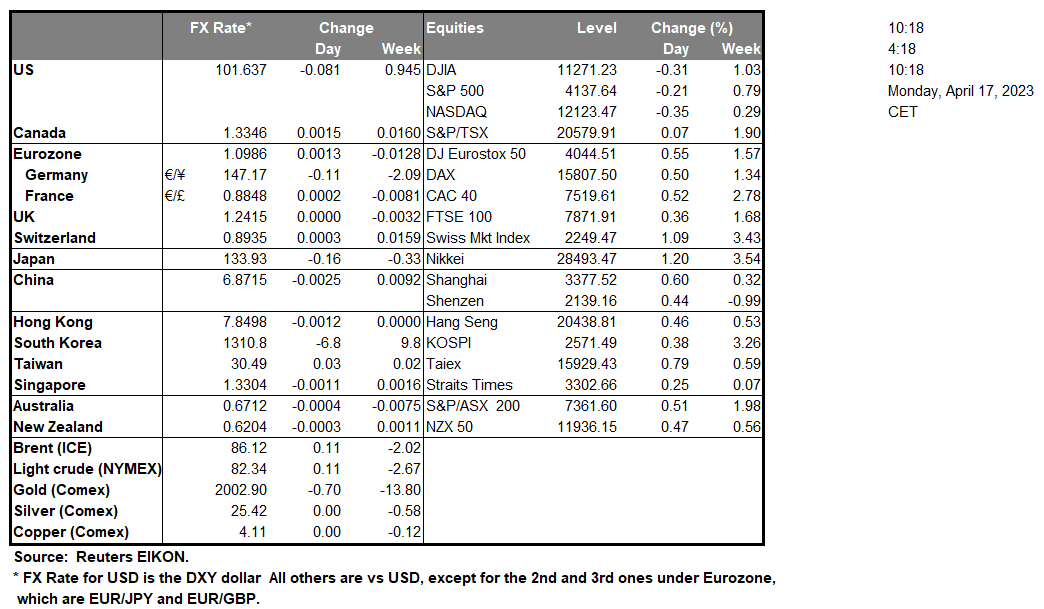

During Friday’s American session, we saw the USD gain across the board following mixed releases on Friday. Retail sales came in lower than expected for March at -1.0% compared to the predicted figure of -0.4% showing a potential tightening in consumer spending, as such reduced consumer spending may limit the Fed’s ability to continue increasing interest rates as the economy may be reaching a slowdown. Yet we note that Industrial production and the Michigan consumer confidence ticked up, potentially indicating that the overall economy may still be growing. Furthermore, we note Fed Governor Waller’s speech on Friday who when discussing the state of Atlanta’s Fed GDP growth tracker stated, “This growth would mean that, so far, tighter monetary policy and credit conditions are not doing much to restrain aggregate demand”,implying that the Fed may need to raise interest rates further during their May meeting thus translating into support for the greenback as we near the FOMC blackout period this Sunday. Moreover we note the earnings release by JPMorgan, Citigroup and Wells Fargo on Friday where all three banks reported greater than expected earnings , in particular JPMorgan posted a 2% increase in deposits ,indicative of the safe heaven inflows from regional banks into larger banks who are perceived as more stable. In the European theatre we highlight Bundesbank President Nagel who on Friday stated that “It is clear that the monetary policy measures still have some way to go for their full effect on inflation to unfold. ” Implying that one of Europe’s largest economies expects interest rates to increase as inflationary Pressures remain high, potentially providing support for the EUR. Last Friday the French Constitutional Court ruled, as was expected in favour of French President Macron’s pension plan to raise the retirement age from 62 to 64. Resulting in continued protests against the Government in one of Europe’s largest economies. This may impact the EUR in the long run as the continued protests may skew economic data for the French economy.

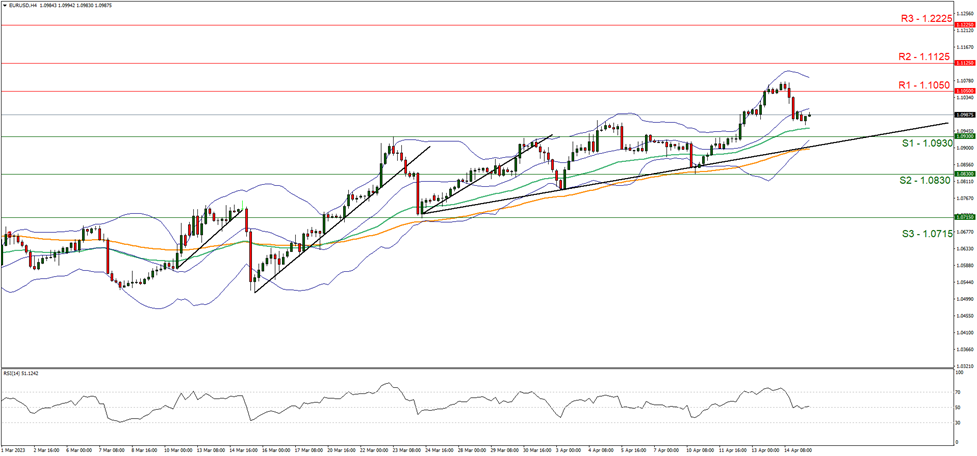

EUR/USD dropped lower yesterday breaking the 1.10 psychological barrier. We tend to maintain a bullish outlook for the pair as the price action remains above the upwards trendline formed on the 24 of March. It should be noted that the RSI indicator is near the reading of 50, implying potential indecisiveness by the market. Should the pair continue to be under the control of the bulls we may see it aiming if not breaking above the 1.1050 (R1) resistance level with the next possible target for the bulls being the 1.1125 (R2) resistance level. On the other hand, should the bears take over the pair, we would like to see a clear break below the 1.0930 (S1) followed by a breaking of the aforementioned upwards trendline, with the next possible targets for the bears being the 1.0830 (S2) support base. However, should the pair remain between support at 1.0930 (S1) and resistance at 1.1050 (R2) in addition to the RSI indicator remaining at 50, we could potentially see the pair move in a sideways motion.

その他の注目材料

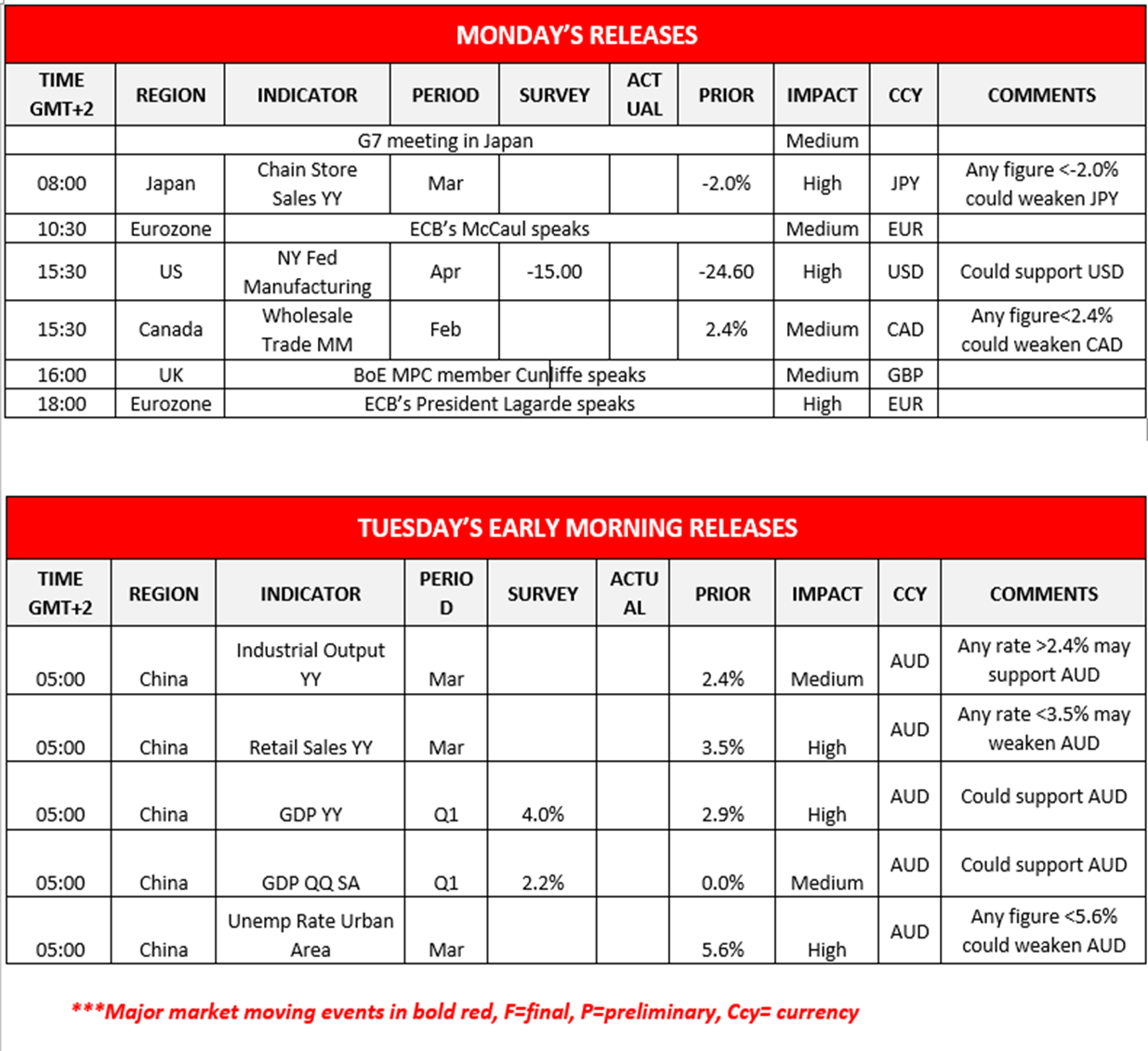

In Europe’s session, note ECB’s McCaul’s speech. In the American session we note the NY Fed Manufacturing survey for April followed by Canada’s Wholesale sales for February. Furthermore, we note that ECB’s President Lagarde and BoE MPC Cunliffe are due to speak later during the day. During tomorrow’s Asian sessions we note China’s Industrial Output,Retail sales and Unemployment Rate all for March, in addition to GDP rates for Q1.

EUR/USD 4時間チャート

Support: 1.0930 (S1), 1.0830 (S2), 1.0715 (S3)

Resistance: 1.1050 (R1), 1.1125 (R2), 1.2225 (R3)

USD/JPY 4時間チャート

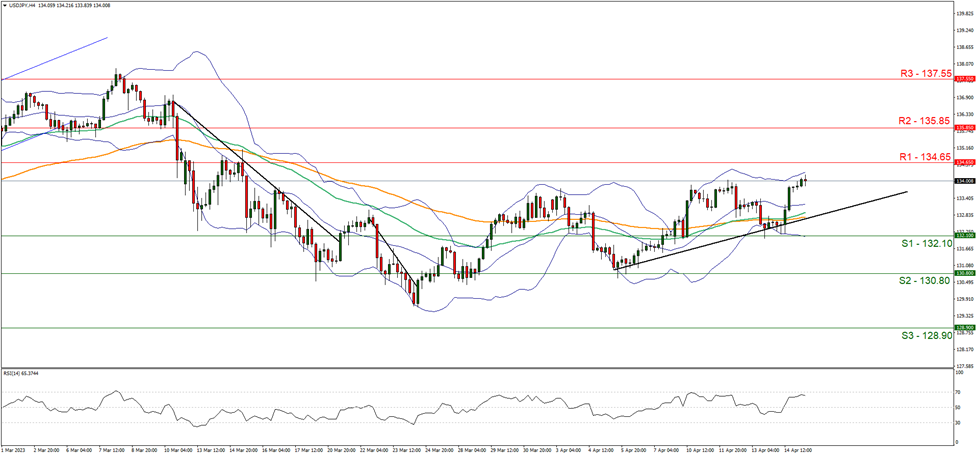

Support: 132.10 (S1), 130.80 (S2), 128.90 (S3)

Resistance: 134.65 (R1), 135.85 (R2), 137.55 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。