WTI moved slightly higher since last Friday. Prospects for future demand and production levels appear to be continuing in guiding the market sentiment and oil prices, with the Fed’s interest rate decision in sight. In this report, we aim to shed light on the factors driving WTI’s price, assess its future outlook and conclude with a technical analysis.

Oil traders look to next week’s interest rate decision by the FED

Traders may be shifting their attention to next week’s Fed interest rate decision. The monetary policy meeting by the FOMC next week may play a key role in oil’s prices. The Fed’s interest rate decision may provide a future outlook into how demand for oil will play out, where should the Fed continue its aggressive rate hiking policy, we may see demand decrease as the Fed tightens its grip on the economy and thus reducing the price of crude. Whereas should the Fed pause or in the extreme scenario cut interest rates, it may ease the noose around the US economy, which could facilitate an in increase in economic activity, hence increasing the price of oil through higher demand factors.

OPEC+ meeting seems to maintain the status quo

Last, week we highlighted the potential outcomes from the OPEC+ meeting, in which we correctly anticipated that Saudi Arabia will push for further production cuts, yet it appears that the further voluntary production cuts by Saudi Arabia by 1mn barrels of oil per day, seem to have had a minimal impact on the overall market sentiment. Furthermore, the voluntary production cut seems to have been underscored by the group’s overall pushback on further production cuts and as such seemed to underscore the kingdom’s attempts to keep oil prices at a higher level. However, brent トレーダー may find a silver lining, as OPEC+ announced that the oil production cuts of 3.66 million bpd in 2022 and the surprise cut of another 1.66 million bpd in April, will be extended into 2024.

China’s trade data troubles oil trader

China’s trade balance that was released on Wednesday, seemed to indicate that the world’s largest oil importer may be losing steam. Despite imports increasing, the exports figure was significantly lower than what was expected, coming in at -7.5% compared to the expected figure of -0.4%. The deterioration in exports, may hint that China’s manufacturing economy is feeling the brunt impact of a reduction in global demand and as such the 中国語 manufacturing economy may seea slowdown in itseconomy. In turn, a reduction in demand by China may have a significant impact on the price of oil, as the oil guzzling giant sees a reduction in demand for its exports.

テクニカル分析

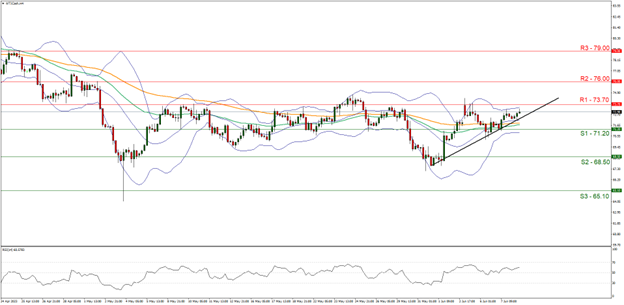

WTI Cash 4H Chart

- Support: 71.20 (S1), 68.50 (S2), 65.10 (S3)

- Resistance: 73.70 (R1), 76.00 (R2), 79.00 (R3)

WTI seems to be attempting to recoup the loses made from the beginning of the week, as the commodity’s price is currently aiming for the 73.70 (R1) resistance level. We maintain a bullish outlook for the commodity as the RSI indicator below our 4-Hour chart is above the figure of 50, implying a bullish market sentiment and supporting our case is the upwards trendline formed on the 1 of June. For our bullish outlook to continue, we would like to see a clear break above the 73.70 (R1) level with the next possible target for the bulls being the 76.00 (R2) resistance ceiling. On the other hand, for a bearish outlook, we would like to see a clear break below support at the 71.20 (S1) level with the next potential target for the bears being the 68.50 (S2) support base.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.