WTI appears to be moving higher following statements made by the Saudi Energy Minister during OPEC’s two-day seminar. In this report, we aim to shed light on the factors driving WTI’s price, assess its future outlook and conclude with a technical analysis.

OPEC’s two-day seminar.

We note some interesting developments in the oil markets, following the beginning of OPEC’s two-day seminar which started yesterday. The UAE’s energy minister stated that they would not be announcing any extra voluntary cuts, striking a blow to the Kingdom’s ambitions to drive oil prices up, following a statement by Saudi Arabia’s energy minister that the recent production cuts by Riyadh and Moscow showed ‘unity’. In addition, the Kingdom announced that they will extend by 1-month their oil production cut, in an apparent attempt to drum up oil prices. Furthermore, the energy minister stated that “the market will not be left unattended”, seemingly showing cracks in the perceived unity of OPEC, with Saudi Arabia trying to increase prices, whilst other nations are attempting to increase production, or at the very least keep them at current levels.

China’s worrying economic data.

The release of China’s Caixin Services PMI figure for June, which came in lower than expected. The continued deterioration in 中国語 economic activity, could be of concern to oil traders, as it may be perceived as an early warning signal that one of the world’s largest economy’s, appears unable to induce economic growth, following it’s post pandemic re-opening. Furthermore, the ongoing Geopolitical tensions between the US そして China, could impact oil prices, with China stating that they would be controlling the number of exports of some 金属 that are widely used for the construction of semi-conductors. Should the tit for tat measures continue, we may see the Chinese Manufacturing Industry feel the brunt of a gradual decoupling by world economies, in order to avoid being swept up in the peacock like manners of the world’s two largest economies. Therefore, on a more macro-economic view we may see oil prices moving lower, given China’s status as the world largest oil guzzling giant, should their economic woes continue.

India’s oil refineries settle payments using the Chinese Yuan.

According to a report by Reuters, Indian oil refineries have announced that they will be paying for Russian oil using the Chinese Yuan. Such a move could potentially help Russia evade sanctions, imposed by the United States and their allies. Furthermore, potential evasion of sanctions, could even undermine OPEC’s attempts to reduce oil production, as Russia could possibly continue pumping oil into the market via India, using the country as a “distribution” hub into the global oil markets.

Iran attacks two oil tankers in the Gulf of Oman

According to the U.S. Naval Forces Central Command of the U.S. 5th Fleet, the US Navy on Wednesday prevented Iranian warships from seizing two oil tankers off the coast of Oman. According to various media outlets, the Iranian warships fired warning shots at the two tankers but backed off once the US Naval vessel arrived on scene. Should the security of one of the world’s most crucial oil arteries be questioned, we may see market worries of a threat to the supply of oil being translated into higher prices for the commodity.

テクニカル分析

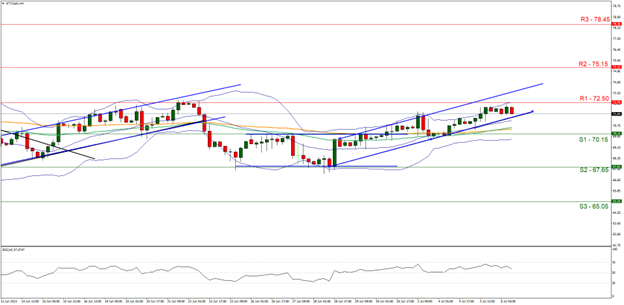

WTI Cash 4H Chart

- Support: 67.65 (S1), 66.05 (S2), 63.00 (S3)

- Resistance: 70.15 (R1), 72.50 (R2), 75.15 (R3)

WTICash appears to continue moving in upwards fashion. We maintain a bullish outlook for the commodity and supporting our case is the upwards moving trendline and an upwards moving channel incepted on the 28 of June.

In addition, the RSI indicator below our 4-Hour chart nearing above the figure of 70, implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 72.50 (R1) resistance level, with the next possible target for the bulls potentially being the 75.15 (R2) resistance level.

On the other hand, for a bearish outlook we would like to see a clear break below the 70.15 (S1) support level, with the next possible target for the bears being the 67.65 (S2) support base. On a more fundamental note, despite the newly found support for oil, should the worries about a recession on a global scale continue, we would not be surprised to see the liquid gold reverse trajectory.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.