WTI moved lower for the 4 week in a row, dropping to one month lows. Prospects for future demand and production levels seem to remain in the epicentre of attention for market participants, guiding the market sentiment and oil prices. In this report, we aim to shed light on the factors driving WTI’s price, assess its future outlook and conclude with a technical analysis.

US oil market continues to tighten.

The Oil market appeared to further tighten last Friday, when the US Baker Hughes oil rig count dropped to levels last seen in June 2020. The continuation of the reduction of oil rigs, appears to aid to the narrative that Oil producers alongside the market are anticipating global economies to enter a recession. Furthermore, fears of a reduction in global demand, where heightened following the release of China’s NBS Manufacturing PMI figures which indicated a contraction in the manufacturing activity of the world’s largest oil importer. However, China’s Caixin Manufacturing PMI figures, indicated a different picture, as the figure rose to 50.9 from its previous 49.5, hence implying an expansion in manufacturing activity. Given that the two appear to be at odds as to whether China’s Manufacturing activity has contracted または expanded, yet our personal view is that China’s Manufacturing activity has potentially declined as the mounting tensions between China and the US seem to have deterred long term investment from US based companies.

US default worries appear to have eased.

Oil - (原油) participants see the light at the end of the tunnel, following the passing of the US debt ceiling bill by the House of Representatives on Wednesday, with the bill now being sent to the Senate where it is anticipated to be voted through. The positive development may have provided some support for oil’s prices, as the risk of a US default has greatly diminished. Hence by avoiding a recession, producers are regaining some confidence that demand for oil will continue, hence temporarily halting the liquid golds decent. However, on the extreme possibility that it does not pass the Senate, we may see Oil - (原油) further weakening. Lastly, by passing the debt ceiling bill, oil market confidence may be more optimistic in the long run, as the bill also includes that the National Environmental Policy act will be limited to just two years for Federal projects and as such may provide further support for oil’s price in the future, as less regulatory obstacles may be in the way of new projects.

OPEC+ meeting this weekend.

Last but not least we highlight the importance of OPEC+ meeting during this weekend. Surprisingly it has been reported that various media groups have been barred from attending the meeting, a move which is highly irregular and as such may have increased market ボラティリティ. Following last week’s comments by Saudi Arabia’s energy minister who warned speculators to “watch out”, we anticipate that Saudi Arabia will push for further production cuts, potentially supporting oil’s price. In addition, in the grander scheme of things, with the price of Oil dropping significantly we hypothesize that should OPEC+ announce oil cuts, they may be smaller in magnitude and more of a symbolic cut but could still support oil’s price. However, on the other hand should they increase または maintain production, then we may see Oil - (原油) further weakening as there will be an increase in supply in the oil market, thus making oil, cheaper for buyers.

テクニカル分析

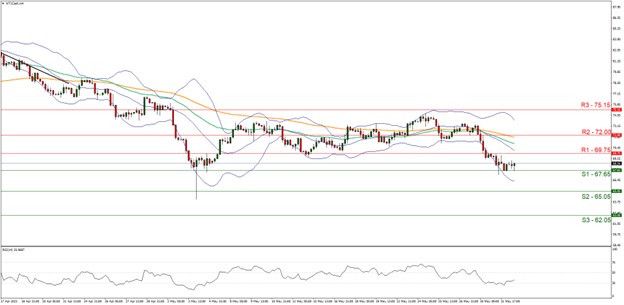

WTI Cash 4H Chart

- Support: 67.65 (S1), 65.05 (S2), 62.05 (S3)

- Resistance: 69.75 (R1), 72.00 (R2), 75.15 (R3)

WTI seems to continue its downwards decent during the week, breaking below the support line, now turned resistance at 69.75 (R1). The commodity’s price erased two weeks gain’s during this week, despite easing US default fears, yet it is likely that the main driver of the commodity’s price may be OPEC+ meeting this weekend. Despite the RSI indicator remaining below 50 and near the 30 figure, implying a strong bearish market sentiment, we anticipate that OPEC+ may increase production cuts and as such we maintain a bullish outlook. For our bullish outlook to occur, we would like to see a clear break above the 72.00(R2) level with the move towards if not also breaking potential resistance at 75.15 (R3). On the other hand, should the bears continue their reign, we may see the break below the 67.65 (S1) support level with the next potential target for the bears being the 65.05 (S2) support base. We stress the importance of the OPEC+ meeting during this weekend, which has the potential to usurp the market due to their significance and ability to dictate to a great degree of the world’s oil production.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.