After several weeks of moving in a sideways range, WTI continues to trade nearby $100 per barrel. Traders have a lot of information to digest at the moment, as geopolitical tensions, post pandemic issues and supply demand constrains continue to drive the market. In this outlook we aim to highlight the most important subjects relating to the Oil market and their potential of creating volatility. We will also provide a WTI technical analysis to support traders with a complete report on both technical and fundamental information.

During the past days, weekly US Oil market data created volatility for WTI once again reminding market participants that the releases should not be taken lightly. On Tuesday the 26 of April the American Petroleum Institute inventory levels indicated stocks where in a surplus of 4.78M barrels. Minutes after the release WTI’s price dropped approximately $0.50. Moreover, on the 27 of April during the important Energy Information Administration’s (EIA) Crude Oil Inventories release, a minor surplus of 0.70M barrels was indicated. Due to the fact that the market expected a notable surplus of 2M barrels, the figure did not go unnoticed and WTI rose nearby $1 upon release. The market seems to respond more forcefully to figures that do not match the forecasted ones. Thus, we would advise traders to keep an eye on the releases in the next week.

At the moment, Oil traders are constantly monitoring developments in China as after Shanghai, Beijing is now increasing COVID-19 restrictions. China, the world’s biggest oil importer has the potential to destabilize supply and demand ends and create substantial volatility within the Oil market. In the scenario of a general lockdown in Beijing we could see Oil prices tumbling. On the other hand, a partial lockdown can create some bearish tendencies for WTI but perhaps not as strong as the first scenario. Major media sites and sources are expected to cover for any updates on the specific subject thus traders are advised to be mindful of unexpected market reactions.

On a different front, Russian tensions in Ukraine continue to create uncertainty within the Oil market. The Russia-Ukraine conflict is expected to persist and no signs of ceasefire can be seen at the moment. On the one hand, Russia a distinguished and key player in the OPEC plus agreement, seems to be creating more tensions in Ukraine forcing western nations to ban its Oil trade. A report by Reuters noted, “Russia may see its oil production drop by as much as 17% in 2022”. However, with no major Oil producing nations showing interest in covering for such a loss in supply, Oil prices could receive support. This is a very delicate and complicated matter from our point of view as higher energy prices could lead to higher commodity prices and eventually strengthen inflationary pressures even more. Thus, this subject could further exacerbate worries on oil demand and at the same time send contradicting messages or forces to traders and WTI prices accordingly.

Finally, as a lot of speculation over OPEC’s next steps is reiterated among market participants, we would like to make a brief reference to the upcoming OPEC+ meeting on the 5 of May. Despite the Oil market being under immense uncertainty with the subjects detailed in the report, OPEC plus is expected to agree another 432,000 barrel per day oil output increase for June. Any change in the output figure could create notable volatility yet OPEC’s views on the major geopolitical subjects at the moment can be very interesting also for traders.

テクニカル分析

WTICash H4

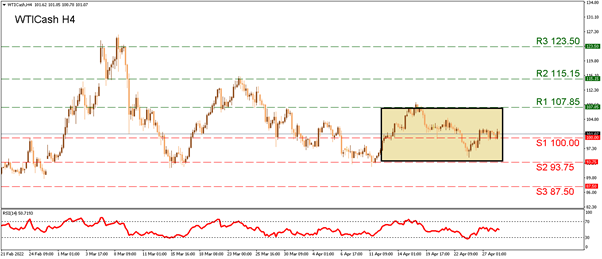

With the price action revolving around the (S1) 100 support, we have evidence that this level is recognized by the market. Yet other important levels at the moment are the (R1) 107.85 resistance and the (S2) 93.75 support. This range (coloured in grey) has been used throughout April and even though the levels have been tested, they have withstood pressure. Any move above or below this range, can be evidence the current sideways trend, may be changing accordingly. If the commodity heads lower, we note the (S2) 93.75 support as the next possible stop for the bears, while the (S3) 87.50 stands as our final support line. In the scenario of a movement higher, we could see the (R2) 115.15 level being targeted by traders while the top consists of the (R3) 123.50 which remains the multiyear high level reached that was last tested on the 9 of March. The RSI indicator remains across the 50-level displaying some uncertainty among traders.