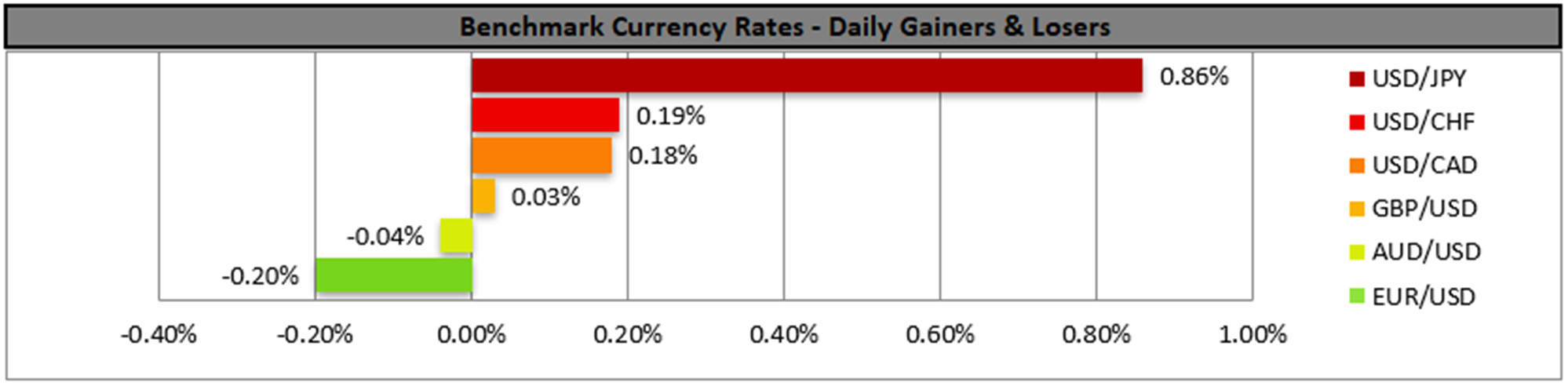

The USD continued to strengthen yesterday as US President Trump’s tariff deadline is nearing. In a latest development on the tariff front, the US President announced that he intends to impose 25% tariffs on Japanese and South Korean products entering the US. Reuters reported that Japan’s PM Ishida stated that negotiations are expected to continue in an effort to find a possible win-win deal, yet the news caused the JPY to tumble against the USD yesterday. Overall, we expect volatility to rise as the markets seem to remain nervous and should the USD regain its safe haven qualities, it may get some support should tensions rise.

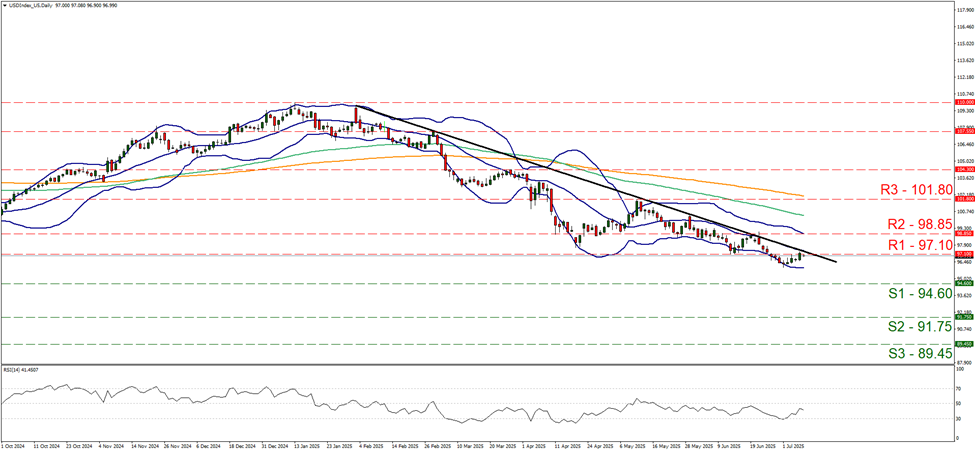

On a technical level, we note that the USD Index rose yesterday, testing the 97.10 (R1) resistance line and signalling a strengthening of the USD against a basket of its counterparts. For the time being we maintain our bearish outlook as long as the downward trendline guiding the index since early March, remains intact. We also note that the RSI indicator despite rising remained below the reading of 50, implying a weakening of the bearish sentiment among market participants, yet for the time being is still there. Should the bears maintain control as expected, we may see the index starting to aim the 94.60 (S1) support line, while even lower, we note the 91.75 (S2) support base. We consider a bullish outlook currently as remote, and for its adoption we would require the index to rise, break initially the prementioned downward trendline in a first signal of an interruption of the downward movement, break also the 97.10 (R1) resistance line, proceed to break clearly also the 98.85 (R2) resistance level and start aiming for the 101.80 (R3) resistance base.

In today’s Asian session, RBA took the markets by surprise as it unexpectedly decided to remain on hold, keeping the Cash rate at 3.85% and causing the Aussie to jump in the FX market. In its accompanying statement the bank expressed doubts for the path of inflationary pressures in the Australian economy, and given the existing cuts accumulating to a 50 basis points lowering of the Cash rate, the bank judged that it had the room to wait. Overall, the release took the markets by surprise as mentioned above, yet the market continues to lean on the dovish side as its expectations to cut rates three times until the end of the year are maintained.

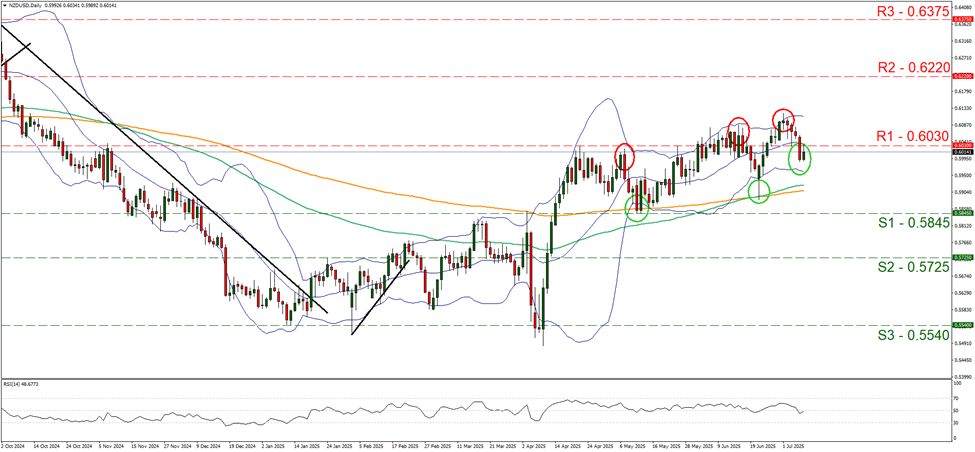

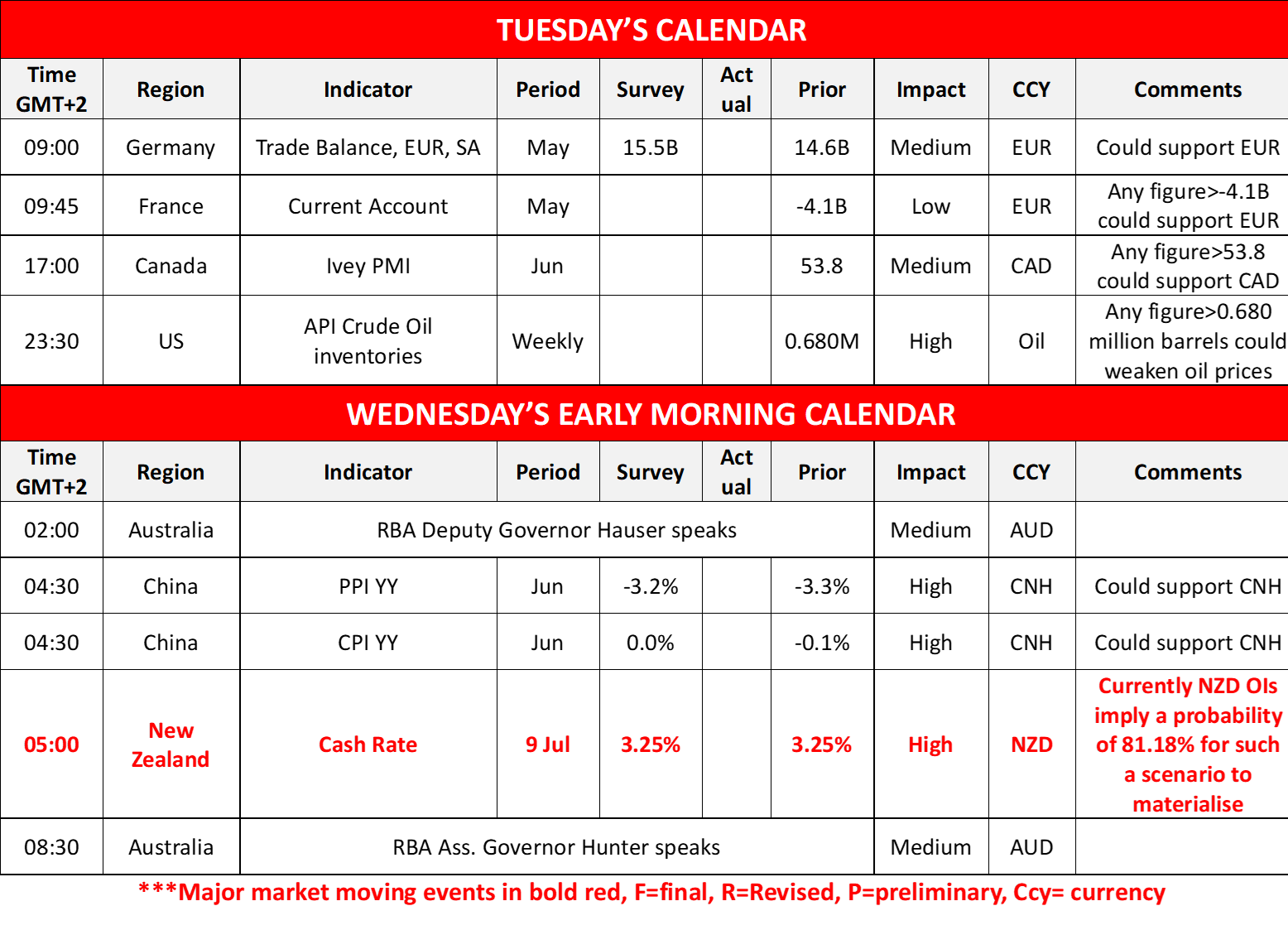

In tomorrow’s Asian session, we note from New Zealand the release of RBNZ’s interest rate decision, and the market expects the bank to remain on hold. Currently, NZD OIS imply a probability of 81% for such a scenario to materialise and also imply that the market expects to deliver a rate cut in the August meeting, maintaining afterwards the cash rate unchanged until the end of the year. Should the bank remain on hold as expected and should the bank signal its readiness to proceed with a rate cut in the next meeting, we may see the Kiwi slipping as the market’s dovishness could be enhanced.

NZD/USD dropped yesterday breaking the 0.6030 (R1) support line now turned to resistance. As for the pair’s direction, we note the consecutive higher peaks and troughs, which could imply some bullish tendencies as could the upward direction of the 100, 200 and 20 moving averages, yet RSI indicator remains near the reading of 50 implying a relative indecisiveness on behalf of market participants. Should the bulls take over, we may see the pair breaking the 0.6030 (R1) resistance line and start aiming for the 0.6220 (R2) resistance level. Should the bears take over we may see the pair aiming if not breaching the 0.5845 (S1) support line.

その他の注目材料

Today we get Germany’s trade data for May, France’s current account balance for the same month, Canada’s Ivey PMI figure for June and oil traders may find more interesting the release of the weekly US API crude oil inventories figure. In tomorrow’s Asian session, we get China’s inflation metrics for June and on a monetary level, we note that RBA’s Hauser and Hunter are scheduled to speak.

USD Index Daily Chart

- Support: 94.60 (S1), 91.75 (S2), 89.45 (S3)

- Resistance: 97.10 (R1), 98.85 (R2), 101.80 (R3)

NZD/USD Daily Chart

- Support: 0.5845 (S1), 0.5725 (S2), 0.5540 (S3)

- Resistance: 0.6030 (R1), 0.6220 (R2), 0.6375 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。