US President Trump threatened to impose additional tariffs of 50% on Chinese products entering the US, should the Chinese not revoke the reciprocal 34% tariffs imposed on US products. The US seems also to halting any negotiations for the issue with China, while other countries are welcomed to discuss. The Chinese seem to be decided to go through with their counter-tariffs and it’s characteristic that China vowed not to bow to “blackmail” from the US and to “fight to the end”. We expect the trade war to continue to dominate the market’s attention and the market turmoil to be maintained if not intensified, which in turn may increase market cautiousness and thus weigh on riskier assets while safe havens may get some inflows. The second issue for the week may prove to be the release of the US CPI rates for March in tomorrow’s early American session. Please note that tomorrow in the late American session we also get the Fed’s March meeting minutes in a period when the Fed’s doubts for extensive rate cuts seem to increase and the Fed’s independence comes under fire from US President Trump. Hence we expect the uncertainty in the markets to be maintained not only on a fundamental issue but also on a macroeconomic level and a monetary level.

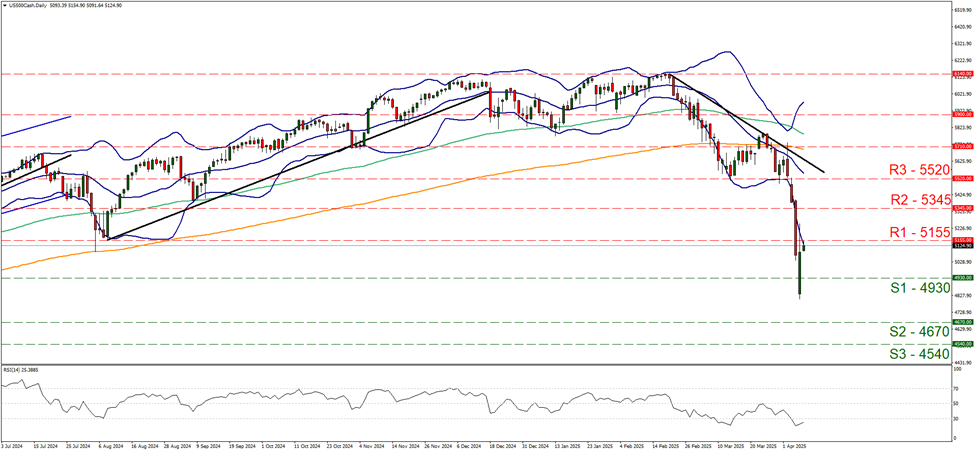

S&P 500 opened with a negative gap yesterday yet recovered the lost ground and then some in today’s Asian session, as it put the 5155 (R1) resistance line to the test. For the time being we treat the index’s correction higher as just that, a correction, and not a change of trend, thus we maintain our bearish outlook for the index. It’s characteristic that the correction was made after the index’s price action dropped below the lower Bollinger Band, with the price action reaching it only now, implying that the correction higher may not be over yet. The RSI indicator despite correcting higher is still below the reading of 30 highlighting that the market sentiment is still strongly bearish for the index yet at the same also implying that the index is still at oversold levels, and the correction higher could be extended. Should the bulls get a chance and take over, we may see the index breaking the 5155 (R1) resistance line and continue higher to break the 5345 (R2) and the 5520 (R3) resistance level. Should the bears renew their dominance over the index’s price action, we may see S&P 500 breaking the 4930 (S1) support line and start aiming for the 4670 (S2) support level.

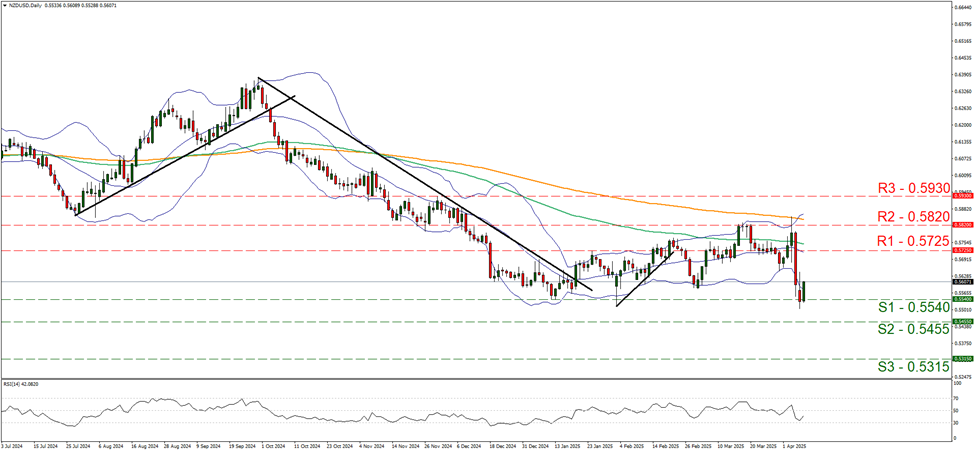

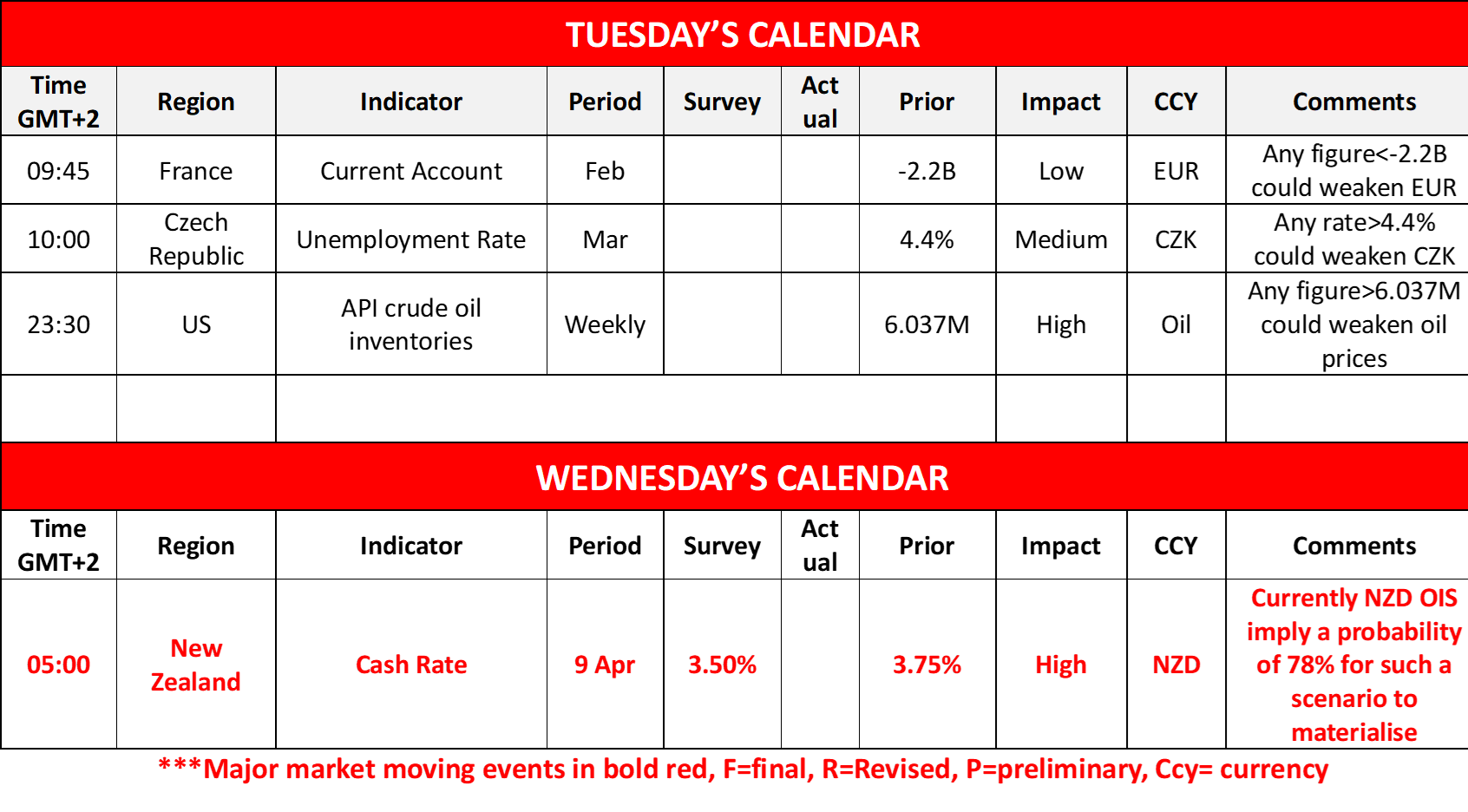

In tomorrow’s Asian session we highlight from New Zealand RBNZ’s interest rate decision. The bank is expected to deliver a 25 basis points rate cut and NZD OIS imply a probability of 75% for such a scenario to materialise, with the rest implying that also a double rate cut is also possible. The market’s dovish expectations are enhanced as besides tomorrow’s rate cut the market expects another three rate cuts by the bank until the end of the year. Hence, should the bank deliver the 25 basis points rate cut as expected, we may see the market attention turning towards the bank’s forward guidance and should the tone not be dovish enough we may see the Kiwi getting some support as the market would have to readjust its expectations and reposition its stance in regards to the NZD.

On a technical level, we note that NZD/USD dropping on Friday and Monday as the USD strengthened, yet recovered in today’s Asian session after bouncing on the 0.5540 (S1) support line. We note that the RSI indicator has corrected higher, yet remains below the reading of 50 which may imply that the bearish sentiment may have eased, yet a bearish predisposition may still be present for the pair. We tend to maintain our bearish outlook for now, and if the bears regain control over the pair, we may see NZD/USD breaking the 0.5540 (S1) support line and start aiming for the 0.5455 (S2) support level. Should the bulls take over, we may see NZD/USD breaking the 0.5725 (R1) resistance level and start aiming for the 0.5820 (R2) line.

その他の注目材料

Today we get France’s current account balance for February, the Czech unemployment rate for March and late in the American session, we get the weekly API crude oil inventories figure.

S&P 500 Daily Chart

- Support: 4930 (S1), 4670 (S2), 4540 (S3)

- Resistance: 5155 (R1), 5345 (R2), 5520 (R3)

NZD/USD Daily Chart

- Support: 0.5540 (S1), 0.5455 (S2), 0.5315 (S3)

- Resistance: 0.5725 (R1), 0.5810 (R2), 0.5930 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。