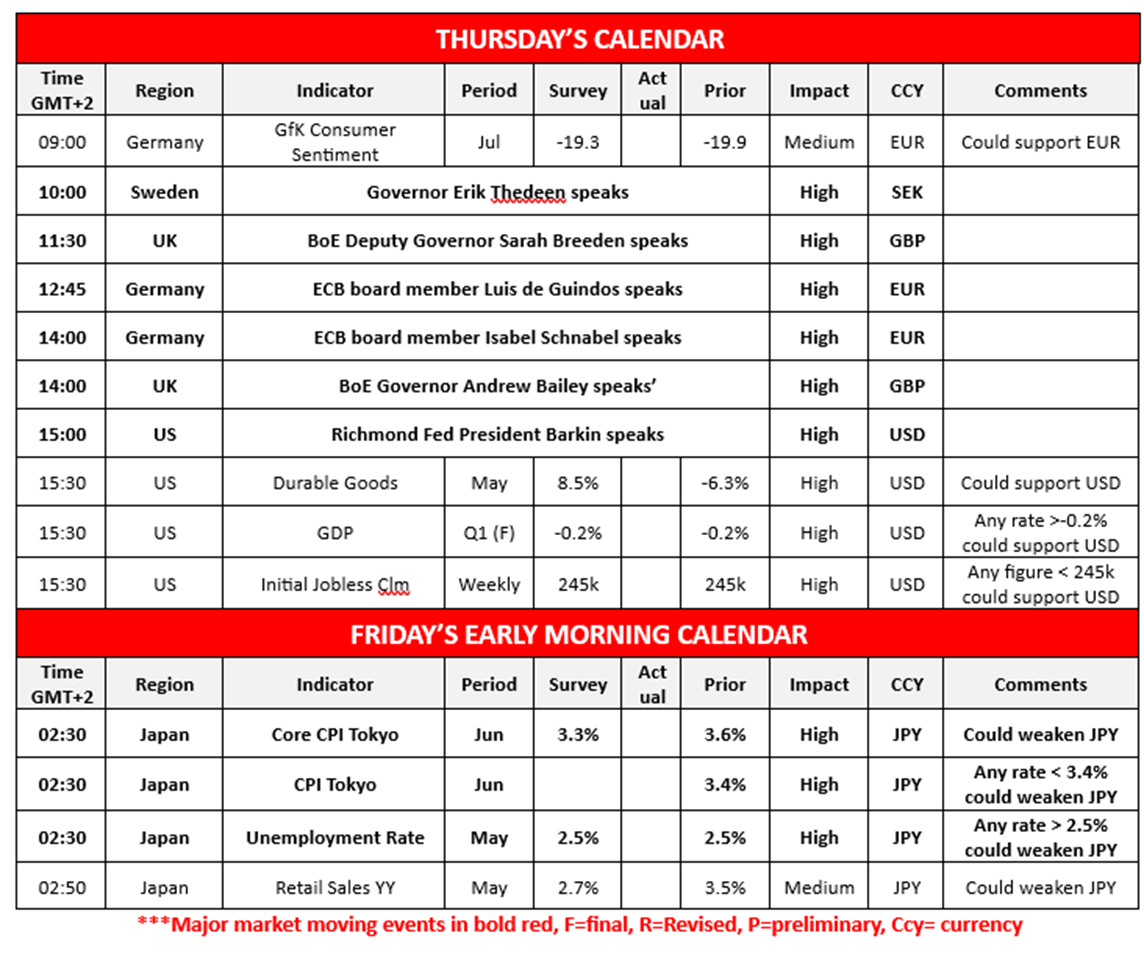

Japan’s Tokyo CPI rates are set to be released during tomorrow’s Asian session. In particular, the Core CPI rate for June is set to come in at 3.3% which would be lower than the prior reading of 3.6%. Therefore in such a scenario where the CPI rates showcase easing inflationary pressures in the Japanese economy, it may increase pressure on the Bank of Japan to refrain from aggressively hiking interest rates in the near future as their current monetary policy path may be bearing some fruit. In turn this could weigh on the JPY. However, should the inflation print come in higher than expected or even showcase an acceleration of inflationary pressures in the Japanese economy, it may have the opposite effect. Such as potentially increasing pressure on the bank to resume on their rate hiking cycle, which in turn may aid the JPY. Nevertheless, even inflation at 3.3% is still above the bank’s inflation target. The US Durable goods orders rate for May is set to come in at 8.5% which would be significantly higher than the prior months rate of -6.3% and thus should the rate come in as expected or higher it may aid the dollar. Whereas should the financial release disappoint market participants by coming in lower than expected it may weigh on the dollar. In the US according to various media outlets, President Trump is considering candidates for the position of the Fed Chair. According to Reuters the leading contenders are reportedly “Former Fed Governor Kevin Warsh, National Economic Council head Kevin Hassett, current Fed Governor Christopher Waller, and Treasury Secretary Scott Bessent.” Regardless, it is our view that the new Fed Chair may be picked based on their dovish views, which may align with President Trump’s ambitions.

XAU/USD appears to be moving in a predominantly sideways fashion. We opt for a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 which tends to imply a neutral market sentiment. However, the MACD indicator below our chart which tends to imply bearish market tendencies. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and the 3385 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2). Lastly, for a bullish outlook we would require a clear break above the 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

EUR/USD appears to be moving in an upwards fashion with the pair currently attempting to clear our R1 level. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our charts which now registers a figure close to 70, implying a strong bullish market sentiment, in addition to our MACD indicator below our chart. For our bullish outlook to be maintained we would require a clear break above the 1.1685 (R1) resistance level, with the next possible target for the bulls being the 1.1885 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between the 1.1445 (S1) support level and the 1.1685 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.1445 (S1) support level, with the next possible target for the bears being the 1.1185 (S2) support line,

その他の注目材料

Today we note the release of Germany’s Gfk consumer sentiment for July, the US Durable Goods orders rate , the final US GDP rate for Q1 and the US weekly initial jobless claims figure. In tomorrow’s Asian session, we get Japan’s Tokyo CPI rates for June, the unemployment rate for May and retail sales rate for May as well. On a monetary level, we note the flurry of speeches starting with Riksbank Governor Theeden, BoE Deputy Governor Breeden, ECB member De Guindos, ECB member Schnabel, BoE Governor Bailey and Richmond Fed President Barkin.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

EUR/USD Daily Chart

- Support: 1.1445 (S1), 1.1185 (S2), 1.0950 (S3)

- Resistance: 1.1685 (R1), 1.1885 (R2), 1.2070 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。