Gold continues its upwards trajectory, as markets anticipate a pause by the FOMC tomorrow. In turn, the precious may capitalize on a weaker greenback and move higher. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

US CPI print comes in lower than expected

Today’s CPI print, came in slightly lower than what was expected ,yet the Core CPI which is the Fed’s favorite tool for gauging inflationary pressures came in lower as was anticipated, potentially validating part the comments made by Philadelphia Fed President Harker of “skipping” the FOMC meeting which is set to take place tomorrow. Following the CPI print, the greenback appears to have weakened against its counterparts, as signs of easing inflation appear to be swinging the market sentiment in favor of the Fed keeping the interest rates at par, rather than continuing its aggressive rate hiking path. With the pressure on the Fed to hike interest rates now easing, we note the weakening of the greenback against its peers may have facilitated the precious metals rise to higher ground. Once again highlighting the inverse relationship between the precious and the greenback, allowing gold to capitalize on the dollar’s weakness and move higher, as it will now be cheaper for oversees investors to buy gold which is denominated in US dollars.

China continues its gold hoardings

For the 7th month in a row, China has increased its gold holdings bringing their total to 2.068 tons , rivaling those of Russia, as they now only have difference of approximately 300 tons of gold difference before China surpasses Russia in gold reserves, according to data for the 1st Quarter of 2023.

The continued addition of gold may appear be a part of a prolonged strategy of reducing China’s and other Central banks dependence on the greenback as the worlds reserve currency. Through increasing their gold holdings, China alongside others may be attempting to reduce their exposure to high volatility market events involving the dollar and as such potentially reducing their dependence on the greenback overall by diversifying into other more stable assets.

Albeit a far-fetched scenario, yet following statements that the BRICS nations which are composed by Brazil, Russia, India, China and South Africa, that they are all looking to adopt a common currency in an attempt to rival the greenback, the currency, could in theory be backed by gold .

A gold standard could potentially compete with the greenback for dominance, yet that would be a behemoth task for anyone attempting to upend the dollars dominance, as the gold reserves would most likely have to be substantial and surpass major competitors in order to maintain a stable price.

Eurozone’s technical recession

The Eurozone entering a technical recession, may have spiked fears of economic downturn in the future. Following financial releases that Germany and the Eurozone as whole have now entered a technical recession, speculators may wonder which economy will be the next and how many more will join them. It may be that, the fears of a global economic downturn, could overall support the price of the precious metal, given its relationship as a hedge during time of financial uncertainty. Hence, should more economies enter a recession even a technical one, we may see the golds price capitalizing on market uncertainty in regards to the health of global economies.

Technical Analysis – Gold

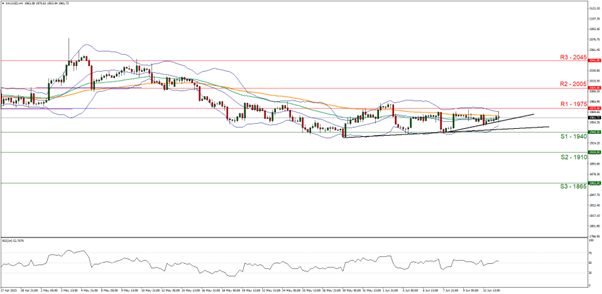

XAUUSD 4時間チャート

- Support: 1940 (S1), 1910 (S2), 1865(S3)

- Resistance: 1975 (R1), 2005 (R2), 2045 (R3)

At the time of this report, Gold’s price moved in an upwards fashion since last week, potentially capitalizing from the release of the US CPI rates, which tended to indicate a reduction in inflationary pressures, thus weakening the greenback and allowing gold to capitalize on a weaker dollar. We tend to maintain a bullish outlook for gold’s price as long as its price action remains above the upwards moving trendline formed on the 7th of May, in addition to the RSI figure breaking above the reading of 50 implying a potential bullish sentiment emerging. For our Bullish outlook to continue, we would like to see a clear break above the 1975 (R1) resistance level, with the next potential target for the bulls being the 2005 (R2) resistance ceiling. On the other hand, for a bearish outlook we would like to see a clear break below the 1940 (S1) level which would coincide with the breaking below the upwards trendline with the next potential target for the bears being the 1910 (S2) support base. Lastly, should the pair fail to break below or above the aforementioned S1 and R1 levels, in addition to the RSI indicator fluctuating around the reading of 50, we may see the precious move in a sideways fashion between the 1940 (S1) and 1975 (R1) support and resistance levels respectively.

免責事項:

This information is not considered investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked, in this communication.