The US over the weekend in what can only be described as a spectacular show of force, reminded the world that they are still very much in control. In particular, the US military kidnapped Maduro from his home and extradited him to the US where he is expected to appear in a New York court over drug charges. The brazen move by the US leaves a power vacuum in Venezuela where it is expected that a pro-western leader may be installed. In turn such a possibility may have weighed on oil prices, as a “friendlier” President who is willing to work with the US may open the nation’s vast oil resources to US companies such as Exxon Mobil (#XOM) and Chevron. Moreover, the possibility of oil sanctions being eased could allow for a larger supply of oil to enter into circulation in the global markets, which may also weigh on oil’s price. Nonetheless, the situation is ongoing as markets await to see who will be the next leader of this oil rich nation.

XAU/USD appears to be moving in an upwards fashion, having cleared our resistance turned back to support at the 4380 (S1) level. We opt for a bullish outlook for the commodity’s price considering the current break above our S1 level, yet for our bullish outlook to be maintained we would require gold’s price to remain above our S1 level if not also clearing our 4450 (R1) resistance line. On the other hand, for a sideways bias we would require gold’s price to remain confined between our 4380 (S1) support level and our 4450 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4380 (S1) support level with the next possible target for the bears being our 4310 (S2) support line.

WTICash appears to be moving in a downwards fashion. We opt for a bearish outlook for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 40 implying a bearish market sentiment. For our bearish outlook to be maintained we would require a clear break below our 55.95 (S1) support level with the next possible target for the bears being our 53.75 (S2) support base. On the other hand, for a sideways bias we would require the commodity’s price to remain confined between our 55.95 (S1) support level and our 57.95 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 57.95 (R1) resistance line with the next possible target for the bulls being our 59.99 (R2) resistance level.

その他の注目材料

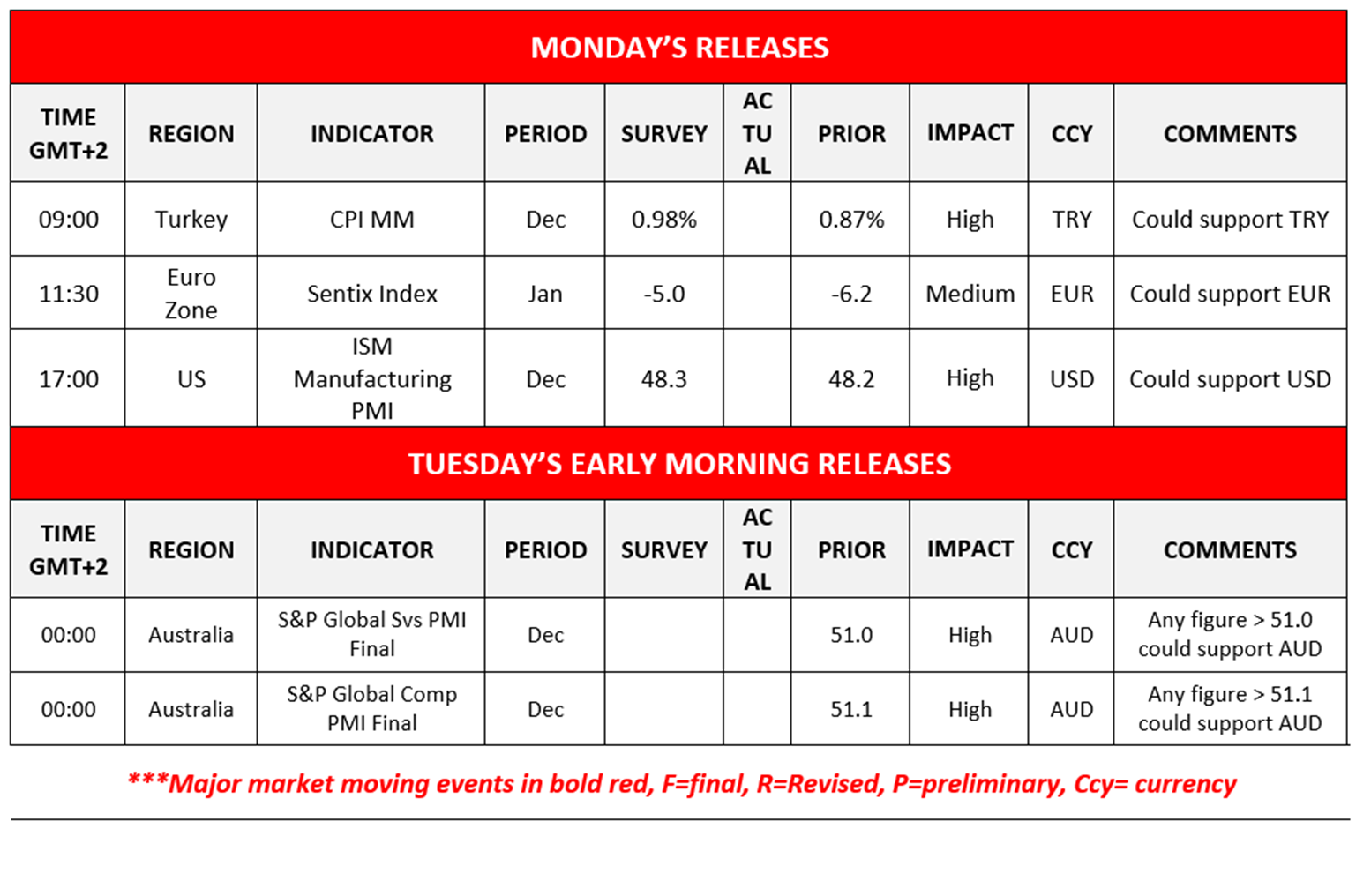

Today we get Turkey’s CPI rates in a month on month basis for December, the Eurozone’s Sentix index figure for January and the US ISM manufacturing PMI figure for December. In tomorrow’s Asian session we would like to note Australia’s S&P services final PMI figure for December and Australia’s S&P composite final PMI figure for December as well.

今週の指数発表:

We note France’s and Germany’s preliminary CPI rates and the US ISM Non manufacturing PMI figure all for December on Tuesday. For Wednesday we note Australia’s CPI rate for November and the Czech Republic’s and Eurozone’s preliminary CPI rates for December and the US ADP employment figure for December. On Thursday, we note Australia’s trade balance figure for November, the UK Halifax house prices rate for December, Sweden’s and Switzerland’s CPI rates for December, the Zone’s economic sentiment figure for December, the US challenger layoffs weekly figure, Canada’s trade balance figure. On Friday we note China’s PPI and CPI rates for December, Sweden’s GDP rate for November, Norway’s CPI rate for December, the US Employment data for December, Canada’s employment data for December and the US UoM consumer sentiment preliminary figure for January.

XAU/USD H4 Chart

- Support: 4380 (S1), 4310 (S2), 4240 (S3)

- Resistance: 4450 (R1), 4530 (R2), 4610 (R3)

WTICash DAILY Chart

- Support: 1.1685 (S1), 1.1560 (S2), 1.1460 (S3)

- Resistance: 1.1815 (R1), 1.1917 (R2), 1.2000 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。