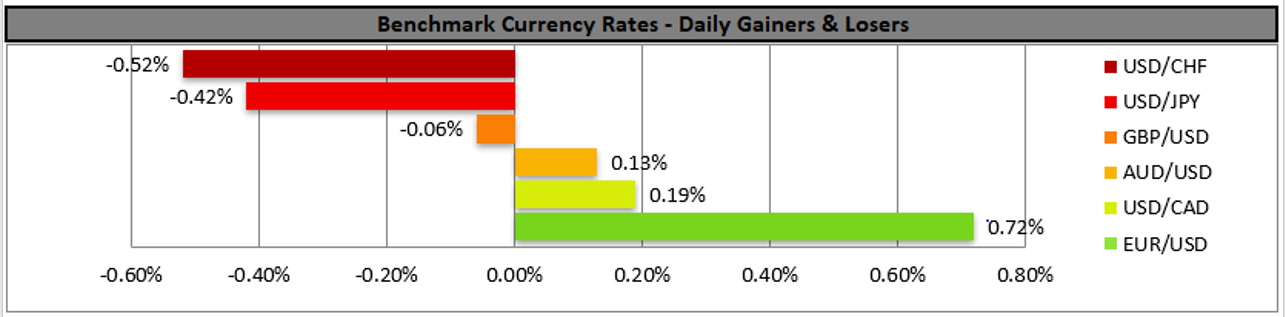

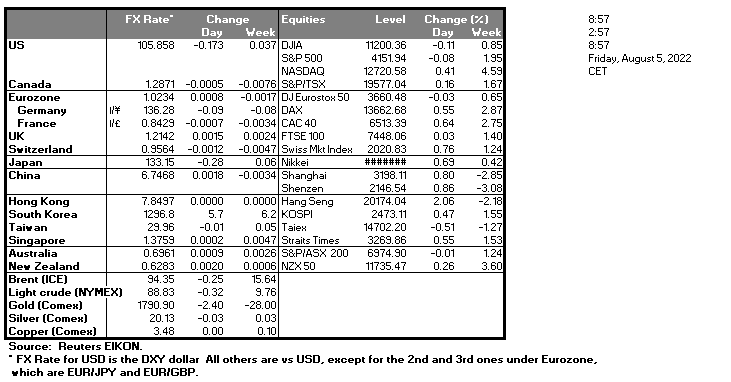

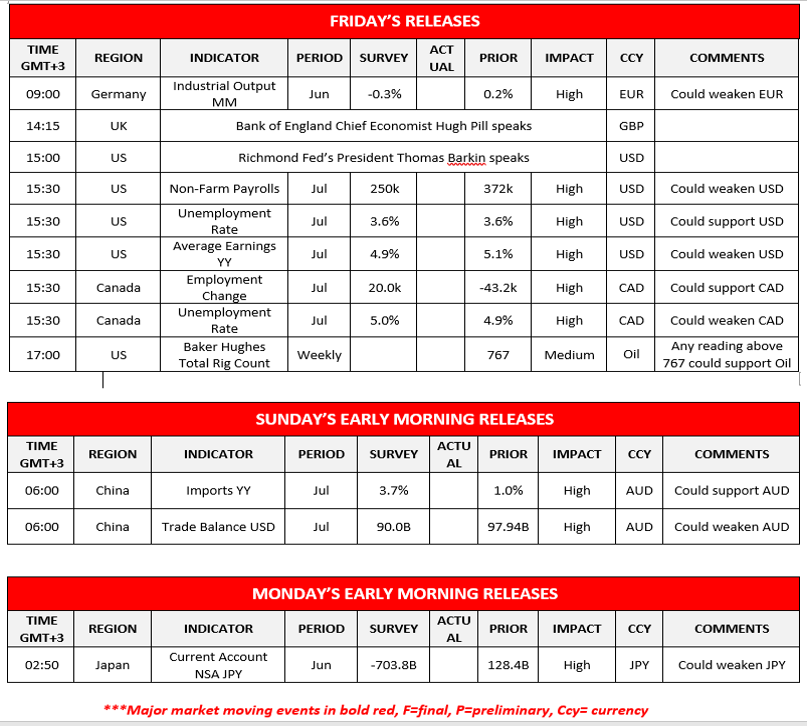

The greenback fell sharply yesterday, underperforming against its major counterparts, as the market awaits in anticipation the US employment data for July and recession fears are ever-present in the economy. Today we note the release of employment data in the US, with the three key indicators namely the Non-Farm Payrolls, unemployment rate and year on year average earnings figures and will hit the market one hour before the US open. The employment reports are expected to grab the markets’ attention as their results will underline the health of the US labour market force. The non-farm payrolls figure is expected to drop to 250k compared to June’s 372k, the unemployment rate is expected to remain unchanged at 3.6%, while the earnings growth is expected to slowdown to 4.9% yoy compared to June’s 5.1% yoy. Should the actual rates and figures meet their respective forecasts, we may see the USD gaining as the US unemployment rate remains stable at low levels which could imply a tight US labour market. On the other hand, the possible drop of the NFP figure, could disappoint USD traders and weaken the USD as it would imply that the US employment market has a reduced ability to create new jobs. Overall though, the picture drawn by the forecasts seems to be of a rather tight US employment market, which in turn could allow the Fed to continue on its rate hiking path, given the bank’s dual mandate, albeit that tightness seems to be losing steam. We also note the speech of Richmond’s Fed President Barkin whose comments on the future monetary policy outlook could be of value. Should the president adopt the same narrative and match the tone of previous speakers then we could see the dollar getting a boost. We also note Canada’s employment report for July, which appear to be overshadowed by the equivalent US reports, as they are being released at the same time. The unemployment rate is expected to tick up while the employment change figure is expected to rise substantially and could excite Loonie traders, as Canada’s employment market appears to remain tight, which may allow BoC to remain hawkish. The aftershocks of BoE’s interest rate decision yesterday, weighed on the sterling, closing the day in the reds, as the 50-basis points hike was anticipated and already priced in. Moreover, the failure of BoE’s members to deliver a unanimous vote came to a surprise at the time of the release, raising credibility concerns, alongside BoE’s grim warning of a long recession ahead of Britain. The pessimistic outlook weighed on the pound. Also, we should note the scheduled speech of BoE’s Chief economist Hugh Pill who will shed light on the matter.

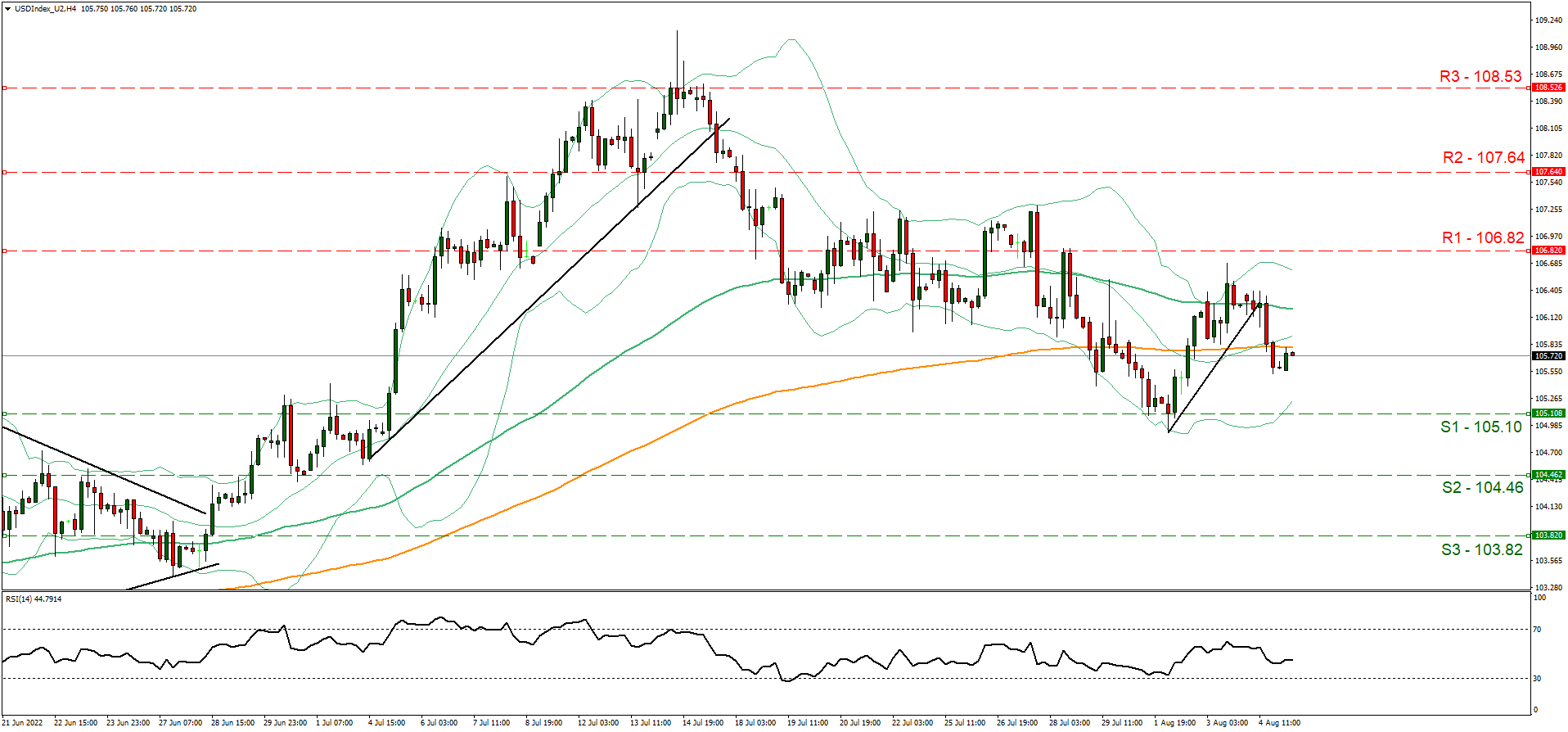

USDIndex crossed below the ascending trendline during yesterday’s session. We hold a sideways bias for its future price action, between 105.10 (S1) and 106.82 (R1) levels. Should the bulls reign over, we may see the break of the 106.82 (R1) line and move towards the 107.64 (R2) level. Should the bears take over, we would require seeing the break below the 105.10 (S1) level and a move towards the 104.46 (S2) barrier.

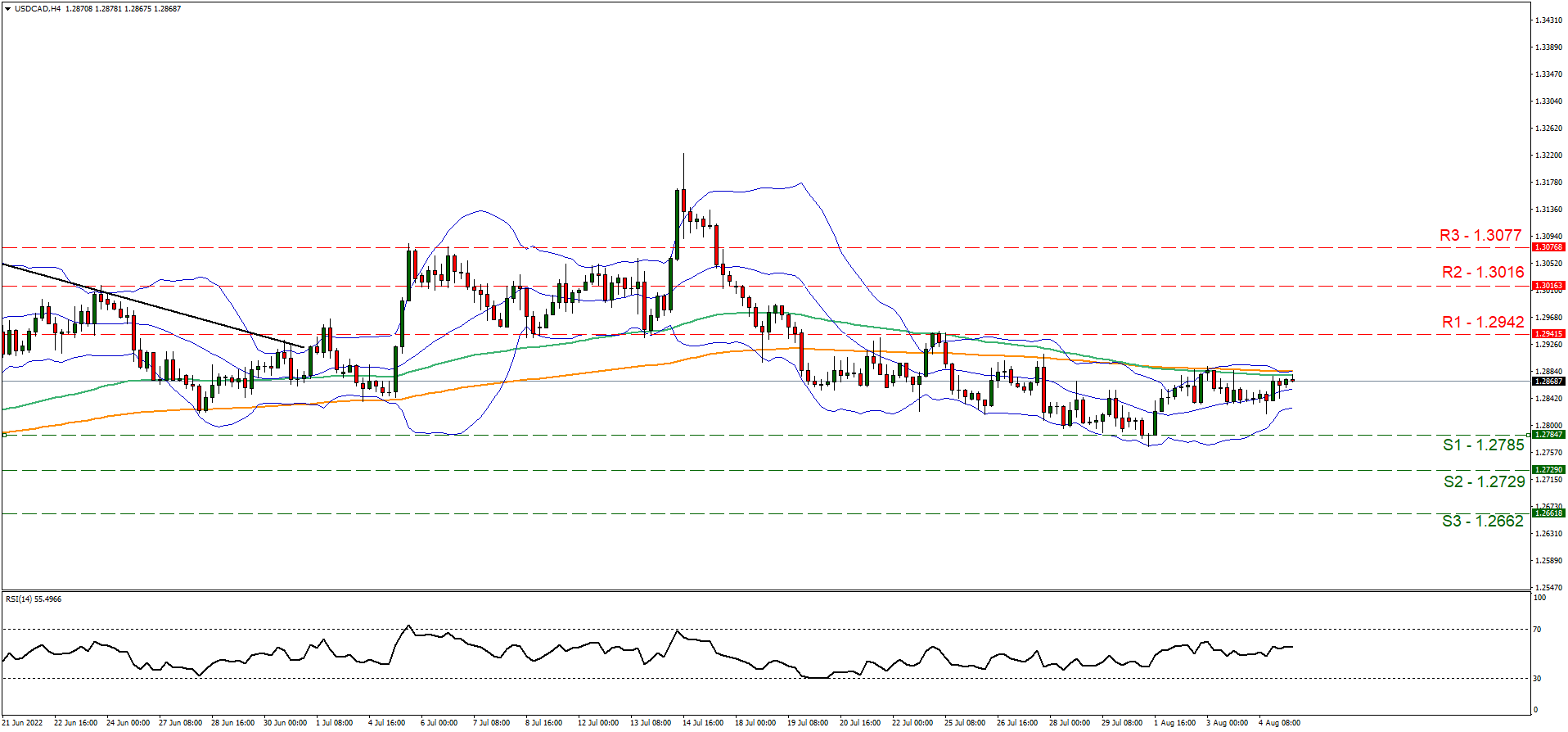

USD/CAD price action has been constrained between 1.2785 (S1) support and 1.2942 (R1) resistance levels. We hold a sideways bias towards its price action as the RSI indicator flatlines near the 50 level showing signs of indecision. Should the pair find extensive buying orders along its path, we may see the break above the 1.2942 (R1) and a move close to the 1.3016 (R2) barriers. Should the selling interest overwhelm, we may see the break below the 1.2785 (S1) and move towards the 1.3016 (R2) levels

その他の注目材料

Today, we also highlight the release of the German Industrial Output figure for the month of June and weekly Baker Hughes total rig count figure. On early on Sunday morning we note the release of China’s yoy Import rate as well as their Trade Balance figure and during the Asian session on Monday morning, Japan’s Current Account NSA figure for the month of June.

USDIndex 4時間チャート

Support: 105.10 (S1), 104.48 (S2), 103.82 (S3)

Resistance: 106.82 (R1), 107.64 (R2), 108.53 (R3)

USD/CAD 4時間チャート

Support: 1.2785 (S1), 1.2729 (S2), 1.2662 (S3)

Resistance: 1.2942 (R1), 1.3016 (R2), 1.3077 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。