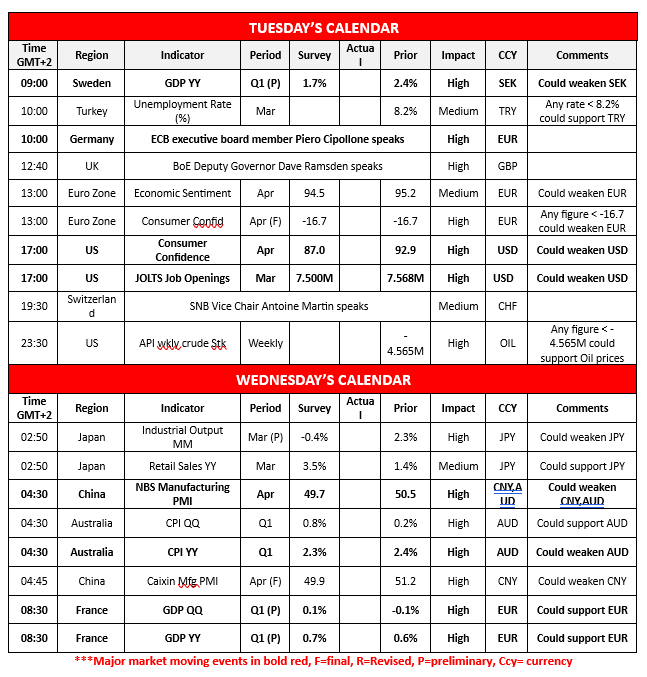

The US JOLTs Job openings figure for March is set to be released later on today. The current expectations by economists are for the figure to come in at 7.500 million, which would be lower than the prior months figure of 7.568 million. In turn, should the figure come in as expected or lower it may imply a loosening labour market in the US which in turn could potentially weigh on the dollar. Over in Australia, the nation’s CPI rates for Q1 are set to be released during tomorrow’s Asian session, with the year-on-year rate for Q1 expected to come in at 2.3% which would be lower than the prior rate of 2.4%. However, on a quarter-on-quarter basis the CPI rate is expected to accelerate from 0.2% to 0.8%, which may contradict the narrative that inflationary pressures may be easing. Nonetheless, should the CPI rates showcase an acceleration of inflationary pressures it may aid the Aussie and vice versa. In Canada, the Liberal Party, led by Mark Carney, has won the election with roughly 43.5% of the votes, compared to the Conservative party, which won roughly 41.4% of the votes. However, with the Liberals holding at the time of this report 168 seats, they are a few shy of the 172 seats required for a majority. In Europe, France’s preliminary GDP rates for Q1 are due out in tomorrow’s late Asian session and could aid the EUR.

EUR/USD appears to be moving in a predominantly upwards trajectory, however, we would not be surprised to see the pair possibly aiming for lower ground in the short term. Nonetheless, we opt for a predominantly bullish outlook, and supporting our case is the RSI indicator below our chart, which currently registers a figure close to 60, implying a bullish market sentiment. Yet the retreat of the indicator from 70 to 60, may imply that the bullish momentum could be fading. Nonetheless, for our bullish outlook to continue, we would require a clear break above our 1.1470 (R1) resistance line with the next possible target for the bulls being the 1.1685 (R2) resistance level. On the other hand, for a sideways bias we would require the pair to remain confined between the 1.1185 (S1) support level and the 1.1470 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.1185 (S1) support level, with the next possible target for the bears being the 1.0950 (S2) support line.

USD/CAD appears to be moving in a predominantly downwards direction. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure close to 40 implying a bearish market sentiment. For our bearish outlook to continue we would require a clear break below the 1.3830 (S1) support level with the next possible target for the bears being the 1.3618 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between the 1.3830 (S1) support level and the 1.4025 (R1) resistance level. Lastly, for a bullish outlook we would require a clear break above the 1.4025 (R1) resistance line, with the next possible target for the bulls being the 1.4235 (R2) resistance level.

その他の注目材料

Today we get Sweden’s preliminary GDP rate for Q1, Turkey’s unemployment rate for March, the Zone’s economic sentiment and final consumer confidence figures for April and during the American session we note the US Consumer Confidence figure for April, the US JOLTS Job Openings figure for March and the US API weekly crude oil inventories figure. In tomorrow’s busy Asian session we note Japan’s preliminary Industrial output and retail sales rates for March, China’s NBS manufacturing PMI figure for April, Australia’s CPI rates for Q1, China’s final Caixin manufacturing PMI figure for April and France’s preliminary GDP rates for Q1. On a monetary level we note the speeches by ECB member Cipollone, BoE Deputy Governor Ramsden and SNB Vice Chair Antoine Martin.

EUR/USD Daily Chart

- Support: 1.1185 (S1), 1.0950 (S2), 1.0740 (S3)

- Resistance: 1.1470 (R1), 1.1685 (R2), 1.1890 (R3)

USD/CAD Daily Chart

- Support: 1.3830 (S1), 1.3618 (S2), 1.3430 (S3)

- Resistance: 1.4025 (R1), 1.4235 (R2), 1.4440 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。