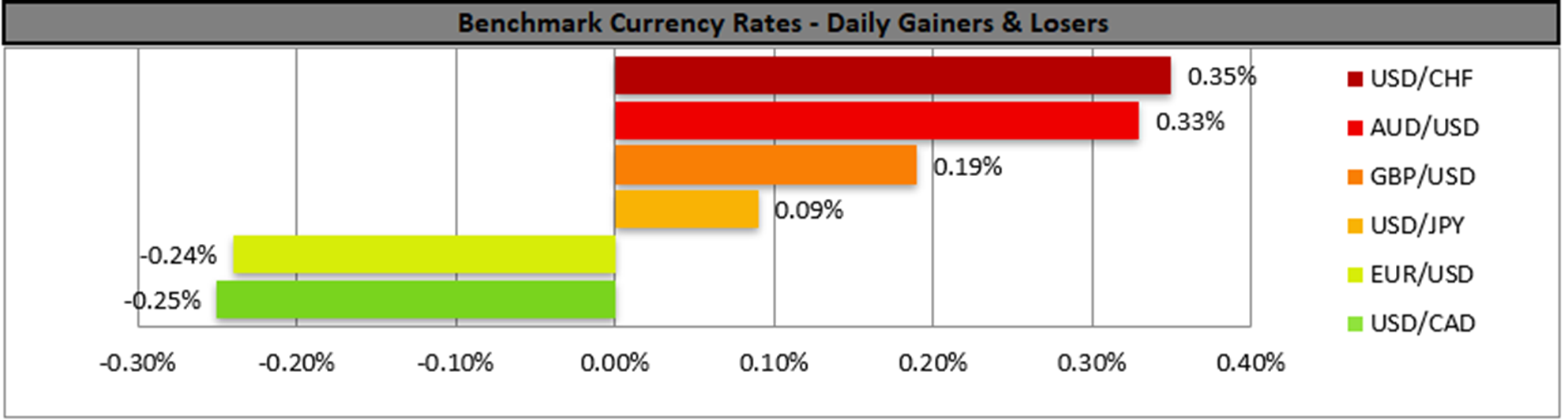

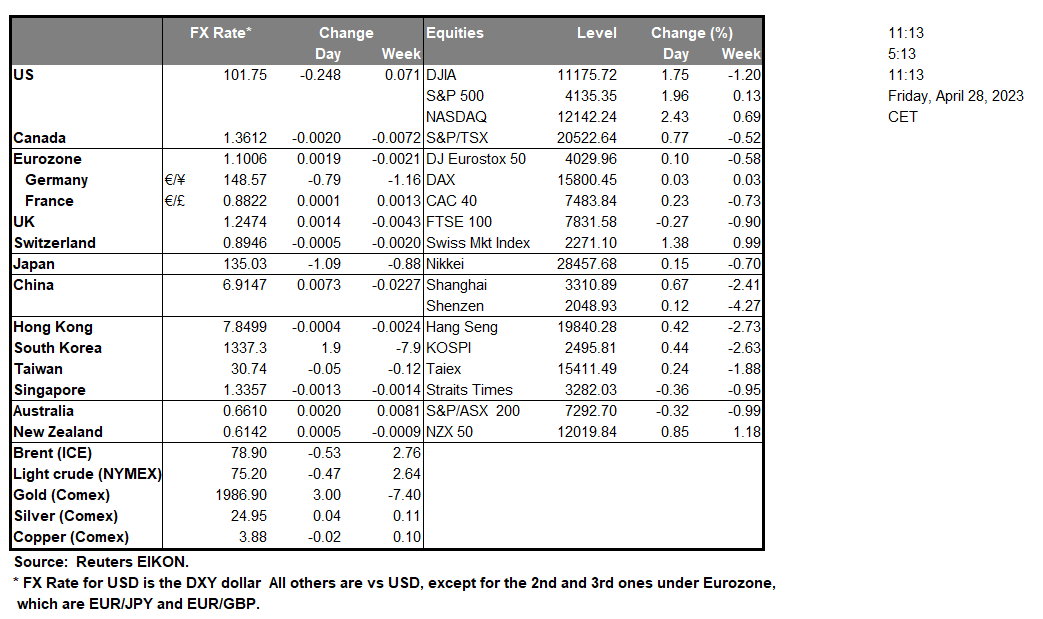

The USD tended to weaken against the pound, Yen as market worries of a recession intensified following yesterday’s lower than expected GDP rate for Q1 coming in at 1.1% versus the predicted figure of 2.0% The US GDP rate intensified worries of a recession in the US economy, in addition to the pending home sales for March significantly being reduced by 5.2% versus the anticipated figure of 0.5%. However, we note the Initial Jobless Claims figure coming in lower than predicted, indicative of a resilient labour market. In the European session we note France’s Preliminary GDP on a QoQ basis for Q1 came in as was anticipated by the market at 0.2%, yet Preliminary GDP on a YoY ticked upwards to 0.8%, outperforming expectations in addition to France’s Preliminary HICP rate coming in higher than expected, may potentially providing some temporary support for the EUR as we near Germany’s and the Eurozone’s Preliminary GDP releases for Q1 due to be released this morning. In Today’s Asian session we note that the BoJ’s interest rate decision was to remain on hold at -0.10% as was widely anticipated by analysts despite Tokyo’s CPI increased on a YoY basis. In addition, we highlight Governor Ueda’s comments that the bank is expected to conduct a review of monetary policy implying that the YCC may be phased out in the next year and a half, in addition to removing a phrase in its forward guidance “short- and long-term policy interest rates to remain at their present or lower levels”. This may be an indication of a willingness to speed up the phasing out of the YCC, in the event of high inflationary pressures remaining in the Japanese economy. In the equities market, we note Amazon’s (#AMZN) higher than anticipated earnings release after the market had closed, Furthermore, the highlights of today’s earnings reports are expected to be Exxon Mobil (#XOM) and Erste Bank (#Erste Bank).

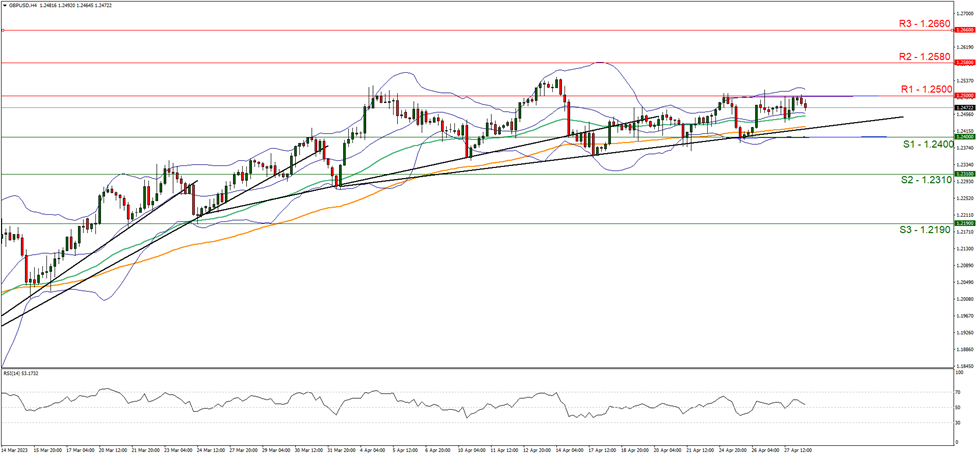

GBP/USD edged higher yesterday yet failed to break above resistance at 1.2500(R1). We tend to maintain a bullish outlook for the pair and supporting our case is the formation of an upwards trendline since the 4 of March. However, we note that the RSI indicator remains near the reading of 50 implying a temporary indecisive market. For our Bullish outlook to continue we would like to see the pair make a clear break above the 1.2500(R1) level with a move towards potential resistance at the 1.2580 (R2) resistance barrier. For a Bearish outlook we may see the pair making a break below the 1.2310 (S1) support line with the next potential target for the bears being the 1.2310 (S2) support base.

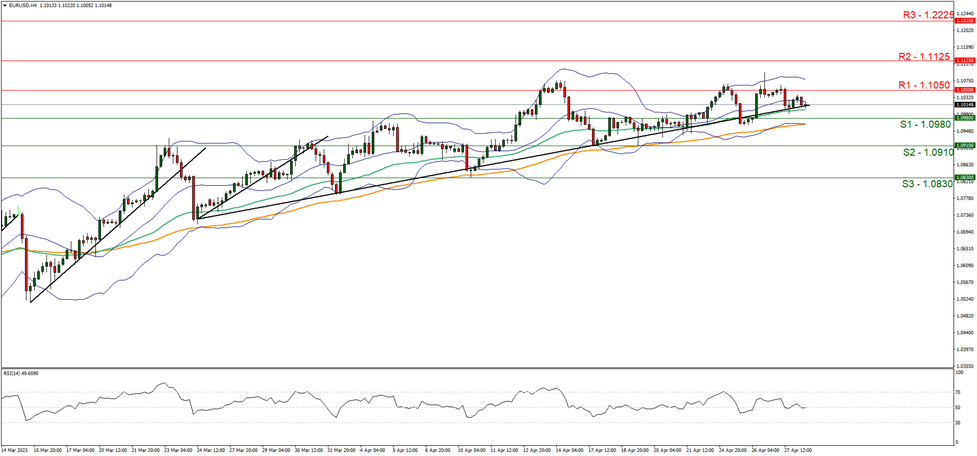

EUR/USD continued its ascent yesterday. We tend to maintain a bullish outlook for the pair as long as it remains above the upward trendline incepted since the 24 of March. Yet we note that the RSI indicator is currently running along the reading of 50 implying market indecisiveness. Should the bulls maintain control, we may see the pair breaking above the 1.1050 (R1) resistance line with the next possible target for the bulls being the 1.1125 (R2) resistance level. Should the bears take over, we may see the pair reversing course breaking the prementioned upward trendline, with a break below the 1.0980 (S1) support line, with the next possible target being the 1.0910 (S2) support level.

その他の注目材料

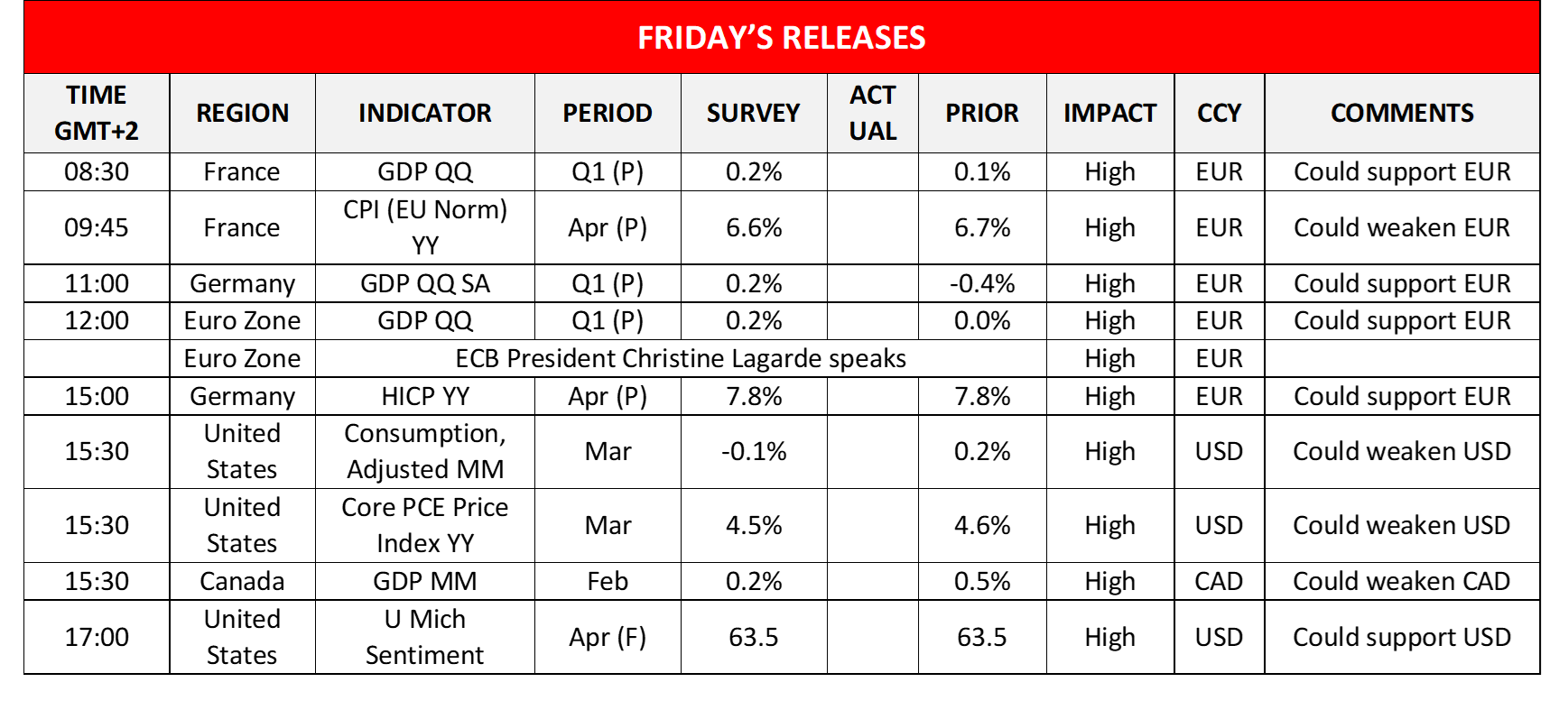

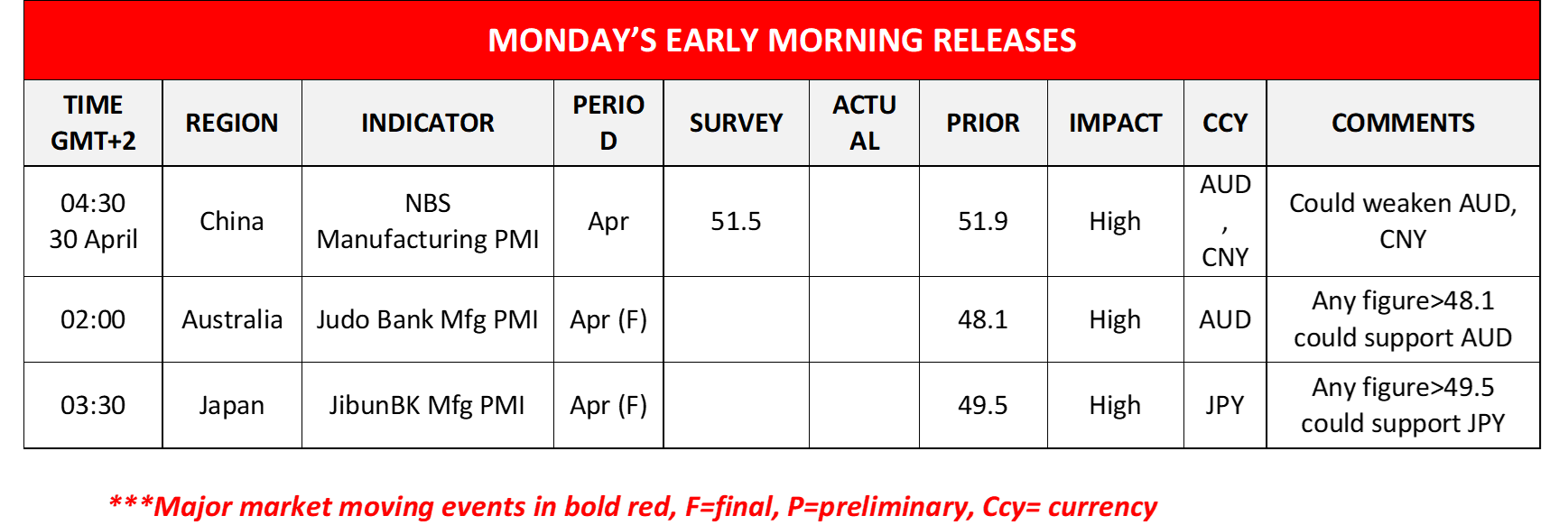

During today’s European session, we note the release of Germany’s and the Eurozone’s preliminary GDP rates for Q1 as well as Germany’s preliminary HICP rate for April , while on the monetary front ECB President Christine Lagarde is to speak during the Eurogroup meeting. In the American session we note the release from the US of the consumption rate and the Core PCE price index, both for March as well as the final University of Michigan consumer sentiment for April, while from Canada we get February’s GDP rate. On Sunday we get China’s NBS PMI figures for April and during Monday’s Asian session, we note the release of Australia’s and Japan’s final manufacturing PMI figures for April.

GBP/USD 4時間チャート

Support: 1.2400 (S1), 1.2310 (S2), 1.2190 (S3)

Resistance: 1.2500 (R1), 1.2580 (R2), 1.2660 (R3)

EUR/USD 4時間チャート

Support: 1.0980 (S1), 1.0910 (S2), 1.0830 (S3)

Resistance: 1.1050 (R1), 1.1125 (R2), 1.2225 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。