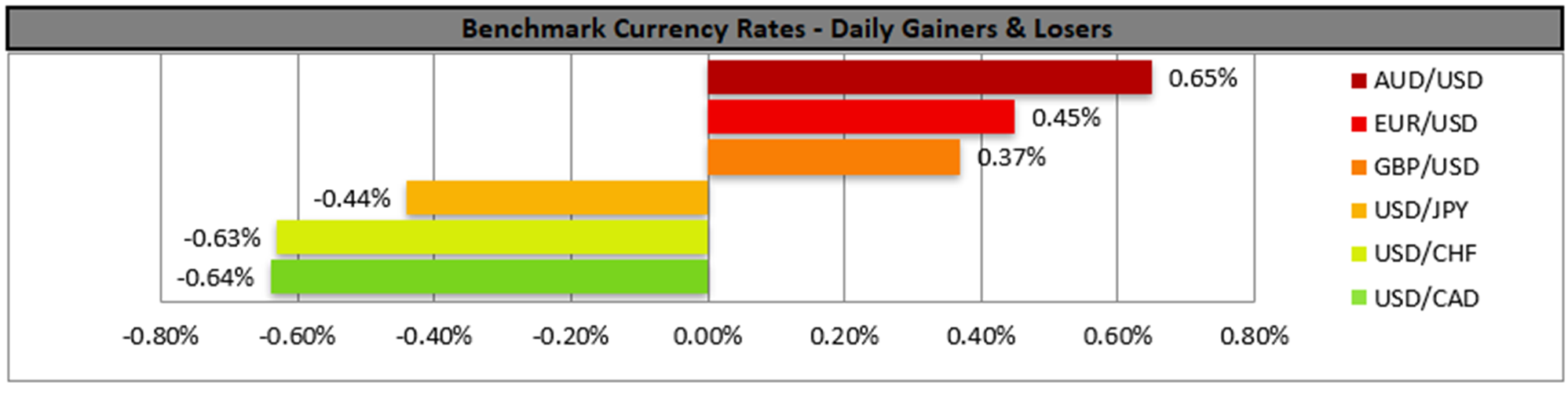

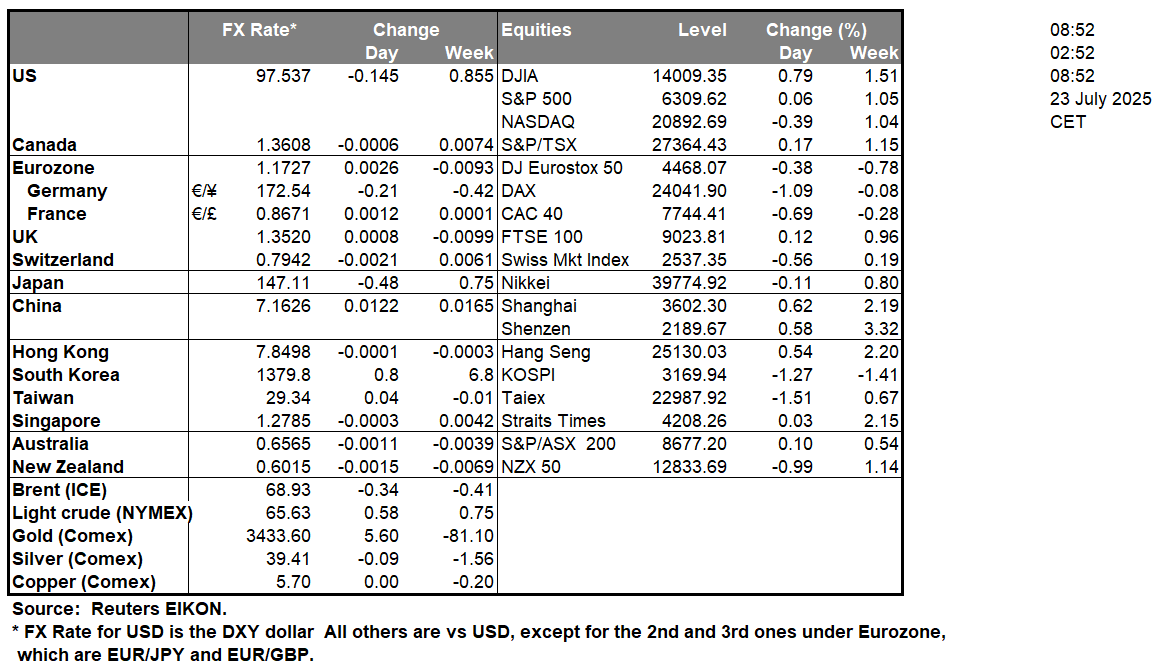

The softness of the USD was maintained yesterday, yet the greenback’s drop against its counterparts was halted in today’s Asian session. On a fundamental level, we highlight that US President Trump announced a trade deal of the US with Japan. The US President posted on Truth Social, that the US import tariffs for Japanese products would be of 15% which is significantly lower than previous 25%, which was expected to come into effect from the 1st of August onwards. On the flip side, Japan is to invest $550 billion in the US. It’s important to state that the deal was announced just eight days before US President Trump’s 1st of August deadline and given the trading volume of the two nations, the deal can be considered as very important. Uncertainty is being maintained for international trading relationships, with attention being increasingly placed on whether the EU will be able to achieve a trade deal or not. Any signals of a rising tensions could weigh on USD and vice versa. On a monetary level, we note the pressure exercised on Fed Chairman Powell to resign by US President Trump and his associates, with the latest episode being the sharing by a Republican Senator, of a fake resignation letter of Powell, albeit it was quickly deleted. Overall, we see the case for the attacks on the Fed to be weighing on the USD at the current stage.

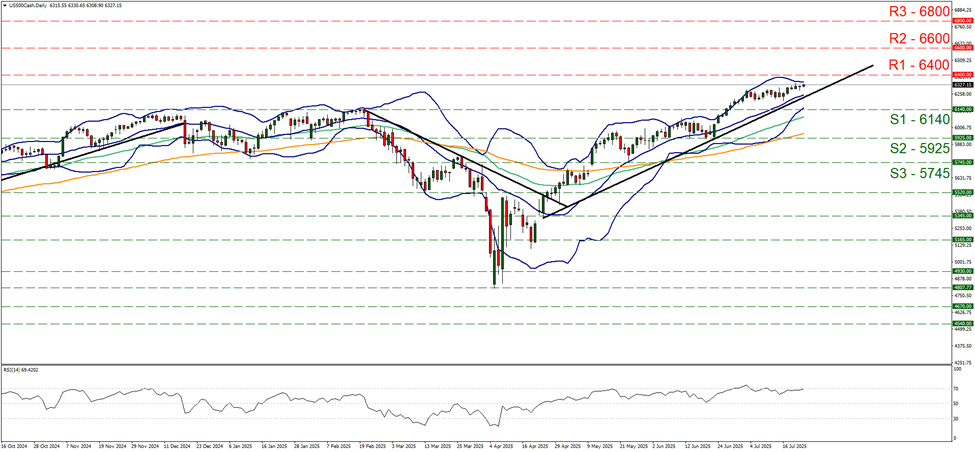

US equities markets continue to rise unaffected by the developments, despite some mixed signals yesterday. Characteristically, S&P 500 continues to rise, moving in unchartered waters and marking new record highs, aiming for the 6400 (R1) resistance barrier. We tend to maintain our bullish outlook for the index, as long as the upward trendline guiding it since the 24th of April remains intact. Also we note that the RSI indicator is near the level of 70, implying a bullish market sentiment for the index, while the 20, 50 and 100 MA, continue to aim for higher ground also suggesting a bullish outlook. Should the bulls maintain control over the index, we may see it breaking the 6400 (R1) resistance line and we set the 6600 (R2) level as the next possible target for the bulls. Should the bears take over, we may see the index reversing course, breaking the prementioned upward trendline, continue to break the 6140 (S1) support line and start aiming for the 5925 (S2) level.

Besides the US-Japan trade deal announced by US President Trump, Japan’s PM Ishiba, whose ruling coalition lost its majority in Japanese Senate elections on Sunday, was reported to have decided to resign by the end of August. The Japanese PM later on refuted the news, yet the developments may have assisted JPY to flip to losses, as political uncertainty intensifies in Japan. The political developments may also hinder the efforts of BoJ to tighten its monetary policy, as politicians are favoring a more dovish stance that would assist growth for the Japanese economy. Thus the issue could weigh on JPY, should market worries intensify.

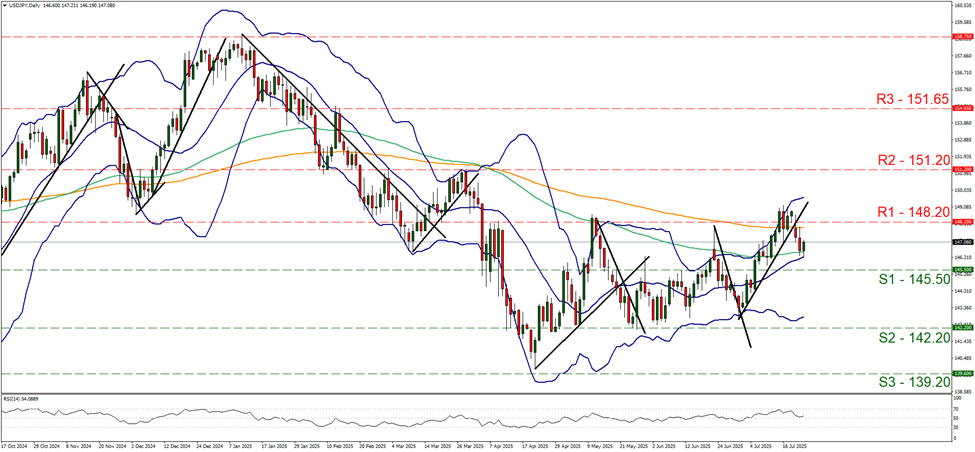

USD/JPY continued to drop yesterday yet the drop of the pair was halted in today’s Asian session between the 148.20 (R1) resistance line and the 145.50 (S1) support level. The RSI indicator remains close to the reading of 50, implying a relative indecisiveness of the market for the pair’s direction, hence we tend to maintain a bias for a sideways motion of the pair. Should the bulls take over, we may see the pair breaking the 145.50 (S1) support line and continue aiming for the 142.20 (S2) support level. Should the bears be in charge we may see USD/JPY breaking the 148.20 (R1) resistance line and continue higher to aim for the 151.20 (R2) resistance level.

その他の注目材料

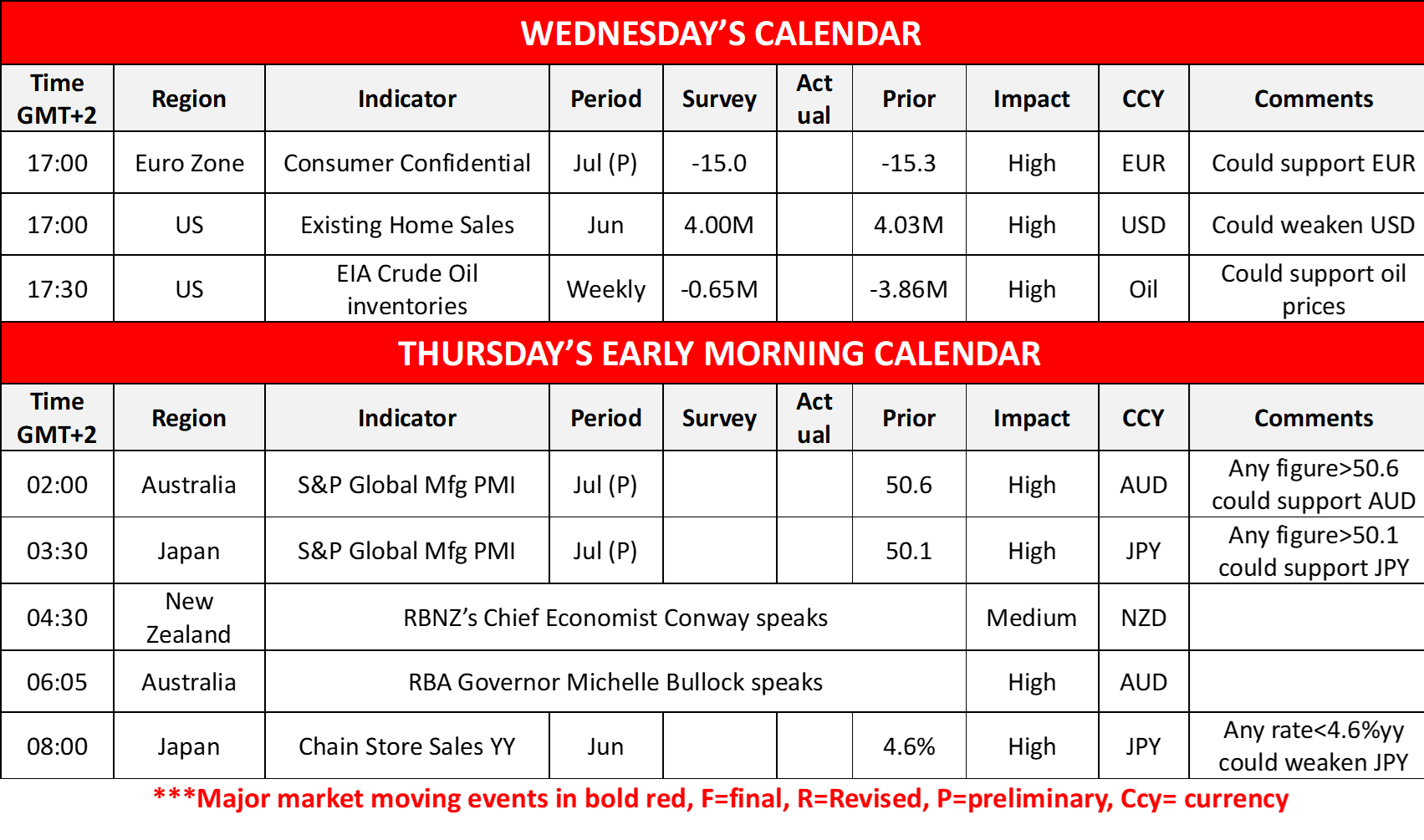

Today we get Euro Zone’s preliminary consumer confidence for July and the US existing home sales for June, and the US EIA crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s and Japan’s preliminary PMI figures for July, as well as Japan’s Chain Store sales for June, while RBNZ’s Chief Economist Conway and RBA’s Governor Michelle Bullock are scheduled to speak.

US 500 Daily Chart

- Support: 6140 (S1), 5925 (S2), 5745 (S3)

- Resistance: 6400 (R1), 6600 (R2), 6800 (R3)

USD/JPY Daily Chart

- Support: 145.20 (S1), 142.20 (S2), 139.20 (S3)

- Resistance: 148.20 (R1), 151.20 (R2), 151.65 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。