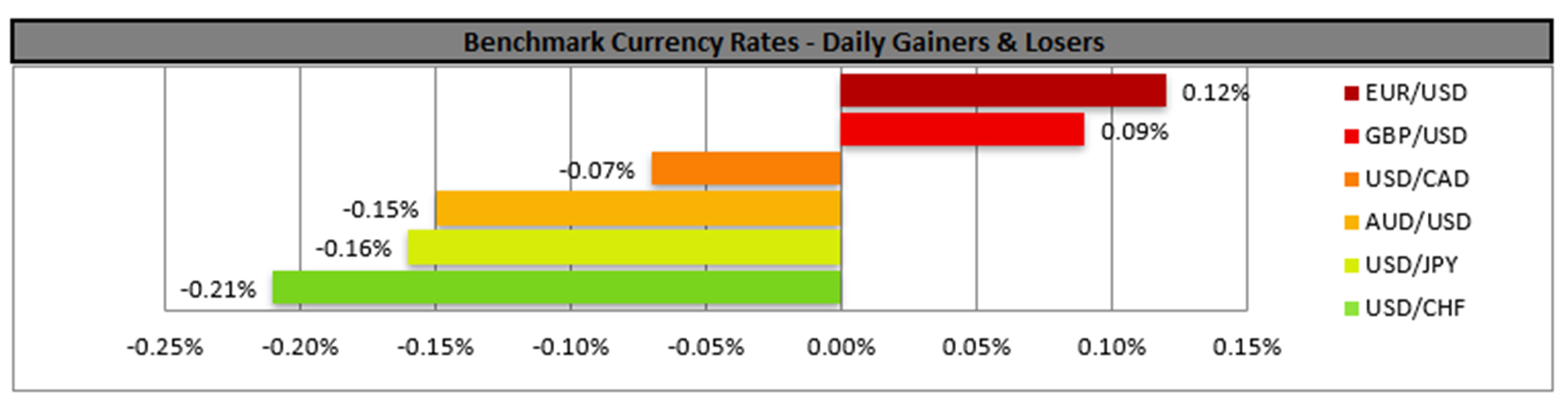

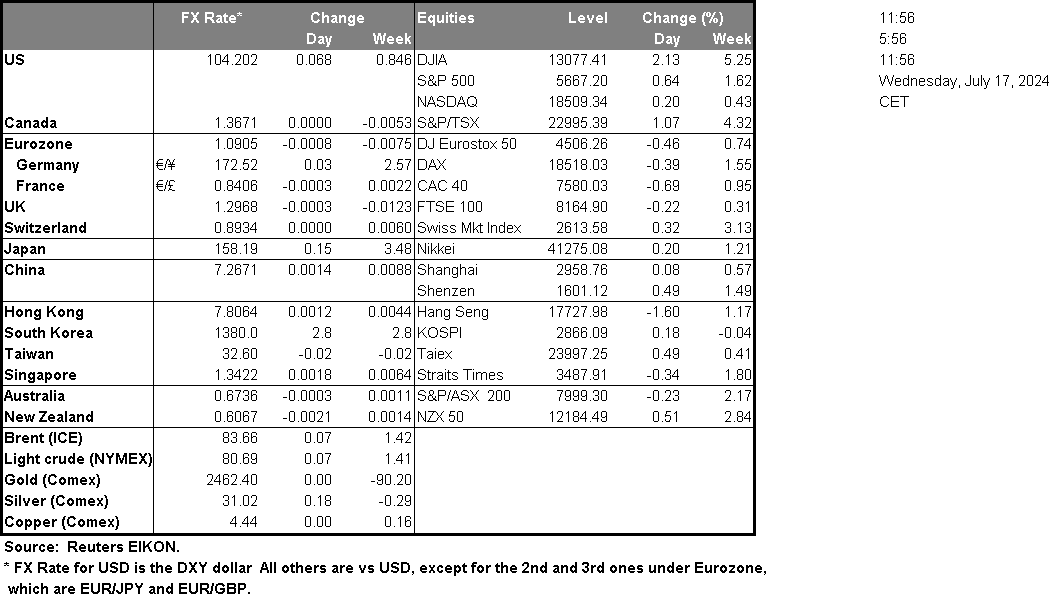

The US retail sales rates for June came in better than expected with the core retail sales rate on a mom level coming in at 0.4% versus the expected 0.1% and the retail sales rate also on a mom level coming at 0% versus the expected -0.3%. The better-than-expected rates, may imply that US consumer spending remains resilient in spite of the tight financial conditions surrounding the US economy. The UK’s CPI rate on a year-on-year level came in higher than expected at 2.0% which was slightly higher than the expected rate of 1.9%, which may imply that inflationary pressures in the UK remain persistent. Yet, we would like to note that the inflation is currently at the bank’s 2% target and as such, could increase pressure on the bank to maintain its restrictive monetary policy stance for longer, as a premature rate cut could fuel inflationary pressures and undo the bank’s progress. The release tended to provide support for the pound . Over in Asia, Australia’s employment data for June are to be released during tomorrow’s Asian session and could shake the Aussie. The unemployment rate is expected to remain unchanged at 4.0%, while the employment change figure to drop to 20k if compared to May’s 39.7k. Should the actual rates and figures meet their respective forecasts, we may see the release having a bearish effect on the Aussie as they would imply a crack in the Australian employment market’s tightness. Over in Japan, we would like to note the nation’s trade balance figure for June which is due out tomorrow and in particular the nation’s exports rate. In the US Equities markets, Johnson&Johnson (#JNJ) is set to release their earnings later on today.

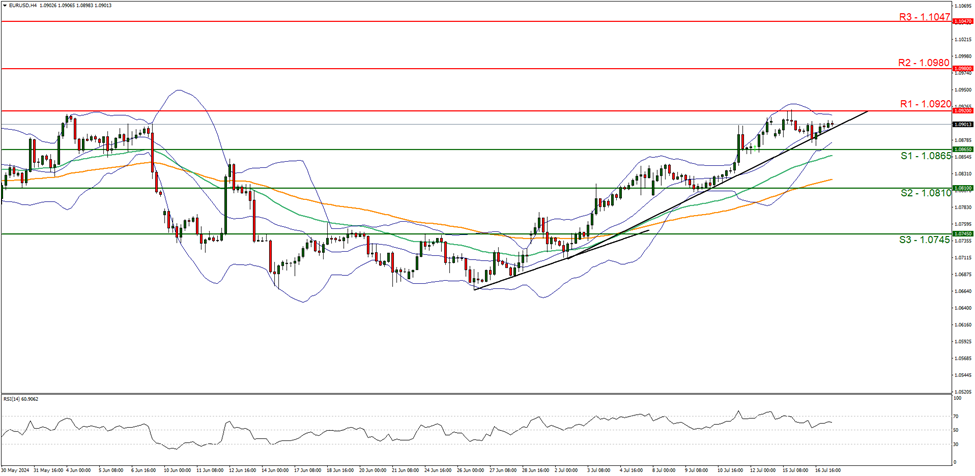

EUR/USD appears to be moving in an upwards fashion. We maintain our bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure of 60, implying a bullish market sentiment, in addition to the upwards-moving trendline which was incepted on the 2nd of July. For our bullish outlook, to continue we would require a clear break above the 1.0920 (R1) resistance line with the next possible target for the bulls being the 1.0980 (R2) resistance level. On the flip side, for a sideways bias we would require the pair to remain confined between the 1.0865 (S1) support level and the 1.0920 (R1) resistance line. Lastly, for a bearish outlook, we would require a clear break below the 1.0865 (S1) support level, with the next possible target for the bears being the 1.0810 (S2) support base.

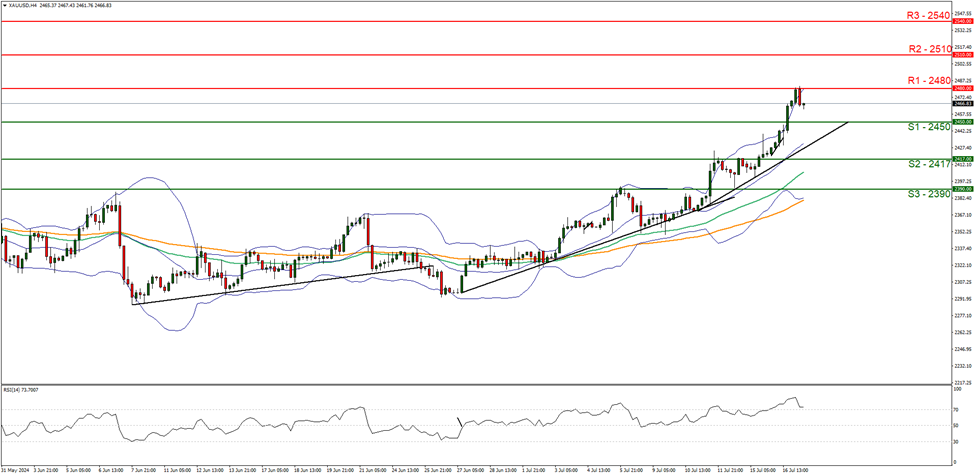

XAU/USD appears to be moving in an upwards fashion, having formed a new all-time high figure near the $2480 per troy ounce level. We opt for a bullish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure of 70 implying a bullish market sentiment, in addition to the upwards moving trendline which was incepted on the 11th of July. For our bullish outlook to continue, we would require a break above the 2480 (R1) resistance level, with the next possible target for the bulls being the 2510 (R2) resistance line. On the flip side for a bearish outlook, we would require a clear break below the 2450 (S1) support level, with the next possible target for the bears being the 2417 (S2) support level. Lastly, for a sideways bias, we would require the precious metal to remain between the 2450 (S1) support level and the 2480 (R1) resistance line.

本日のその他の注目点

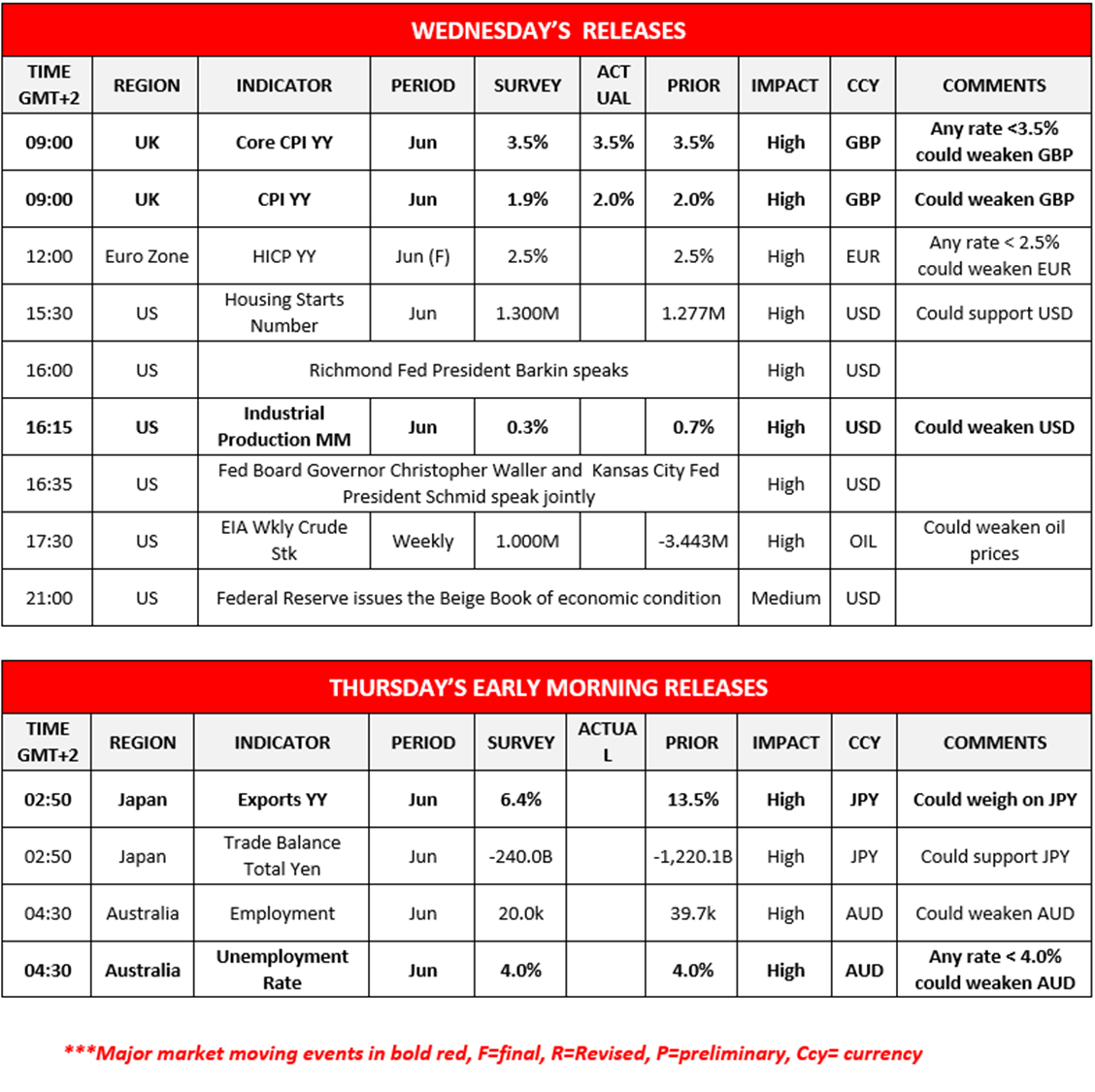

Today in the European session, we note the Eurozone’s final HICP rate all for June. During the American session, we note the US housing starts figure and industrial production rate both for June, followed by the US EIA weekly crude oil inventories figure. In tomorrow’s Asian session, we note Japan’s trade data and Australian employment data both for the month of June. On a monetary level, we note the speech by Richmond Fed President Barkin and the joint speech by Fed Board Governor Waller and Kansas Fed President Schmid, followed by the release of the Fed’s beige book.

EUR/USD 4H Chart

- Support: 1.0865 (S1), 1.0810 (S2), 1.0745 (S3)

- Resistance: 1.0920 (R1), 1.0980 (R2), 1.1047 (R3)

XAU/USD 4H Chart

- Support: 2450 (S1), 2417 (S2), 2390 (S3)

- Resistance: 2480 (R1), 2510 (R2), 2540 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。