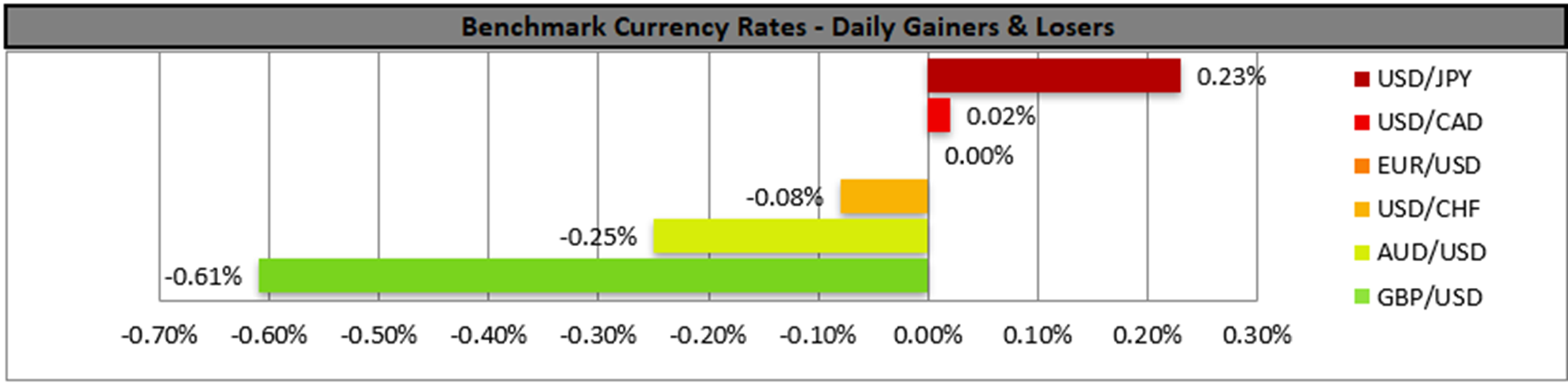

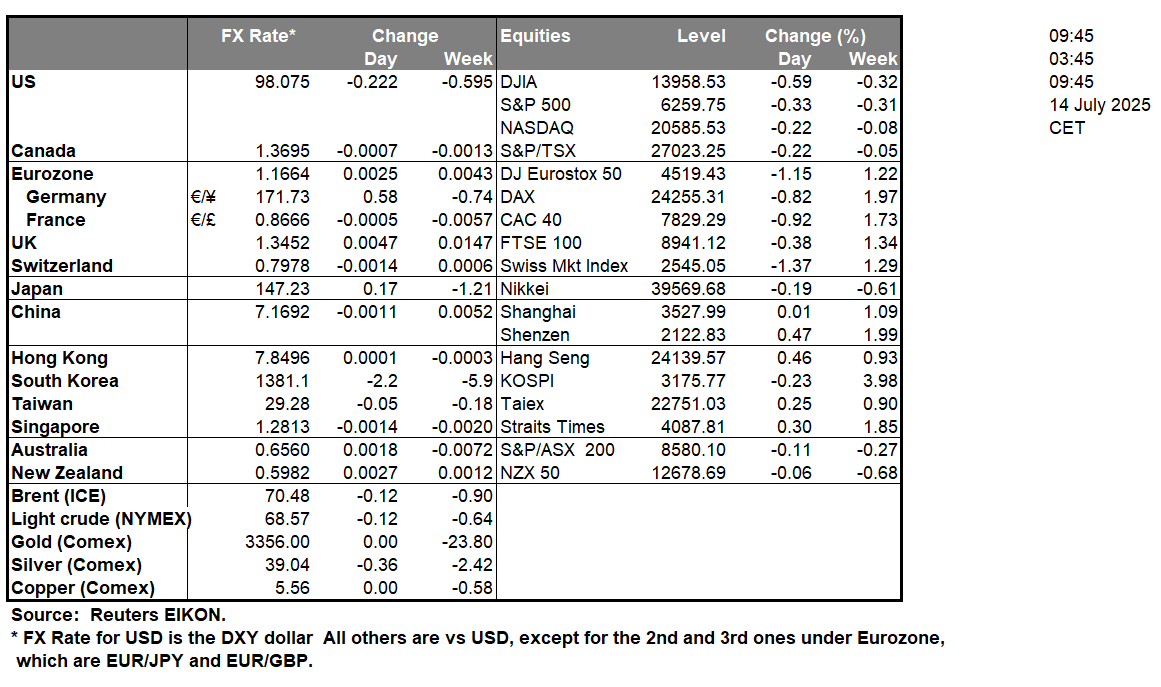

The euro continued to weaken reaching a three-week low in today’s Asian session against the USD as the greenback seems to have gained its counterparts. US President Trump continued with his trade wars, threatening to levy a 30% tariff on imports entering US soil from the EU and Mexico, from August 1st onwards. Letters announcing the US intentions were sent on Saturday to the two sides. The US intentions were characterised by the EU and Mexico as unfair and efforts are still being made for a possible solution to the problem yet market hopes for such a scenario may have been weakened.

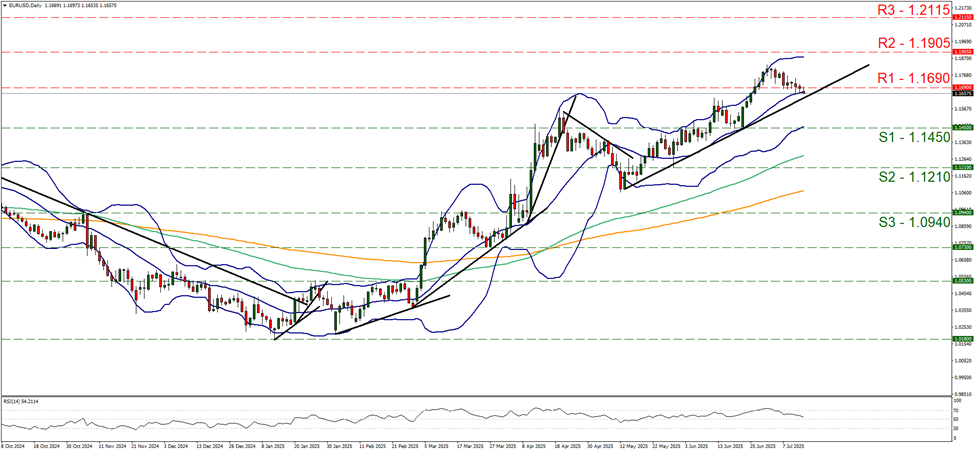

EUR/USD continued to edge lower on Friday and during today’s Asian session, has broken the 1.1690 (R1) support line, now turned to resistance. The pair’s price action has reached 3 week low levels and in its downward motion is nearing the upward trendline guiding it since the 13th of May. Furthermore, we note that the RSI indicator continued to drop in further signals that the bullish sentiment is easing, yet there is no presence of a bearish market sentiment for the pair yet. For a bearish outlook to emerge we would require the pair to initially break the prementioned upward trendline, in a first signal of an interruption of the upward movement and continue lower to break the 1.1450 (S1) support line, with the next possible target for EUR bears being the 1.1210 (S2) level. For the bullish outlook to be maintained, we would require the pair to break the 1.1690 (R1) resistance line and aim if not breach the 1.1905 (R2) level.

Overall, the markets seem to be less sensitive to US President Trump’s trade wars and despite the issue still being fundamentally important, seems to be generating little movement in the FX market but also on in US stock markets which are characterised by a relative optimism. Hence it may take substantial unexpected developments for the markets to react on the issue. US stock markets are preparing for the beginning of the earnings season which could draw attention. As for the crypto market, BTC reached new record high levels at $122k and is still rising as the US crypto week is beginning.

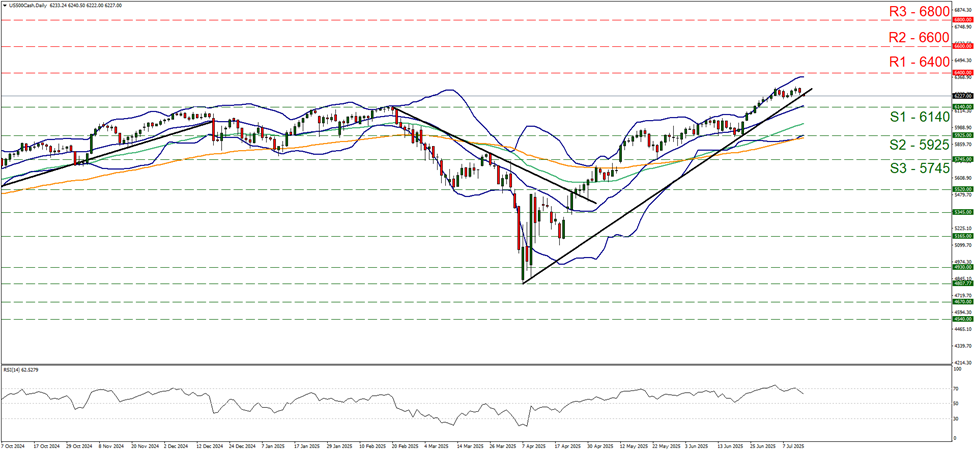

On a technical level, S&P 500 edged lower on Friday and during today’s Asian session, stabilizing somewhat just above the 6140 (S1) support line. The index’s bullish outlook, has reached a make or break point as it is testing the upward trendline guiding it since the 7th of April. The RSI indicator is lowering from the reading of 70 implying an easing of the bullish sentiment. Should the bears take over we may see the index breaking the prementioned upward trendline clearly and continue to break also the 6140 (S1) support line taking aim of the 5925 (S2) support level. Should the bulls take over we may see the pair bouncing on the prementioned upward trendline and continuing higher breaking the 6400 (R1) line, paving the way for the 6600 (R2) level.

その他の注目材料

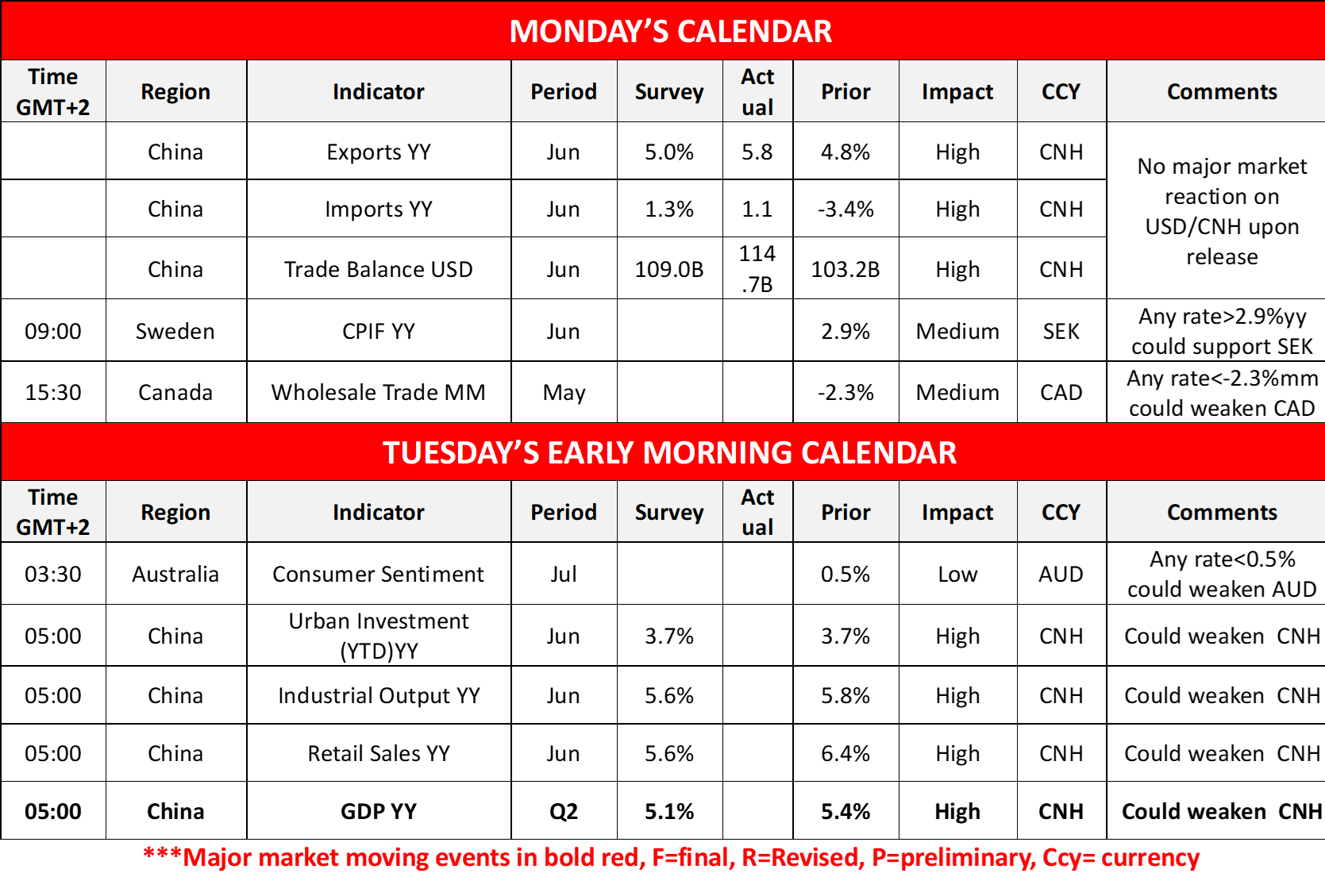

Today we Sweden’s inflation metrics for June and Canada’s wholesale trade for May. In tomorrow’s Asian session, we highlight the release of China’s urban investment, industrial output, retail sales rates all for June and GDP rates for Q2, while we also note Australia’s consumer confidence for July.

今週の指数発表

On Tuesday, Germany’s ZEW indicators for July as well as the US and Canadian CPI rates for June, while on a monetary level, we note that BoE Governor Bailey is scheduled to speak. On Wednesday, we get Japan’s chain store sales, UK’s CPI rates, as well as the US PPI rates and industrial output, all being for June. On Thursday, we get Japan’s trade data for June, Australia’s employment data for June, UK’s employment data for May, Euro Zone’s final HICP rates for June, the US Philly Fed Business index for July and the US retail sales for June. Finally, on Friday, we note the release of Japan’s CPI rates for June and from the US the preliminary University of Michigan consumer sentiment for July.

EUR/USD デイリーチャート

- Support: 1.1690 (S1), 1.1450 (S2), 1.0940 (S3)

- Resistance: 1.1450 (R1), 1.1905 (R2), 1.2115 (R3)

US500 Daily Chart

- Support: 6140 (S1), 5925 (S2), 5745 (S3)

- Resistance: 6400 (R1), 6600 (R2), 6800 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。