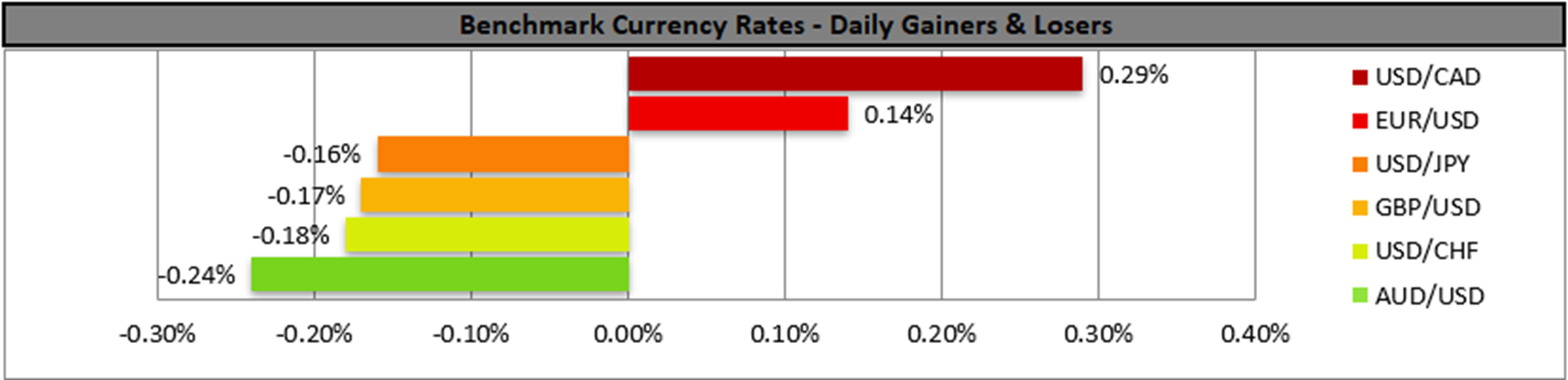

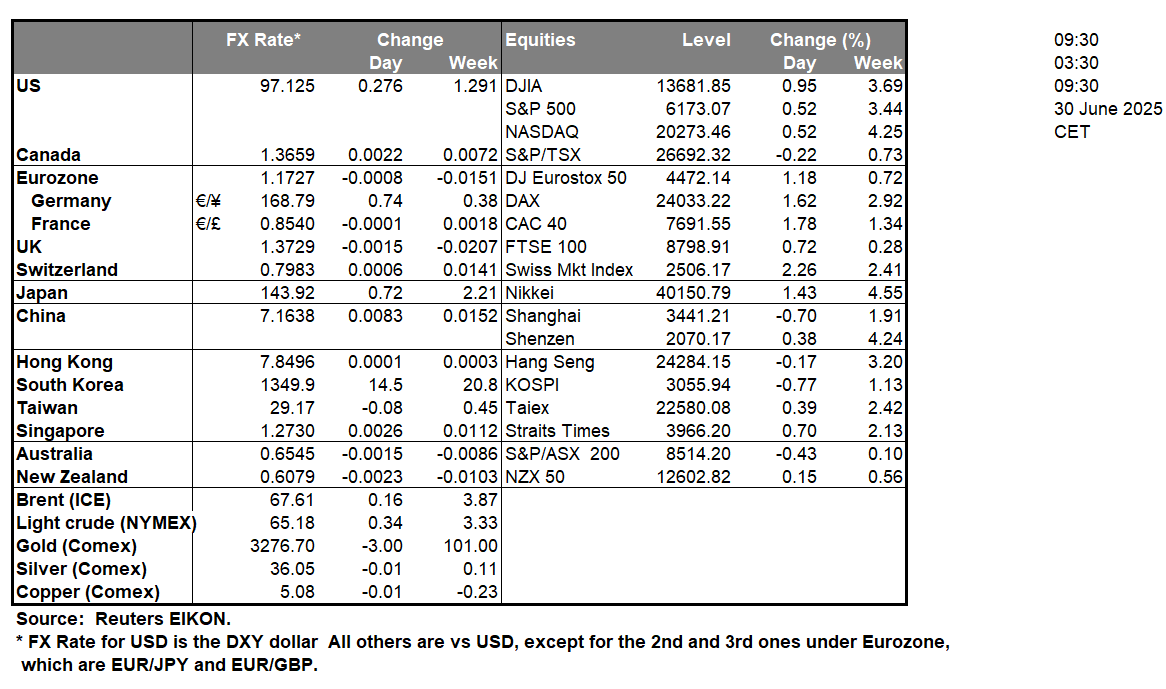

Maybe the main characteristic in the FX market as the week is about to begin, is the continuance of the weakness of the USD. It’s characteristic that the greenback is at 15-year lows against the CHF, while it’s also at 4-year lows against the EUR. In Trump’s trade wars, it’s notable that the US is reported to be nearing a trade deal with China, while Canada scrapped a digital services tax for trade negotiations with the US to restart, both issues tending to be positive for the USD. On a monetary level, the market’s expectations for the Fed to cut rates in the July meeting run high with Fed Fund Futures implying a probability of 80% currently for such a scenario to materialise, which in turn tends to weigh on the USD. Last but not least we note the attacks of US President Trump on Fed Chairman Powell, in an effort to undermine him and make Powell resign before the end of his term. The issue tends to undermine the market’s perception of the independence of the Fed and is weighing on the USD.

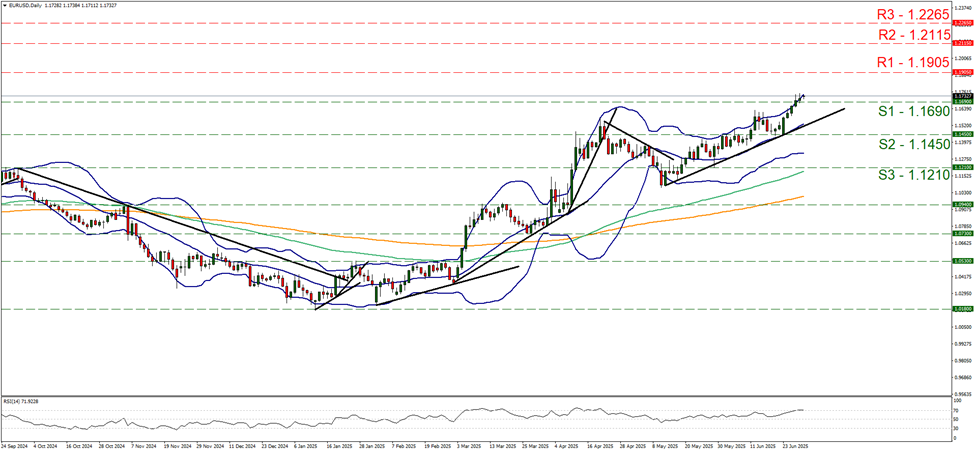

In the FX Market EUR/USD continued to rise breaking the 1.1690 (S1) resistance line, now turned to support. We maintain our bullish outlook for the pair as long as the upward trendline guiding the pair since the 13th of May remains intact. As a word of warning for the bullish outlook we note that the pair’s price action id flirting with the upper Bollinger Band for the past four days, which could slow down the bulls. The RSI indicator has reached the reading of 70, implying a strong bullish sentiment on behalf of market participants for the pair, yet at the same time may also imply that the pair is at overbought levels and may be ripe for a correction lower. Should the bulls maintain control, we may see it aiming if not breaking the 1.1905 (R1) line, a level that has seen no price action since August 2021. Should the bears take over, we may see the pair dropping, breaking the 1.1690 (S1) line and continue to reach if not breach the 1.1450 (S2) level.

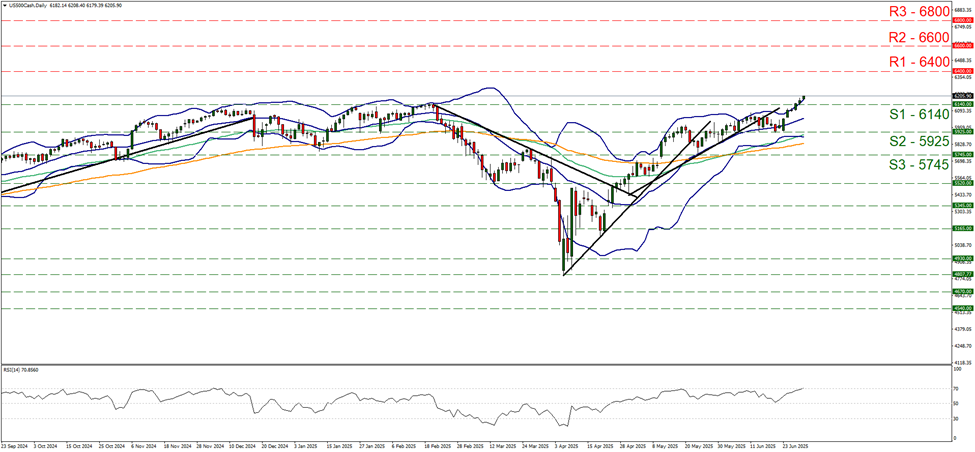

As for US equities we note a relative optimism on behalf of the market with S&P 500 reaching new record high levels, breaking on Friday the 6140 (S1) resistance line, now turned to support. As the index’s price action has broken 6140 level, we switch our sideways motion bias in favour of a bullish outlook. Yet note that the index’s price action has been testing the upper Bollinger band and RSI indicator has reached the reading of 70, both implying that the index’s price action may be nearing overbought levels and prone for a correction lower. For the bullish outlook to be maintained, we may see the index aiming if not reaching the 6400 (R1) resistance line. For a bearish outlook we would require the index to reverse course, breaking the 6140 (S1) support line and continue lower to break also the 5925 (S2) support level.

その他の注目材料

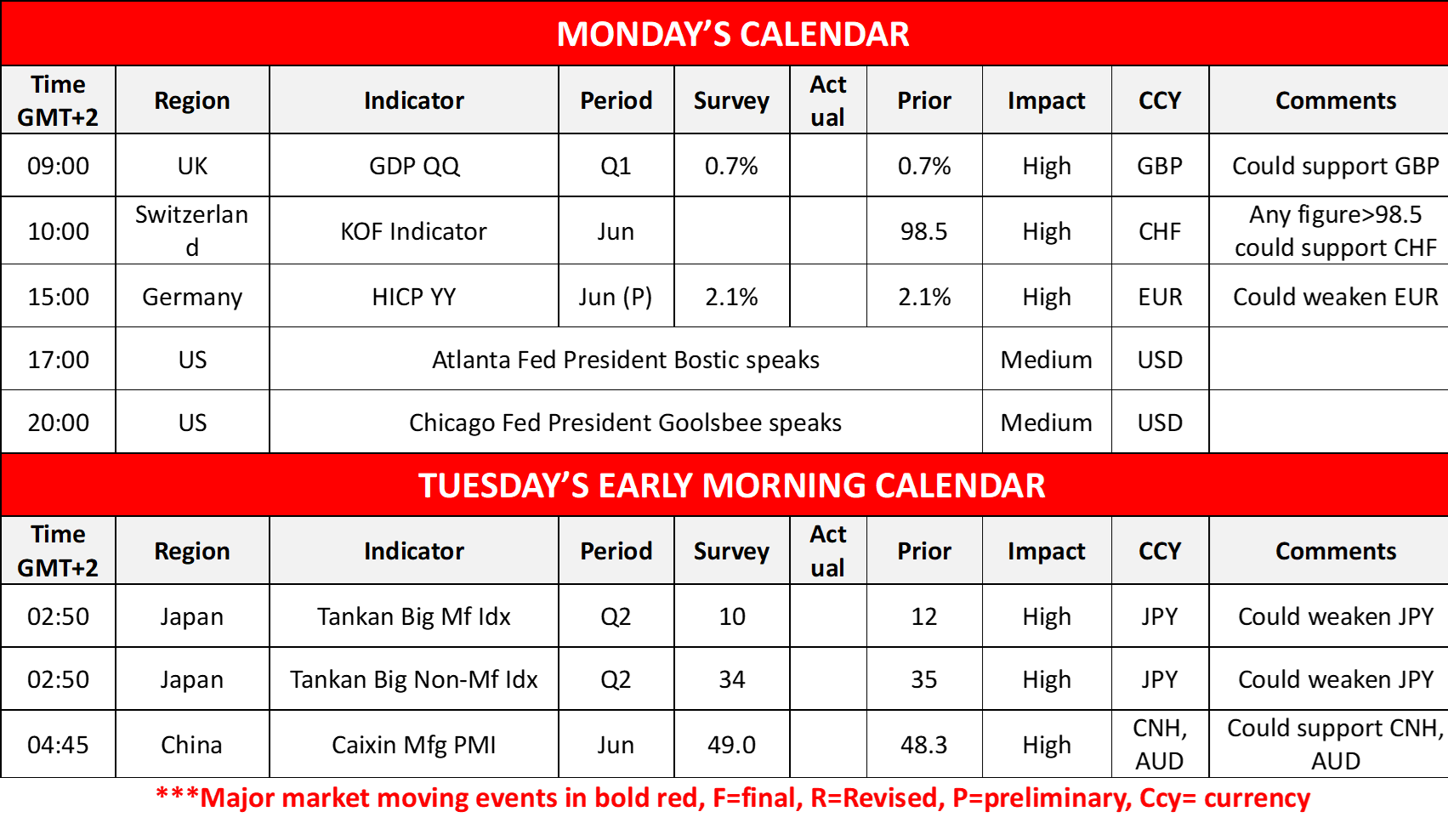

Today we get UK’s final GDP rates for Q1, Switzerland’s KOF indicator for June, Germany’s preliminary HICP rate also for June and Atlanta Fed President Bostic and Chicago Fed President Goolsbee speak. In tomorrow’s Asian session, we get Japan’s Tankan indexes for Q2 and China’s Caixin manufacturing PMI figure for June.

今週の指数発表:

On Tuesday we get Euro Zone’s preliminary HICP rate for the same month, the ISM manufacturing PMI figure for June and JOLTS job openings for May, while Fed Chairman Powell is scheduled to speak. On Wednesday we get the US ADP national employment figure and Canada’s S&P manufacturing PMI figure, both for June, while ECB President Christine Lagarde is to make statements. On Thursday we note the release of Australia’s trade data for May, Switzerland’s and Turkey’s CPI rates for June, the US weekly initial jobless claims figure, May’s US factory orders, June’s ISM non-manufacturing PMI figure Canada’s trade data for May and the US employment report for June, which may be the crown of financial releases for the week. On Friday we get Germany’s industrial output for May.

EUR/USD デイリーチャート

- Support: 1.1690 (S1), 1.1450 (S2), 1.1250 (S3)

- Resistance: 1.1905 (R1), 1.2115 (R2), 1.2265 (R3)

S&P 500 Daily Chart

- Support: 6140 (S1), 5925 (S2), 5745 (S3)

- Resistance: 6400 (R1), 6600 (R2), 6800 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。