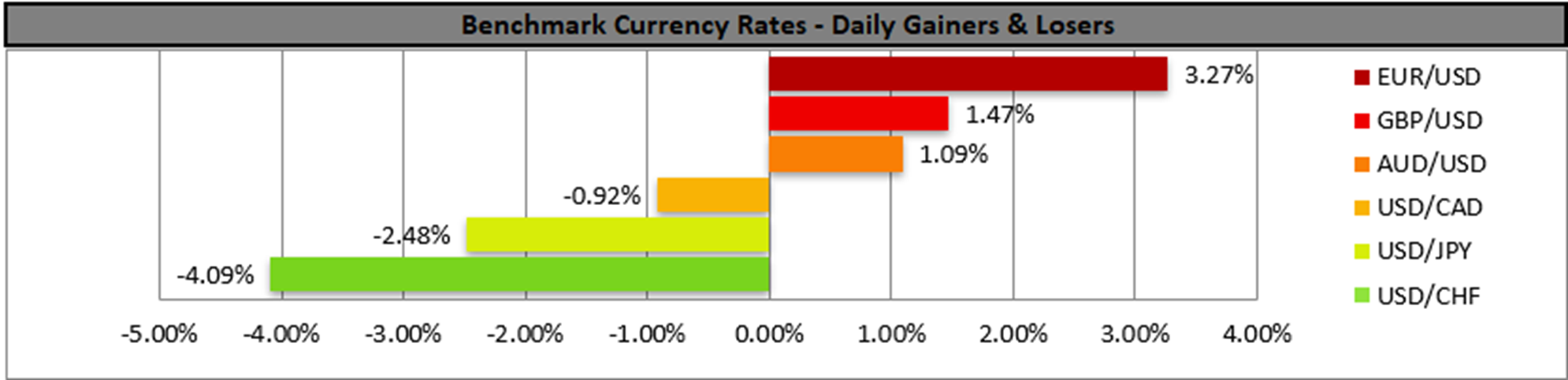

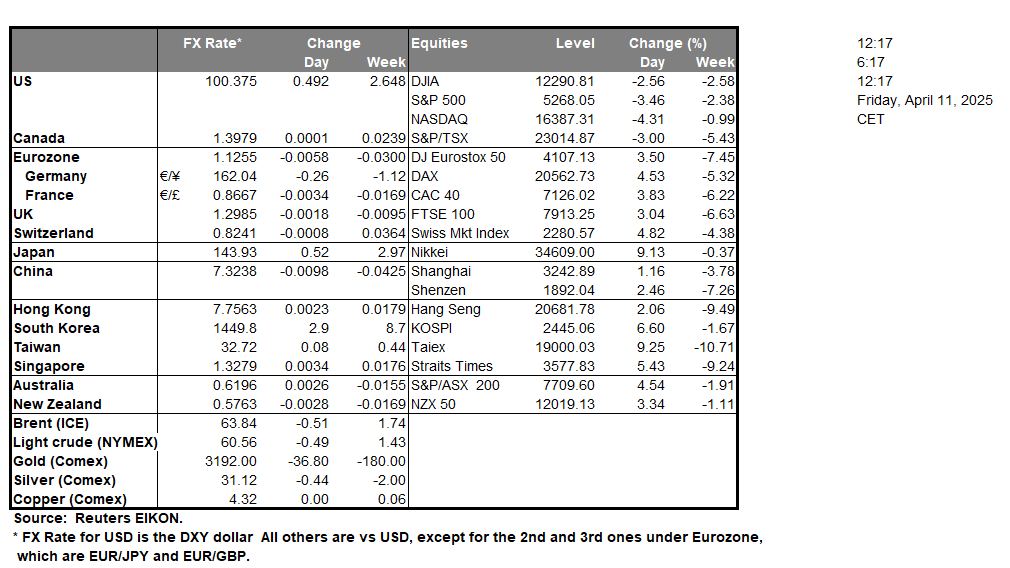

The USD tumbled across the board yesterday as the lack of market confidence in the prospects of the US economy and the possible negative side-effects of the trade war seemed to dominate the markets. The uncertainty of the markets remains high as the scenery remains unclear in regards to the international trading environment. On a macroeconomic level, it should be noted that the US CPI rates for March decelerated beyond market expectations both on a core and headline level, with the headline rate contracting on month-on-month level for the first time since June last year. The release tended to intensify the market’s dovish expectations for the Fed’s next moves, yet the market still prices in that the bank will remain on hold in its next meeting as per Fed Fund Futures. On the other hand, Fed policymakers seem to remain worries for the possible inflationary effect of Trump’s tariff policies, with some analysts even highlighting the possibility of stagflation being visible in the horizon. It’s characteristic how Chicago Fed President Goolsbee in a rather blunt statement stated that tariffs risk a “stagflationary shock” that may challenge the Fed’s ability to react, as per Politico. It’s understandable that US stock markets closed their day with losses in a uniform way, while gold’s price reached new record highs as safe-haven inflows may have supported its price. With the USD CPI rates for March attention is now turned to the release of the US PPI rates for the same month and a possible acceleration, as expected could provide some support for the USD as it would be highlighting the qualitative effect of inflationary pressures in the US economy. Please note that the effect of the new tariffs imposed on US imports has not been measured yet with the first rates and figures expected next month.

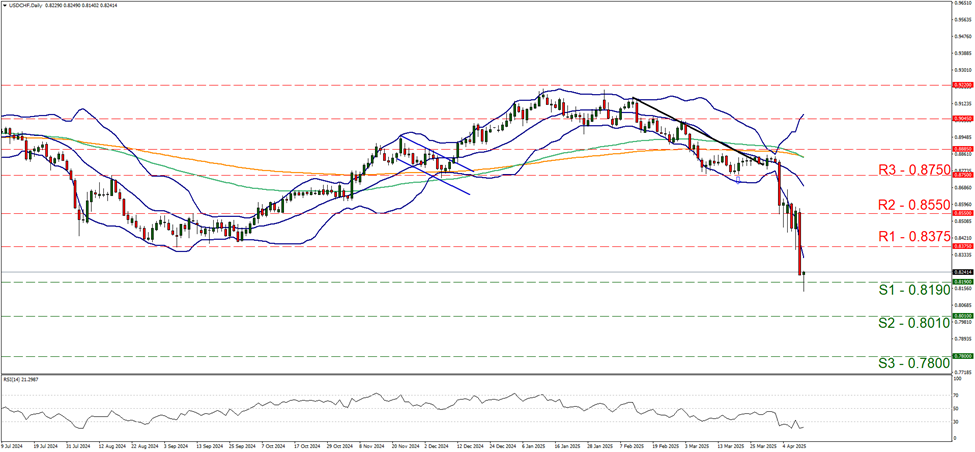

In the FX market we note the tumbling of USD/CHF testing in today’s Asian session the 0.8190 (S1) support line which marks a 10 year low. We maintain a bearish outlook for the pair yet at the same time, we note that the price action is below the lower Bollinger Band and the RSI indicator is below the reading of 30, both signaling that the bearish sentiment is strong yet at the same time that the pair may be at oversold levels and may be ripe for a correction higher. Should the bears maintain control over the pair, we may see USD/CHF breaking the 0.8190 (S1) support level and start aiming for the 0.8010 (S2) support level. A bullish outlook is currently remote and for its adoption we would require the pair to reverse yesterday’s losses, by breaking consecutively the R1, R2 and the 0.8750 (R3) resistance levels.

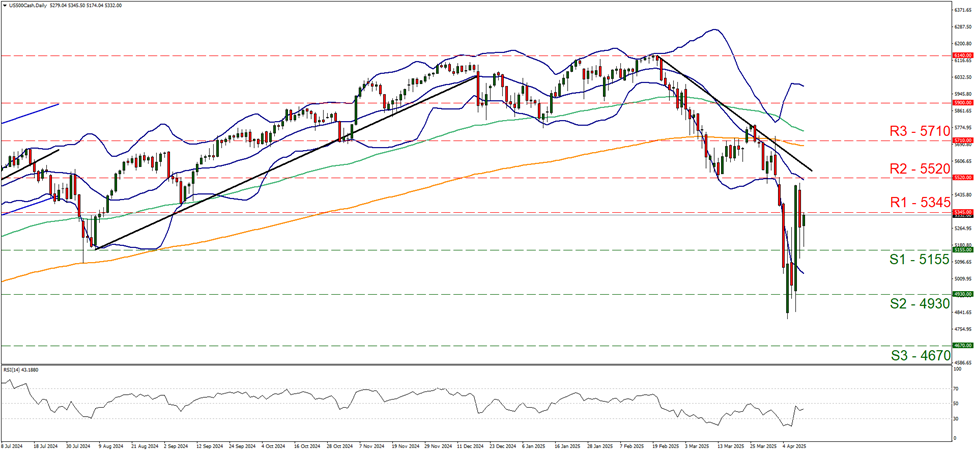

In the US equities market, we note the correction lower of the S&P 500 after failing to reach the 5520 (R1) resistance level. The RSI indicator dropped after nearing the reading of 50, which may imply that there are still a bearish predisposition of the market for the index. We tend to maintain a bias for the sideways motion of the index yet also issue a warning for any bearish tendencies of the index. Should the bears take the lead once again, we may see the index breaking the 5155 (S1) support line and aim for the 4930 (S2) support level. Should the bulls take charge, which is not currently expected, we may see the index’s price action breaking the 5345 (R1) resistance line, break also the 5520 (R2) resistance level and start aiming for the 5710 (R2) resistance barrier.

その他の注目材料

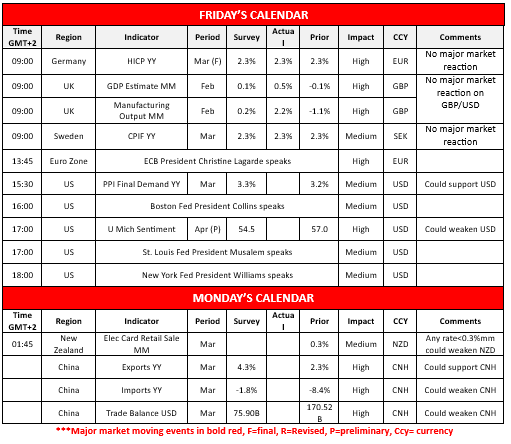

In today’s European session, we note the verification of Germany’s HICP rates for March, while across the Channel UK’s GDP and Manufacturing output rates for February were better than expected, yet provided little support for the pound while ECB President Lagarde is to take part in the Euro Group meeting. Later we get from the US the PPI rates for March and the UoM consumer sentiment for April while Boston Fed President Collins, St. Louis Fed President Musalem and New York Fed President Williams speak. In Monday’s Asian session, we highlight the release of China’s trade data for March.

USD/CHF Daily Chart

- Support: 0.8190 (S1), 0.8010 (S2), 0.7800 (S3)

- Resistance: 0.8375 (R1), 0.8550 (R2), 0.8750 (R3)

S&P 500 Daily Chart

- Support: 5155 (S1), 4930 (S2), 4670 (S3)

- Resistance: 5345 (R1), 5520 (R2), 5710 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。